Robert Way

XPeng (NYSE:XPEV) reported its Q3 2022 earnings today, which were decent considering current industry and market headwinds, but medium to long-term growth prospects remain good and its shares are undervalued, making XPeng an attractive play in the Electric Vehicle (EV) sector.

Background

As I’ve analyzed on previous articles, I’m bullish on XPeng over the long term because the company is very well positioned to be one of the leading EV brands in China, and potentially abroad over the coming years. Its business mix of combining EVs with strong technological capabilities has been quite successful, in an industry where new entrants usually struggle to win significant market share.

While the long-term growth prospects are good, over the past few quarters the market environment for the auto sector has been tough, due to supply bottlenecks and China’s zero-COVID policy, which has affected auto sales and production levels.

Despite the challenging background, XPeng has been able to deliver about 30,000 cars per quarter, which can be seen as positive considering the headwinds the company had to face during this period. In the most recent quarter, XPeng delivered 29,000 vehicles, representing an increase of 15% YoY and in-line with its guidance, but down by some 16% compared to the previous quarter.

Since the beginning of the year to the end of October, XPeng’s total deliveries amounted to 103,654 vehicles, an increase of 56% YoY. This is quite good considering the issues that have impacted the auto industry during this year, showing that the company’s growth strategy is progressing well and is delivering good results.

Taking into account this backdrop, XPeng reported today a mixed set of results, while its short-term guidance was also not particularly upbeat.

XPeng Q3 2022 Earnings Analysis

XPeng released its earnings related to Q3 2022 financial results today, which were more or less in-line with expectations on the top line, but missed consensus on earnings. Nevertheless, this quarter its financial performance was closer to expectations than compared to Q2, showing that external issues are making less impact on the company’s operating performance.

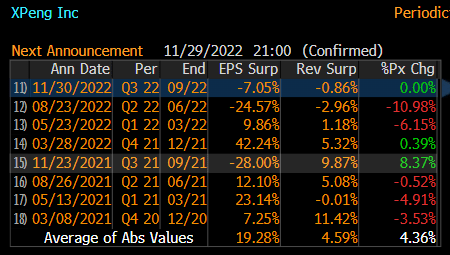

Earnings surprise (Bloomberg)

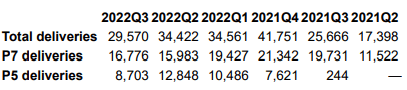

Its revenues amounted to $960 million in Q3 (+19.3% YoY), being slightly below estimates, while its EPS loss of $0.36 was 7% worse than expected, as shown in the previous table. During the third quarter of 2022, XPeng delivered more than 29,000 units, of which the majority were from the P7 model (close to 17,000 units), while the P5 model was responsible for about 8.7k units.

Deliveries (XPeng)

In October, XPeng started deliveries of its new flagship SUV, the G9 model, delivering some 623 units in the last few days of the month. This model is very important for XPeng’s volume growth, as its previous small SUV (the G3 mode l) was launched in 2018 and was targeted for the mass-market instead of the premium segment.

In China, the SUV premium segment is quite important and is responsible for significant volume sales, which means that with the G9 model the company is now in direct competition with NIO Inc. (NIO) and Tesla (TSLA) in this important market segment. This model is a strong support for XPeng’s unit and revenue growth in the coming quarters, as the company was mainly present in the sedan segment with the P5 and P7 models, as the G3i small SUV was also being updated and the face-lifted model resumed deliveries in the past month (709 units were delivered in October).

The company also continued to expand its self-operated charging network, and had more than 1,100 locations in operation at the end of last September.

Regarding margins, XPeng reported an improvement compared to the previous quarter, considering that gross margin was 13.5% (vs. 10.9% in Q2 2022), even though this margin is lower than in the same quarter of 2021 (14.4% in Q3 2021). This lower margin is mainly explained by rising raw material and battery costs incurred in the last few months, which the company is only able to pass to its customers to some extent.

Competition in the EV market is quite strong in China, thus higher prices to reflect increasing costs aren’t easy to do, at least without hurting demand for its products. For instance, Tesla has recently cut its prices in China by about 9%, due to soft demand, putting pressure on competitors such as XPeng or NIO to do the same, if they don’t want to lose market share to competitors. This means that gross margin is expected to remain under pressure for some time, as hiking prices is not likely for XPeng in the short term.

While this trend is not ideal for the company to reach operational breakeven in the next few years, XPeng said that it has recently performed an in-depth review of its business strategy and did some organizational restructuring, aiming to implement some cost control initiatives and improve operational efficiency. As the auto industry is clearly a business that benefits from economies of scale, higher margins are possible from the expansion of its product line-up and higher production volumes, which will lead to a lower cost of each vehicle, as fixed costs will be diluted by a larger number of units sold.

Nevertheless, the company is still operating in the red, as XPeng reported a loss of $330 million in Q3, slightly lower than its loss in the previous quarter.

Regarding its balance sheet, XPeng has a solid financial position, given that at the end of last quarter it had some $5.64 billion in cash, which is enough to finance its business growth over the next few years and therefore dilution risk seems to be quite low at this point, as the company does not need to raise capital in the short to medium term.

Moreover, as the company’s unit sales increase, its cash flow is also expected to grow, while at the same time capex needs in the coming years are expected to be lower compared to 2022. This means that XPeng seems to be capable of financing itself from organic cash sources, despite still being an early-growth company, and could potentially be cash flow positive in 2024, which is quite positive for current shareholders.

Regarding its guidance for Q4, it was quite weak, as XPeng only expects to deliver between 20,000-21,000 units, a decline of about 50% YoY, while revenue should be about $770 million, also down by some 42% at the mid-point of its guidance compared to the same quarter of 2021. This is justified mainly by COVID-related restrictions, which reportedly China might be phasing out in the next few weeks, which would be positive for a potential deliveries rebound in the next months.

Moreover, beyond normalization of supply-chain issues and Covid-related restrictions, there is also unit growth potential coming from a new mid-size SUV to be launched by the middle of next year, which is expected to have a lower price tag than compared to the G9 model. While XPeng expects to be able to sell about 10,000 G9 units per month, if there aren’t external issues affecting its operations, it has even higher expectations for the new model, as it will be targeted to a higher-volume market segment.

This means that XPeng is likely to reach some 125k unit deliveries during 2022, a number that can increase to about 200k in 2023 if restrictions are eased in China, and grow to some 290k units by 2024. Therefore, while there are some important headwinds for unit sales growth, XPeng’s medium-term growth prospects remain quite good, supported by an expanding product portfolio.

XPEV Stock Valuation & Estimates

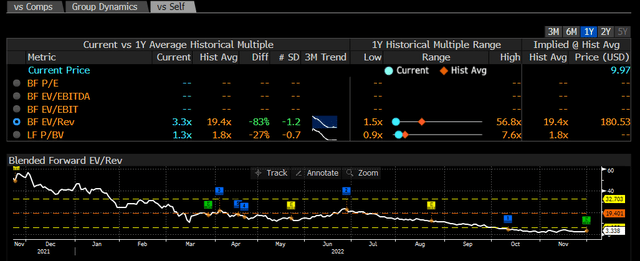

Like many growth companies and EV start-ups, XPeng’s share price has been quite weak during 2022 and is down by more than 80% since the beginning of the year. This reflects general market weakness and negative investor sentiment toward unprofitable growth companies, but also its struggles during the year to grow its deliveries due to supply-chain issued and COVID-related restrictions in China.

Despite this background, in my opinion, the company’s growth prospects remain strong and XPeng made important steps to improve its product competitiveness, through the launch of the G9 model and the updated G3i model. This means that the fundamentals and valuation aren’t aligned, a trend that is visible in its valuation de-rating experienced over the past few months.

Indeed, XPeng’s valuation has declined from about 40x forward revenues at the end of the year, to only 3.3x revenue nowadays, showing that its share price weakness has been quite hard and XPeng is currently trading at very low multiples. For instance, Tesla is currently trading at some 5x forward revenue, supporting the view that XPeng is currently undervalued.

Regarding medium-term estimates, revenue expectations continue to show a strong path in the coming years, considering that according to analysts’ estimates, XPeng’s revenue is expected to be $4.5 billion in 2022, while for 2023 revenue is expected to increase to $8.1 billion, and be close to $16.4 billion by 2025. Therefore, assuming its current valuation of 3.3x forward sales multiple, XPeng’s fair value would be about $21 per share by end-2024, which is more than double its current share price.

Conclusion

XPeng has delivered a decent quarter considering the issues impacting the auto industry in China, which also explains its weak guidance for Q4. Despite that, XPeng’s medium-term growth prospects remain quite strong, and expectations of softer COVID-related restrictions in China led to a surging share price reaction today. Nevertheless, XPeng remains quite undervalued considering its fundamental’s and growth expected ahead, remaining a good play in the EV secular growth investment theme.

Be the first to comment