Paperkites

Micron’s (NASDAQ:MU) stock was pummeled after its June 30, 2022 earnings call because of the weak guidance, and it impacted numerous other semiconductor stocks including NVIDIA (NVDA), Advanced Micro Devices (AMD), Intel (INTC), QUALCOMM (QCOM), and Marvell Technology (MRVL), all which fell nearly 4% in mid-day trading.

Mis-cue’s and Lack of Understanding of the Memory Business

My contention, and the point of this article, is that there were mis-cues, lack of understanding of the memory business by analysts and investors, and poor macroeconomic factors that not only affected MU but nearly all technology stocks. And it comes also from Micron.

Micron CEO Sanjay Mehrotra in its earnings call said industry demand had weakened recently, citing weakness in PCs and smartphones, and company would take actions to moderate supply growth in fiscal 2023.

Mistake #1

That’s a key mistake from Mehrotra using the term “recent” (remember this was a June 30 call) because TSMC (TSM) Chairman Mark Liu actually said March 30, 2022. That’s 3 months or 90 days BEFORE Mehrotra’s call. Liu said:

“Consumer electronics demand is showing signs of slowing amid geopolitical uncertainties and COVID-related lockdowns in China…the slowdown is emerging in areas “such as smartphones, PCs, and TVs, especially in China, the biggest consumer market.”

Mistake #2

Micron’s Q3 Guidance for Q4 was $7.2 billion +/- $400 million. But the Street Q4 Consensus was $9.2 billion. MU stock was pummeled after the earnings call because of the weak guidance, and it impacted numerous other semiconductor stocks. That raises a question – why wasn’t the Street Q4 consensus at $9.2 billion lowered before the call when there was talk since March 30 about slowing PC and smartphone sales by none other than renowned TSMC Chairman Liu.

Mistake #3

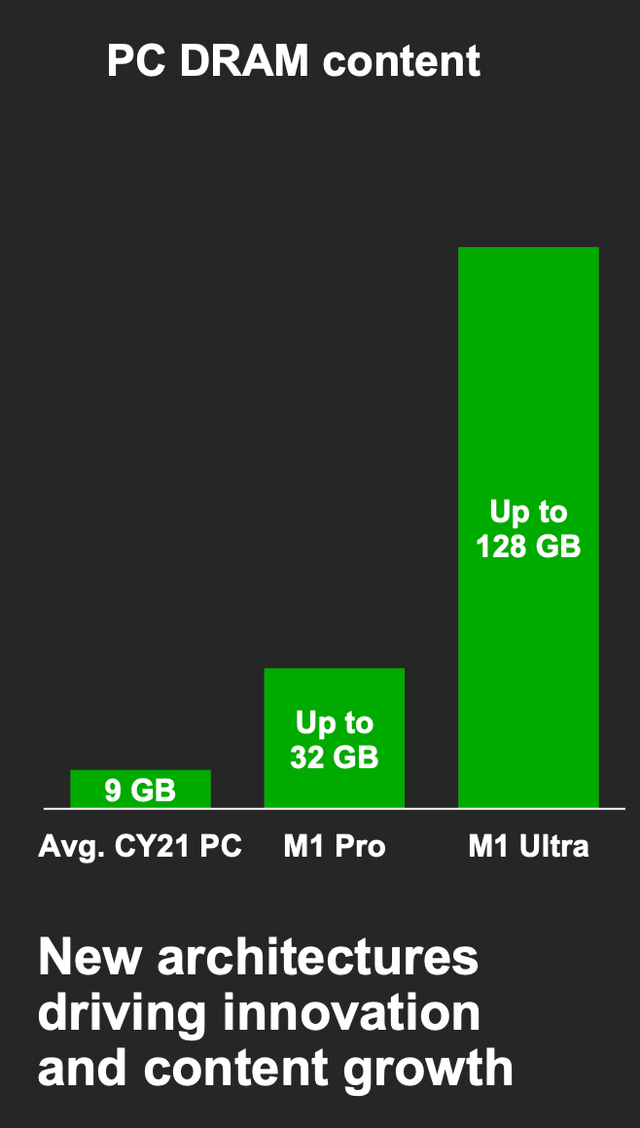

What I have said in several Seeking Alpha articles is that the industry “analysts” are neglecting to recognize that the amount of memory (in “bits” of data) varies by model and increases with each generation of PC. Most recently, I presented data in a June 27, 2022 Seeking Alpha article entitled “Is Micron Technology Stock A Buy Before Upcoming Earnings?“

I noted that PCs had 9GB of DRAM in 2021 but Apple’s (AAPL) M1 Pro incorporates up to 32GB of DRAM. In other words, a PC shipment is counted 1 shipment, but if it contains 32GB of DRAM, in principle, it should be counted as 3 units rather than 1 shipment.

Also, Micron estimates that Apple’s M1 Ultra will contain up to 128GB of DRAM, as shown in Chart 1. That means it’s equivalent to 14 9GB PCs, yet it is counted as just 1 shipment.

This is what analysts and investors miss. Bit shipments of memory in a PC are not equal to unit shipments of a PC.

Chart 1

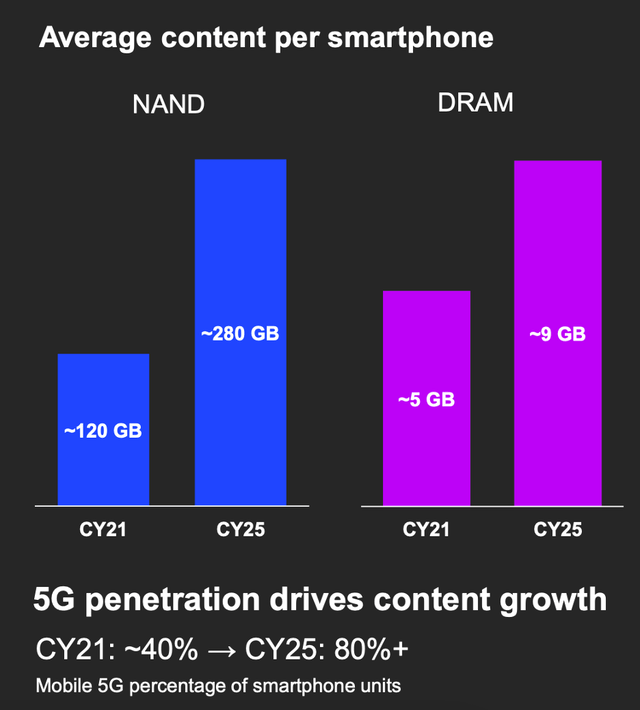

Likewise, NAND content per smartphone is expected to grow from 120GB in 2021 to 280GB in 2025. DRAM content will grow from 5GB to 9GB, as shown in Chart 2. Also, note that 5G insertion was 40% of smartphones in 2021 but is expected to increase to 80% in 2025.

Chart 2

Also note that 5G insertion was 40% of smartphones in 2021 but is expected to increase to 80% in 2025, according to The Information Network’s report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.”

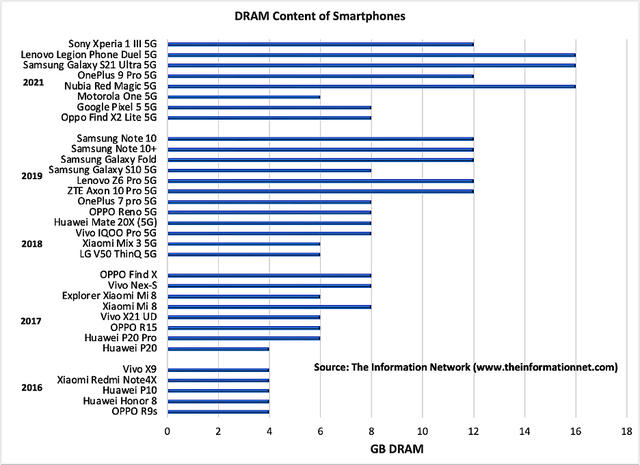

Chart 3 shows the amount of DRAM by smartphone model between 2016 and 2021, and note the increase in DRAM with 5G smartphones. I had presented this chart in a November 26, 2019 Seeking Alpha article entitled “Micron Technology: Demonstrating DRAM Technology Leadership.”

5G devices are expected to grow 25.5% year over year in 2022 and account for 53% of new shipments with nearly 700 million devices and an average selling price (“ASP”) of $608.

Chart 3

Micron – Samsung Data

DRAM Bit Shipments

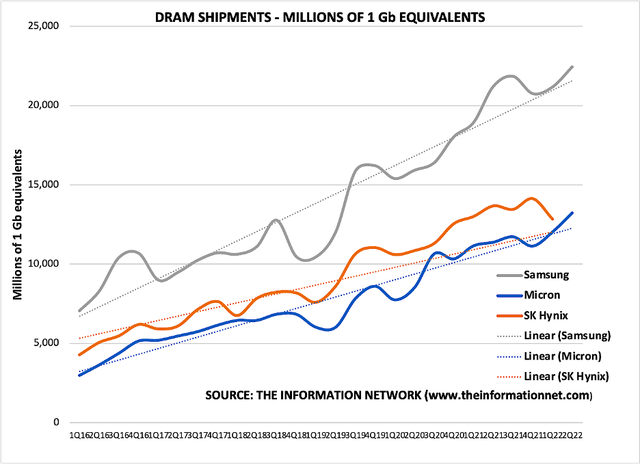

This is substantiated in Samsung’s (OTCPK:SSNLF) preliminary bit shipment data. In 2Q, DRAM bit growth likely stood at a mid-single digit percent and NAND bit growth likely expanded q-q slightly.

Chart 4 shows DRAM Bit Shipments for Samsung and Micron for 2Q 2022 along with SK hynix for Q1 2022. Despite the drop in PC and smartphone shipments, bit growth increased. And it must be remembered that 5G smartphones have more memory per device and the penetration rate of 5G smartphones continues to increase.

Chart 4

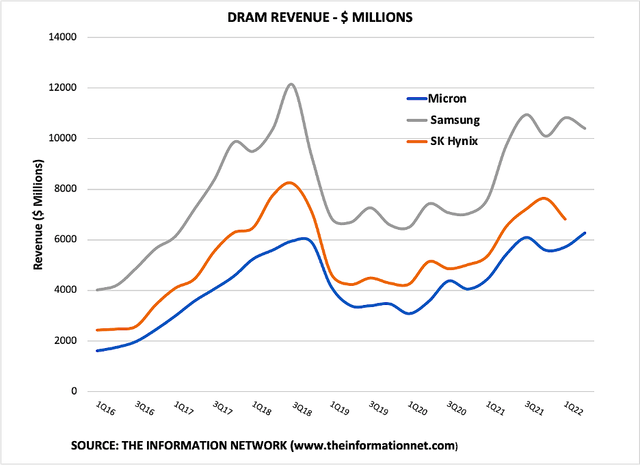

DRAM Revenues

DRAM revenues are shown in Chart 5. Samsung reported estimated DRAM up 8% QoQ but because of the strong U.S. dollar, which increased 12% compared to the Korean Won, revenues in dollars decreased 4%. Micron’s revenue increased 9.7%. Despite the drop in PC and smartphone shipments, DRAM increased in native country revenues.

Chart 5

Investor Takeaway

Economic Malaise

Macro uncertainties have had an adverse impact on smartphone/PC demand. Shanghai China lockdowns impacting the supply chain earlier in the year, must not be overlooked. Delivery delays moved from component shortages to logistics disruptions as the Shanghai port was essentially closed.

Another significant factor permeating the entire industry is how “analysts” keep mucking things up. Micron’s earnings call was an excellent example. As I discussed at the beginning of this article.

There are a lot of inconsistencies coming from analysts since Micron’s poor FQ4 guidance on June 30, 2022 during its FQ3 earnings call.

When Micron provided Q4 guidance during its Q3 earnings call of just $7.2 billion, share prices plummeted since Q4 consensus was pegged at $9.2 billion.

The macroeconomic and geopolitical issues that have been responsible for a strong slide in the market didn’t happen overnight. But the analysts, touting a drop in “spot” DRAM prices and a slowdown in consumer products, didn’t lower consensus, keeping them at $9.2 billion.

Samsung’s preliminary Q2 earnings are strikingly similar to that of Micron, which announced one month earlier. But what is key is the fact that bit shipments are not unit shipments, particularly with stronger demand for memory chips in 5G smartphones.

Micron Reports Power Disruption at Hiroshima Manufacturing Facility

Micron reported that it experienced a prolonged power disruption at its Hiroshima DRAM manufacturing facility on Friday, July 8, 2022, due to inclement weather in the area. The loss of power prompted the implementation of factory shutdown protocols. Operations have resumed at reduced levels and will continue to ramp over the next week. Micron is assessing the wafers in process at the time of the incident to determine whether they will meet the company’s stringent quality standards.

Micron expects production output loss and associated cost impact from both productivity and wafer scrap across Micron’s fourth quarter of fiscal 2022 and first quarter of fiscal 2023.

This is the same typhoon that caused the Japanese Renesas plant to shut down.

Conclusion

Micron’s performance in the past fiscal quarter is comparable if not better than main competitor Samsung Electronics. Thus, Samsung’s preliminary earnings call indicates that Micron’s battering after the recent call was due to excessively high consensus from analysts.

The clearest example of the disconnect between analysts is the fact that DRAM revenues and bit shipments increased for MU while PCs and smartphones unit shipments decreased. In other words, bit shipments = revenue and bit shipments do not = unit shipments of end products.

There are a number of significant headwinds facing share performance of Micron. It is down 38.19% YTD, primarily tied to the 10-year Treasury Rate, which I discussed in my July 1, 2022 Seeking Alpha article entitled “Why Are Tech Stocks Selling Off And What Is The Outlook?”

Micron is my favorite semiconductor manufacturer, but unfortunately is a victim of a bad economy and bad analysis. I rate the company a Buy.

Be the first to comment