gesrey

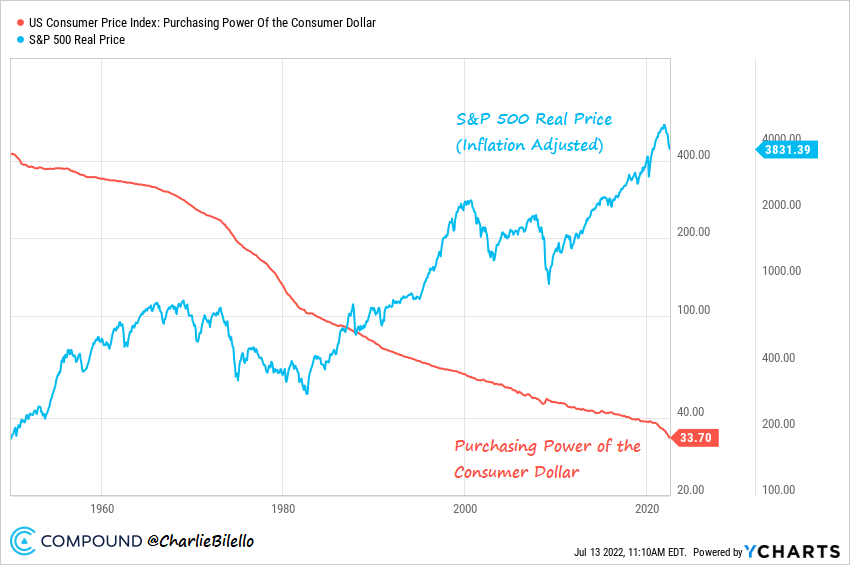

We all know that holding cash is a sure way to lose money in the long run. Even with just 2% inflation, you lose about half of your purchasing power in 20 years.

This is well-known to most people and it is one of the main reasons why we invest our savings in productive assets like stocks. They allow us to preserve and grow our purchasing power in the long run.

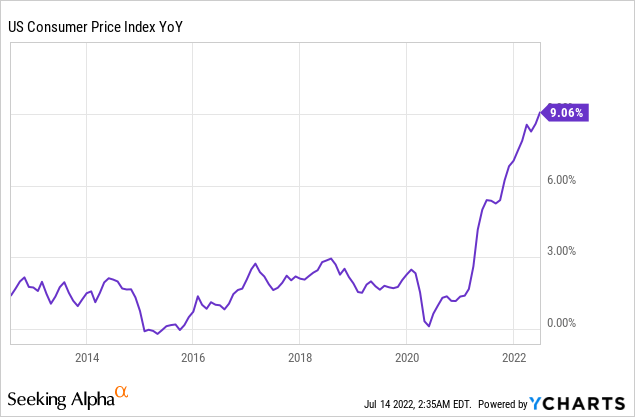

Yet, recently, as inflation surged to nearly 10% (a 40-year high!), increasingly many investors made the surprising decision to move into cash. They sold stocks, which are supposed to protect them, and switched into cash, which is guaranteed to lose purchasing power in the long run:

They argue that stocks are simply too risky in today’s environment.

Inflation is too high, interest rates are on the rise, and we are nearing a recession.

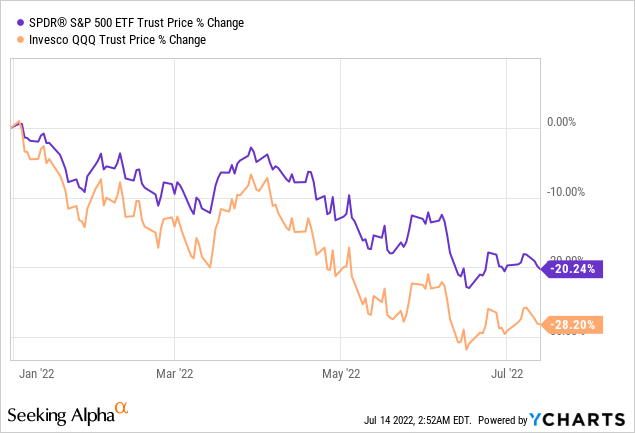

As a result, volatility is on the rise, and stocks recently dropped into a bear market. The S&P 500 (SPY) is down by 20%, and tech stocks (QQQ) are down even more at closer to 30%:

I get it that stocks are scary in this environment, but is cash really the best solution in a 9% inflation world?

I strongly believe that “cash is trash” because:

- You are guaranteed to lose money in real terms.

- It is impossible to time the market.

- And there are always opportunities somewhere.

In one chart: here’s why you should stay invested.

CharlieBilello via Twitter

If stocks were way overpriced, you could make the argument that “stocks are even trashier than cash“, but that’s not exactly the case. The average P/E of the S&P500 is now near historic averages, and some sectors of the market are priced at large discounts to fair value.

My favorite sector isn’t a secret here on Seeking Alpha.

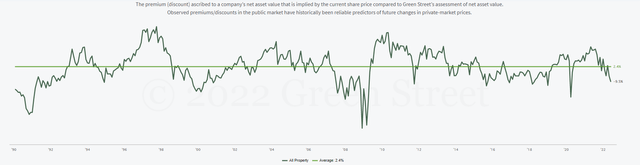

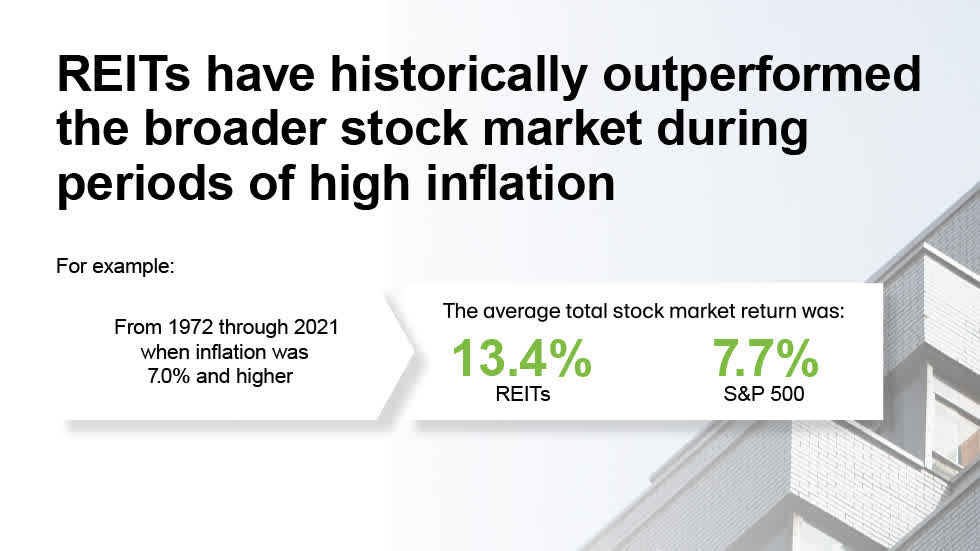

I invest about 50% of my net worth into the REITs (VNQ) that are highlighted at High Yield Landlord. I invest so heavily in them because they are today priced at their lowest valuations in years, and they have historically generated particularly high returns during times of high inflation:

Lowest valuations in years:

Green Street Advisors

Inflation benefits REITs:

NAREIT

Historically, when inflation is above 7%, REITs generate nearly 2x higher returns than regular stocks. This makes sense since real estate investments are great inflation hedges:

- Interest rates are locked for many years and mortgages are inflated away.

- The replacement cost of properties rises.

- New development projects are canceled/delayed, reducing supply.

- When gas and grocery prices rise, so does your rent.

- And as increasingly many people seek inflation protection, prices of properties are often bid up.

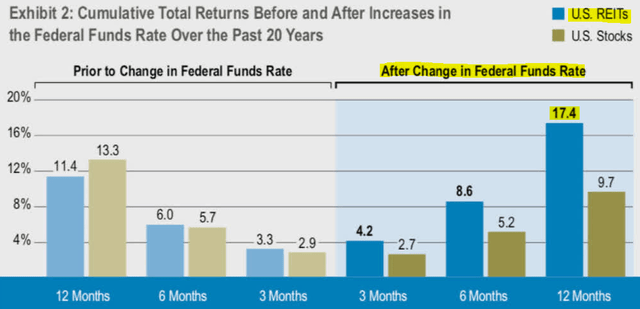

Yet, today, REITs are deeply discounted trading at their lowest P/NAV valuations in years due to fears of rising interest rates. What most investors appear to ignore is that REITs also outperform during times of rising interest rates, and this is because the negative impact of rising rates is much smaller than the positive impact of inflation:

Cohen & Steers

So I reiterate my point: cash is trash and I would much rather invest in undervalued, inflation-protected, productive assets like REITs, which are assured to generate higher returns over time.

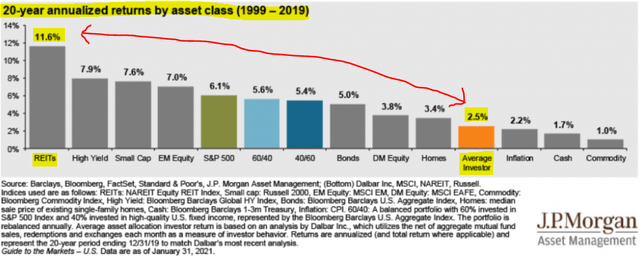

No one can time the market, not even Warren Buffett, and trying to get in and out is a sure way to lose purchasing power in the long run:

J.P Morgan

With that said, here are 2 REITs that I expect to soar with inflation. They are today deeply discounted and we are accumulating them at High Yield Landlord.

Whitestone REIT (WSR)

One of the most resilient businesses in the world is grocery stores.

People need to eat, whether the economy is booming or collapsing, and generally, people will accept the inflation in food costs, and simply save elsewhere to get by.

This explains why grocers like Kroger (KR), Walmart (WMT), Dollar General (DG), and Costco (COST) have outperformed the market in 2022.

But an even safer business is to be the landlord of these grocers. That’s because you own the real estate and earn your cut of their profits via fixed rents. You get paid first, and if the tenant fails to pay, you simply replace it with another one.

As long as you own desirable properties in growing neighborhoods, your rents should also grow over time, and if you are a sophisticated investor, you may also seek to add further value by redeveloping/densifying/dividing assets.

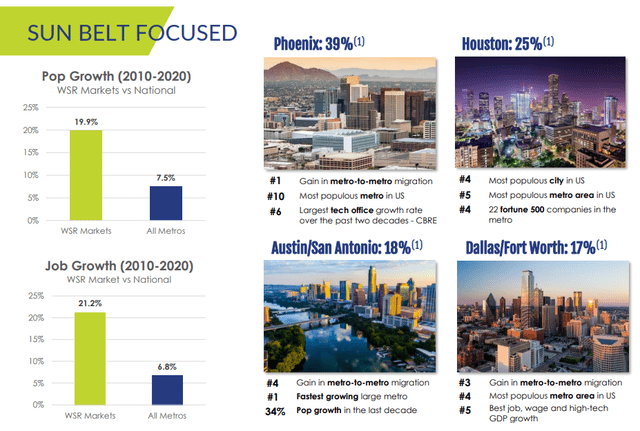

Whitestone is currently one of our favorite service-oriented shopping center REITs. Most of its properties are anchored by grocers and/or other essential services, and importantly, its properties are mainly located in rapidly growing sunbelt markets like Phoenix and Austin:

Whitestone REIT

Whitestone REIT

These 2 markets experienced some of the fastest growth and property price appreciation in 2020 and 2021, and despite that, WSR completely missed out on this appreciation.

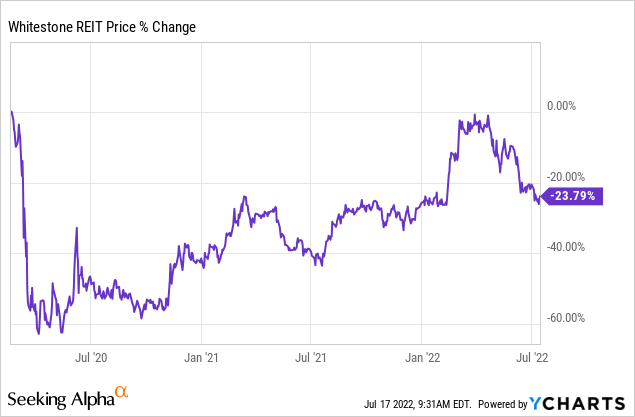

Today, its share price is still ~25% below pre-covid levels:

As a result, its shares are today priced at an estimated 35% discount to net asset value, and just 10x FFO.

It is especially hard to make sense of this low valuation because the company has guided for 15%+ FFO per share growth in 2022 as it hikes rents, cuts costs, and grows its occupancy rates.

Typically, REITs that grow at this pace trade at closer to 20x FFO.

20x FFO may be a stretch for a small-cap REIT, but even getting to just 15x FFO would unlock 50% upside and while you wait, the company pays you a 5% dividend yield and continues to grow in value. I love the risk-to-reward in today’s environment.

STAG Industrial (STAG)

We have all heard the headlines of rapid e-commerce growth.

Amazon (AMZN) and Spotify (SPOT) type companies hugely benefited from it, and the trend only accelerated during the pandemic.

But there are other hidden beneficiaries.

One of them is industrial REITs that own warehouses and distribution centers, which are vital to e-commerce companies.

STAG Industrial is one of the best opportunities in this segment of the REIT market. Its biggest tenant is Amazon and a large portion of its portfolio handles e-commerce activity.

STAG Industrial

Its multi-year leases provide consistent cash flow, and since its rents are below market, it has a predictable path to rapid growth in the years ahead. In fact, STAG recently noted that its rent growth is accelerating to the fastest in the company’s history.

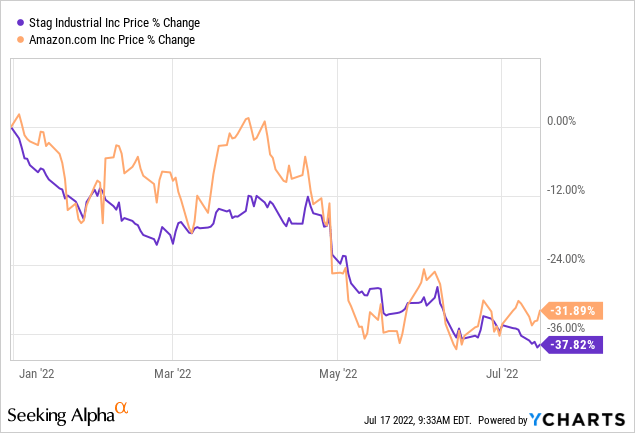

New leases have been signed with 15%+ hikes thus far in 2022, but despite that, STAG’s share price has dropped alongside Amazon as if it was a tech stock:

Tech companies are suffering today, and Amazon’s growth will likely slow down, but the market is mistakenly interpreting that as a significant issue for STAG when in reality, it really isn’t.

As we noted earlier, STAG generates steady cash flow from multi-year leases and its rents are today below market.

Beyond that, it is not just reliant on the growth of e-commerce. Today, increasingly many companies (e-commerce or not) are bringing back larger portions of their supply chains into the US (onshoring) in response to the supply chain issues caused by the pandemic and Russia’s invasion of Ukraine.

All these companies need warehouse space and distribution centers and it bodes well for leasing and rent growth in the coming years.

All in all, we see a path to ~8% annual FFO per share growth in the coming years, and yet, the shares trade today at just 14x FFO and an estimated 30% discount to NAV after the recent sell-off. This is its lowest valuation ever:

STAG is the cheapest ever (Tikr)

We estimate that the company has ~50% upside potential to our fair value target, and while you wait, you earn a monthly 5% dividend yield. That’s very attractive coming from a defensive, investment-grade rated company with predictable growth prospects.

Bottom Line

Each and every time when the market dips, investors run for the exit and move into cash. They claim that “this time is different” and that the market is uninvestable.

Yet, they are always wrong and the market soon recovers, missing significant gains and leaving them holding cash that has depreciated in value.

Today, inflation is near 10% and yet, many are making the same mistake again. They think that they can time the market when in reality, it has been proven time and time again that it isn’t possible.

REITs, on the flip side, are today priced at steep discounts to fair value and they have historically provided strong total returns during times of high inflation. While I cannot predict how REITs will perform in the short run, I am confident that well-selected REITs will provide high returns over the coming 5 years and that’s all that matters to me.

Be the first to comment