Thomas Barwick

Online travel is going to take a bigger share of the overall travel industry in India. Travel is a growing industry in India, and online travel has seen faster growth within the travel industry. Online travel is growing as the internet continues to grow from 700 million internet connections to a billion internet connections in the next couple of years. Yatra Online, Inc. (NASDAQ:YTRA) stock has weathered the pandemic and is setting up for an up move. In this article, we take a look at the travel industry and Yatra Online, Inc. stock.

Travel Industry

Category

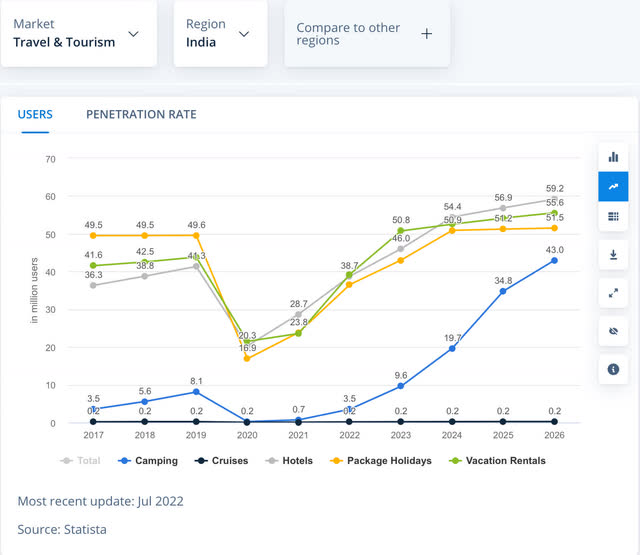

The travel industry in India is broadly grouped into vacation rentals, package holidays, hotels, cruises, and camping segments.

ARPU

Average revenue per user (ARPU) has been growing steadily for all segments, especially package holidays and cruises, where ARPU is likely to take a higher share of the total spend.

Growth in tourists

Camping is going to have the highest growth rate, but across the board, there is going to be steady growth in most travel segments.

Penetration rates are low, and as the Indian economy improves, the penetration rates are likely to go higher.

Travel Penetration Rate (Statista)

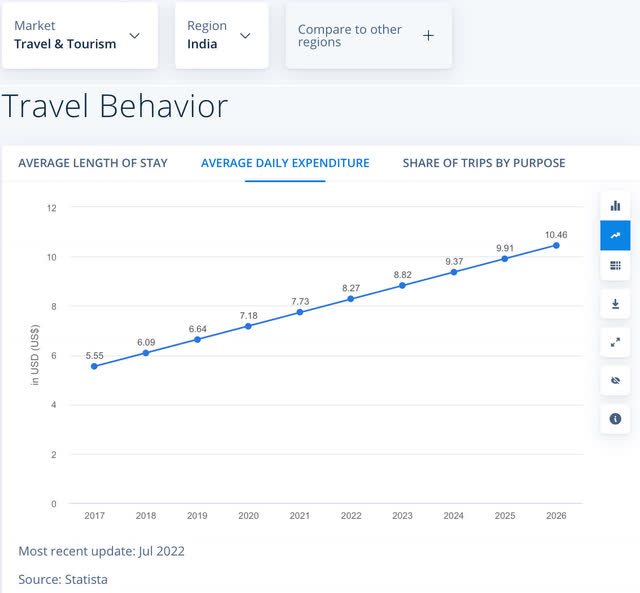

Average daily expenditure is going to have a steady increase in coming years.

Travel Average Expenditure (Staista )

As online bookings increase and spend per person goes higher, Yatra Online, Inc.’s growth should have tailwinds to drive revenue higher.

Online Travel – Share of revenue

Online revenue was 39% of the total revenue in the travel industry in 2017, and by 2022, the share of online travel revenue had grown to 49% of the total travel revenue. In the coming years, online travel revenue is going to continue to grow and, by 2025, have a 55% share of the travel revenue.

Travel industry share (Statista )

Company Analysis

Yatra Online Inc. is an Indian business and consumer travel search engine and online travel agency. It is based in Gurugram, Haryana, and was founded in 2006. The company is organized into the following business segments: Air Ticketing, Hotels and Packages, and Other Segments. The company provides travel-related services, including domestic and international air ticketing, hotel bookings, homestays, holiday packages, bus ticketing, rail ticketing, cab bookings, and ancillary services for leisure and business travelers. It also offers various services, including exploring and searching, through its website and mobile application. These platforms comprise web and mobile platforms that enable customers to explore and search for flights, hotels, holiday packages, buses, trains, and other activities through its Website and mobile application. In addition, Yatra Online Inc. offers tours, sightseeing, shows, and event services.

In 2019, Yatra Online Inc. agreed to be acquired by Ebix, Inc. (EBIX). However, as travel got severely impacted by COVID and the revenues declined dramatically, the acquisition of Yatra was called off. Yatra Online Inc. has managed through the pandemic period by focusing on automation, reducing headcount and expenses. Yatra Online Inc also raised additional funds through a secondary offering. All of the events impacted the stock price, which has not recovered. The stock does not reflect the growth opportunities of travel bookings for the business segment where Yatra Online, Inc has primarily focused.

Yatra Online, Inc. controlled Indian subsidiary, Yatra Online Limited, filed on March 25, 2022, with the Securities and Exchange Board of India (SEBI) for a potential initial public offering and listing of its equity shares on the Indian stock exchanges. Yatra Online, Inc. is working with the regulators in India to obtain clearance for the offering on the Indian stock exchange. Yatra Online, Inc. expects that offering to strengthen their balance sheet. The recovery in travel and the imminent IPO of the Indian subsidiary at a higher valuation could make the parent stock go much higher.

Yatra Online, Inc. agreed to be acquired in 2019, so there is a possibility that it could be an acquisition target again due to its brand recognition and high growth. Corporate officers within Yatra Online, Inc. have increased their stake to above 10% of the company, which means they are fairly confident of their stock purchase, either due to a depressed valuation or a possible acquisition.

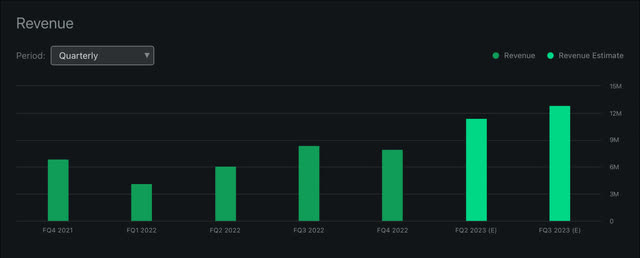

Revenue

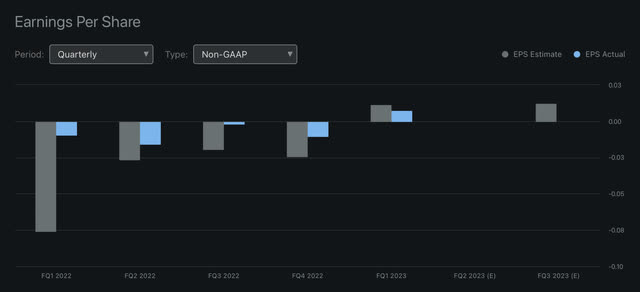

Revenue for Yatra Online Inc. is expected to quadruple in 2023 as compared to 2021 results. Quarterly revenue in June 2021 came in at $4 million and had steadily grown to $11.4 million by June 2022. The company is expected to become profitable in the coming quarters.

Technical Analysis of YTRA

The chart of YTRA has gone sideways, and a breakout and close above $3 could lead to much higher prices. All-time highs were above $12. The target to take a profit is $8. If one buys, the stop loss is at $1.98.

Risks

Major risks include travel-related health advisories. China continues to have COVID lockdowns. Other countries could possibly reactivate travel restrictions. Yatra Online, Inc. will have both positive and negative effects from a stronger U.S. dollar, as it will spur more travel to India as well as increase travel by locals within India. However, a weaker rupee would be a headwind, especially hitting the international packaged vacation segment. The other risk is the execution of the IPO for the Indian subsidiary, Yatra Limited. If Yatra Limited gets the go-ahead from SEBI, then it should be well received; if not, it will impact shares traded on NASDAQ. On the other hand, if the Indian subsidiary is well received, then the price of YTRA will likely go higher to bridge the price gap.

Conclusion

Yatra Online, Inc. has multiple tailwinds helping it fly through the turbulence in the travel industry. Recovery in the business segment should bode well for future revenue and earnings. Based on the analysis of the stock chart, there is potential for a move higher. In fact, from a chart perspective, the potential is to make $5 per share with a $1 per share loss. This is a favorable risk-reward setup. I would recommend a small position in this small-cap international stock after YTRA breaks out above $3 with a stop loss just below $2.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment