Firn

Life is complicated.

It always has been, and it always will be to some degree or another. That’s because life involves change.

Lots of it, in fact.

There’s the changing of the seasons, for one thing (one out of millions). Maybe you live someplace where the Earth’s turning around the sun doesn’t lead to anything too drastic. But there are still noteworthy differences.

To quote UC Santa Cruz:

“Real seasons, as opposed to calendar ones, are not necessarily equal. In the northeast, for example, winter lasts about five months, spring about one or two months, summer three or four, and fall one or two.

“By New England standards, lowland California has no winter, about six months of spring and six months of summer, the last month or two of which you might or might not see fit to call a sort of lackluster fall.

“Another maybe more accurate way of looking at it is that we have only two seasons: a cool, wet season from about November to March, and a warm-dry season the rest of the year.”

But two seasons – even “by New England standards” – is still change. No matter your location, it’s going to happen.

There’s no escaping it, no matter how hard we try.

We’re Not in 2019 Anymore, Toto

We also have seasons of life. I’m reminded of that every time I look at my grandson, Asher.

He’s seven months old now and getting bigger and more interactive every time I see him.

Yet he’s still ultimately a helpless little baby and will remain that way for months more. Then he’ll graduate to an explorative (and ultimately helpless) toddler… young boy… teenager… young adult… adult… middle-aged man… and then senior citizen.

There’s just no changing the aging progression, complete with differing levels of hormones, interests, goals, and so much more.

Even if we could somehow revise that reality, I don’t think that would make a difference in other areas of life. By that, I mean economic alterations.

Like the ones we’re experiencing now. Which is anything but optimal for most people.

Take MarketWatch’s recent article, “Thanks, inflation: Thanksgiving dinner costs 20% more this year, running $65.04 on average – before alcohol.” It reads:

“In fact, the cost of buying a turkey and the trimmings to feed a family of 10 is the highest it’s been [in] years, according to the latest American Farm Bureau Federation survey. The… Bureau’s 37th annual survey puts the average cost of a classic Thanksgiving feast at $65.04 this year, which is a $10.74, or 20%, increase over last year’s average $53.31 tab.”

That’s why many outlets are reporting that most Americans are approaching their Thanksgiving plans differently.

FinanceBuzz, specifically, reports that “86% of people” out of 1,500 surveyed “anticipate rising food costs impacting their Thanksgiving meal this year (up 23% from 2021).” And 18% “plan on switching to a less expensive alternative to turkey.”

They’re coping with economic changes as best as they can.

Change, Change, Change… Change of Fools

I’m not going to say anyone’s wrong to alter their Thanksgiving plans accordingly. We need to adapt to life’s changes to a very large degree.

Going back to that New England weather we began with, can you imagine still wearing shorts, a t-shirt, and flipflops up there in February? That would be insane!

That’s why you’re almost never going to see anyone doing it. Because most people, while varying shades of crazy, are naturally inclined to put two and two together: If A and B, then C.

Unfortunately, there are a lot of changes that don’t seem so easy to figure out at face value. Combine that with how we’re naturally inclined toward making predictions and coming to conclusions, and we’ve got an automatic problem.

Some of us are too quick to jump to decisions. Others of us are too quick to consider every factor ad nauseum, wasting precious time as we do.

But in so many cases, we really would be best to rely on traditional wisdom in the form of the more modern slogan: Keep it simple, stupid. Or, if you’d like a less blunt version: Keep it simple, sweetheart.

To do this, your first order of business should be to breathe.

Really. I’m not being condescending. If you’re struggling to make sense out of your investing options, just go for it. Just take a deep breath. And then another one. And then another one…

Until you’re no longer feeling so stressed about the economy, your financial situation, and whatever’s going to be the fallout of that crypto debacle going on right now. Once you’ve reached that goal, you’re ready for step 2.

Stick With the Classics. They Tend to Love You Back Longer.

Step 2 is to remember how it used to be, back through past thicks and thins. Recall how trends come and go, but the classics never go out of style.

One of those classics is without a doubt healthy dividend-paying stocks like real estate investment trusts (“REITs”): companies that are sometimes slow to make their gains but finish strong over the long term.

Step 3 then is to buy into those companies (after an appropriate level of research and personal assessment, of course) at undervalued prices. And there are plenty of stocks to choose from in that narrowed-down category despite recent overall market gains.

Plenty of REITs too, if we’re going to get specific, which you know I will.

That’s what I mean by “keep it simple, stupid.” It’s not to say that you’re actually stupid. Because you’re not.

I know my readers. You’re exceptionally intelligent and hard-working, and you aim to do things the right way.

With that said, you’re still human. And we humans can get overwhelmed by changes, especially when it’s two and a half years’ worth of them… from lockdowns to market swings, financial fears to physical fears, re-openings to bewildering levels of inflation…

My job here is to help you see through and get through all that by sticking with the basics that haven’t failed us yet. Here are three stocks to help you do exactly that.

KISS REIT #1 – Realty Income Corporation (O)

When it comes to keeping it simple and not over-complicating things, it starts with Realty Income. Realty Income is the gold standard when it comes to REITs.

They provide:

- Consistent Results

- High-Yield Total Returns

- Strong Portfolio

- Investment Grade Tenants

- Strong Management Team

The list can certainly go on, but when looking at REITs, Realty Income certainly checks off many if not all the boxes.

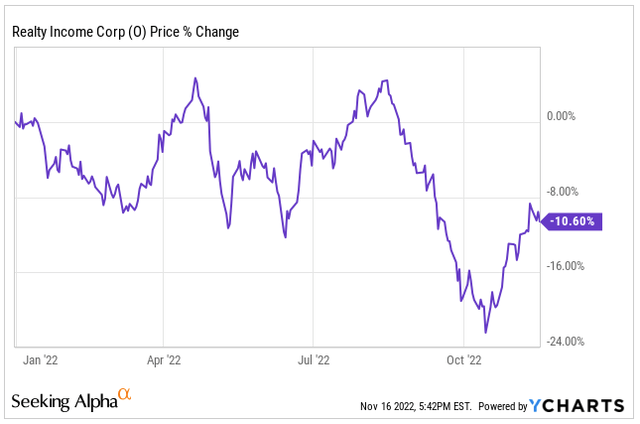

On the year, shares of Realty Income are down 10.6%, but that was over 20% just a few weeks prior. Over the past month, Realty Income shares have rallied 15%.

Did you know that leading up to the pandemic, REITs have been a top performing asset class for a number of decades. That all starts with Realty Income. Since the start of 2010 through February 2020, the start of the pandemic, Realty Income had total returns of 390% compared to the S&P 500s (SPY) total return of 252% over the same time period.

Keeping it simple by investing in a strong company, who partners with investment grade tenants, and backed by a strong balance sheet, does not get any more simple than that.

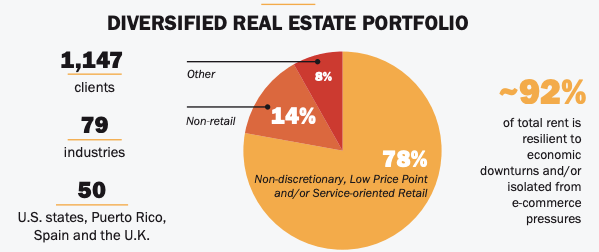

O Investor Presentation

Worried about a pending recession? If anything, Realty Income is a hedge against those fears due to the diversification and strength within their portfolio. As you can see in the chart above, Realty income has 78% of their portfolio coming from non-discretionary and service-oriented properties.

In addition, since 1998, the REIT has averaged a high occupancy level of 98%, with 96.6% being the lowest level back in 2009.

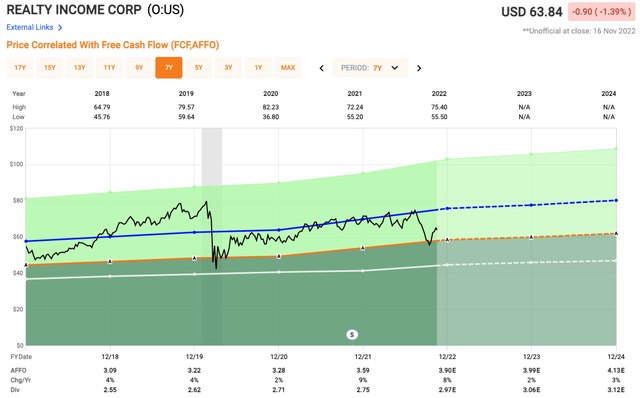

Shares of Realty Income currently trade at a P/AFFO of 16.5x. Over the years, given how consistent the company has been as compared to others in the industry, Realty Income shares tend to trade at a premium. The shares have a 5-year avg AFFO multiple of 19.5x, suggesting that shares are undervalued right now.

In addition to the shares being undervalued, the company recently declared their 629th consecutive monthly dividend. Realty Income currently pays a dividend yield of 4.6% with a low payout ratio of 75%.

At iREIT on Alpha, we currently rate shares of Realty Income as a BUY.

KISS REIT #2 – Omega Healthcare Investors, Inc. (OHI)

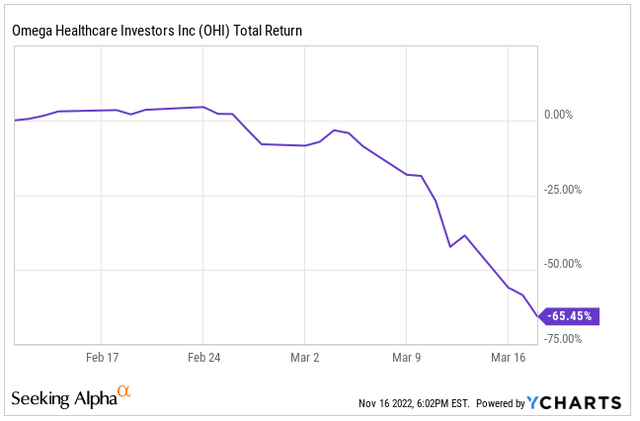

Omega Healthcare Investors is the next KISS REIT we are going to look at today. OHI is a little different when it comes to Realty Income in the fact that OHI REIT got completely hammered in the midst of the pandemic.

In a matter of five weeks, from mid-February to mid-March 2020, shares of OHI fell over 65%. Anything related to healthcare was crushed.

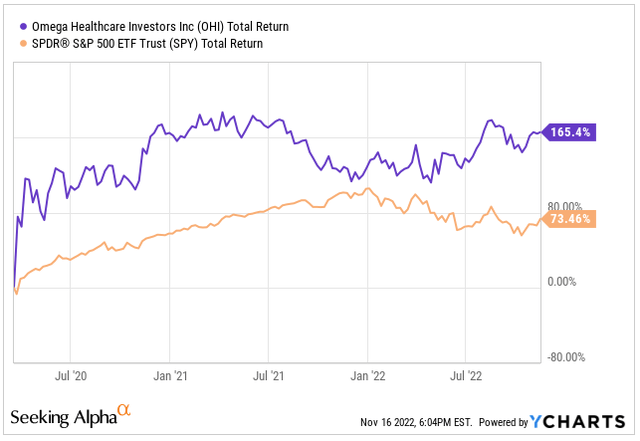

Since those dark times, shares of OHI have bounced back with a vengeance, jumping 165% to date, over doubling the 73% return in the S&P 500 (SPY).

Omega recently announced their Q3 earnings that beat on both the top and bottom line.

- FFO (funds from operations) of $0.76 vs $0.74 expected

- Revenue of $239.4M vs $215.9M expected.

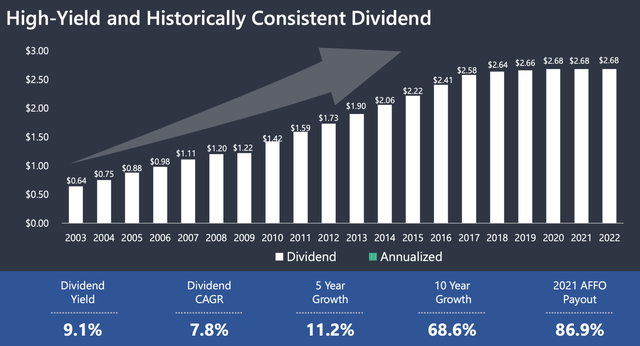

OHI has a very high dividend yield of 8.6%, which has been the center of many concerns about OHI. Bears believe the dividend needs to be cut, but OHI management has not indicated that this is on the table yet, instead pointing to their operator restructurings and improving financial results.

OHI pays a quarterly dividend of $0.67 and we saw the FFO was $0.76 above, which means the company is currently operating with an FFO payout ratio of 88%.

Occupancy levels continue to improve, albeit not at the pre-pandemic levels yet, but management expects this to continue. Operators are still struggling in the high-cost environment, so with that looking to have peaked, this should help operators breathe a little easier.

For those of you investors looking more for yield, OHI could be a great REIT to consider.

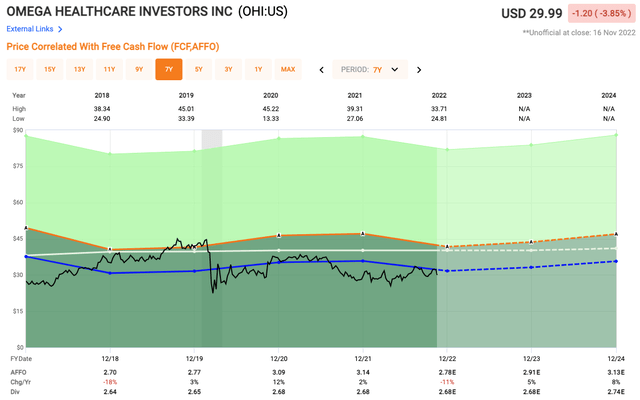

Shares of OHI currently trade at an AFFO multiple of 10.6x, which is slightly below their five year average of 11.4x. Analysts are expecting occupancy levels to improve in the coming years, as the average analyst estimate has OHI increasing their AFFO by 5% in 2023 and 8% in 2024, so from a forward looking basis, shares of OHI are even cheaper.

At iREIT on Alpha, we rate shares of OHI as a BUY.

KISS REIT #3 – Digital Realty Trust, Inc. (DLR)

The final KISS REIT we will look at today is Digital Realty Trust, which yet again comes from a completely different sector than the others we have looked at.

All three of these REITs can be viewed as leaders in their respective industries. Realty Income is the gold standard across almost all REITs. OHI is a leader, but fell on hard times during the pandemic and is finally climbing its way back. DLR is a leader in the data center space, but they have come under pressure due to a short position from Jim Chanos.

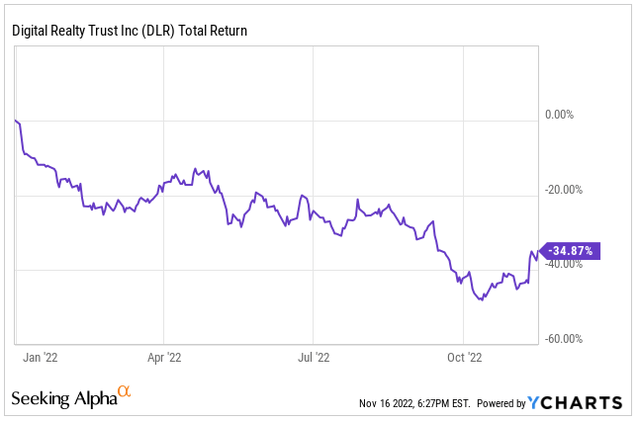

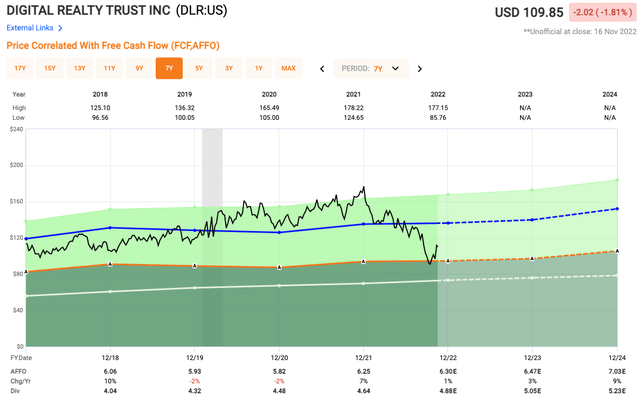

Due to this, shares of DLR are down 35% on the year.

As such, shares could be scooped up at a great valuation. Mr. Chanos’ argument is that big tech names like Alphabet (GOOG, GOOGL), Meta Platforms (META), and others are going to start going away from REITs like DLR and build their own data center spaces.

This is true, there is no disputing that, but that is something that will still take years to come to fruition and frankly, it is not feasible for all companies to do this.

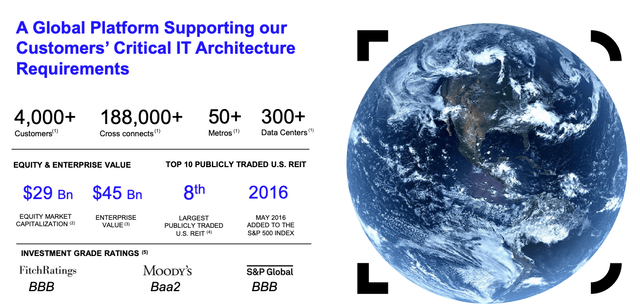

DLR is one of the largest Data Center REITs on the market today with a market cap of $31.5 billion. The company is the largest global provider of cloud and carrier-neutral data center and interconnection solutions.

Digital Realty Trust has in-demand properties from all types of tenants which will lead the company to delivering stable results going forward. Bookings on a historical basis have shown growth for over a decade now with no signs of a slowdown.

Digital Realty has over 4,000 global customers and over 300 data centers across the globe, making them one of the top 10 largest U.S. REITs on the market today.

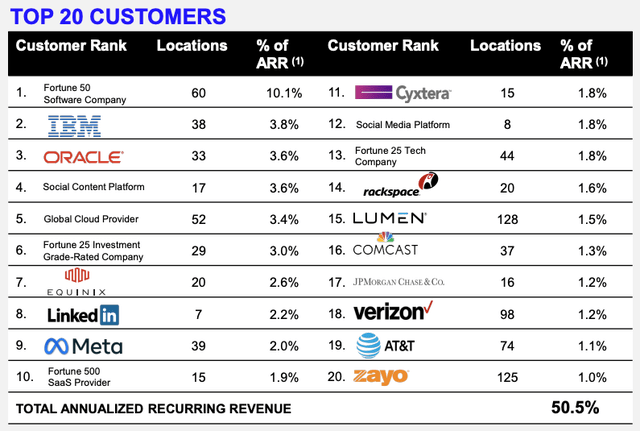

As you can see, the company has a large number of customers and the non-big tech clients tend to have larger spreads for the company, which could be a driver for the company if some big tech customers did lessen some of their exposure to DLR.

Here is a look at DLR’s top 20 tenants, which account for 50.5% of annualized recurring revenue, or ARR.

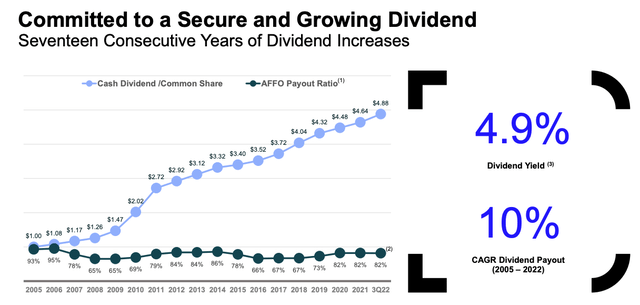

The company continues to perform at a high-level, which has resulted in investors seeing their dividend income consistently grow. Currently, the company pays an annual dividend of $4.88, which equates to a dividend yield of 4.4%. The dividend is plenty covered with an AFFO payout ratio of 82%.

Given the pressure shares of DLR have been under, the REIT now finds itself trading at an AFFO multiple of just 17x. Over the past five years, DLR has traded at an average AFFO multiple of 21.6x, well-above their current levels.

If you are a believer in the demand DLR continues to see moving forward, and you like high-quality companies trading at a discount, then DLR might just be the perfect fit for your portfolio.

At iREIT on Alpha, we currently rate shares of DLR as a STRONG BUY.

Is Your KISS On My REIT List?

I hope you enjoyed my KISS article and as always, thank you for allowing me to spread the REIT love here on Seeking Alpha. Good luck and happy REIT Investing!

Be the first to comment