Pavel Byrkin/iStock Editorial via Getty Images

Introduction

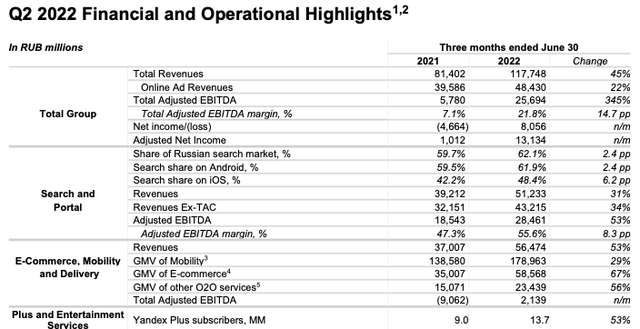

Trading in Yandex (NASDAQ:YNDX) shares on the stock exchange is still suspended. Despite the fact that the company posted a strong 2Q report, I think that the company will face a high level of uncertainty and new risks in future periods. The company’s management refused to provide guidance and canceled the guidance that was published earlier. At the moment, the company has significantly reduced the investment program and focused on increasing the level of profitability to pay off debt and accumulate cash.

Survey of Q2 results

Despite the fact that the company posted strong 2Q 2022 results, I believe that we cannot consider these financials as sustainable and make assumptions about future cash flows based on 2Q data.

Firstly, in the 2nd quarter the company managed to increase its market share and demonstrate revenue growth due to the withdrawal of the company’s main competitors from the Russian market.

Secondly, the company has significantly reduced costs and investment program, which has provided strong support to the operating margin.

However, Yandex continues to be a growth company and the reduction in investments and expenses, in my personal opinion, will have a negative impact on the growth rate of the business in the next periods.

In addition, the company continues to face the loss of key business employees.

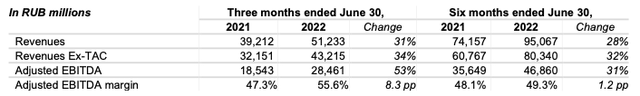

The company’s revenue growth amounted to +45% YoY. In the Search and Portal segment, revenue grew by 31% due to an increase in market share from 59.7% to 62.1%, which was caused by a decrease in competition in the Russian market, because large Western companies left the Russian search and advertising market. It is important to understand that the current changes cannot be considered sustainable, because: 1) competitors may return to the Russian market 2) a decrease in the level of business activity and consumer confidence, in my personal opinion, may have a negative impact on business spending on advertising on the Internet.

Search and Portal

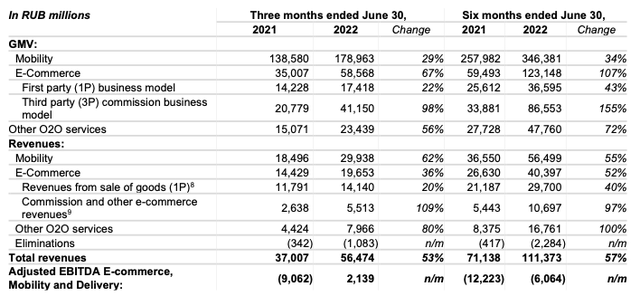

In the E-commerce, Mobility and Delivery segment, revenue growth was 53% YoY. Here I note that the positive in the Mobility segment is associated with the departure of Russian competitors (Gett), now Yandex is a monopolist in the taxi segment in the Russian market, where it can 1) successfully increase prices 2) reduce drivers’ commissions.

In the e-commerce segment, the company showed a 67% increase in GMV (gross merchandised volume), however, further growth is unstable, as the company announced plans to significantly reduce investment in new projects, and in the Russian e-commerce market, further growth needs to be continued invest in prices and discounts, as competitors do. I went over the business details of Ozon’s main competitor in my article earlier.

E-commerce, Mobility and Delivery

Guidance

At the moment, the company has refused to provide guidance and canceled the guidance that was given earlier due to geopolitical uncertainty.

Risks

Macro: high inflation, declining consumer confidence, declining real household incomes and slowdown in business activity could affect all segments of the company’s business. First, the decline in business activity has a negative impact on the growth of the company’s advertising revenue. Secondly, the decline in real income is negative for revenue in the e-commerce and taxi segments.

Growth: The increase in prices in the e-commerce segment has allowed the company to significantly improve operating profitability, however, in my personal opinion, this will lead to a significant slowdown in business growth in the Russian e-commerce market.

Geopolitics: rising tensions continue to weigh on company perceptions. Trading is currently suspended on the NASDAQ.

Conclusion

Despite the fact that, in my opinion, Yandex is a great company, the company’s growth prospects are currently under serious pressure. Rising geopolitical tensions and the suspension of trading on the NASDAQ exchange make stocks unavailable to international investors. The deterioration of the macro situation in Russia continues to have a negative impact on the company’s prospects. Thus, the decline in business activity and consumer confidence limit the company’s ability to grow revenue and launch new products. I believe that we should wait for 1) the normalization of the geopolitical situation 2) comments from management on the company’s strategy 3) the resumption of trading.

Be the first to comment