FatCamera

Thesis update

This is an update to my original Xponential Fitness (NYSE:XPOF) thesis. My opinion that XPOF is undervalued remains unchanged. We can see that among our close friends and relatives, personal fitness has become increasingly mainstream in recent years. I am confident that it will continue to increase its share of the market because of its strong market position, diversified brand portfolio, and proven ability to deliver.

Earnings update

The North American region’s $264.8m in system sales were slightly lower than the Street’s $264m forecast. This follows the pattern seen in the previous quarter, when AUVs rose year-over-year and surpassed comps, a phenomenon I attribute to the brand mix. In comparison to the previous quarter, the quarterly run rate for AUVs was $489k, an increase of $9k.

Franchise, equipment, and other services drove net revenue of $63.8 million, which was higher than the $54.9 million expected by analysts, showing that XPOF is benefiting from its new partnerships and digital and XPASS initiatives. I saw a slight improvement in product costs and franchise revenue, but SG&A was higher than I anticipated, leading to an adj EBITDA that was only slightly ahead of consensus estimates of $18.8 million. Additionally, notable qualitative indicators include a 33% increase in total members and a 28% increase in visitation, versus a 37% increase in system sales.

Strategic updates

The results of XPOF’s 3Q earnings were in line with my projections. So far, the post-IPO trend of beating and raising expectations appears to be holding, and more increases are expected this time given the company’s strong start to the year relative to its annual guide. In my opinion, development has been the primary force, and XPOF is on track to open 500-520 units this year. This has fueled equipment sales and fees, which have generally performed better than expected, increasing annual revenue forecast to $235-240 million from $201-211 million at the beginning of the year (despite lifting it again in the third quarter). In my opinion, this is a very positive sign of the underlying growth momentum and optimism in the economy. It also appears that other expansion efforts are also picking up steam. XPOF’s increased activity in new partnerships, as well as the introduction of services like digital and XPASS, have also contributed to expansion.

With $1 billion in North American system sales anticipated throughout the year, average unit volume recovery, the main driver of royalty revenue, has been largely on track. This recovery has been strong, but it hasn’t been better than I thought it would be. I believe maintaining SSS at a stable rate is still one of the stock’s biggest long-term problems.

Revenue growth has pushed the company’s adj. EBITDA forecast for the year is up to $70-74 million from $68-72 million in the prior year and $67-71 million at the beginning of the year. However, I must note that this hasn’t been what I originally expected, with SG&A running higher on an underlying basis (I expect them to be in the high $80 million this year). Considering what it’s accomplished this year, I suppose this is to be expected, but it does make me pay more attention to short-term margin developments.

On the other hand, the company’s transition units, which it is temporarily owning until the refranchising process is complete, have continued to operate slightly above normal, impacting both other revenue and SG&A expense. In general, I see the path of development and revenue beyond this year as promising, though I would be more wary of margin expansion in the years to come (something to keep a lookout).

Valuation

Price target update

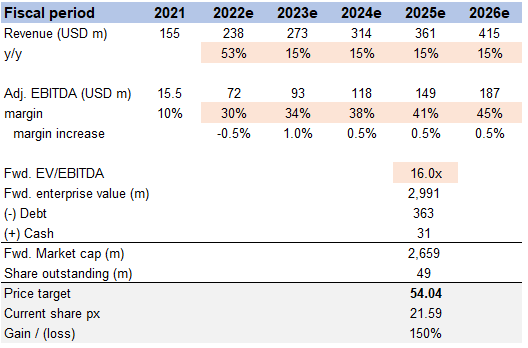

My updated model still suggests upside for XPOF – a price target of ~$54 or ~150% upside from today’s share price of $21.59. I have revised my model to reflect the new guidance in FY22 (revised upwards).

Own’s estimates

Conclusion

I still believe XPOF is undervalued as of today. These 3Q earnings and revised earnings (upwards) have further supported my thesis and confidence that XPOF is moving in the right direction.

Be the first to comment