Joe Raedle

Consumer discretionary stocks have been very strong recently, which is encouraging for the health of this market. We remain in a bearish phase in 2022, but as I’ve maintained since June, I think we’ve already seen the low. The fact that we’re seeing aggressive areas of the market perform well is a great sign, but there remains much work for the bulls to do to solidify the end of the bear market.

Because consumer discretionary stocks are performing well, it makes a lot of sense to see which ones are leading the way. Right now, I’d say Carvana (NYSE:NYSE:CVNA) is one of those. But does it have staying power? I think the chart looks great for now, but fundamentally and longer-term, I have serious concerns.

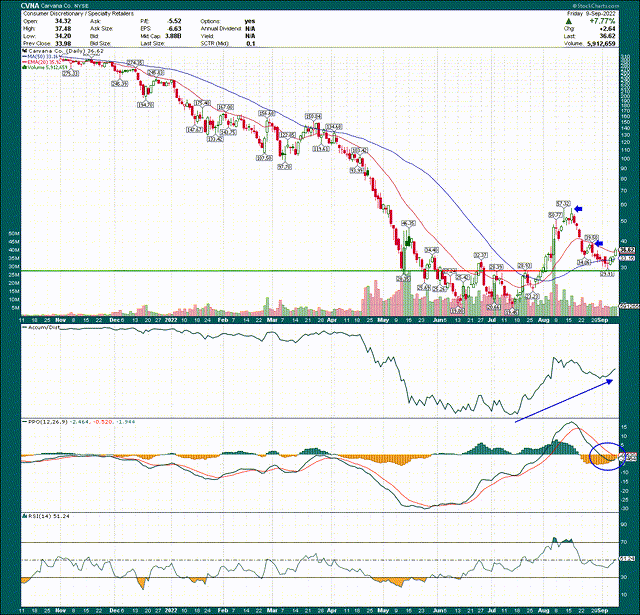

We can see Carvana went through a lengthy bottoming pattern this summer, but it resulted in a massive breakout rally. The stock has since pulled back sharply, but to my eye, it looks like the next rally has started.

The rally began right at the breakout point of ~$29, which is exactly what you want to see. It corresponded with a very strong accumulation/distribution line, as well as a textbook bullish setup on the PPO.

The higher A/D line means investors are buying dips rather than selling rips, and the PPO is turning sharply higher right at centerline support. None of this guarantees the start of a new bullish phase, but it does look very favorable for a trade on the long side.

The first price target is $39.50, which is the bounce level during the selloff. I don’t think that will offer much resistance, so the next objective would be the high at $57. That one will likely offer much more resistance, but it’s also a long way up from here.

In short, the chart looks great for a bullish trade here with significant upside potential. However, as we’ll see below, I’m struggling with Carvana’s future.

Mo’ money, mo’ problems

Carvana was a pandemic darling as it was in the right place at the right time. Auto production virtually stopped for parts of the pandemic, which meant new car supply was woefully inadequate against demand. The logical conclusion of that story was used car prices flying higher, and fly they did. Carvana was also in the process of ramping volumes anyway, so it generated a virtuous combination of lots of cars sold at very high prices. It was perfect.

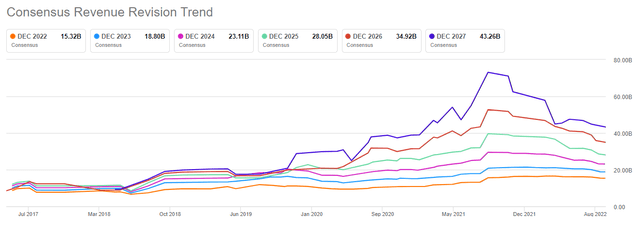

The company saw revenue estimates absolutely explode higher, and that meant the share price did as well. Not only did revenue expectations fly higher, but investors were willing to pay more for that growth. Again, a virtuous combination of higher expectations and a higher multiple.

Since the middle of last year, however, expectations have come back down to earth, as has the share price. That was obviously needed given the excesses that were priced in, but what we haven’t seen is estimates flatten out, and then eventually start rising again. When that will happen is anyone’s guess but for now, this isn’t exactly bullish longer-term.

Carvana is still expected to grow revenue at ~20% annually for the foreseeable future, so it’s very much a growth stock. But is that good enough to see the stock higher over the long-term? I’m not sure it is.

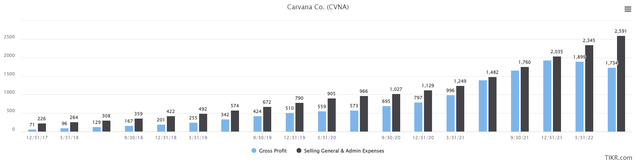

The reason is because at some point, Carvana has to stop spending so much for the sake of selling more cars. It has done a masterful job of growing vehicle volumes, and it’s even doing a nice job of higher gross profit per vehicle. The problem, however, is that it is even better at spending money.

Below is a trailing-twelve-months look at gross profit and SG&A, both in millions of dollars.

There hasn’t been one single period where gross profit was greater than SG&A. That means Carvana is a very long way from generating any sort of profit. Gross profit minus SG&A is the most basic form of operating income, and it’s not even close to breakeven, before even considering other expenses.

The most recent TTM period saw gross profit of $1.7 billion, but SG&A spending of $2.6 billion. That’s the definition of unsustainable, and Carvana has, in my opinion, ruined its capital structure in pursuit of growth-at-any-cost.

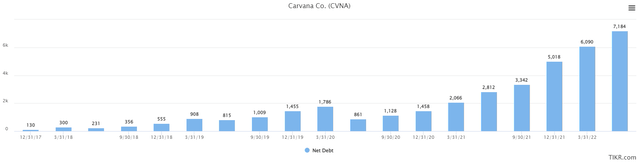

First up is net debt, in millions of dollars.

The company operated with a manageable amount of debt for years, but recently ramped its borrowings because it’s continuing to shed enormous amounts of money through its growth strategy. The cash has to come from somewhere, and one place it has come from is a net debt load in excess of $7 billion, and rising.

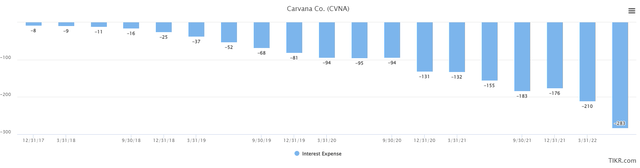

This, of course, carries with it substantial costs, and below we can see TTM interest expense in millions of dollars.

Carvana is now on the hook for more than $400 million annually based upon its most recent quarter, so the $283 million above on a TTM basis will almost certainly continue to rise for the foreseeable future. That’s $400 million Carvana doesn’t have, given it loses money every day it operates. This will worsen its capital structure over time as it will either result in even more borrowings, or more dilution.

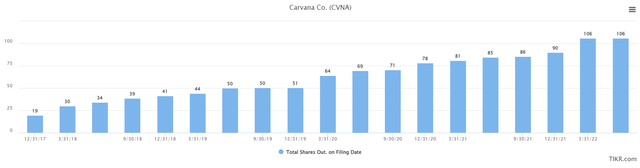

Below we have the company’s share count in millions, and it doesn’t look any better than net debt.

The share count has ballooned over the years, and given what we’ve seen with the balance sheet, I wouldn’t be at all surprised to see the share count continue to rise substantially over time. Dilution is almost always a bad idea for shareholders (barring an accretive acquisition, or similar), but I don’t see where Carvana has a lot of choice.

It’s losing huge amounts of money, it owes more than $100 million per quarter in interest expense, and there’s no end in sight from what I can tell.

For its part, management has stated publicly they’re trying to focus on leveraging down SG&A costs, but until that actually starts to happen, I think there’s a lot of cause for concern longer-term.

Final thoughts

On the plus side, CVNA stock is cheap. Below we have price-to-forward-sales since the company went public, and it’s quite interesting.

The valuation was generally just under 1X forward sales pre-pandemic, but spent most of the pandemic between 2X and 3X. Today, the stock is 0.2X forward sales, which is very near the cheapest it has been on that measure. However, before you mortgage your house to buy this “cheap” stock, remember that profitability plays into the P/S ratio investors are willing to pay. A stock with extremely high margins and recurring revenue – like software – will generate very high P/S ratios. A stock with chronic unprofitability, extreme leverage, and from what I can tell, no path forward, should trade at a cheaper multiple.

That’s what we have here with Carvana; there’s a lot of growth in terms of market share the company can do, but at what cost? The stock looks cheap on P/S and maybe it is, but this company has a lot of problems and I don’t know how it is going to solve them.

The balance sheet is highly leveraged, the company is outspending gross profit by hundreds of millions of dollars, and it owes hundreds of millions of dollars in interest expense every year.

I think the chart looks great for a quick trade, but this is not a stock you want to own long-term.

Be the first to comment