gremlin

Investment Thesis

XPEL, Inc. (NASDAQ:XPEL) was a pure software company in the protective film industry providing independent installers access to a library of pre-cut film designs. It gradually expanded into developing its own products consisting of paint protection film and window film. As one of the leading providers of protective film in the U.S., it also expanded to markets like Canada, China, and Europe. They adopt an asset-light and scalable business model as it outsources manufacturing to third parties.

In this article, I attempt to try out a different format from my usual article writing by focusing on the key highlights of the quarter, and so as to provide readers with a more direct and concise view of the earnings result. Generally, there were no surprises in the 3Q22 quarter, except for the uncertainty surrounding the recovery in the new car inventory level.

Key Highlights During The Quarter

1) Tailwind: Pent-up demand for car inventories

The pent-up demand for car inventories in the last 2 years may be a catalyst for XPEL, as buyers are waiting for cars to be delivered due to shortages in semiconductors. Management has reiterated that paint protection films (“PPF”) and window films are not discretionary products as repeat rates and attach rates (to new cars) are increasing every month.

2) Dealership’s revenue to benefit from new car inventories

XPEL’s revenue primarily comes from the aftermarket markets, and its entry into dealership markets allows it to pre-load window film and PPF onto new cars. Since this business is closely tied to new car inventories, its revenues and overall gross margins are impacted. However, as car inventories gradually recover, window film revenues are likely to recover and push up the gross margins.

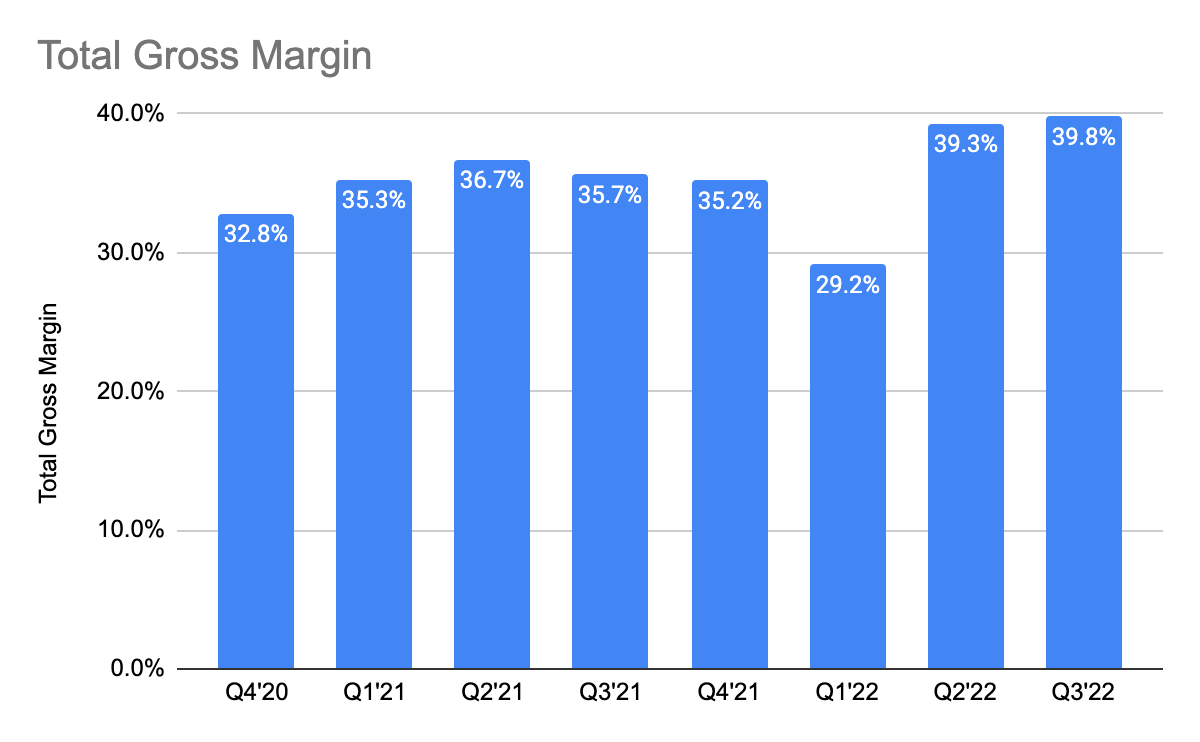

3) Gross Margin Improvement

XPEL 10-Q

Gross profit grew 46% Y/Y and gross margin increased to 39.8% from 39.3% last quarter. Excluding FX market conditions, margins will be at 40%. Management is implementing price increases at the end of the year to offset cost pressures, which I believe will lead to higher margins. As mentioned earlier, gross margins can trend higher as dealership revenue resumes, although, there are uncertainties in supply shortages.

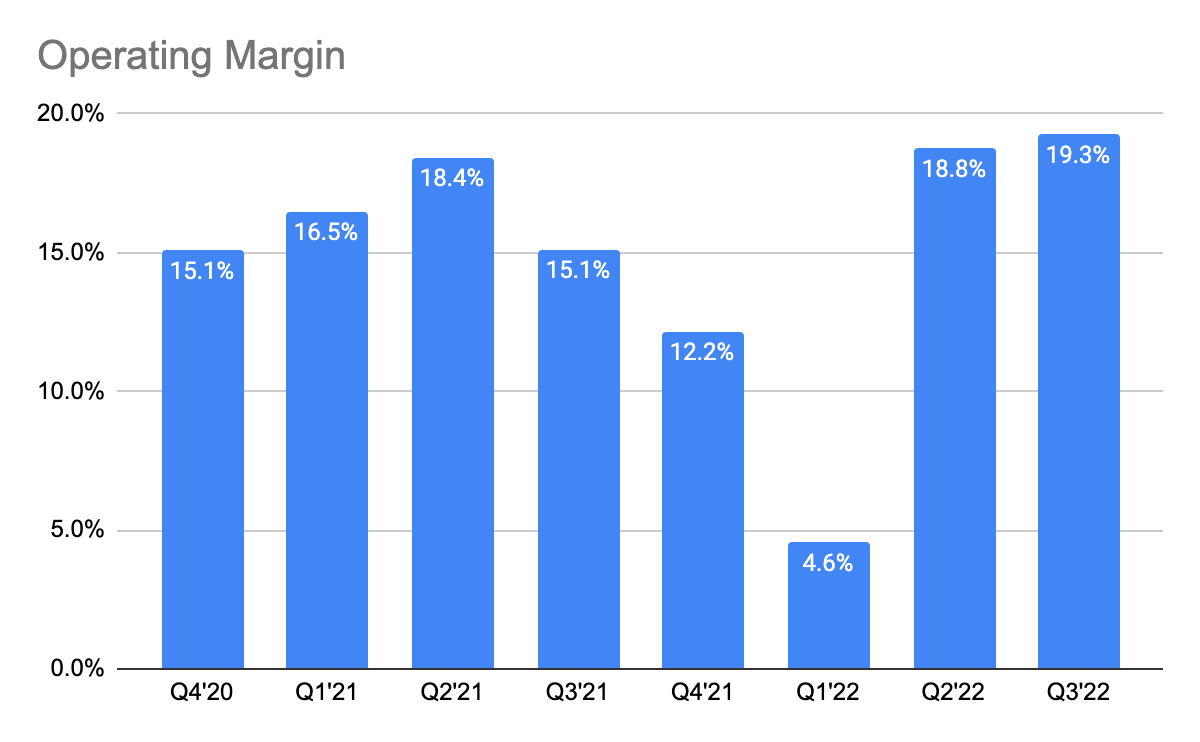

4) Strong Operating Leverage

XPEL 10-Q

Operating profit grew 67% Y/Y to $17.3 million, and the operating margin expanded to 19.3% from 18.8% in the last quarter and 15.1% a year ago. This growth rate is double that of its total revenue growth of 31% Y/Y. With gross margin expansion and revenue reacceleration, the operating margin is likely to expand further.

5) Investing in its partners

Its newly-improved DAP software platform is set to be launched in December. It is designed to help aftermarket partners sell more efficiently and improve revenue generation. By investing in its partners and helping them to grow, XPEL will also grow alongside them. Talk about customer-centric management, and this creates a win-win situation for both parties.

Conclusion

There are no surprises in XPEL’s quarter, and things seem to be moving on track, with the uncertainty being the speed of recovery for new car inventories. Assuming it does not persist, we may see stronger growth in FY23 and room for margin expansion.

What are your thoughts on the quarter? Let me know in the comment section below!

Be the first to comment