Michael Vi

Zendesk (NYSE:ZEN) reported a better than expected Q2, with revenue growing 28% yoy and FCF margin coming in at 10%. However, with the pending acquisition by Hellman & Friedman and Permira expected to close in Q4, investors may be wondering if the $77.50 takeout price is too cheap.

In my opinion, this quarter all but confirmed the pending acquisition will close in Q4 (as expected). While the company posted a Rule of 40 score of 34% during Q2, the 5.5x forward revenue implied multiple now seems a little cheap.

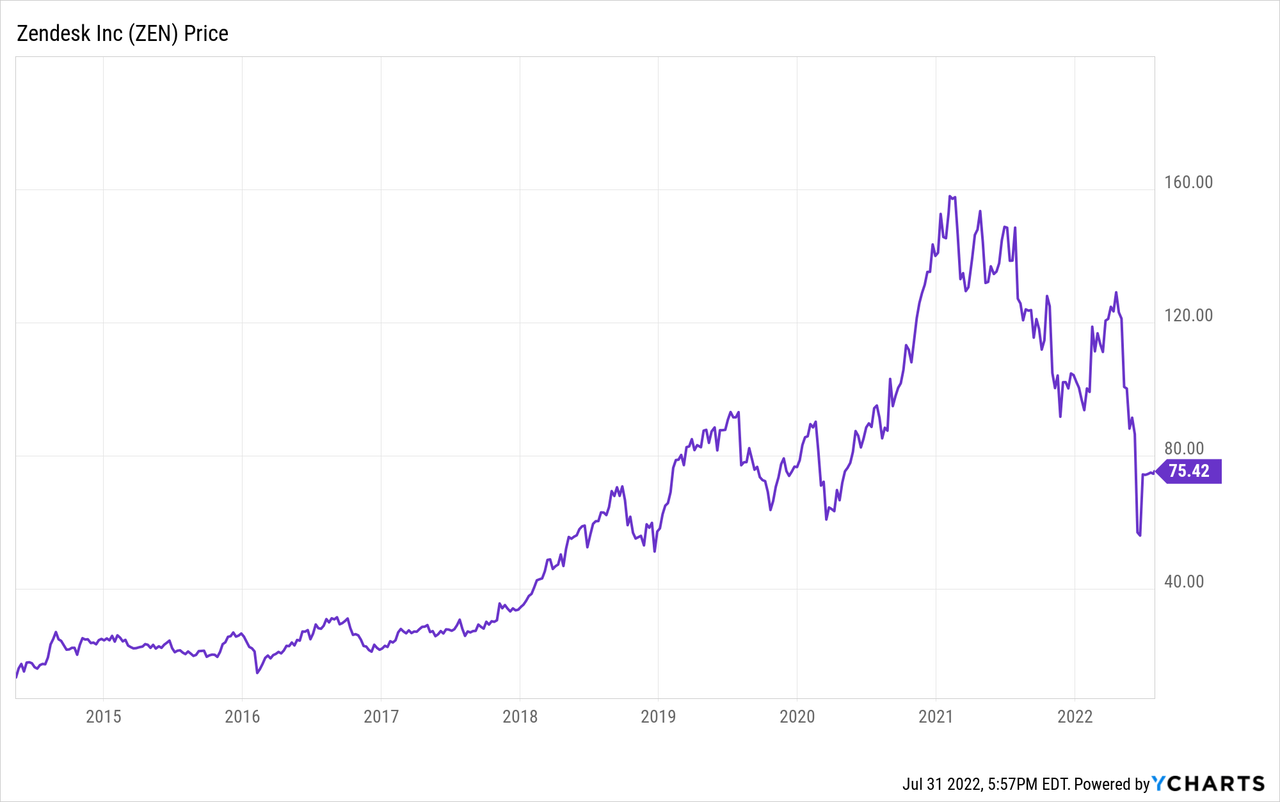

Since this takeout was first announced on June 24, investors had been questioning if the $77.50 takeout price was a lowball offer, especially considering the stock had traded above that level for most of 2019-current period.

Given the stock currently trades around $75.50 and Q2 demonstrated ongoing strong results, I find it difficult to believe anything but a successful acquisition will occur.

However, while the shareholder approval meeting has yet to confirm the transaction, I believe ZEN could have received a higher offer.

Financial Review

Even though the Q2 earnings report was somewhat irrelevant given the pending takeout, trends during the quarter were quite good. The company reported revenue growth of 28% yoy to $407 million, which beat consensus expectations for $404.5 million.

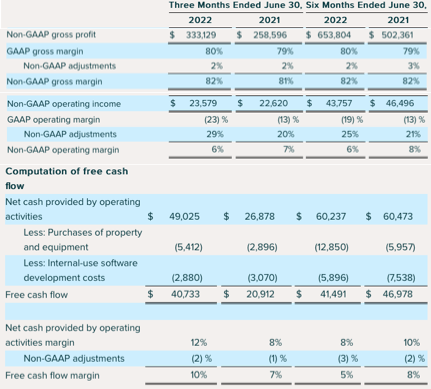

Not surprisingly, non-GAAP gross margin remained very strong at 82%, even improving ~1 point from the year ago period. ZEN has historically reported non-GAAP gross margins above 80%, which is driven by their software subscription operating model.

Zendesk

Though the gross margin improvement did not flow to operating income, non-GAAP operating margin of 6% was pretty similar to the year-ago period of 7%. This led to the company reporting a Rule of 40 score of 34 during the quarter, and while this is a little below that coveted 40 level, ZEN continued to perform well operationally.

The biggest improvement during the quarter seemed to be from FCF margin, which came in at 10% during the quarter and improved from 7% in the year ago period. In a time where investors are pivoting towards more stable, profitable companies, ZEN would have likely seen a positive stock reaction post-earnings (if the pending takeout transaction had not occurred).

Not surprisingly, the company did not provide guidance for Q3 and is suspending their full-year 2022 guidance metrics, due to the pending transaction.

Seller’s Remorse?

The past year has been difficult for many fast-growth technology stocks, as fears around rising interest rates and potential recession have caused investors to rotate to more safe assets. ZEN fully participated in this pullback with the stock down around 65% from their all-time high, before the company announced the takeout transaction.

However, given the recent solid performance and the significant valuation pullback, one must start to think that ZEN may be regretting their decision to sell at 5.5x forward revenue.

Back in February 2022, ZEN rejected an unsolicited, non-binding proposal from several private equity firms, which offered to acquire the company at $127-132 per share. Before this news, the stock was trading right around $100, meaning the implied takeout price was around 30% above the stock’s levels at that time.

The Board continues to believe strongly that the continued execution of its strategic plan, including the proposed acquisition of Momentive, will generate substantial additional long-term value for shareholders. The Board unanimously recommends a vote FOR its proposal to approve the issuance of Zendesk stock in connection with the transaction at the shareholder meeting on February 25.

However, just a matter of months later and after the stock pulled back to around $55, ZEN’s board agreed to be acquired for just $77.50 per share. While this takeout price represented around 34% premium to the stock, it was a bit surprising to see ZEN agree to the takeout price.

ZEN did complete a strategic review of the company in early June, with the company reinforcing their commitment to executing as an independent company, which makes it even more surprising they accepted a takeout offer shortly after.

Given the continued strong operational performance with revenue growing nearly 30% and margins continuing to improve, one must think ZEN may possibly be regretting accepting such a low takeout offer.

Valuation

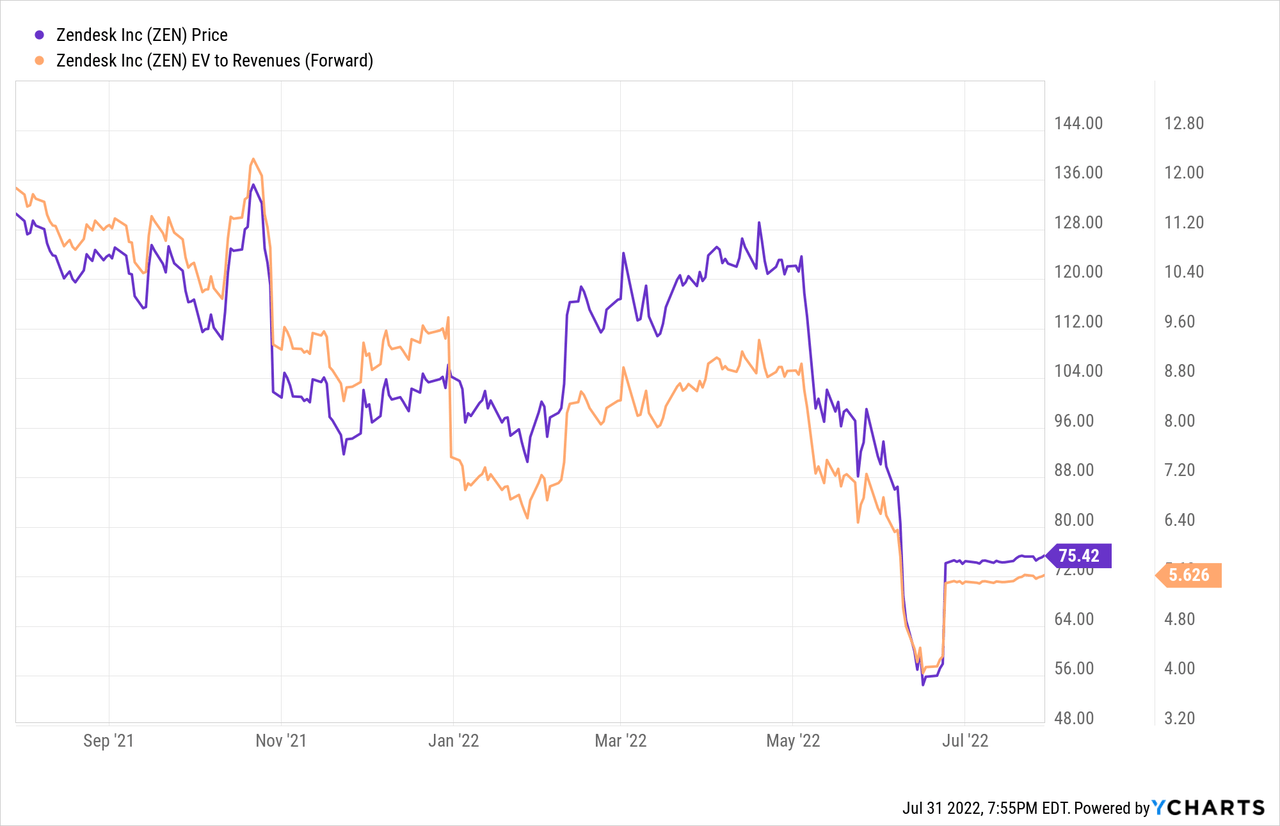

The $77.50 takeout price implied ~5.5x forward revenue at the time, and while this is not an overly expensive multiple to pay in the land of fast-growth software technology companies, I believe ZEN could have received a better offer.

It would not be surprising if the company continued to grow revenue 20%+ for several more years with operating and FCF margins continuing to expand. In a more normal environment, a software stock with those financial attributes would consistently trade around 5x forward revenue.

The chart above clearly shows that ZEN had historically traded well above the ~5.5x forward revenue takeout multiple. At the time of the takeout announcement, the stock was trading just above 4x forward revenue, though revenue growth has continued to remain above 25%.

For now, I believe there is little to do with the stock, given the acquisition is expected to close in Q4. However, investors may want to keep an eye on the name just in case ZEN’s shareholders reject the proposed acquisition. Yes, the odds of that happening remain quite low, but with continued strong operational performance, ZEN may be regretting such a low takeout price.

Be the first to comment