graphixel/E+ via Getty Images

Obscurity is the progenitor of mispricing and there are few things in the market more obscure than a publicly traded preferred attached to a private subsidiary of a different name which is attached to a public company with yet another different name.

To my knowledge, there is no term for this relationship, so I am going to call it an orphan preferred.

Blackstone’s (NYSE:BX) buyout of PS Business Parks may have created a great fixed income opportunity in the orphaned preferreds. Let me begin with the background and then dig into the analytics that generate the thesis.

How the orphans lost their parents

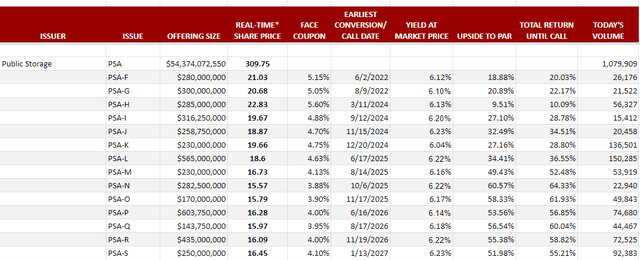

Public Storage as an entity spawned two long tenured companies, Public Storage (PSA) and PS Business Parks (PSB) which famously had a different management style in which the company intentionally maintained ultra low debt levels and instead opted for the use of preferreds to finance expansion. Due to the low debt levels both companies were able to issue their preferreds at extremely low coupons. Here is the list of PSA preferreds, some of which have coupons below the 10-year Treasury rate.

Portfolio Income Solutions

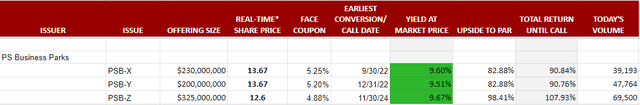

PS Business Parks isn’t as large as PSA so its coupons aren’t quite as low, but 4.88% to 5.25% is still a phenomenal cost of capital in today’s market.

Portfolio Income Solutions

It is these PSB preferreds that have now been separated from their parent company.

On July 20th, 2022, Blackstone completed its $7.6B acquisition of PS Business Parks. Such mergers are quite typical of Blackstone as they have bought up dozens of REITs along with many other investments. One key difference here is that when Blackstone bought the assets of other REITs, the preferreds got redeemed. BlueRock Residential and Preferred Apartment Communities (APTS) both had preferreds redeemed when BX bought their assets.

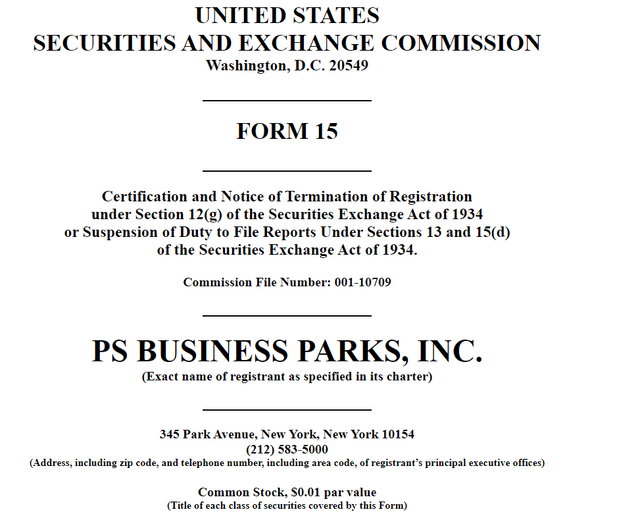

Yet, when BX bought PSB they immediately put out a Form 15 terminating the registration of PSB common but notably lacking from this form 15 were the preferreds.

Edgar

It financially makes sense. Both BRG and APTS had high coupon preferreds so BX retired them in favor of their other cheaper sources of capital. PSB’s preferreds, however, have coupons that are just a hair above Treasury rates so BX wants to keep this ultra cheap permanent capital.

Usually, a merger would trigger change in control provision that preferreds come with in which a change of control triggers an automatic redemption at par value ($25 per share in this case), but in their typical fashion Blackstone had clever financial engineering to get around this.

Rather than absorbing PSB into Blackstone, PSB is surviving as roughly a standalone entity in a subsidiary of BX called Sequoia.

From the merger 8K

“This Current Report on Form 8-K is being filed in connection with the completion on July 20, 2022 (the “Closing Date”) of the transactions contemplated by that certain Agreement and Plan of Merger, dated as of April 24, 2022 (the “Merger Agreement”), by and among PS Business Parks, Inc., a Maryland corporation (the “Company”), Sequoia Parent LP, a Delaware limited partnership (“Parent”), Sequoia Merger Sub I LLC, a Maryland limited liability company (“Merger Sub I”), Sequoia Merger Sub II LLC, a Maryland limited liability company (“Merger Sub II” and, together with Parent and Merger Sub I, the “Parent Parties”), and PS Business Parks, L.P., a Maryland limited partnership (the “Partnership”). The Parent Parties are affiliates of Blackstone Real Estate Partners IX, L.P., which is an affiliate of Blackstone Inc. (“Blackstone”).”

Within this shell, the PSB preferreds still exist and are still publicly traded. The preferreds were deemed to be “unaffected” by the merger as per the language in the 8K (bold added for clarity):

“Preferred Stock: Each share of the 5.250% Series X Cumulative Preferred Stock of the Company, par value $0.01 per share, 5.200% Series Y Cumulative Preferred Stock of the Company, par value $0.01 per share, and 4.875% Series Z Cumulative Preferred Stock of the Company, par value $0.01 per share (collectively, the “Existing Preferred Stock”), issued and outstanding immediately prior to the Company Merger Effective Time and each depositary share issued pursuant to the deposit agreements for the Existing Preferred Stock, representing one-thousandth of one share of Existing Preferred Stock issued and outstanding immediately prior to the Company Merger Effective Time, was unaffected by the Company Merger and will remain outstanding in accordance with their respective terms;”

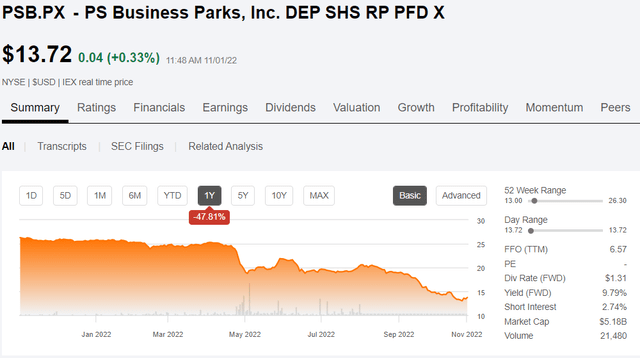

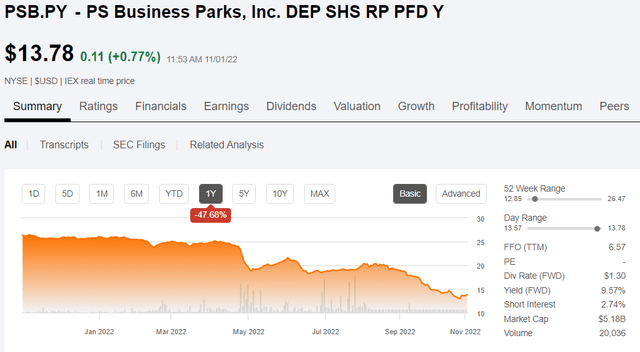

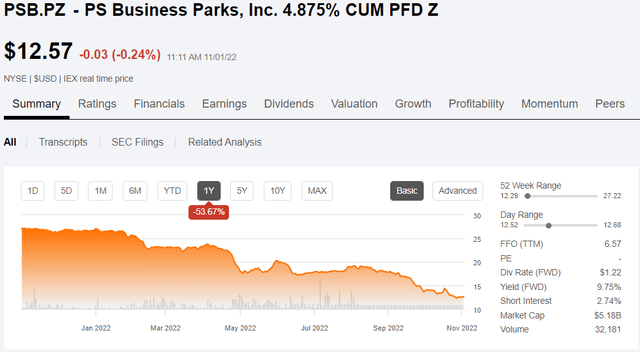

We will soon show that the preferreds were in fact, massively affected. For starters, their market prices have dropped by half (PSB.PX) (PSB.PY) (PSB.PZ).

SA

SA

SA

This is what makes these orphan preferreds interesting.

I generally have no interest in a 5% coupon preferred. That just isn’t enough return. But when that preferred is trading at half of par it is a nearly 10% current yield and there is the potential for nearly 100% capital appreciation if these things ever get redeemed or float back up to around par where they were just a year ago.

To determine whether this is a real opportunity we must examine the fundamental delta and compare that to the pricing delta.

What has changed fundamentally?

There were two major changes we should take into account

- The macro interest rate environment

- Risk profile changes due to merger

From a macro perspective interest rates have changed. Some of that drop in price would happened regardless of the merger just because a high-4 coupon to low-5 coupon preferred simply should not trade at par when Treasuries are in the 4% range.

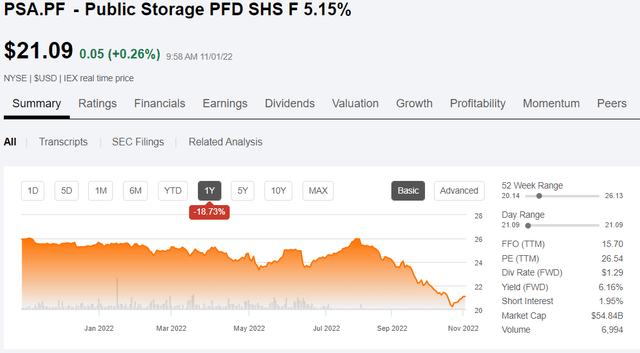

PSB preferreds were quite low risk for preferreds, but there is still a significant risk gap between an equity REIT preferred and a Treasury so I think the market would demand more than an 80 basis point premium in yield. To get a sense for where PSB preferreds would trade today without the merger, we can turn to PSA preferreds.

PSA-F has a 5.15% coupon which is quite similar to PSB-X at 5.25%. It also had a similar risk profile in that it is attached to a low debt and responsibly managed equity REIT. PSA-F dropped to about $21 per share or a current yield of around 6.2%.

SA

That is roughly the impact I would expect for the PS Business Parks preferreds with regard to interest rate changes.

The rest of the drop that caused them to go from par to about half of par was merger related. Within merger related there are two separate effects that we can quantify to identify whether or not these are opportunistic today.

- The portion of the drop related to increased fundamental risk

- The portion of the drop related to obscurity preventing new buyers from coming in.

Blackstone’s use of risk shifting to extract value from the preferreds and funnel it to BX proper

Risk shifting is a process in which one tranche of a capital stack is benefitted at the expense of another. Common equity is often benefitted from levering up because it receives the upside potential of leverage along with the risk whereas more senior tranches with fixed liquidation preferences cannot benefit from the upside and only see the increased risk. I believe that is what BX has done here. They levered up the subsidiary to increase Blackstone’s ROE and in the process stole value from the orphaned preferreds.

The specifics

With preferreds, one must note who is actually responsible for paying the dividends and supporting the liquidation preference. Prior to the merger, PSB was responsible for paying the dividends and par value. If these were not paid, the common stockholders could not get paid.

Today, despite Blackstone buying PSB, it is not Blackstone that is responsible for the dividends. It is Sequoia, the subsidiary in which it was packaged that is responsible for paying the dividends. Basically, this subsidiary cannot pay dividends to Blackstone unless it remains current on the PSB preferred dividends. In fact, it has already paid the September dividends due to the preferreds. Thus, it does appear they have intent to continue supporting the preferreds.

That said, I think the preferreds are significantly less supported in this shell than they were in PSB. One of the key features of PSB that made the preferreds such a reliable source of income was that the company had billions of equity underneath the preferreds and minimal debt above the preferreds. As such, even somewhat large changes to the value of the assets would not affect the preferreds. Downdrafts could simply be absorbed by the common.

In the current shell the capital structure is significantly less conservative. Blackstone has pulled out a large portion of their equity by taking on a $2.73B loan and a $1.96B loan. From the merger documents linked earlier:

“In connection with the completion of the Mergers, certain indirect subsidiaries of the Partnership and certain property owners within the Non-Core Portfolio as described in Item 2.01 below (collectively, the “Loan A Mortgage Borrowers”) obtained a $2,733,620,000 mortgage loan (the “Loan A Mortgage Loan”) from Bank of America, N.A., Citi Real Estate Funding Inc., Barclays Capital Real Estate Inc., Morgan Stanley Bank, N.A., and Societe Generale Financial Corporation (together with its successors and assigns, the “Lenders”) and certain other indirect subsidiaries of the Partnership and certain other property owners within the Non-Core Portfolio as described in Item 2.01 below (collectively, the “Loan B Mortgage Borrowers” and, together with the Loan A Mortgage Borrowers, the “Mortgage Borrowers”) obtained a $1,960,000,000 mortgage loan with an additional $96,000,000 future funding option (the “Loan B Mortgage Loan” and, together with the Loan A Mortgage Loan, the “Mortgage Loans”) from the Lenders. The Loan A Mortgage Loan is secured by first-priority, cross-collateralized mortgage liens on certain of the Company’s properties located in California, Florida, Maryland, Texas, Washington and Virginia, as well as other properties comprising the Non-Core Portfolio described in Item 2.01 below, all related personal property, reserves, a pledge of all income received by the Loan A Mortgage Borrowers with respect to such properties and a security interest in a cash management account. The Loan B Mortgage Loan is secured by first-priority, cross-collateralized mortgage liens on certain of the Company’s properties located in California, Florida, Texas, Washington and Virginia, as well as other properties comprising the Non-Core Portfolio, all related personal property, reserves, a pledge of all income received by the Loan B Mortgage Borrowers with respect to such properties and a security interest in a cash management account.”

Due to Sequoia being a private subsidiary we are not privy to all the numbers, but based on the profitability of PSB’s property portfolio pre-merger, the cashflows associated with the properties should fully cover the interest expense on these mortgages with enough left over to still cover the preferreds. I would even estimate that there is significant extra coverage that will likely be paid as some sort of common dividend from sequoia to BX.

So I don’t see the preferreds as in any sort of immediate or near term danger, but they are significantly less secure than they were.

Preferreds of a high debt equity REIT should trade at a higher yield than preferreds of a low debt REIT. Thus, the market price should have dropped as a result of the fundamental changes to their new structure.

As discussed previously, the changes to the macro interest rate environment should have caused the yield to go up from low 5s to maybe mid 6s ceteris paribus. A mid 6% yield would be appropriate for the preferred of a low debt REIT, but now it is a moderate to high debt real estate subsidiary. In my opinion, that warrants a 200 basis point premium over the low debt REIT, so I think an appropriate yield would be in the mid 8% range.

The rest of the drop in price that has taken these preferreds to a nearly 10% yield I would consider mispricing and thus opportunity/upside for those who buy today. I attribute this price movement to obscurity.

Obscurity eliminates buyer interest

While in the long term market prices track toward fundamental value, short term pricing is often determined by supply and demand for the given security. The merger both increased supply of shares (more sellers) and decreased demand for shares (fewer buyers).

The pool of potential sellers consists of those who own the given stock. PSB was very much a tortoise sort of company in the tortoise and hare sense of the term. This was the kind of preferred that people rationally thought they could just hold for an extremely long time collecting reliable dividends. The merger changed that profile. It introduced confusion and uncertainty. I suspect the radically different profile likely stirred up some of the formerly long term holders to start selling.

At the same time, buyer interest has largely been cut off. Even just finding these preferreds is much harder now. I run screens for REIT preferreds every week and after the merger these do not show up. Most screens only show preferreds of publicly listed companies, so while the preferreds are public, Sequoia is not.

Even once someone spots the existence of the preferreds, the due diligence is many times harder than normal. PSB of course no longer files documents and Sequoia is not public so the usual sources of information do not exist. In order to find the details, I had to dig through old filings on Edgar. The merger is still fresh so the 8K was not hard to find, but over time it will get increasingly buried.

On top of the difficulty of due diligence there is an added layer of opacity in that even with digging one cannot get all the information they would want due to the private nature.

Putting these factors together, more supply and less demand leads to a plummeting market price. I believe the sharp drop has taken the price to a fairly opportunistic range. I think fair value is a yield of about 8.5% for each of these issues, so the nearly 10% current yield represents opportunity.

I think it is a reasonable purchase today and we have bought a tiny position, but I am mostly excited about the potential for bigger opportunities to manifest down the road. I see two potential sources of opportunity

- The supply demand imbalance further drops the price and takes it to an extreme yield (13%+)

- Blackstone could make a tender offer for the preferreds somewhere in the $20 range. This would be an immediate gain for BX to the tune of $5 per share and quite profitable for preferred holders who buy at today’s price.

The obscurity of this stock facilitates interesting and outsized opportunity. It is definitely worth putting on the radar screen.

Be the first to comment