naphtalina/iStock via Getty Images

Thesis

Xometry (NASDAQ:XMTR) looks to be improving on the top line, with strong growth in accounts and services but struggles to improve on the bottom line, where costs are growing faster than revenue, such as G&A, leading to a continuation in losses, and thus an expected decline in the share price.

Intro

XMTR is a provider of an AI driven marketplace, a one-stop shop, that connects buyers and suppliers of manufactured parts and assemblies in both the US and globally. These services include items such as CNC machining, milling, cutting, and metal forming, among others. The company is based in Derwood, Maryland and was created in 2013.

Top Line Growth

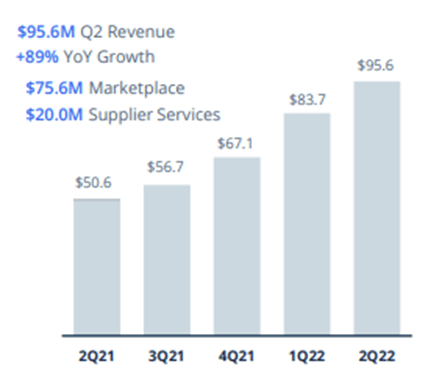

XMTR have been successfully growing their business, where the latest YoY growth was recorded at almost 90% year on year, with a recent improvement in gross margin from 30% to almost 40% last quarter.

Investor Presentation

(Source: Investor Presentation)

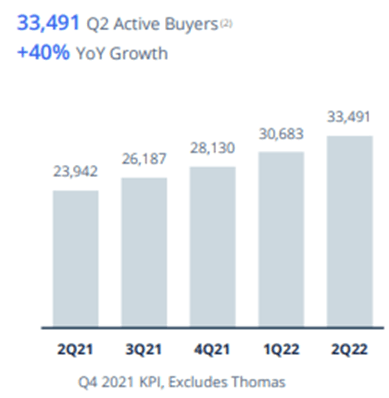

This growth has been driven by an increase (40% year on year growth) in active buyers to 33,000.

Investor Presentation

(Source: Investor Presentation)

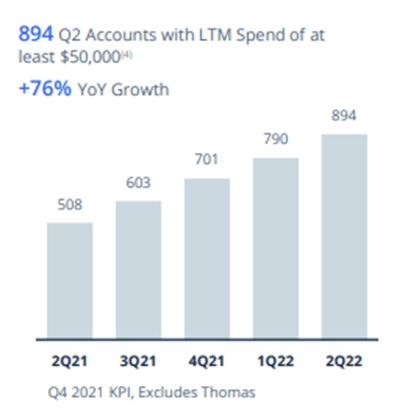

And a 76% year on year growth in accounts with spend of at least $50,000

Investor Presentation

(Source: Investor Presentation)

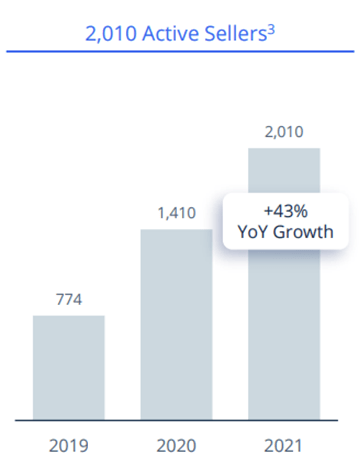

This growth is seen as sustainable given that 95% of revenues come from existing accounts. The number of suppliers has also grown significantly over the past few years to reach over 2,000.

Investor Presentation

(Source: Investor Presentation)

The company is also expecting a significant windfall in buyer accounts due to their latest acquisition of Thomas, potentially moving over 1.4m accounts onto the XMTR platform, further increasing top line growth. Supplier accounts are also expected to increase by over 500k from the acquisition.

Bottom Line Issues

However, not everything is going well for XMTR. While top line growth is robust, there are issues at the bottom line, especially within specific G&A costs which has led to steeper losses. We know that gross margin is improving as revenue is growing faster than COGS, but unfortunately operating costs are growing much faster than revenue.

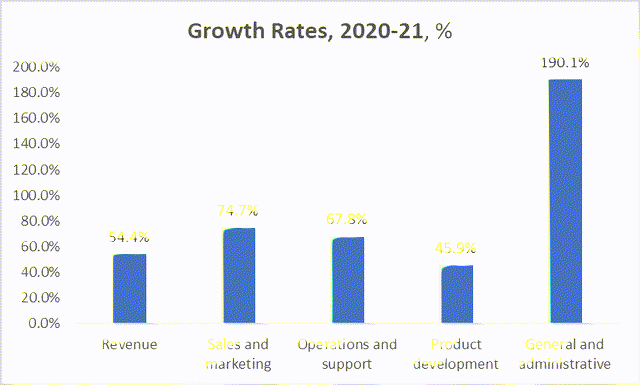

(Source: Company Accounts)

As illustrated above, revenue grew 54% between 2021 and 2022. Except for Product Dev, all other divisions experienced much higher growth in costs. Ops and support grew almost 70% while sales and marketing grew 75%. However, the most important item is the growth in G&A, which grew almost 200% within the year to become the second highest cost on the PnL.

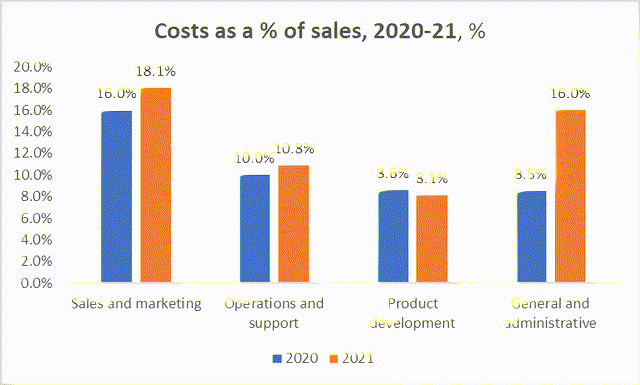

(Source: Company Accounts)

G&A grew from 8.5% of revenue to 16% of revenue. This led to the operating profit margin increasing from 21% in 2020 to 27% in 2021.

Now, we know that XMTR made an acquisition which would of course bring a small amount transaction costs to the picture. These were almost £6m, recorded in G&A. The integration of Thomas onto XMTR would no doubt temporarily increase costs, and these are expected to decrease and normalise with time (and the company also expects cost synergies as well, but we must wait to find out if these would actually be realised). Secondly, the company went public, and had to record around $12m of public company costs. These costs are fair and justified (although still a little expensive).

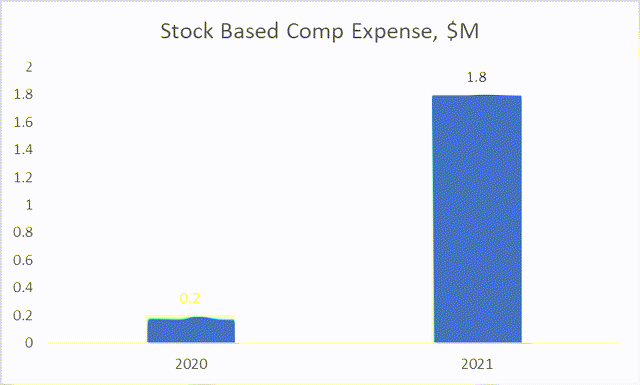

However, the increase in G&A costs can’t be accounted for these individual cost increases alone. When looking deeper into the accounts, we can see that the company stated that stock-based compensation is recorded in G&A, and these costs went through the roof.

(Source: Company Accounts)

Stock based comp grew 800% in a single year.

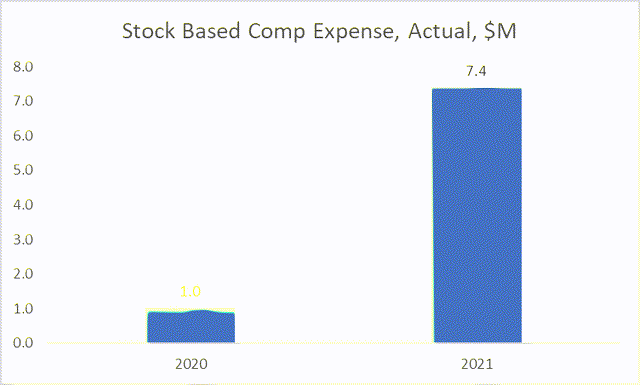

On the other hand, one would think the figure for $1.8m is still a little small relative to the overall top line. However, when looking further, we can see that the company actually understated this figure. Instead of $1.8m, stock-based comp expense looks closer to $7.5m.

(Source: Company Accounts)

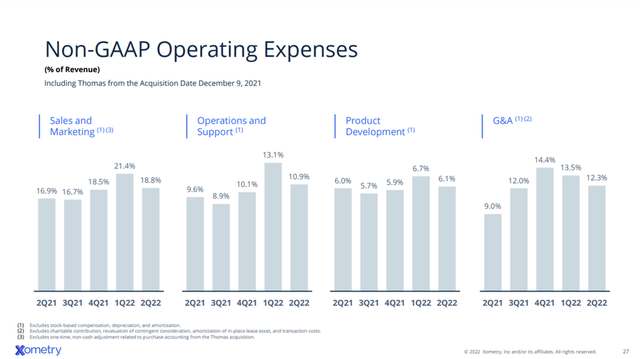

This figure, stock based compensation expense, is almost 3.5% of revenue alone, and growing quickly. This means that overall, G&A is growing incredibly quickly, but this is not what the company are telling investors. Looking at a slide from their investor presentation of 1Q22 earnings, they state that G&A is decreasing.

(Source: Investor Presentation)

But if you look closer at the footnotes, they have excluded stock-based comp from their G&A, which is the largest item in G&A which is the fastest growing.

(Source: Investor Presentation)

Therefore, XMTR are not showing the big picture and where the key costs are actually increasing, leading to a poor bottom-line result and getting further away from recording a positive EBITDA figure. Guidance for 2022 Adj EBITDA is around -$32m, which EXCLUDES the stock-based comp expense, so actual EBITDA is likely to be lower, potentially lower than -$40m or -$50m, dependent on what is realised for stock-based comp in 2022.

Risks

One risk were to be if the stock-based comp expense peaked last year, and the cost figure begins to decline leading to an improvement in profit.

Secondly, if there was a drop in other operating expenses, plus continued improvement in gross margin (which is expected), then these cost reductions could offset the increase in stock-based comp expense and result in improved EBITDA. This scenario is somewhat likely given that operating costs, where many costs are one off (such as transaction costs), and cost synergies are expected with the recent acquisitions being made.

Another risk would be if the employees receiving this compensation leaves, then there is no longer this expense within the PnL, and profit would be improved significantly.

Conclusion

In conclusion, XMTR is successfully growing their revenue by making key acquisitions, continually improving their services, and acquiring key user accounts. But unfortunately, the bottom line is suffering due to a hefty increase in certain costs, mainly attributed to transaction costs and public company costs (which are expected to decrease) and stock-based compensation expense which is growing significantly (and expected to grow further), growing faster than revenue and is a large part of overall expenses. Last year, stock-based comp expense was around 3.5% of revenue. The share price has done well year to date despite the rough economic conditions and bear market. But this share price increase may not continue and is likely to suffer due to costs not being tamed. Expect the share price to decrease in the medium term.

Be the first to comment