FilippoBacci/iStock Unreleased via Getty Images

The Invesco S&P 500 ex-Rate Sensitive Low Volatility ETF (NYSEARCA:XRLV) offers exposure to bellwether U.S. equities that are capable of benefiting from rising interest rates and are not prone to frenetic price swings.

Today, I would like to take a closer look at the essential principles of its investment strategy, current portfolio holdings, factor exposure (size, value, quality, etc.), touch upon the past performance to weigh existing pros and cons and arrive at a conclusion about whether XRLV deserves a Buy rating at the current price.

What is XRLV’s investment strategy?

The cornerstone of XRLV’s investment strategy is the S&P 500 Low Volatility Rate Response Index. The index targets a 100-strong cohort of the S&P 500 constituents exhibiting two significant characteristics: they fare comparatively well amid contractionary monetary policy in the U.S. and have lower volatility. For the first part of the equation, the index managers consider

a regression of the prior 60 monthly stock returns to changes in the 10-year U.S. Treasury rate,

selecting the 400 most resilient ones. For the second part, the twelve-month realized volatility is taken into account to arrive at a 100-strong equity basket. Constituents exhibiting higher volatility are underweighted. Rebalancing and reconstitution follow a quarterly schedule, with the most recent one implemented in November 2022.

Since the fund targets bellwethers via the S&P 500 index which serves as a selection universe, there are two reasons to confidently expect an at least above-average level of profitability its holdings are capable of demonstrating. First, the U.S. market barometer itself shuns unprofitable companies as per its methodology, which is in essence a small but useful quality ingredient, and second, larger size correlates with higher quality and vice versa. We will return to the assessment of this issue shortly.

Factors to consider

Looking under the hood, we see precisely 100 names (aside from cash), with the major ten having a modest weight of 11.7%. Neither of the elite $1 trillion club members has qualified for this portfolio, owing to the rising interest rates exposure screen that they most likely failed. However, we still see a remarkable share of the net assets allocated to the mega-cap echelon, around 21.6%, with Berkshire Hathaway (BRK.B) being the largest, boasting a market value of around $684 billion. Overall, the weighted-average market capitalization is approximately $84.5 billion.

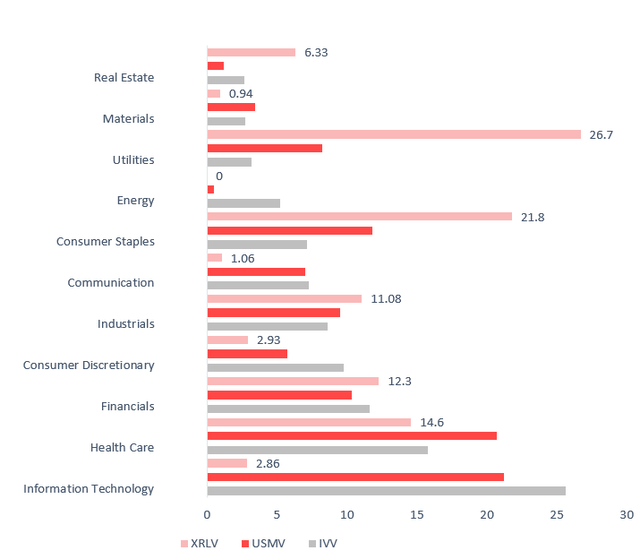

In the chart below, XRLV’s sector mix is juxtaposed with the iShares Core S&P 500 ETF (IVV) and iShares MSCI USA Min Vol Factor ETF (USMV).

Created by the author using data from the funds

As can be quite clearly seen, there are sizeable differences not only compared to IVV but also to USMV. There are a few reasons for that.

- XRLV has almost no exposure to IT (just 2.86%) owing to the sector’s high sensitivity to rising interest rates that eat into cash flow growth prospects and subsequently into valuations of traditionally generously priced tech players. In fact, there are just three IT names in the portfolio, the largest being ~$142 billion International Business Machines (IBM), which because of the smart-beta weighting has only 0.98% weight. The same holds true for the expanded tech sector and, as a consequence, for some GICS consumer discretionary sector players (remember, both Tesla (TSLA) and Amazon (AMZN) operate in the said sector, and none is in the XRLV portfolio).

- Speaking of USMV, its strategy is centered on the optimization algorithm that scrutinizes the correlation between stocks among other things, so the resulting sector mix is principally its product.

On a side note, please take notice that XRLV has ignored the energy sector completely.

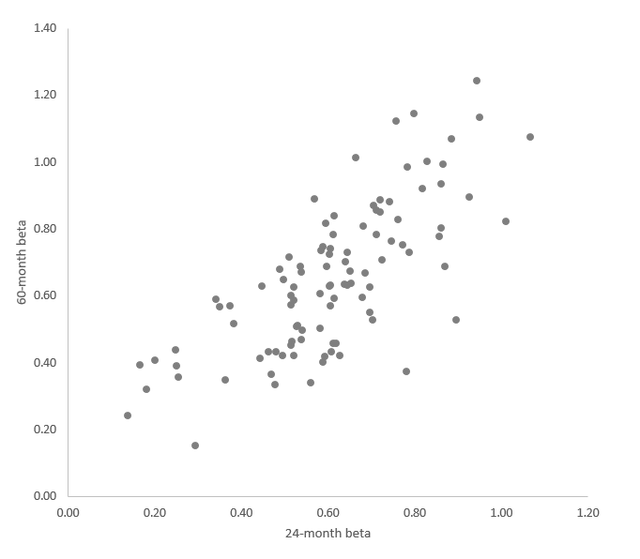

Expectedly, the 24-month and 60-month betas of the holdings are something XRLV could be justly proud of. Specifically, just two equities in the mix have a 24-month beta of marginally above 1, namely Roper Technologies (ROP) and Verisk Analytics (VRSK); the median for the portfolio is 0.61, signaling most stocks are markedly less volatile than the market. The 60-month coefficients are on par or above 1 in the cases of only eight stocks. The scatter plot below should provide better context.

Created by the author using data from Seeking Alpha and the fund

But does lower volatility mean better valuation? In the case of XRLV, it clearly does not. Let me explain the essential points.

- First, the weighted-average earnings yield (Last Twelve Months) of 4.6%, as per my calculations, is not a level I am completely comfortable with, assuming the 10-year Treasuries yield at about 3.79%. Put another way, this is a 21.9x Price/Earnings, compared to the S&P 500’s of below 19x.

- Most interestingly, a 4.6% WA EY comes with a weighted-average forward EPS growth rate of 6.8%, which is undoubtedly bleak.

- The WA Price/Sales ratio of 3.68x does not chime well with the WA forward revenue growth of 5.9% either.

- Most importantly, around 67.6% of the holdings have a D+ Quant Valuation grade or worse, while only 12.4% are, principally real estate and utility companies, priced relatively comfortably, with a B- grade and better.

Turning to the quality factor, there is just one unprofitable company in this mix, BRK.B (so its GAAP earnings yield is negative 0.2%). Also, none of the companies (outside the financial sector) is cash-burning. Importantly, I also see that 89% of the holdings have a B- Quant Profitability grade or better. As I said above, the size factor and the S&P 500’s profit screen likely contributed to this result. Overall, this is sufficient to conclude almost all companies represented are resilient enough to fare well in a higher interest rates environment and in a potential recession.

Performance: low volatility back in vogue in 2022

At first glance, an ordeal for investors in almost every asset class or style, from speculative growth to quality growth, FX strategies (a mere calamity), REITs, etc., 2022 was still a comparatively strong year for a few strategies including energy-centered, inverse funds, maximalist value, and value & quality; low volatility, one of the hotly debated factors some investors have reasons to be unenthusiastic about despite the ‘low volatility anomaly,’ also earned its place on this list.

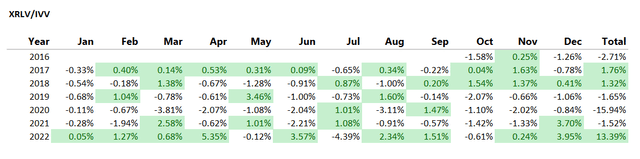

In 2022, XRLV has lost about 4.77%, an exemplary performance by present-day standards, assuming IVV was down by 18.6%, underperforming the Invesco fund every month except for May, July, and October. In fact, 2022 was XRLV’s strongest year since its inception in September 2015.

Created by the author using data from Portfolio Visualizer

The data below show that despite XRLV’s soft performance in 2018-2021, it still managed to outperform IVV over the May 2015 – December 2022 period, delivering the strongest compound annual growth rate amongst its peers USMV and the Invesco S&P 500 Low Volatility ETF (SPLV). Risk-adjusted returns are also the highest.

| Portfolio | XRLV | IVV | USMV | SPLV |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $22,454 | $21,231 | $20,386 | $20,160 |

| CAGR | 11.13% | 10.32% | 9.74% | 9.58% |

| Stdev | 14.65% | 16.10% | 13.05% | 13.16% |

| Best Year | 29.60% | 31.25% | 27.69% | 27.63% |

| Worst Year | -4.77% | -18.16% | -9.42% | -4.89% |

| Max. Drawdown | -23.71% | -23.93% | -19.06% | -21.37% |

| Sharpe Ratio | 0.73 | 0.63 | 0.7 | 0.69 |

| Sortino Ratio | 1.1 | 0.95 | 1.07 | 1.05 |

| Market Correlation | 0.93 | 1 | 0.91 | 0.84 |

Created by the author using data from Portfolio Visualizer

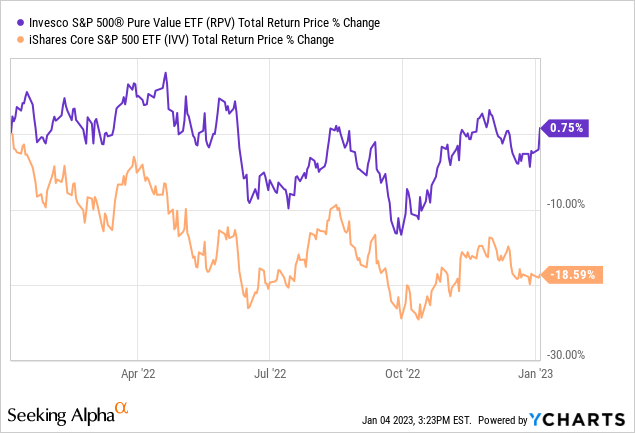

However, there is still something to dislike here. As I said above, there are factors that performed similarly strongly or even better. The maximalist value represented by the Invesco S&P 500 Pure Value ETF (RPV) is a fund to mention here. As can be seen, it confidently beat XRLV last year.

Final thoughts

XRLV addresses two paramount concerns investors have been tackling since late 2021. First, stocks’ sensitivity to rising interest rates (and inflation, indirectly). Second, the magnitude of share price swings. In my view, XRLV is designed to become something of an equity safe haven amid contractionary monetary policy, a concept that should appeal to risk-averse investors. The fact is, it did provide some safety in 2022, finishing ahead of the S&P 500 ETF by 13.4%. And on a side note, a 0.25% expense ratio is fairly competitive.

However, the value & quality balance XRLV has at the moment (tilted towards expensive quality) is not the one I like, which leads to a decision not to assign it a Buy rating despite the advantages discussed.

Be the first to comment