CUHRIG/E+ via Getty Images

Brief Overview

Coal is dead. With global Wokeism and widespread cancel culture laying siege to most Western societies, valid arguments about better environmental stewardship and corporate accountability have regularly gotten lost in over politicized agendas to push certain national interests.

Only about a year ago, we had the IEA call time on the fossil fuel industry with pleas for a stop to new oil, gas & coal exploration. How things can change over a year!

Since then, eye-watering inflation has plagued global economies. Super majors have binned capital investment in favor of returning investor money and sent energy prices soaring. Most sovereign banks are forcing restrictive monetary policies to combat sky-high prices, pushing the global economy into a violent nose-dive.

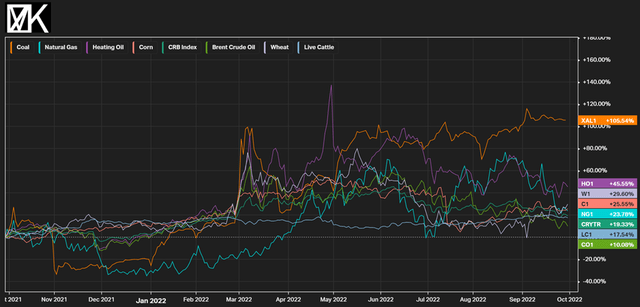

Coal, an oft prized resource for emerging markets to fuel their economies, has outperformed literally every single commodity year to date. Extensive economic volatility, a lack of under-investment, and the persistent demonization of global energy have rocketed coal prices skyward, returning +105% year-to-date.

These figures are even more extraordinary given noteworthy Covid related shutdowns in China and a US dollar whose unrelenting strength has somewhat kept a cap on commodity prices.

Koyfin

Newcastle Coal Futures (orange line) have outperformed all commodities combined year to date, posting gains of +105.54%

For contrarian investors wishing to capitalize on soaring energy prices, Thungela Resources, South Africa’s premier coal miner could fit the bill. The firm engages in mining and production of coal in South Africa, owning interests in thermal coal from multiple mine sites in the Mpumalanga region.

Its prime customers, located in emerging markets in India and Asia, use the lion’s share for power generation. Strong upside remains forecast for the firm with demand severely outstripping supply.

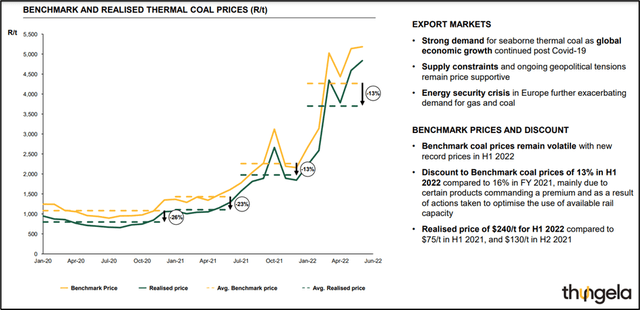

Export markets for seaborne thermal coal remain healthy with emerging markets slowly coming back online. Prolonged geopolitical tension has supplied natural support to record prices which are likely to continue to be reflected in Thungela’s accelerating revenues.

To put that into perspective, realized prices for H1 2022 hit $240/t. One year earlier, the same ton would have solely fetched $130.

Source: Thungela Resources Investor Presentation – Interim Results H1, 2022

Geopolitical factors and mayhem in energy markets continue to provide support to Thungela’s revenue streams.

Unlike a large swathe of global energy players, the company has attempted to extend life of mine with some measured development and investment in assets.

This includes the Elders project, a conventional 5 section underground development looking to replace volumes at the firm’s Goedehoop operation.

These investments also sustain local jobs, build community supply networks and strengthens Thungela’s social license to operate.

Simplified Income Statement

Thungela’s revenues have surged on the back on colossal commodity prices, posting USD $255M sales in FY 2020, USD $1.6B in FY 2021 and USD $2.6B LTM. Such revenue growth is more commonplace with high flying tech-plays, not dirty old South African coal miners trading at 2.2x forward earnings.

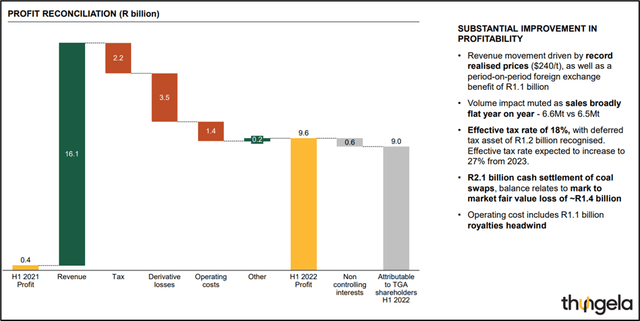

The company has taken prudent measures to hedge out possible downside commodity risk through derivatives markets.

Sales are more impressive given the considerable challenges facing the coal miner, including lacklustre port infrastructure, a decrepit rail system and curtailed production at Zibulo (opencast), Greenside (5 seam plant) and Khwezela (Navigation Pit) One can only wonder the positive net effects on sales, earnings and valuations if the company manages to solve these issues.

Energy costs have impacted Thungela Resources too with ~10.2% inflation hitting the bottom line through an arrive of indirect costs such as consumables, steel, petroleum, and explosives.

Net income numbers have almost been as impressive as coal’s unrelenting rise, with Thungela Resources posting a loss in 2020 (USD-$22.5M) followed by mammoth gains in FY 2021 (USD $403M) and last twelve months (USD~$931M)

Source: Thungela Resources Investor Presentation – Interim Results H1, 2022

Thungela Resources has made prudent use of derivatives markets to hedge out downside risk on coal prices.

Simplified Balance Sheet

The company has crafted a war chest of cash and marketable securities to support its generous distribution program. Currently paying a dividend yield of 23.5%, Thungela Resources posts an equally impressive payout ratio of only 16.15%.

Since floating on the London Stock Exchange, cash on hand has ballooned, from USD $13M FY2020 to USD $933M LTD.

This cash-rich coal player has benefited subsequently with long term debt non-existent and funding requirements easily manageable. The Elders Project will require some financing to extend life of mine, but this should not pose big liquidity worries.

Simplified Cash Flow Statement

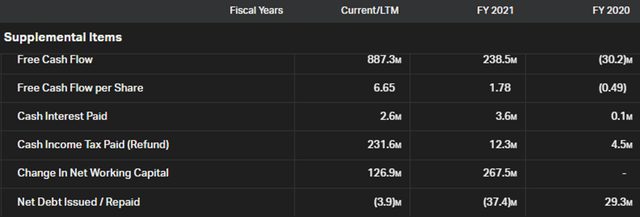

Thungela Resource’s is a cash machine, posting USD $985M in cash flow from operations over the last 12 months. To put that into perspective, in FY 2021 the company posted USD $383M, laying testament to the sheer strength that lofty coal prices have had on the bottom line.

Source: Koyfin

Free cash flow per share has ballooned at Thungela Resources over the past couple of years

Cash flows from investing show prudence in the venture’s approach to capital expenditure, with a modest USD $98M spent over the last 12 months. Thungela issued $161M of long-term debt a year ago but that has since been repaid.

Cash flow from financing over the last twelve months has been non-descript, save the USD $150M distributed to shareholders. All-in, free cash flow per share has almost tripled since last year – an amazing feat for a company trading at a measly forward price earnings ratio.

Valuation

Relative valuations for Thungela Resources, despite being rock-bottom, factor in a degree of sizable risk. Beyond exposure to coal which the investment world has wholly fallen out of love with, this ticker also embraces meaningful country risk and big exposure to the South African Rand.

Consequently, relative valuations are among the lowest for big coal operations. Forward price earnings are pitching at 2.2x with price to sales at less than 1. Book values are around 1.7x during the past 12 months, increasing very marginally.

That makes for a compelling investment, given mammoth margins (EBITDA LTM – 56.8%), huge return on assets (44.53%), and gargantuan return on equity (86.27%).

Risks

Despite blockbuster numbers, margins, and ratios – the company is not risk-free. Archaic port and railway infrastructure has hampered efforts to ramp up volumes, hampering sales. Domestic infrastructure, national corruption problems, illegal mining, and spiraling price pressures all figure on the risk radar.

Coal as a commodity is likely to still have some legs and price risk has been hedged through a basket of derivatives covering production.

If Thungela Resources can get the rail and port infrastructure right, additional upside may rapidly be reflected in volumes and the stock price.

Key Takeaways

- Social change, better environmental stewardship, and packaged investments under the guise of ESG, have all contributed to thermal coal’s demise.

- Yet geopolitical tensions, resource scarcity, and a commodities boom have seen seaborne coal prices accelerate upwards.

- Emerging markets continue to use thermal coal as a cheap, reliable (yet heavily polluting) source for power generation.

- Thungela Resources has been perfectly placed to capitalize on energy markets in disarray.

- The company has posted record sales growth, eye-watering cash flows, meaningful profits and a laudable dividend policy.

- Port and rail infrastructure has plagued the company and put an artificial lid on full economic potential.

- However, at 2.2x forward earnings, with a generous dividend policy, and little signs of energy costs abating, this ticker is worth further scrutiny.

Be the first to comment