RapidEye/E+ via Getty Images

Investment Thesis

Touted as a potential rival to Tesla (TSLA), XPeng Inc (NYSE:XPEV) unfortunately faced multiple headwinds in the Chinese market, with slowing sales due to the intense competition from multiple EV makers and shortage of chip supply impacting its production outputs thus far. In the meantime, XPeng’s robotic and flying car endeavors are still relatively hypothetical, since their launch will only occur by FY2024 and FY2026 respectively. The lack of profitability, coupled with its reliance on long-term debts and further share dilution, underscored the fact that XPEV remains a speculative play for the next few years.

Nonetheless, investors with a long-term perspective and higher tolerance for risk may add XPEV at the low $20s, due to its historical support level. Additionally, its City Navigation Guided Pilot (NGP) feature looks relatively encouraging in the multiple test drive scenarios in China thus far, based on the latest videos released by the company. Its equivalent of Advanced Driver Assistance Systems (ADAS) looks like a strong contender to Tesla’s future Full Self Driving capability in the EU, where autonomous cars may be legalized by September 2022.

In the meantime, we would also recommend the portfolio be sized accordingly, due to the potential volatility ahead.

XPeng Continues To Pursue Growth-At-All-Cost

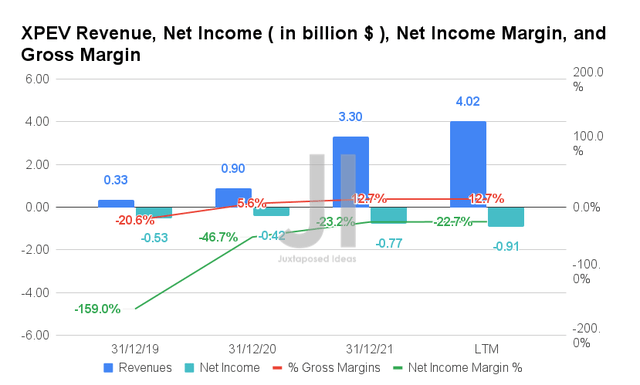

XPEV has been growing its revenues at an impressive rate in the past year. By the LTM, the company reported revenues of $4.02B and gross margins of 12.7%, representing excellent increases of 446.6% and 7.1 percentage points from FY2020 levels, respectively. In contrast, XPEV still struggles with profitability, given its deepening net losses of -$0.91B and net income margins of -22.7% in the LTM. It represents a decline of 216.6% though a notable improvement by 24 percentage points from FY2020 levels, respectively.

In the meantime, XPEV reported 34.4K deliveries in FQ2’22, representing a decline of 0.4% QoQ though an increase of 98% YoY. July 2022 saw the company delivering only 11.5K vehicles, representing a decrease of 24.7% QoQ though an increase of 43% YoY. The minimal QoQ growth was mostly attributed to the Chinese government’s ongoing Zero COVID Policy. It is worsened by the fact that Shanghai as China’s main financial hub continues to experience intermittent lockdowns and restrictions for the past five months.

Assuming that the Zero COVID Policy carries on, we expect to see a similar impact through H2’22, due to President Xi‘s reelection in November 2022. Thereby, potentially triggering a continuous weakness in XPEV’s stock performance ahead, since falling -19.1% from $30.28 on 01 July 2022 (June delivery report) to $24.47 on 01 August 2022 (July delivery report).

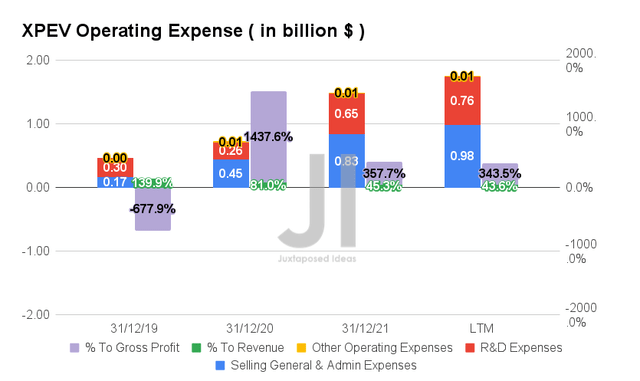

It is evident that XPEV has been rapidly growing its capabilities, thereby highlighting the expansion in its operating expenses thus far. By the LTM, the company reported total operating expenses of $1.75B, representing an increase of 243% from FY2020 levels. This segment is also responsible for XPEV’s lack of profitability thus far, since these costs account for 43.6% of its growing revenues and 343.5% of its gross profits by the LTM.

Nonetheless, we are not overly concerned as XPEV is at the growth-at-all-cost stage, typical of many new auto companies with high capital expenditures. Even Tesla had taken 15 years to report sustained FCF profitability by FQ3’18 and 16 years for net income profitability by FQ3’19, since its incorporation in 2003 and the original launch of Roadster in 2008.

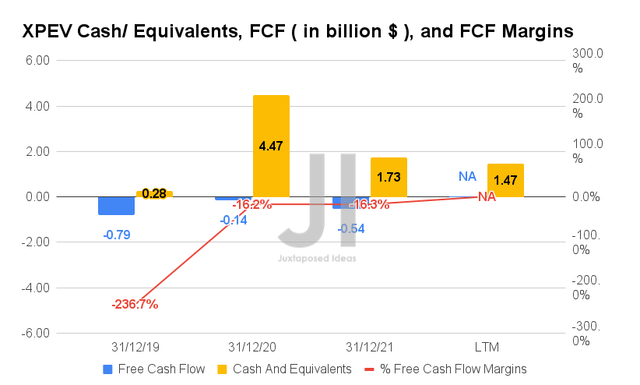

As a result of its lack of net income profitability and high capital expenditure, XPEV has yet to report positive Free Cash Flow (FCF) thus far, with an FCF of -$0.54B and an FCF margin of -16.3% in FY2021. Its continuous cash burn is also reflected in the company’s declining cash and equivalents on its balance sheet at $1.47B by the LTM, compared to $4.47B in FY2020. Thereby, highlighting XPEV’s need to raise more capital in the short term.

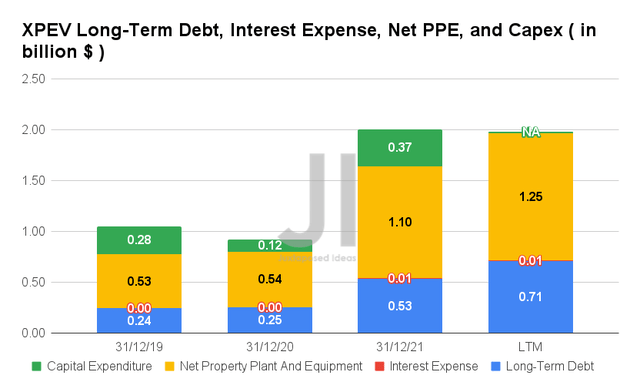

Due to its lack of profitability, XPEV has been relying on long-term debts to finance its expansion thus far. By the LTM, the company reported long-term debts of $0.71B, representing an increase of 284% since its IPO in FY2020. In the meantime, XPEV has also increased its production capacity for up to 600K vehicles annually (assuming double shift), based on its growing net PPE assets of $1.25B by FQ1’22 and capital expenditure of $0.37B in FY2021.

Nonetheless, we do not expect XPEV to continue ramping up its capacity aggressively in the intermediate term, due to its slowing sales and the intense competition from other Chinese EV makers. On the other hand, the company continues to experience a shortage in chip supply through 2023, indicating further headwinds to its production output in the short term.

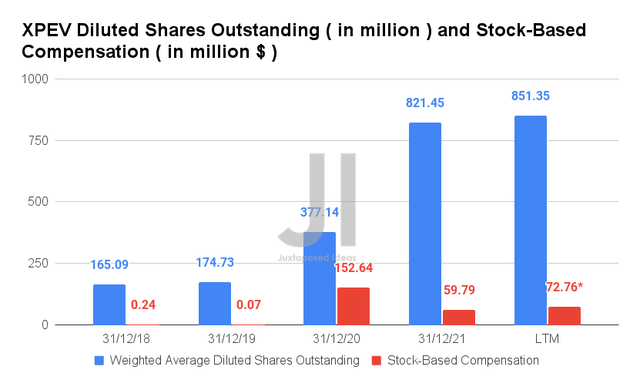

Therefore, due to its lack of profitability for the next three years, we expect XPEV to continue its reliance on stock-based compensation (SBC) moving forward. By the LTM, the company reported $72.76M of SBC expenses, with a notable YoY increase of 91.1% in FQ1’22. Assuming a similar rate ahead, we may see SBC expenses of up to $114.1M for FY2022, thereby pushing its diluted shares outstanding to 941.05M simultaneously. It represents a further dilution of 235.4% since its IPO in August 2020 and 25.9% since its secondary offering in December 2020. Investors take note.

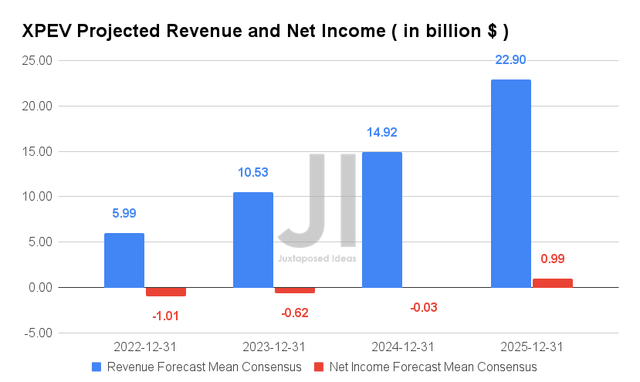

For the next four years, XPEV is expected to report revenue growth at an impressive CAGR of 62.3%, while potentially achieving net income profitability of $0.99B in FY2025. For FY2022, consensus estimates that the company will report revenues of $5.99B and net incomes of -$1.01B, representing YoY growth of 81.5% though a decline of 32.8%, respectively.

In the meantime, analysts will be looking closely at XPEV’s FQ2’22 performance, with consensus revenue estimates of $1.09B and EPS of -$0.33, representing a YoY increase of 87.85% though a decline of -52.71%, respectively. Nonetheless, given how the company has continually disappointed in its EPS execution for the past six consecutive quarters, we do not expect to see another rally ahead.

So, Is XPEV Stock A Buy, Sell, or Hold?

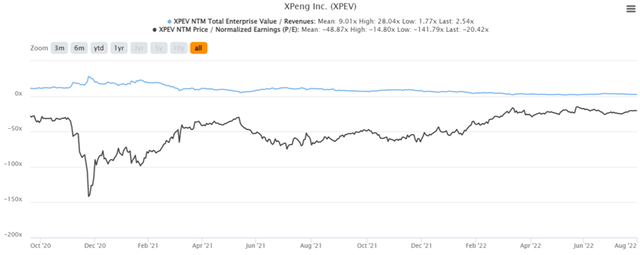

XPEV 2Y EV/Revenue and P/E Valuations

XPEV is currently trading at an EV/NTM Revenue of 2.54x and NTM P/E of -20.42x, lower than its 2Y mean of 9.01x and -48.87x, respectively. The stock is also trading at $24.15, down 57.2% from its 52 weeks high of $56.45, nearing its 52 weeks low of $18.01.

XPEV 2Y Stock Price

However, despite the consensus estimates’ attractive buy rating with a price target of $35 and 44.93% upside, we prefer to wait for more clarity on its financial performance from its upcoming FQ2’22 earnings call before making any decisions.

Nonetheless, investors with a higher tolerance for volatility may consider adding at the low $20s, since the stock is trading near its historical support level. There might also be temporary tailwinds for stock recovery, assuming the eventual support from the Chinese government for EV subsidies beyond 2023. Even then, XPEV still looks somewhat over-valued, due to the tight supply of chips, rising material prices, the speculative nature of the stock, and its lack of profitability in the intermediate term.

Therefore, we rate XPEV stock as a Hold for now.

Be the first to comment