Sakorn Sukkasemsakorn

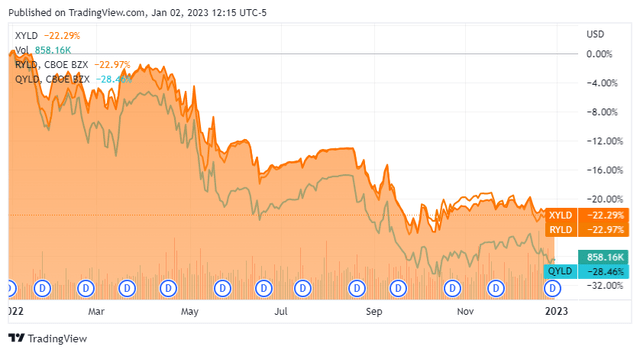

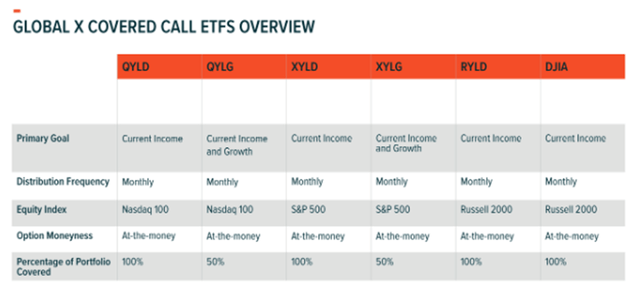

Global X by Mirae Asset has three main covered call ETFs that utilize a buy-write strategy to generate large amounts of income for investors. These funds have become increasingly popular as they purchase stocks within a specific index and then write covered calls monthly on the same index. This allows them to collect monthly options premiums paid to their investors through monthly distributions. The option overlay strategy has allowed the Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD), the Global X Nasdaq 100 Covered Call ETF (QYLD), and the Global X Russell 2000 Covered Call ETF (RYLD) to generate double-digit yields over the trailing twelve months or TTM. Investors are sacrificing the majority of the underlying asset’s upside potential for a continuous monthly income stream. Now that 2022 has concluded, I have updated my charts and determined that XYLD has been a better investment than RYLD and QYLD in 2022, but since the beginning of 2021, RYLD has done slightly better after factoring in distributions. I am bullish on these three funds for 2023 but feel XYLD could be the most appealing option if you were to choose only 1 of these ETFs as part of an overall income-producing strategy.

How my analysis in the next two sections is conducted.

In the next two sections, I will compare XYLD to RYLD and QYLD. I will look at these ETFs as if someone had purchased 100 shares of each fund and taken the distributions as income. I have gone through the Global X site to see the dates each distribution was paid, then through Seeking Alpha to see what each ETF traded at on that specific day to build out my grids. I am looking at the initial investment ROI prior to factoring distributions, then the total ROI after the distributions are accounted for. I am conducting two analysis’s; the first is from the beginning of 2022, and the second is from the beginning of 2021. In both analyses, the 2022 December distribution hasn’t been paid yet, as it will be paid at the beginning of January so this has been left out, even though Global X has listed what the payment will be.

XYLD, RYLD, and QYLD compared since 1/3/22

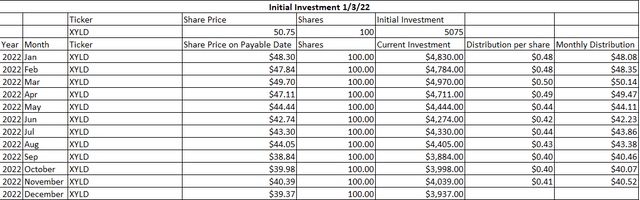

At the beginning of 2022, XYLD traded for $50.75, so 100 shares would have cost $5,075. XYLD closed 2022 at $39.37, which is a loss of -$1,138 and an initial investment ROI of -22.42%. XYLD has paid $490.67 in distributions from its 2022 fiscal year, which is a 9.67% yield on invested capital. When the distributions are netted against the losses from depreciation, the total profit is -$647.33 for a total ROI of -12.76%.

Steven Fiorillo, Seeking Alpha, Global X

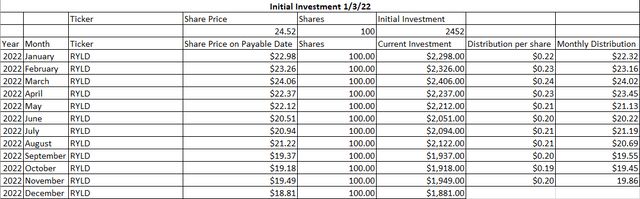

At the beginning of 2022, RYLD traded for $24.52, so 100 shares would have cost $2,452. RYLD finished 2022 at $18.81, so the initial investment would have declined by -$571 for an initial investment ROI of -23.29%. RYLD has paid $235.04 in distributions from 2022, which is a 9.59% yield on invested capital. When the distributions are netted against the losses, the investment in RYLD has declined -$335.96 or -13.70%.

Steven Fiorillo, Seeking Alpha, Global X

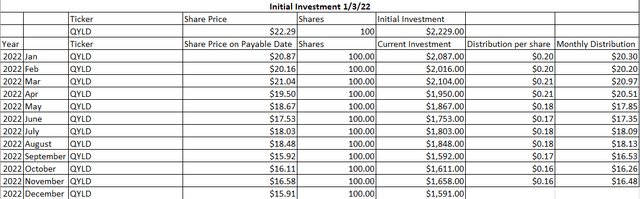

QYLD has been the worst in the group. QYLD started 2022 at $22.29 and finished at $15.91. The initial investment declined by -$638 for an initial investment ROI of -28.62%. QYLD has paid $202.67 in distributions which is a 9.09% yield on invested capital. When the distributions are netted against the losses, the entire investment is down -$435.33 for a total ROI of -19.53%.

Steven Fiorillo, Seeking Alpha, Global X

Looking at XYLD, RYLD, and QYLD since 1/4/21

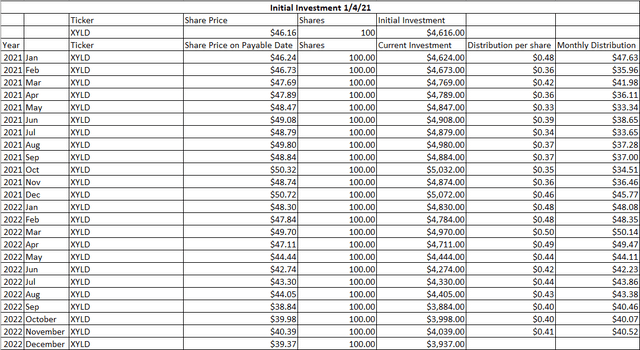

Going back to 2021, XYLD traded at $46.16 on 1/4/21, so an initial investment of 100 shares would have cost $4,616. Based on XYLD’s current price, the initial investment would have declined by -$679, so the initial investment ROI would be -14.71%. XYLD has paid $949 in distributions since the beginning of 2021, making its yield on invested capital 20.56%. When the distributions are netted from the losses, XYLD has been a positive investment, generating $270.02 in profit for an ROI of 5.85%.

Steven Fiorillo, Seeking Alpha, Global X

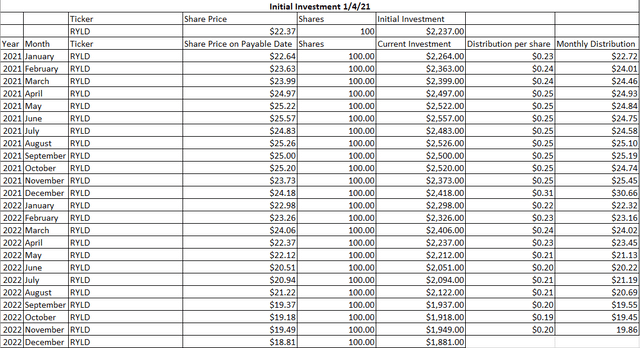

RYLD traded at $22.37 at the beginning of 2021, making an initial investment of 100 shares cost $2,237. Based on today’s price, the current investment would be worth $1,881, declining -$356 for an initial investment ROI of -15.91%. RYLD has paid $536.47 in distributions, a 23.98% yield on invested capital. When the distributions are netted from the losses, the total profit is $180.47 for a total ROI of 8.07%.

Steven Fiorillo, Seeking Alpha, Global X

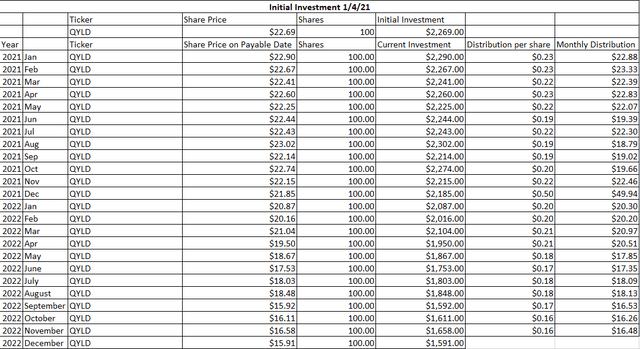

QYLD has been the worst in the group as an initial investment at the beginning of 2021 would have cost $2,269 and declined to $1,591 for a loss of -$678. This is an initial investment ROI of -29.88%. QYLD has paid $487.13 in distributions since the beginning of 2021 for a 21.50% yield on invested capital. When the distributions were netted against the deprecation, QYLD was still in the red as the total profit was -$190.27, and the total ROI was -8.39%.

Steven Fiorillo, Seeking Alpha, Global X

Side-by-side comparison

Looking at 2022, XYLD had the largest yield on invested capital at 9.67%, and its initial investment ROI was the lowest at -22.42%. When the distributions are netted against losses, XYLD had the least losses with a total ROI of -12.76%. RYLD was the 2nd best performing ETF at -13.70% total ROI, while QYLD came in a distant 3rd with a total ROI of -19.53%.

|

2022 Total ROI and Statistics for RYLD, XYLD, and QYLD |

|||

|

RYLD |

XYLD |

QYLD |

|

|

Initial Investment |

$2,452.00 |

$5,075.00 |

$2,229.00 |

|

Current Investment |

$1,881.00 |

$3,937.00 |

$1,591.00 |

|

Profit |

-$571.00 |

-$1,138.00 |

-$638.00 |

|

Initial Investment ROI |

-23.29% |

-22.42% |

-28.62% |

|

Current Distributions Paid |

$235.04 |

$490.67 |

$202.67 |

|

Yield on Investment |

9.59% |

9.67% |

9.09% |

|

Total Profit |

-$335.96 |

-$647.33 |

-$435.33 |

|

Total ROI |

-13.70% |

-12.76% |

-19.53% |

When looking at these investments since the beginning of 2021, XYLD had the best initial investment ROI at -14.71%. RYLD generated the largest yield on invested capital at 23.98%, which carried over into total ROI. RYLD has generated an 8.07% total ROI since the beginning of 2021, while XYLD produced 5.85%, and QYLD was the only one in the red with -8.39%.

|

Since 2021: Total ROI and Statistics for RYLD, XYLD, and QYLD |

|||

|

RYLD |

XYLD |

QYLD |

|

|

Initial Investment |

$2,237.00 |

$4,616.00 |

$2,269.00 |

|

Current Investment |

$1,881.00 |

$3,937.00 |

$1,591.00 |

|

Profit |

-$356.00 |

-$679.00 |

-$678.00 |

|

Initial Investment ROI |

-15.91% |

-14.71% |

-29.88% |

|

Current Distributions Paid |

$536.47 |

$949.02 |

$487.73 |

|

Yield on Investment |

23.98% |

20.56% |

21.50% |

|

Total Profit |

$180.47 |

$270.02 |

-$190.27 |

|

Total ROI |

8.07% |

5.85% |

-8.39% |

Conclusion

If you’re looking for capital appreciation, none of these investments will meet your investment criteria as their upside potential is capped due to writing covered calls against 100% of its portfolio. These are ETFs that are structured for investors looking for larger-than-average levels of yield. In 2022, XYLD was the best performer for the group, generating the largest yield on invested capital and the least amount of losses when total ROI is looked at. In the longer term, XYLD has had the least amount of losses from an initial investment ROI perspective, but RYLD has generated a larger yield on invested capital which has helped its total ROI exceed XYLD’s since the beginning of 2021. I am bullish on all three funds as they all have a place in my overall income strategy for the long term. Based on the year-end results, XYLD has been more stable on price, and I am most bullish on XYLD making a recovery as the companies in the S&P 500 are better situated to withstand future headwinds than companies in the Nasdaq or the Russell. After looking at the data, I am ranking XYLD as the best investment of the three, RYLD a very close 2nd, and QYLD a distant 3rd.

Be the first to comment