cmannphoto/iStock via Getty Images

Some investors are in the camp of “this is just a temporary bear market rally,” and others, like myself, are banking on a robust rebound by year-end. In my view, the best way to play this coming rebound is to load up on small/mid-cap stocks that have been pummeled heavily since the start of the year but still have strong fundamentals or are only facing temporary macro headwinds that are not company-specific.

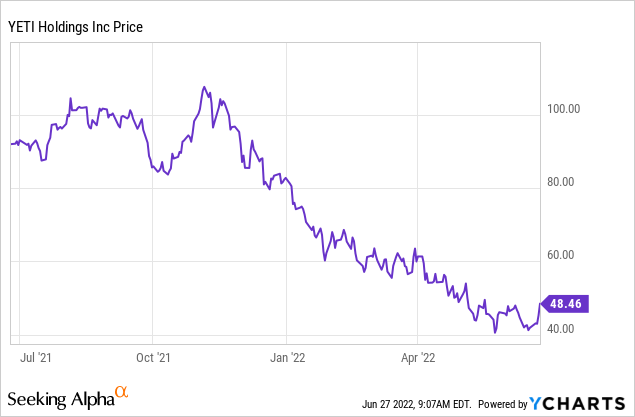

YETI Holdings (NYSE:YETI), in my view, fits this bill perfectly. The beloved maker of hard coolers, a very popular brand in the Southern and Central U.S. but not yet so prevalent on the coasts (according to YETI’s own reports on unaided brand awareness) has seen its share price crumble by 40% year to date. Outside of simply weaker sentiment for small/mid-cap growth stocks due to this year’s “risk off” mentality, investors are also eyeing YETI’s loss of margins, which I view as due entirely to macro factors out of the company’s control. In my view, YETI’s share price has deteriorated far faster than its fundamentals, and it’s worth a hard second look as we prepare for a year-end rally.

For most Americans, the specter of COVID dominating our daily activities and routines is over. This summer, many American families are resuming “normal” summer activities against a backdrop of pent-up demand. Domestic travel, especially to destinations that are reachable by car (perhaps now not due to fear of air travel, but because airfare has heavily inflated as well), is picking up. This is a strong summer backdrop for YETI to be accelerating its sales growth.

I remain quite bullish on YETI and believe it will surprise investors to the upside through year end. For investors who are newer to this name, here are the chief reasons I am bullish on YETI:

- The company is extending its immensely popular brand into new products. Drinkware and coolers are still the bread-and-butter categories for YETI, but the company is now taking advantage of its rising brand profile to roll out new products. Last year, the company announced a new collection of bags, backpacks, duffels, and luggage – another high-margin category that can fuel further growth. A rollout of more women’s apparel is another area for planned expansion in 2022.

- Continued strong direct channel execution. Thanks to YETI’s focus on social media advertising and digital sales, the company has seen growth index stronger in its direct channel than in resellers, and direct is now more than half of YETI’s overall revenue mix.

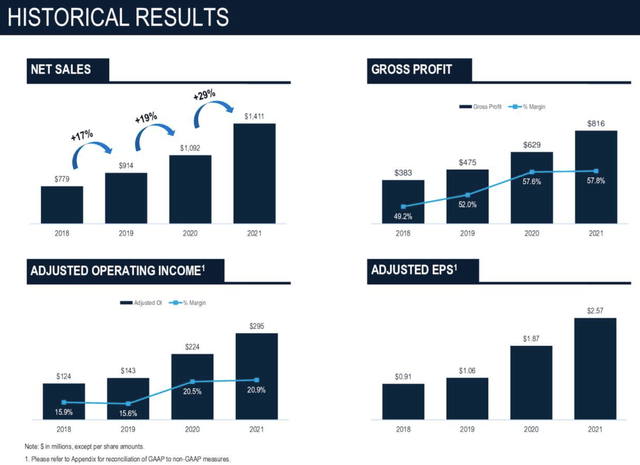

- Tremendous margin gains thanks to direct channel mix shift. For consumer products and retail-oriented companies, gains in gross margins are equally as important to investors as overall growth. YETI has been improving its margins at a roughly five-point pace, and with overall gross margins reaching just shy of 60%, YETI’s revenue stream is much richer in profitability and scalability than other typical retail names.

- Regional and international expansion. YETI has been primarily popular in the South and Midwestern regions of the U.S., but brand penetration on the West and East coasts as well as internationally is still low and provides YETI with plenty of room for growth. The company’s recent tilt toward online and social media marketing also makes it easier for the brand to flower in new places.

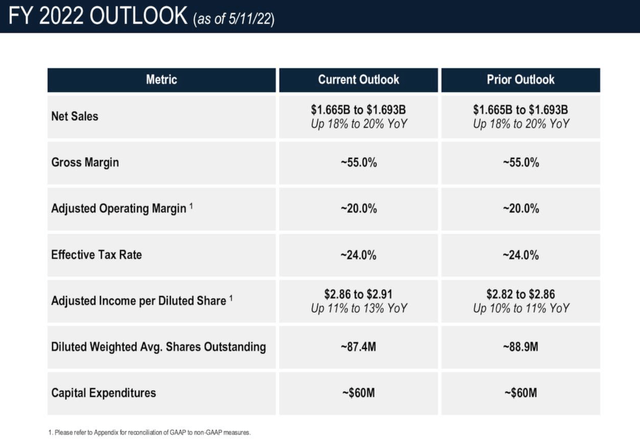

Note as well that YETI recently boosted its earnings guidance for the remainder of the year, primarily because it’s expecting to lower its share count thanks to the $100 million buyback program it announced last quarter. The company is now expecting adjusted EPS of $2.81-$2.91, a $0.045 increase at the midpoint and representing 11-13% y/y growth:

YETI outlook (YETI Q1 earnings deck)

To me, YETI’s current 16.6x forward P/E ratio represents a very attractive entry point into the stock, as its multiple is in-line with the S&P 500 even though YETI is delivering accelerating high-teens revenue growth. Earnings growth should line up with/exceed revenue growth once gross margin pressures lap and subside.

The bottom line here: there’s a lot to like about YETI. All things considered, YETI is still a young brand with plenty of geographic and product-line expansion to bank on. Buy this stock while it’s still trading cheaply.

Q1 recap

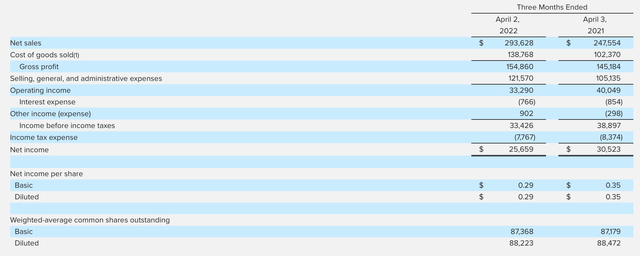

Let’s now touch on YETI’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

YETI Q1 results (YETI Q1 earnings deck)

YETI’s revenue in Q1 grew 19% y/y to $293.6 million, beating Wall Street’s expectations of $290.4 million (+17% y/y) by a two-point margin and accelerating by one point versus Q4’s growth rate of 18% y/y. Direct-channel revenue continued to index above the company average, growing 23% y/y while wholesale revenue increased 14% y/y. And by product category, drinkware led the way with 24% y/y growth to $184 million (63% of revenue), boosted by new product releases.

From a go-to-market perspective, YETI noted as well that corporate orders are healthy. In particular, YETI has noted many companies placing large repeat orders, which helps YETI build up a strong recurring sales pipeline. Management noted as well that retail stores continue to perform ahead of expectations, with the company opening a tenth retail location in San Antonio in the first quarter and expecting to open at least two more through year-end.

International is another major focus for YETI. It’s still a small slice ($37.4 million, or 13%) of overall sales, but growing rapidly at 45% y/y in Q1. The company noted strong performance in Canada, Australia, and Europe.

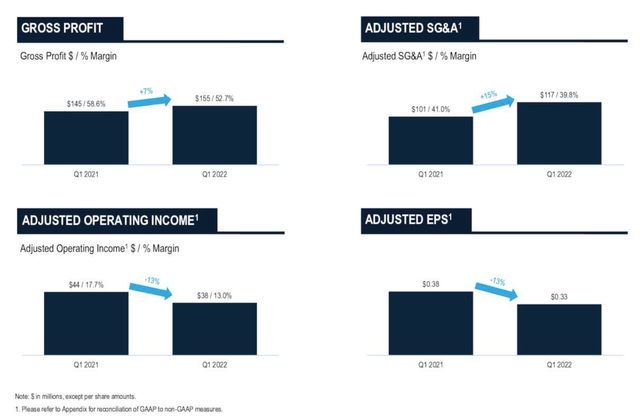

The big draw this quarter, of course, was gross margins – a challenge for virtually any maker of consumer products across all industries. Gross profit dollars still grew 7% y/y , but gross margins declined 390bps to 52.7% in Q1.

YETI margin performance (YETI Q1 earnings deck)

Commenting on the drivers behind the margin pressure, CFO Paul Carbone noted as follows on the Q1 earnings call:

The 590 basis points year-over-year contraction was primarily driven by a 680 basis point impact from higher inbound freight. In addition to planned freight inflation, we also received some late trailing invoices from our main freight forwarder which resulted in a true up that should have flowed through our P&L in the fourth quarter of fiscal 2021. This contributed to an additional$6.4 million of freight expense or 220 basis points during the quarter.

In addition to inbound freight, other unfavorable factors included 60 basis points from higher duties related to the exploration of the GSP program, 50 basis points from other impacts, and 30 basis points from higher product costs. These headwinds were partially offset by 140 basis points from pricing and 90 basis points from channel and sales mix.”

We do note, however, that operating expense leverage helped to offset gross margin declines, with selling, general and administrative expenses as a percentage of revenue declining by 110bps.

We also should put YETI’s margin in historical perspective. If you look at the top-right side of the chart below, you’ll note that YETI’s gross margins used to sit below 50%, and only jumped to 57% after the company’s direct-channel mix started to take over during the pandemic year 2020.

YETI historical metrics (YETI Q1 earnings deck)

In my view, the seven points of freight headwind are neither company specific, nor will they last forever. Investors should focus on YETI’s strong top-line performance and its operating leverage in other categories.

Key takeaways

YETI remains a powerful brand with tremendous expansion capacity both domestically and abroad. To me, the opportunity to buy this stock at a valuation multiple in-line with the S&P 500 is an attractive one; especially if inflationary pressures cool off by year-end, YETI is highly likely to outperform the broader markets.

Be the first to comment