JHVEPhoto

Dear Readers,

In this article, we’ll be taking a look at Yum Brands (NYSE:YUM) – a restaurant company with plenty of appeal across multiple associated segments, representing several well-known brands with international recognition and fame. There is, I believe, much to like about Yum Brands making this a good investment.

However, we of course want the “right” price for the company – and at current times, I’m unsure how much of that we’re getting.

So, here are my targets and my initial thesis for Yum Brands.

Yum Brands – The company and what it does

Yum Brands is a BB+ rated restaurant business based in the US. It has a market cap of over $32B at this point, and its typical trading pattern for the long term is that of a premium.

The company owns several well-known brands. Yum Brands has over 53,000 restaurants spread across 157 countries, and these are operated primarily under one of four concepts.

- KFC

- Taco Bell

- Pizza Hut

- Habit Burger

I’ll be honest and say that I had not even heard the fourth name on the list – but then I saw that it only generated about half a billion in sales, and only represents 3% of its international units in 3 countries. Compared to the other ones – which are ubiquitous even here – that’s small.

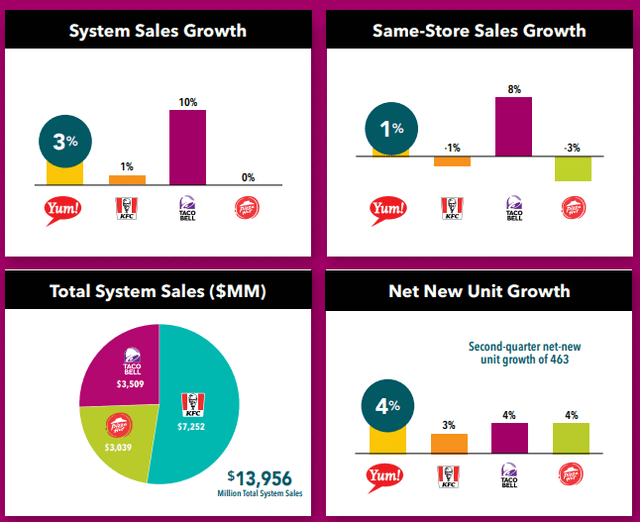

YUM IR (YUM IR)

So, Yum Brands is essentially three megaconcepts/restaurants with extremely well-known selections. The company owns KFC, founded in 1939, Taco Bell, opened in 1962, and Pizza Hut, founded in 1958. Pizza hut Is the largest restaurant chain in the world focused on ready-to-eat pizza, and the other two brands are massive in their own right. Habit burger is a smaller brand, founded in 1969 with a concept built around diverse menus of chargrilled burgers and sandwiches.

YUM IR (YUM IR)

Yum Brands is built around a franchising concept. The company has successfully increased franchise ownership, thereby lowering its own risk exposure. The current number as of FY21A is 1,500 franchisees with contracts, utilizing both store-level franchise contracts and master franchise contracts to grow. The company has over 52,000 franchised units, where around 30% of them operate under what is known as a master franchise agreement, which includes almost 11,000 restaurants in China alone. 70% of the rest, operate under store-level franchise agreements.

The way that this works, typical for franchises, is that the franchisees’ supply capital is used to purchase or lease the land, building, equipment, seating, inventories, and supplies, thereby reinvesting in the business over time. However, the company has, in certain cases, retained land ownership and building ownership and worked under a leasing model to its franchisees.

The company earns money on upfront fees, and recurring fees, (4-6% of sales) and the franchise also comes with marketing obligations in order to promote and work the brand. Under a master agreement, the company allows franchises to operate restaurants as well as sub-franchise restaurants in certain geographies – such as China, and master franchisees typically have higher responsibilities.

With regards to China, Yum spun this off into an independent public business called Yum China Holdings, from which Yum Brands gets a recurring 3% fee on sales.

Naturally, this business saw massive impact during COVID-19, though looking at recurring earnings, the actual impact as almost unnoticeable in EPS – only an EPS growth of 2% instead of the typical double digits we’re used to see from Yum Brands.

Naturally, the company uses a significant amount of input. Yum Brands and the franchisees are substantial buyers of food products, paper products, equipment, and supplies, with principal perishable inputs being chicken, cheese, beef, and pork. Other than that, paper and packaging materials. These inputs are subject to significant pricing volatility, forcing companies to adapt and see some of the price increases that we’ve been seeing. The company does much of its procuring by being a member of the Restaurant Supply Chain Solutions LLC, focusing on buying on some of these products. In short, the company needs to make sure that its purchasing power exceeds or reflects the size of its operations, to drive prices and ensure scale advantages.

One advantage of course, is that this business is in no way seasonal.

The company has an interesting debt structure, which formally puts the debt at very high levels (323% LT debt/Cap), and is the root cause of the company’s sub-par credit rating. However, watching the company’s results and trends, you should not in any way be worried about the company’s ability to pay its own bills or manage its debt.

Recent results provide us no real issues or worries about the company’s ability to pivot from a pandemic into a post-pandemic period. YUM delivered growth across the board, despite continued COVID-19 restrictions in some of the company’s key geographies.

The company managed to open over 780 new units and even delivered sales of nearly $6B overall. The company, with its global scale and capabilities, is rivaled only by very specific businesses such as McDonald’s (MCD) and others in the same categories.

Specific quarterly/current trends see continued China impact – which leaves room for normalization growth once such things happen, but non-China sales came in very strong, with taco bell as the strongest performer with an 8% same-store sales growth.

YUM is also in the process of completely, like many others, leaving Russia behind as a market. Pizza Hut is already sold and the concept is being rebranded. Meanwhile – the company’s locations in Ukraine remain open for business where possible. Nearly all stores are open and continue to sell the company’s inarguably tasty food to consumers.

Challenges and risks to the company?

I will argue that the main risks to YUM are related to the price you pay – not the company quality. YUM is a quality restaurant incumbent with little to no signs of slowing down. It can handle COVID-19 restrictions and maintain growth. It can handle the full exit of an entire nation without seeing massive overall impacts. In fact, we can even point to massive sales growth from new geographies like India (79% growth) and the Middle East (18%) as the company’s growth markets.

Pizza Hut was the only real relevant decliner here, due to flat unit growth and operational challenges (driver capacity).

As of the end of Q2, approximately 55% of our U.S. locations have implemented delivery as a service, up from 40% at the beginning of the quarter. Additionally, we are leaning into our aggregator partnerships by joining third-party marketplaces so our consumers can access our craveable food wherever they shop. As of the end of Q2, roughly 70% of eligible stores have opted into using at least one aggregator marketplace, up from approximately 45% at the beginning of Q2. Finally, the team shifted promotional focus towards compelling value to address the needs of the consumer.

(Source: David Gibbs, 2Q22 Earnings Call)

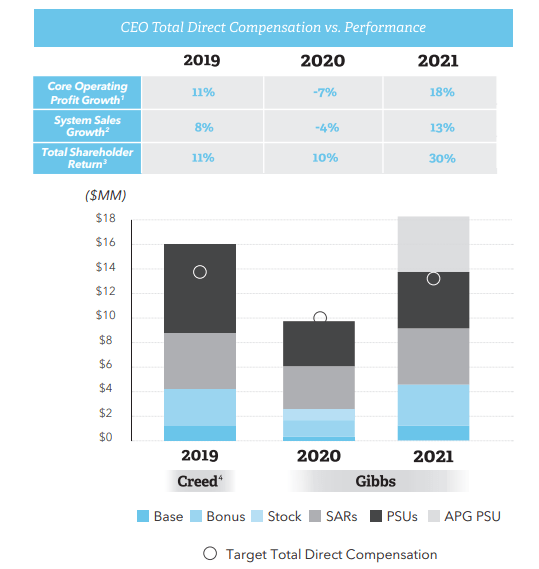

Management is extremely aligned with performance, as comp is directly tied, and management sees a massive impact if profit goes down, even if adjusted EPS does not. Take a look.

YUM IR (YUM IR)

So, the company is fairly well-aligned. I would characterize any momentary weakness here as just that – momentary, and likely fixed within a few quarters or years – and for the company to be a convincing long-term performer.

At least for as long as chicken, tacos, pizza and burgers remain food staples and appealing alternatives to consumers – which I don’t see stopping anytime soon.

YUM’s distance in terms of risk due to its franchise model is also appealing, as much of the risk with new restaurants is instead on the company’s franchisees, and the company simply takes an upfront payment and recurring portions of sales – akin to simply sitting at the bottom line and taking a small “tax” or revenue portion, making excellent results based on this.

Let’s look at what investors need to pay for this “revenue machine”.

Yum Brands valuation

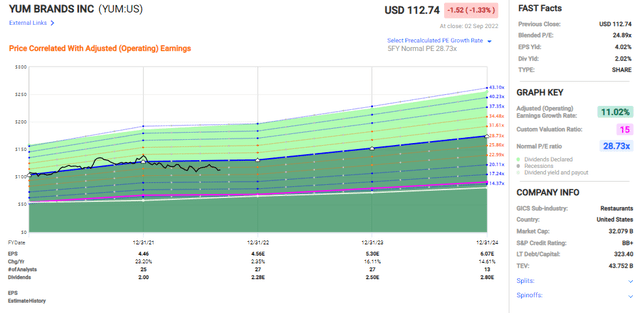

And we’re really looking at a revenue machine. The company has a double-digit revenue growth rate for the past 20-or-so years, with a 10.77% average. This sort of performance has seen the company turn from a 15x P/E investment to averaging well over 20x P/E. But investors who bought in the financial crisis have been able to make returns of no less than 14.7% per year, or over 560% total RoR in less than 15 years.

And as things stand, the revenue growth and EPS growth is set to continue. Yum Brands forecasts call for double-digit 11% CAGR EPS for the next 3 or so years, with especially impressive trends in 2023 and 2024, in part based on China normalization and further growth in the company’s new markets, such as India and the Middle east.

We’re also seeing the company trade below a premium of a 5-year 28.7x, with a current P/E of close to 25x.

So, the question really becomes if we should pay a 24.9x P/E for a 2% yield with relatively good DGR and a solid revenue growth trend, backed by Taco Bell, Pizza Hut, and KFC.

Yum brands valuation (F.A.S.T graphs)

My answer to this question is a resounding: “Maybe”.

I cannot help but feel that it would be more attractive, and even necessary, to see Yum Brands drop down to maybe around 20-22x P/E before really “getting into” the investment with a good, conservative upside.

In layman’s terms, I’m willing to consider Yum at a 20-22x P/E premium, based on a basically immovable market position for 3 strong brands. This goes along with the typical premium for a staple company in a similar situation. Above that though, I get a bit more hesitant.

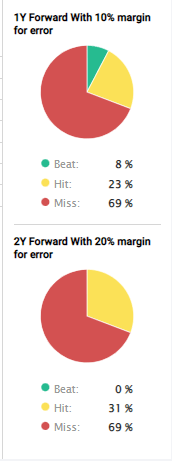

In part, this is because of abysmal forecast accuracy. The company may be forecasted to grow, but just how accurate is this, historically speaking?

YUM forecast accuracy (F.A.S.T Graphs)

Not very. S&P Global gives similar, uncertain price targets for the company. We see a range from around $100 to $150, which is a fairly incredible spread. 23 analysts follow the company with a PT just above $130/share, and while this would imply an upside, less than half of the analysts are at a “BUY” here.

A premium/optimistic upside for the business would be an RoR of about 22.41% annually at 2024E, and that’s at a 28.7x P/E based on current forecasts, or a total RoR of 60%. At normalized estimates of 20-22x P/E though, that number goes down to 8-10% annually, or 22-26.5% total RoR.

What I’d want to see before putting money to work is a price drop to around $105 or so – at that price, Yum Brands becomes digestible for me.

That’s also where I put my initial target, and why I consider the company a “HOLD”.

Thesis

The thesis for Yum Brands is as follows:

- Yum brands is a very attractive business, holding four very attractive franchises/restaurant brands, three of which have undoubted international fame. The company has decent fundamental (below-IG credit rating), and superb historical trends, making it a theoretically attractive investment at a decent price – even a premium.

- I’d like to see a 20-22x P/E before getting into the business, as I want a 15% conservative upside to work with, especially with a 2%-yielding investment.

- Because of that, I go with a “HOLD” at a PT of $105/share.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment