Olemedia

Note: Unless otherwise stated, all references to dollars ($) are to the Canadian currency.

I first wrote about Frontier Lithium Inc. (OTCQX:LITOF) this past May, and in the article, I discussed a number of catalysts that investors could anticipate over the coming months. Events such as the release of results from this year’s drill program, the issuance of a Pre-Feasibility Study (‘PFS’), and the eventual completion of a cap raise. And since then, some of these events have come to pass, with Frontier posting excellent numbers in each case.

But as most shareholders are probably well aware, the company’s stock price has not responded as one may have hoped. It has underperformed the sector as a whole as well as more senior lithium producers by a wide margin since early May. Therefore, this article will review the steps taken by Frontier over the past six months and discuss what comes next for the company.

Drilling Program

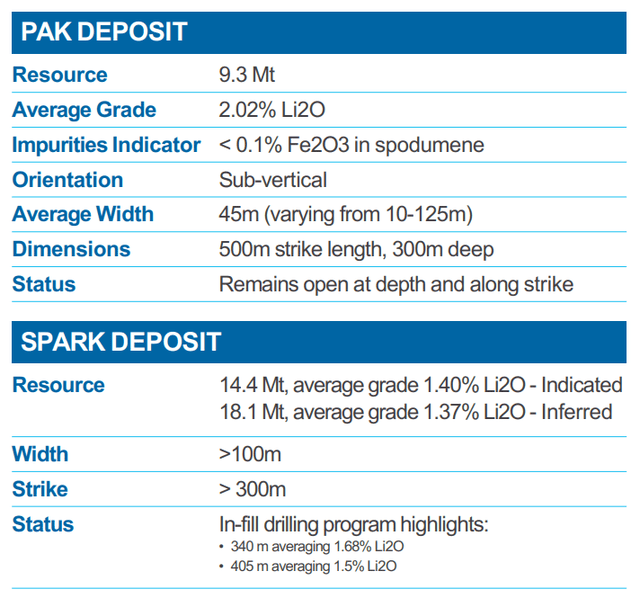

After Frontier closed a $12 million private placement last December, management laid out an ambitious drill program for the year to come; the company was targeting the completion of 15k meters of exploration drilling in 2022. The goal of this exploration work was to justify taking as much of the lithium rock currently sitting in the Spark deposit’s Inferred category and moving it over to the Indicated category. Doing so would obviously be a tremendous boost when it came time to draw up the Prefeasibility and Definitive Feasibility Studies. That’s because Spark currently has 18.1Mt listed as Inferred Resource.

Frontier’s Pak and Spark Deposits (Investor Presentation)

So, as we now approach the end of 2022, that drilling has largely been completed. The company has reported drilling 14,641 meters spread out over 45 holes. And although some assay sample results won’t be released until Q1 2023, the results that the company has been able to provide so far are very encouraging.

Highlights include intersecting 326.6m of pegmatite averaging 1.92% Li2O with 50 of those meters averaging 2.98%. Another highpoint was intersecting 338m of pegmatite averaging 1.64% LI2O with a 68m span of that averaging 2.00%.

All this good news led Garth Drever, Frontier’s VP of Exploration, to state that “We’re confident we’ve converted the required tonnage on the Spark pegmatite for our upcoming PFS and have also added to the total resource with new inferred material to the west and at depth.” That comment seems to indicate that there’s a high probability that a significant portion of Spark’s Inferred resource will be reclassified as Indicated, and also leads one to believe that the total resource size may be enlarged. Those would be very positive developments indeed.

Change of Plans

Now, as you can probably imagine, drilling ain’t cheap. Exploration costs were $4.3 million for the quarter that ended September 30th; leaving the company with only about $13 million of cash on its balance sheet. For that reason, Frontier completed another cap raise this October in which it netted $21.5 million, and leaving it with what management believes will be sufficient capital to complete the Prefeasibility Study.

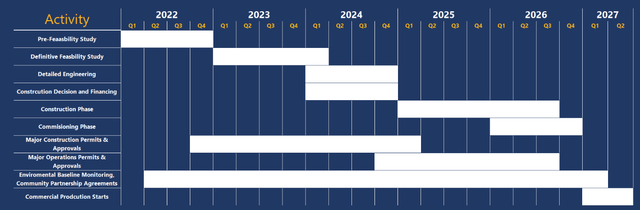

The PFS, which the Company anticipates will be completed sometime in the Spring of 2023, will include important changes from the original plans outlined in the Preliminary Economic Assessment (‘PEA’) issued last year. Those plans foresaw commercial production beginning in Q1 2027 when both the mine and lithium hydroxide conversion facility would be ready for production.

Frontier’s PEA Schedule (Investor Presentation)

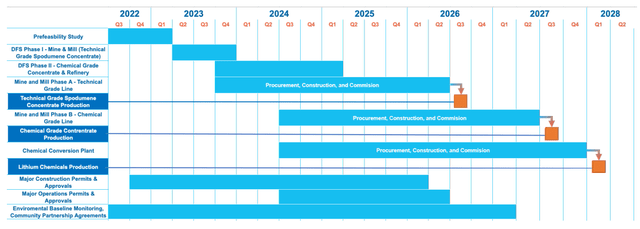

However, in October, management announced the decision to develop the project in phases. This new approach will see a mine and mill dedicated to the production of technical-grade spodumene built in the initial phase. The second phase will be geared towards expanding both the mine and mill in order to produce chemical-grade concentrate. And the third phase will see construction of the chemical production plant.

Frontier’s Revised Schedule (Investor Presentation)

While this approach will see hydroxide production begin a year later, it should result in the production of technical-grade spodumene starting six months before the date that was initially forecasted in the PEA. That would be a very positive development as income from the sale of spodumene could cover some of the costs related to the construction of the other two phases. Production will now start in three and a half years instead of the previous four.

Downside Risks

But while the revised initial start date is a positive development, it is still three and a half years away at the earliest. Much can still go wrong in the planning and construction of the project, and management has yet to raise the funds for the buildout of the mine and mill. And assuming all of that gets done on time and on budget, investors in the project will still need the price of lithium to remain at relatively elevated levels. All potential investors should bear in mind that investing in explorers is a risky proposition.

Takeaway

While Frontier’s stock has underperformed since May, recent developments at the miner show it to be making steady progress towards the release of its PFS. Drill results have been solid, and the company has had no trouble in raising additional cash. Granted, the market doesn’t seem to have paid much mind to these catalysts, but the Company should get more attention when it releases its PFS in the spring of next year. Frontier continues to be a top-tier junior lithium miner.

Be the first to comment