Mongkol Onnuan

The days of living in a yield-starved environment seem like a distant memory. During 2020, the U.S 10-Year Treasury Notes fell under a 1% yield, and this time last year, investors would have only produced 1.46% buying the 10-year. For income investors, Treasury notes were sidelined as you could produce the same amount of yield from an S&P 500 index fund. Today is a much different environment where the yield on the 10-year exceeds many popular dividend funds, including the Schwab U.S. Dividend Equity ETF (SCHD) and Vanguard High Dividend Yield ETF (VYM). For income investors, there is less of a reason to allocate capital toward SCHD yielding 3.73% and VYM yielding 3.39% when they can purchase a 3.83% yield on the 10-year with little to no risk. The 10-year at a 3.83% yield presents a dilemma for equities and many dividend-focused funds as capital could flow out of the equity markets and into treasuries.

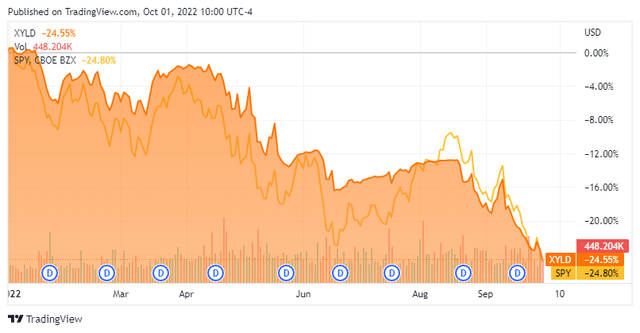

I believe this will make high-income covered call funds more attractive as the risk-reward for investing in SCHD or VYM has greatly decreased. There is a segment of the investment community that isn’t focused on fluctuations, as income generation is the primary goal. For income investors who are less concerned with capital appreciation, it’s going to be a harder sell to invest in an ETF yielding 3.5% than a 10-year Treasury note yielding 3.83%. It was easy to find places to allocate capital in a yield-starved environment as everything was compared to a low yield on the 10-year. Now that the 10-year is approaching 4%, it’s not so easy to make a case for many equity investments from an income perspective. This is why I believe more income investors will gravitate toward high-yielding ETFs such as the Global X S&P 500 Covered-Call ETF (NYSEARCA:NYSEARCA:XYLD) rather than dividend-focused ETFs with yields under the 10-year. The bear thesis used to be that Covered-Call ETFs would implode during a bear market and severely underperform the markets. 2022 has been a difficult investing environment, but XYLD has stayed in lockstep with the SPDR S&P 500 Trust (SPY) while generating double-digit yields. XYLD is yielding 13.82% and could be a great income-generating vehicle for income investors.

XYLD and RYLD are neck and neck for total ROI in 2022, leaving QYLD behind

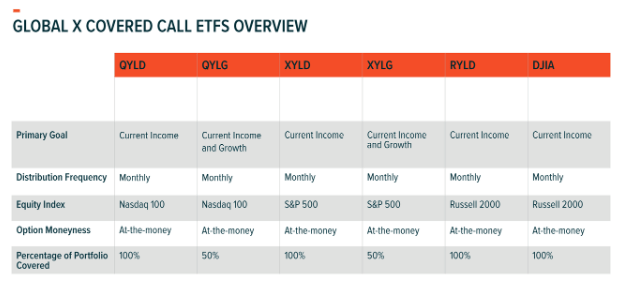

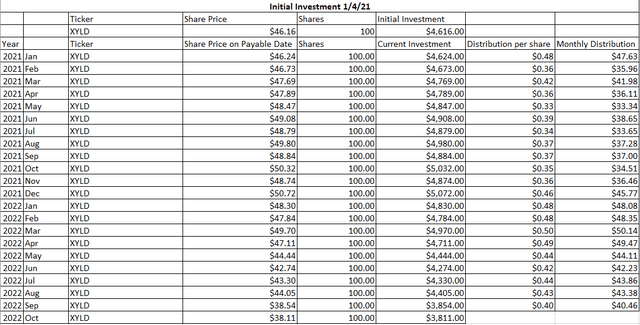

Global X has 3 main covered-call ETFs consisting of XYLD, Global X Russell 2000 Covered Call ETF (RYLD), and Global X Nasdaq 100 Covered Call ETF (QYLD). These funds utilize a buy-write where they buy exposure to the stocks in their respective indexes (S&P, Nasdaq 100, Russell 2000) and write or sell corresponding call options on the same index. The options are written at the money on a monthly basis and the premiums collected are used to fund its monthly distributions to shareholders. Covered Calls are written on 100% of the portfolio, which is how these ETFs can generate such large yields. Now that the September distributions have been paid, I have updated the models, and they indicate XYLD and RYLD are neck and neck while QYLD is still the laggard of the group. The models I created utilize a 100-share investment for each ETF, purchased on 1/3/22.

Global X

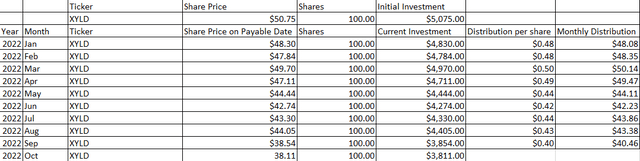

An initial investment of 100 shares in XYLD would have cost $5,075. XYLD closed on 9/30 at $38.11, putting the investment at $3,811. The initial investment declined by -$1,264 or -24.91% YTD. Over the previous 9 months XYLD has paid $410.08 in monthly distributions placing its current yield on investment at 8.08%. In 2022, XYLD has had a total ROI of -16.83% when the distributions are netted against the capital decline.

Steven Fiorillo, Seeking Alpha, Global X

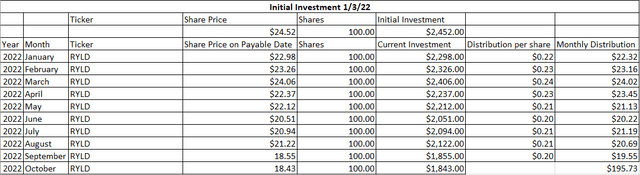

Purchasing 100 shares of RYLD at the beginning of 2022 would have cost $2,452. Shares of RYLD have declined to $18.43, placing the initial investment at $1,843 for an initial capital decline of -24.84%. Thru September, RYLD has paid $195.73 in distributions placing its yield on investment at 7.98%. RYLD has a total ROI of -16.85% when the distributions and capital decline are netted against each other.

Steven Fiorillo, Seeking Alpha, Global X

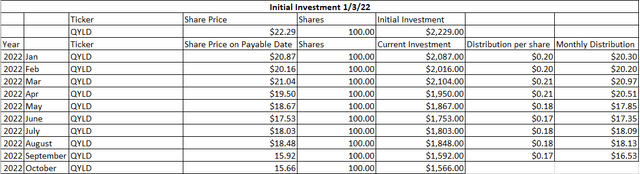

While XYLD and RYLD were neck and neck, QYLD has become the laggard. An initial investment in QYLD would have cost $2,229 and its since declined to $1,566 which is a -29.74% decline. QYLD has paid $169.93 in distributions in 2022 which is a 7.62% yield on investment. When the distributions and capital loss are netted out, QYLD has a total ROI of -22.12%.

Steven Fiorillo, Seeking Alpha, Global X

While I am more heavily invested in QYLD, XYLD has been the better investment. I also believe more investors will gravitate toward XYLD in the future as the S&P 500 has been less volatile than the Nasdaq. This isn’t an environment where yield is lacking, and 3.5% yields aren’t as enticing when the 10-year is at 3.83%. It’s hard to find investments that are up in 2022, and the bear thesis about covered-call funds imploding has been proven incorrect. Yes, they declined in 2022, but so have the major indices. XYLD will recover just as it did during the pandemic crash, and the unknown is when that will occur. Along the way, XYLD will continue to generate monthly income and achieve double-digit annual yields.

What XYLD has looked like longer term

I updated the longer-term model to illustrate what an investment at the beginning of 2021 would look like. On 1/4/21, XYLD traded for $46.16, placing an initial investment of 100 shares at $4,616. The initial investment in XYLD has declined by -$805 placing its initial capital ROI at -17.44%. XYLD has paid $868.43 in distributions over the past 21 months, which is an 18.81% yield on invested capital. When the distributions are netted against the capital depreciation, XYLD’s total ROI is $63.43 for a 1.37% ROI.

Steven Fiorillo, Seeking Alpha, Global X

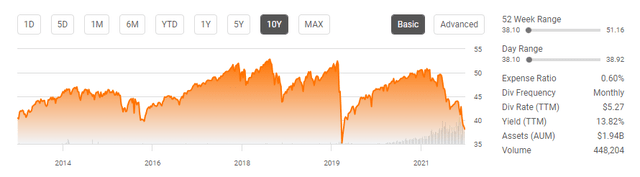

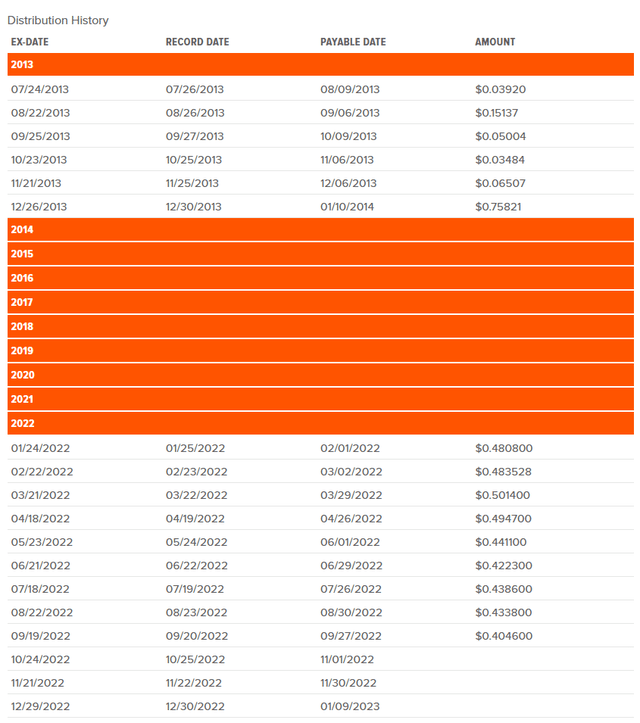

XYLD went public on 6/24/2013 at $40 per share. Since going public, XYLD has declined by -4.73% as it closed at $38.11 on 9/30. Since its inception, XYLD has paid 111 consecutive monthly distributions amounting to $27.64 per share. XYLD has paid 69.10% of its initial price through distributions. This is an annualized yield of 7.43%, considering XYLD has been public for 9.3 years.

There are investors who still believe XYLD and others like it are gimmick funds. The historical data on XYLD indicates that selling covered calls to generate income isn’t a gimmick. This is an investment that has paid almost 70% of its initial price in distributions through the years. XYLD has gone through several market cycles, this isn’t the first bear market, and it won’t be the last bear market that it experiences. For income investors, XYLD continues to deliver some of the largest yields found in the market, and as an added benefit, its distributions are paid monthly. From an income perspective, XYLD has accomplished its primary goal of generating monthly income, and with the markets bouncing along the bottom of a bear market, it’s still performing slightly better than its respective index. XYLD has solidified its track record of generating income, and there is no indication that XYLD won’t continue generating monthly income in the future.

Conclusion

Now that yield isn’t hard to find, investors have options on having to produce income from capital investments. I believe that the 10-year notes yielding 3.83% makes XYLD more attractive. Income investors now have a little to no risk option to generate a respectable yield on invested capital and don’t have to select dividend-paying equities or moderate-yielding dividend ETFs to generate income. As the 10-year approaches 4%, investors will probably reconsider funds such as XYLD because the spread between the 10-year and many income investments is gone. XYLD offers a 13.82% yield, making it a significant alternative to the 10-year, where an investor is generating an extra 10% yield for the additional risk they are taking. I think XYLD is a great product for income investors to consider, and if the markets are getting closer to a bottom, XYLD at these levels could become a great income investment with moderate capital appreciation in the future.

Be the first to comment