vitapix

Dear readers/Subscribers,

York Water (NASDAQ:YORW) is one of those companies you often hear about in various dividend news channels, because it’s one of the companies – the company – that has paid an uninterrupted, unbroken dividend for the longest time in history. This history lends the company advantages typically completely unassociated with companies of this size – because YORW is actually very small, at only $650M in market capitalization.

Still, the number of companies that can claim that they began paying dividends prior to the American civil war, kept paying them through the conflict and started paying dividends less than 50 years after the founding of the nation of the USA are… well, they’re few.

Investors like companies such as that because of the unprecedented level of safety to their operations. Because YORW doesn’t just have traditional/historical safety, but operational safety as well.

Updating on York Water

Companies that operate water infrastructure have similar positions to utilities, living space/housing companies, or telecommunications. Consumer staples such as food are in a similar spot as well, but out of all of them water is perhaps one of the most basic needs that just needs “to work”.

Like other commodities in these categories, these companies are to a very high degree, regulated businesses that don’t control their own pricing and pricing increases, in exchange for unparalleled levels of income safety and stability from regulators. These sorts of businesses make for excellent income and stability investments.

In a positive environment, York Water Company could provide you with double-digit annual RoR, of which only a small portion is dividends, but unparalleled levels of safety. That’s the situation you want to be investing in, and what I invested in when I started putting money to work in York Water.

The company has an overall service territory with a population of around 204,000 people. This includes a very mixed customer base, including very classic residential and some basic industrial/commercial with manufacturing of fixtures, furniture, electrical machinery, and many other areas. This is not the largest base, nor does it focus on expansion or growth of its customer base (at least not to any significant degree). What you see, is more or less what you get.

Trends in this company are somewhat seasonal – by that I mean not consumer trends, but rainfall trends. Revenue impacts can be particularly heavy during periods of dryness, and dry spells can create supply imbalances where more water is used for water, washing, golf courses, and other things which can lead to government-instituted drought policies.

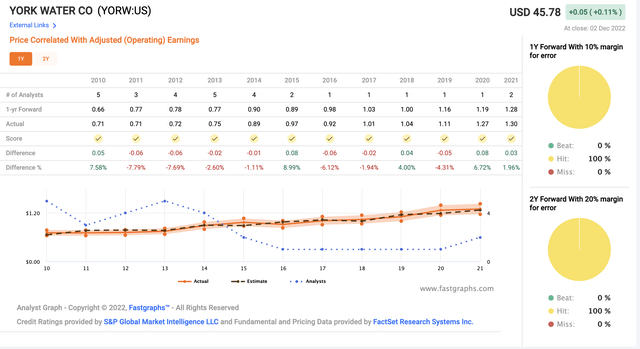

Water companies are neither capital-intensive companies, and do not require expansive amounts of WC. Its earnings visibility is among the best in the entire market, backed up by the following 12-year analyst scorecard.

YORW earnings forecast accuracy (F.A.S.T. Graphs)

Rounding errors of 3-7% – no more than that. Through thick and thin, the company provides safety, stability, and cash flows as well as dividends. The one issue is that the amount of those dividends is neither especially impressive nor likely to grow substantially in the future. A 1.5%-2% yield is what you can expect. There are companies that yield less than YORW, but I wouldn’t consider them especially attractive insofar as dividends go.

It’s not just the low dividends either – it’s the multiples that the market “wants” for the company in question. Getting to buy YORW below a 30x normalized P/E is a rarity. It happened during a day or two back a few months ago, which is when I loaded up a few more shares, but it quickly bounced back up. Premiumization is very real for this company and has been for as long as 7 years at this time.

Back in the financial crisis, you at one point could buy YORW as low as 17x normalized P/E. Had you done that, your RoR would have been very impressive indeed, with 413% RoR or 12.7% annually, beating the market while investing in water.

In an ideal world, I would want 5% YORW at a cost basis that allowed for a 2.5%+ yield, and it’s one of those companies that I would not sell below a 50-60x normalized P/E (and yes, the company has inched close to 45-50x P/E).

Despite its extremely small size with a market cap of less than $1B and a relatively high LT debt/cap at 46.45%, the company’s history, and nature have given it an S&P Credit rating of A-, which is something to be quite amazed by, as I see it.

Furthermore, fundamentals of investing in a water business should be clear to everyone. People need water. People will continue to need water. The company operates one of the most time-tested systems in existence and is under public listing. While the global water market will get a lot larger, it seems unlikely that YORW will see part of that massive growth.

However, large water companies with service areas of more than 100,000 customers have long been favorites for investors due to their safe and reliable nature.

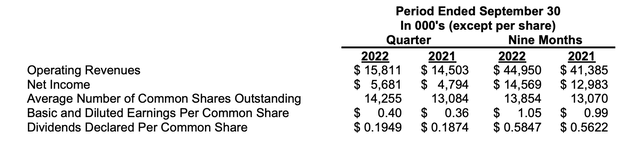

Recent results for YORW confirm this tendential upside going forward. The 9-month earnings are in, and the company recorded a quarterly operating revenue increase of $1.3M, with a net income of around $5.7M for the quarter, increasing basic EPS by 4 cents on a YoY basis.

The reason here was a slight growth in the company’s customer base due to a recent wastewater M&A in West Manheim, and some charge utilizations due to replacements of aging infrastructure.

At the same time, YORW is certainly not immune from cost increases and inflation, and the company saw higher operational and maintenance CapEx levels, as well as some standard D&A. Both revenues and income saw 9M YoY increases as well. The company invested close to $35M for some routine items, and wastewater treatment construction, with another $11M to be invested for the remainder of the year.

No surprises and no real worries in terms of the company’s results and numbers that would significantly impact my overall valuation thesis for York Water.

Let’s look at company valuation.

York Water Company valuation

The company’s premium remains high – even higher at this particular point in time, making the case for investing in the company somewhat prohibitive from a valuation perspective.

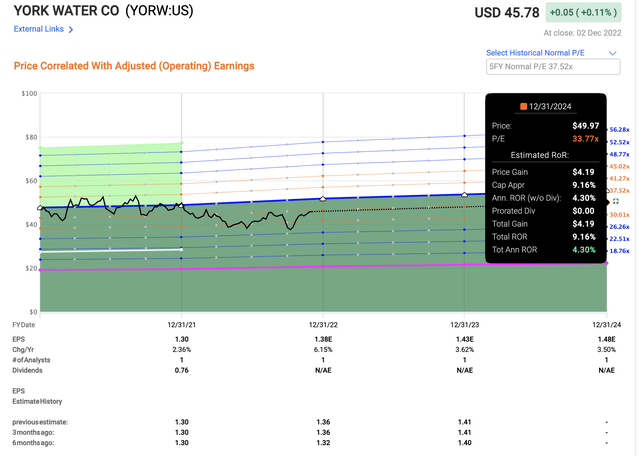

I bought shares of the company at closer to 30x P/E, which was a valuation I could stomach. As of today’s market action, this company is now once again hovering very close to a $46 mark, which has pushed the yield down below 1.8%, and the realistic upside that is to be garnered from YORW even at a normalized premium valuation to below 5% per year.

YORW estimated RoR (F.A.S.T. Graphs)

There is a time to hold a stock, and a time to buy a stock. There is a time when a company becomes too expensive.

For YORW, that time is when the company’s share price goes above $44/share. At such a point, even the most positive cases for this business can generate, as I see it, no great returns, and cause me to become conservative on this business.

However, as you can see in the recent past, there have been times when this company most certainly could have been “bought”. So it’s all about setting those targets and act on them when an investment drops to that level.

S&P Global would consider the company in the following way at this time. The analysts consider the company as they have considered it before, legitimizing a much higher share price target of an average of $55/share. That means the company is now 20% undervalued to this analyst price target (Source: S&P Global).

As I’ve said in previous articles, I wouldn’t consider this target legitimate for a conservative investor. And when I say “average”, what I mean is that only one analyst follows YORW, and that analyst has held that $55/share price target for over 2 years at this point.

My own PT is $44/share and has been for some time. I believe this target offers a far tighter and more “correct” range for the company.

Thesis

My thesis for York Water Company is the following:

- This is the oldest consistently dividend-paying company in existence. It’s trading at a significant premium but may well deserve some of this premium.

- My target for YORW is a 33X P/E, accepting the 10-year P/E average, giving us a PT of $44/share.

- YORW has gone too far – I’m “HOLD”ing here, and I consider it better to wait to drop before buying more.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic, good upside based on earnings growth or multiple expansion/reversion.

As you can see, the company fulfills only 3 out of 5 criteria here – making it a “HOLD” to me.

Be the first to comment