DNY59

The earnings of Horizon Bancorp, Inc. (NASDAQ:HBNC) will most probably continue to grow through the end of 2023 mostly on the back of moderate loan growth. Meanwhile, the net interest margin will likely face some pressure in the fourth quarter of 2022 before recovering next year. Overall, I’m expecting Horizon Bancorp to report earnings of $2.11 per share for 2022, up 6%, and $2.13 per share for 2023, up 1% year-over-year. Compared to my last report on the company, I’ve reduced my earnings estimates mostly because I’ve decreased both my loans and non-interest income estimates. Next year’s target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Horizon Bancorp.

Loan Growth to Slow Down

Horizon Bancorp’s loan portfolio grew by 1.9% in the third quarter, which was a sharp slowdown from the second quarter and below my expectations. This disappointing growth was attributable to paycheck protection program forgiveness and the sale of commercial participation loans. Excluding these transactions, total loans grew by 7.8% quarter-on-quarter during the third quarter, as mentioned in the earnings release, which is quite impressive.

Loan growth will likely slow down in the fourth quarter due to the following reasons.

- High-interest rates will temper credit demand.

- Pipelines are not as robust as before. As mentioned in the earnings presentation, commercial pipelines were positioned at $126 million entering the fourth quarter compared to a pipeline of $160 million at the start of the third quarter.

- Horizon Bancorp has closed seven branches in the first nine months of 2022 to cut costs. This footprint reduction can hurt loan growth.

- Horizon has historically relied on a mixture of organic and acquired growth. Currently, the company is only focusing on organic growth, as mentioned in the earnings presentation. The absence of acquired growth will keep loan growth for 2023 below some of the previous years.

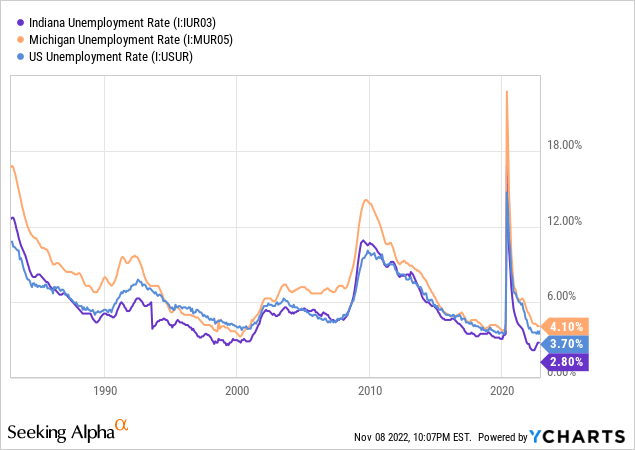

One positive factor supporting loan growth is strong job markets. Horizon Bancorp operates in the states of Indiana and Michigan. While Indiana currently has a job market that is hotter than most other states, Michigan’s labor market isn’t faring as well. Nevertheless, the unemployment rates for both states are near record lows.

Considering these factors, I’m expecting the loan portfolio to grow by 1.5% every quarter till the end of 2023, leading to full-year loan growth of 13% for 2022 and 6% for 2023. Compared to my last report on Horizon Bancorp, I’ve reduced my loan growth estimates for both years because of the disappointing growth during the third quarter. Further, my economic outlook is now worse than before.

Deposits will likely grow in line with loans. However, the growth of both securities and equity book value will trail loan growth. As interest rates have increased, the market value of available-for-sale securities has fallen, leading to a surge in unrealized mark-to-market losses reported under accumulated other comprehensive income. This has reduced the book value by 11% in the first nine months of 2022. As mentioned in the earnings presentation, the management has no intention of selling these securities; therefore, the unrealized losses will not materialize. They will get reversed when rates start falling most probably by late next year. Nevertheless, the stock’s market valuation will get affected in the short term as many investors consider the price-to-book multiple to value banks.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 2,996 | 3,619 | 3,810 | 3,553 | 4,020 | 4,267 | ||||

| Growth of Net Loans | 6.3% | 20.8% | 5.3% | (6.7)% | 13.1% | 6.1% | ||||

| Other Earning Assets | 827 | 1,078 | 1,325 | 2,731 | 3,052 | 3,176 | ||||

| Deposits | 3,139 | 3,931 | 4,531 | 5,803 | 5,918 | 6,281 | ||||

| Borrowings and Sub-Debt | 588 | 606 | 590 | 791 | 1,170 | 1,193 | ||||

| Common equity | 492 | 656 | 692 | 723 | 628 | 671 | ||||

| Book Value Per Share ($) | 12.8 | 15.1 | 15.7 | 16.5 | 14.4 | 15.4 | ||||

| Tangible BVPS ($) | 9.4 | 11.0 | 11.7 | 12.5 | 10.4 | 11.4 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Margin Likely to Decline in the Fourth Quarter

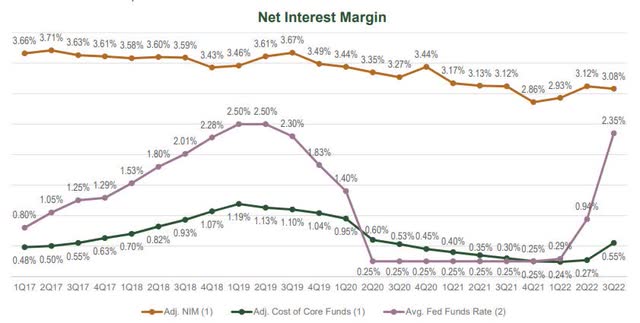

As can be deduced from the data given in the presentation, variable-rate loans made up only 37% of total loans at the end of September 2022. At the same time, deposits with adjustable rates (interest-bearing transaction accounts) made up 64% of total deposits. Therefore, the positive effects of the up-rate cycle will come with a lag. The management also mentioned in the conference call that as of September 30, it is modeling liability sensitivity. According to the results of the management’s model, a 200-basis points hike in interest rates could decrease the net interest income by 3.19% over twelve months.

Horizon’s deposit beta (or rate sensitivity) worsened to 23% in the third quarter from 3% in the second quarter of 2022, as mentioned in the earnings release. Horizon’s deposit mix hasn’t worsened much over the quarter. The beta deteriorated only because Horizon Bancorp was able to delay the repricing of deposits in the second quarter. The management expects the deposit beta to rise even further in the fourth quarter because the landscape is getting more competitive, as mentioned in the conference call.

Horizon Bancorp has a sizeable debt securities portfolio, which will hold back the margin as market interest rates rise. This is because most of these securities have fixed rates. As of the end of September 30, 2022, securities made up 43% of total earning assets.

The margin’s historical trend shows that it has been positively but loosely correlated with the Fed Funds rate in the past, as shown below. Therefore, there is hope that by next year, late asset repricing will overtake liability repricing and boost the margin.

Overall, I’m expecting the margin to decline by five basis points in the fourth quarter of 2022 before rising by ten basis points in 2023.

Expecting Earnings to Grow by 6%

The anticipated loan growth discussed above will likely be the chief driver of earnings through the end of 2023. On the other hand, a dip in mortgage banking income (included in non-interest income) will reduce earnings. Mortgage income has already declined to a level much below expected during the third quarter of 2022. Therefore, the bottom of the mortgage banking income downtrend seems to be lower than I previously anticipated. As a result, I’m slashing down my non-interest income estimates for both 2022 and 2023.

Meanwhile, I’m expecting the net-provision-expense-to-total loan ratio to remain near the 2017 to 2019 average. Further, the slight change in net interest margin will likely have a negligible impact on earnings.

Overall, I’m expecting Horizon Bancorp to report earnings of $2.11 per share for 2022, up 6% year-over-year. For 2023, I’m expecting earnings to be somewhat flattish at $2.13 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 135 | 161 | 171 | 182 | 207 | 221 | ||||

| Provision for loan losses | 3 | 2 | 21 | (2) | (1) | 4 | ||||

| Non-interest income | 34 | 43 | 60 | 58 | 47 | 41 | ||||

| Non-interest expense | 103 | 122 | 131 | 139 | 150 | 148 | ||||

| Net income – Common Sh. | 53 | 67 | 68 | 87 | 92 | 93 | ||||

| EPS – Diluted ($) | 1.38 | 1.53 | 1.55 | 1.98 | 2.11 | 2.13 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Horizon Bancorp, I estimated earnings of $2.27 per share for 2022 and $2.44 per share for 2023. I’ve revised downwards my earnings estimate because I’ve reduced both my loan balance and non-interest income estimates.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

HBNC is Currently Trading at a Large Discount to the Target Price

Horizon Bancorp changes its quarterly dividend almost every year. Given the earnings outlook, I’m expecting the company to increase its dividend to $0.18 per share in the third quarter of 2023 from the existing dividend of $0.16 per share. The earnings and dividend estimates suggest a payout ratio of 32% for 2023, which is within the target range given by the management in the presentation. The dividend estimate suggests a high forward dividend yield of 4.3%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Horizon Bancorp. The stock has traded at an average P/TB ratio of 1.53 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 9.4 | 11.0 | 11.7 | 12.5 | ||

| Average Market Price ($) | 19.4 | 17.0 | 12.4 | 18.2 | ||

| Historical P/TB | 2.07x | 1.54x | 1.06x | 1.46x | 1.53x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $11.4 gives a target price of $17.4 for the end of 2023. This price target implies a 10.3% upside from the November 8 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.33x | 1.43x | 1.53x | 1.63x | 1.73x |

| TBVPS – Dec 2023 ($) | 11.4 | 11.4 | 11.4 | 11.4 | 11.4 |

| Target Price ($) | 15.1 | 16.3 | 17.4 | 18.6 | 19.7 |

| Market Price ($) | 15.8 | 15.8 | 15.8 | 15.8 | 15.8 |

| Upside/(Downside) | (4.1)% | 3.1% | 10.3% | 17.5% | 24.7% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.6x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.38 | 1.53 | 1.55 | 1.98 | ||

| Average Market Price ($) | 19.4 | 17.0 | 12.4 | 18.2 | ||

| Historical P/E | 14.1x | 11.1x | 8.0x | 9.2x | 10.6x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.13 gives a target price of $22.5 for the end of 2023. This price target implies a 42.4% upside from the November 8 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.6x | 9.6x | 10.6x | 11.6x | 12.6x |

| EPS 2023 ($) | 2.13 | 2.13 | 2.13 | 2.13 | 2.13 |

| Target Price ($) | 18.2 | 20.4 | 22.5 | 24.6 | 26.7 |

| Market Price ($) | 15.8 | 15.8 | 15.8 | 15.8 | 15.8 |

| Upside/(Downside) | 15.5% | 28.9% | 42.4% | 55.8% | 69.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $20.0, which implies a 26.3% upside from the current market price. Adding the forward dividend yield gives a total expected return of 30.6%. Hence, I’m maintaining a buy rating on Horizon Bancorp.

Be the first to comment