Torsten Asmus

~ by Snehasish Chaudhuri, MBA (Finance)

BNY Mellon Municipal Bond Infrastructure Fund (NYSE:DMB) is a closed-end fixed income mutual fund (“CEF”) that primarily invests in rated municipal bonds. The fund’s investment objective is to seek to provide as high a level of current income exempt from regular federal income tax as is consistent with the preservation of capital. The fund pays monthly dividends with a steady yield between 4 to 5 percent. The yield may not be exceptionally high but is almost certain, as the fund’s investments enjoy an average coupon of 5.56 percent. Moreover, 70 percent of its investments are rated BBB and above. Thus, it can be a decent investment option for income seeking investors.

DMB has a Strong Portfolio that Can Meet Its Objectives

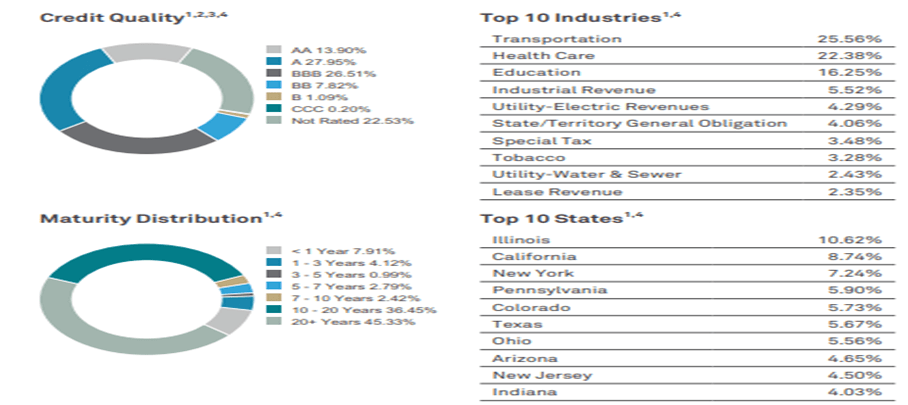

BNY Mellon Municipal Bond Infrastructure Fund was formed on April 25, 2013 and is domiciled in the United States. It primarily invests in the tax-exempt investment grade debt securities issued by or on behalf of states, territories and possessions of the United States and the District of Columbia and their political subdivisions, agencies and instrumentalities, or multi state agencies or authorities, and certain other specified securities. The fund was earlier known as Dreyfus Municipal Bond Infrastructure Fund, Inc. Almost 83 percent of its investments have a maturity in excess of 10 years. This provides stability to the fund.

BNY Mellon Investment Adviser, Inc. manages this fund, and has engaged its affiliate, Insight North America LLC (“INA”), to serve as the Fund’s sub-investment adviser. The Fund’s primary portfolio managers, Jeffrey Burger, Daniel Rabasco and Thomas Casey have vast experiences in managing municipal bond funds and have been associated with DMB since the very beginning. They made effective use of leverage in order to enhance the fund’s corpus and thus generate higher coupon income. The leverage component of this fund is almost 35 percent, and the interest expense is 0.55 percent of the entire fund value.

The Basis of DMB’s Portfolio

Management employs fundamental and quantitative analysis by focusing on certain basic factors such as the relative value and attractiveness of various sectors and securities. DMB tries to exploit pricing inefficiencies in the municipal bond market and actively trades in various sectors which is decided on the basis of their apparent values, general economic and monetary conditions, prevailing interest rates and the condition of the general money market and the municipal bond market, the size of a particular offering, the maturity of the obligation, and the rating of the issue to create its portfolio.

DMB Portfolio (BMY website)

BNY Mellon Municipal Bond Infrastructure Fund benchmarks itself against the Bloomberg US Municipal Index. The fund invests its bonds mostly issued by the infrastructure sector including transportation, energy and utilities, social infrastructure, water and environment, and other similar public sectors with an effective duration of up to 14 years. The management team is very experienced in investing in municipal bonds and has managed the fund since its inception in 2013. Such a focused infrastructure rated municipal bond fund is thus an appropriate balancing option at a time of market uncertainty and uncertain price growth.

Risks Associated with Municipal Bonds, and DMB

Bonds in general are subject to interest-rate risks, credit risks, liquidity risks and market risks. Provided all other factors stay constant, prices of investment-grade bonds are inversely related to interest-rate changes, and rate increases can cause price declines. High yield bonds are subject to increased credit risk and are considered speculative due to the chances of default in making interest payments and principal repayments on a timely basis. The use of leverage magnifies the fund’s investment, market and certain other risks. The use of derivatives involves additional risks over investing directly in the underlying assets. Derivatives can be highly volatile, illiquid, and difficult to value.

Bond CEFs by their very nature of portfolio will be exposed to liquidity risk on the secondary market, credit risk, concentration risk and discount risk. It may also involve foreign exchange risk, if it has invested in securities in foreign markets or in foreign currency. Shares of CEFs frequently trade at a market price lower than their net asset value. This is commonly referred to as “trading at discount.” This characteristic of CEFs creates some additional risks that are separate and distinct from the risk of dilution of net asset value.

In addition to the general risks associated with municipal bond CEFs, there are some specific risks with respect to BNY Mellon Municipal Bond Infrastructure Fund. The fund has a very low assets under management (“AUM”) of $234 million, and also a lower market capitalization of $244 million. Despite being such a small fund with an average coupon of 5.6 percent, it has a quite high management fee of 1 percent. This creates a major hurdle in the path of generating a steady and high yield on a consistent basis. In addition to that, the fund had a poor price performance. It dropped by 15 percent and 7.4 percent during the past 1 year and 3 years, respectively.

Investment Thesis

BNY Mellon Municipal Bond Infrastructure Fund provides investors a monthly federal tax-exempt dividend by investing in a mix of high quality and high yielding municipal bonds, with an emphasis on infrastructure projects. With an uncertainty over generating consistent yield in the coming months, many investors find municipal bonds attractive due to their local government appeal and tax-exempt status.

The steady monthly yield generated for the past few years is almost certain to be repeated, as it is covered by the average coupon earned on its portfolio of rated municipal bonds. Although the fund has high management expenses and has performed poorly in terms of market price due to the recent price loss, the fund is also available at a good discount. As a result, it is not a bad time to buy DMB.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment