Rockaa/E+ via Getty Images

As predicted before, the Upstart Holdings (NASDAQ:UPST) lending model sounds great, but it doesn’t work in practicality. Without a committed funding source, most fintech lending platforms ultimately run into problems with investors during market turmoil. My investment thesis is more Neutral on the stock with the collapse to below $15 in after-hours trading following another big guide down.

Investors Drying Up

The AI lending marketplace offers an attractive concept of using technology to quickly fund loans at attractive economics for banking partners. The problem with the model is the reliance on banking partners to fund loans. Whether or not the unit economics remain attractive, banks partners might reign in lending impacting the short-term financial results of a fintech like Upstart.

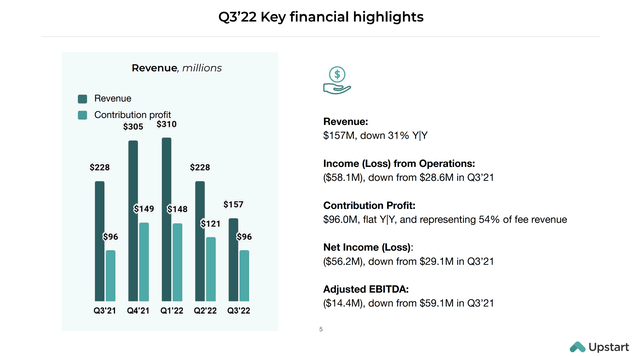

The company continues to face this prime scenario with Q3’22 revenue of $157 million falling a massive 31% from last Q3. Upstart reported the contribution was nearly flat YoY, but the contribution level was down over $50 million from the peak quarterly levels. All of these numbers led the fintech to report a massive quarterly loss from operations of $58 million.

Source: Upstart Q3’22 presentation

Key transaction values and conversion rates were down dramatically in the quarter. Though Upstart now has a record 83 bank and credit union partners in Q3’22, loan originations were down 48% to $1.9 billion with the conversion rate at only 10% versus 23% last Q3.

In essence, bank partners cut back from the loan quality they were willing to approve in the quarter. Upstart continues to provide data suggesting a huge separation in the loans the fintech approves versus FICO at a level of 5x separation with borrowers designed an A+ or B significantly defaulting less on loans than even a typical borrower with a FICO score above 680. Over time, the average Upstart loan has averaged 9.5% gross annualized returns, but some of the recent vintages of underperformed expectations with gross returns below 5%.

Even worse here, Upstart guided to Q4 revenues of only $125 to $145 million with the consensus estimate up at $185 million. The company is predicting revenues dipping $22 million sequentially, at the midpoint, while the market was expecting a big increase.

These revenue declines become even more problematic when the fintech had a massive $215 million in Q3 operating expenses and a still massive $178 million when excluding stock-based compensation. Clearly, the AI lending platform comes at a high cost.

Business Model Must Change

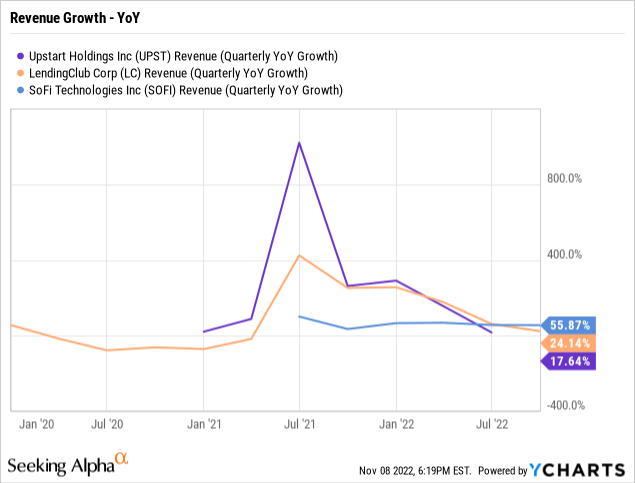

Until Upstart finds committed funding, the business will remain very volatile. Both LendingClub (LC) and SoFi Technologies (SOFI) both bought digital bank charters in order to better fund loans when investment partners disappear. These fintechs are still generating solid revenue growth while Upstart just reported revenues are falling off a cliff.

While a fintech business model where the company doesn’t take any loan risk is appealing, the problem here is that the attractive loan economics should make Upstart investors want to benefit from those loans. After all, the model won’t work if the risk model fails, so the company should just control the loan funding in the process as well.

The stock now has a market cap near $1.3 billion with annualized revenue trickling down to ~$500 million now. The company still generates large losses and a negative EBITDA of $35 million in the quarter, which is far from ideal in this market climate.

Upstart has probably faced the necessary pain, but investors shouldn’t rush into the stock here until the business model is altered via sources of committed loan funding. Besides, the macro trends could easily lower revenues again in Q1.

Takeaway

The key investor takeaway is that Upstart must fix the business model to where the fintech actually benefits from the unit economics and isn’t reliant on fickle bank partners. The stock isn’t wildly expensive here with the healthy balance sheet and long-term business prospects, but investors must steer clear of the stock until the committed funding arrives and the cost structure matches this improved model.

Be the first to comment