DNY59

Editor’s Note: This article is meant to introduce Vladimir Dimitrov’s Marketplace service, The Roundabout Investor

The era of ultra-cheap money is slowly coming to an end.

Whether it’s with a bang or a slow and painful pivot it doesn’t matter for anyone who expects to stay within the markets for the next 10 years. Most investment strategies that worked well over the past decade are unlikely to deliver satisfactory returns over the next one.

This is where The Roundabout Investor fits in, by focusing on high quality business models that are managed for the long term. Such enterprises were often overlooked by the one-sided market where extreme levels of monetary intervention favored short-term revenue growth over profitable businesses with sustainable competitive advantages.

This service will appeal to investors with medium- to long-term horizon who also prioritize steady value accumulation and are not interested in pursuing the hottest momentum stocks that are making the headlines.

While roundabout investments tend to do well in all kinds of environment, in recent years, the extreme levels of monetary and fiscal intervention have made momentum-following the only game in town. All investors had to do was to focus on the high-growth names and they were certain that the Federal Reserve got their back.

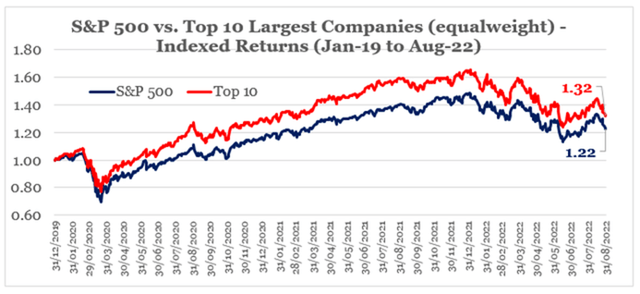

prepared by the author, using data from Seeking Alpha

At a time of excess liquidity, it was easy to beat the market by simply buying and holding the 10 largest companies of the S&P 500.

Companies that did not engage in excessive short-term risk-taking in order to maximize topline growth were far less appealing to investors due to the so-called Fed put. However, most investors were caught off-guard in recent years as this decade-long market paradigm reached an inflection point.

That is why an investment strategy is needed that could deliver strong results in the adverse scenario of liquidity being drawn out of the market, while also performing well during periods of loose monetary conditions.

What I have found through all of my years of investment experience is that the notion of a roundabout investment seems to do just that.

Anatomy of a Roundabout Investment

So, what is exactly a roundabout investment, and more specifically, what does the roundabout investor strategy look like?

The notion of being roundabout could be applied whenever an investment decision needs to be made. We could think about it both through the lens of management of a given company when contemplating future projects and when we as investors decide whether or not to invest in such companies.

At its core, being roundabout is being able to forego short-term rewards (profits) for the greater good that comes as a result of long-term investments that bring strategic competitive advantages. In its most simplistic form, this applies to management that refuse to manage the business on a quarter-by-quarter basis just to appease investors and Wall Street analysts, but rather are long-term oriented and purses a solid strategy. This would often require large investment being done now, in order to secure long-term competitive advantages.

An example of such behaviour are the managerial decisions made at Texas Instruments (TXN). The company operates in a highly cyclical semiconductors industry, where high growth has been rewarded with extraordinary multiples.

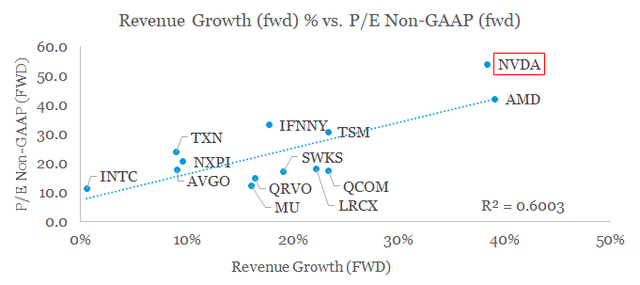

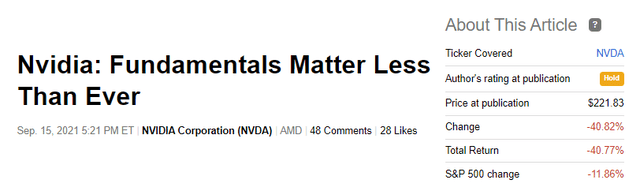

The graph below clearly illustrates that and it is taken from a thought piece that I wrote on NVIDIA (NVDA) in September of 2021.

prepared by the author, using data from Seeking Alpha

Although it was hard to believe that the strong business fundamentals of the champion within the semiconductors industry have become irrelevant for its future returns, it is exactly what happened. Even though Nvidia continued to deliver extraordinary results, the share price tanked by more than 40% since then while the broader market fell by mere 12%.

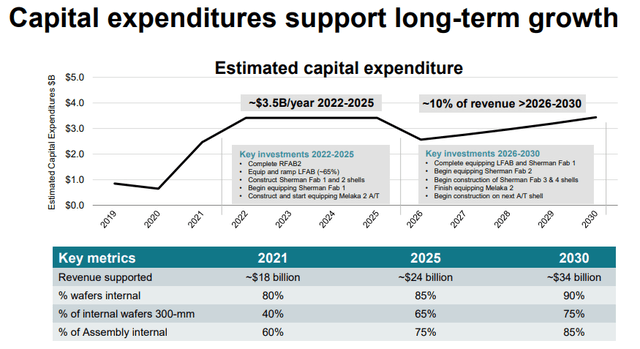

In spite of the temptation to pursue exciting acquisitions or to expand into areas that could deliver short-term gains, Texas Instruments management has taken a very different approach. Instead, it focused on securing its long-term future in the analog space by significantly increasing its investments in manufacturing capacity in the United States, at a time when fabless companies in the digital space were reaping all the benefits.

Texas Instruments Investor Presentation

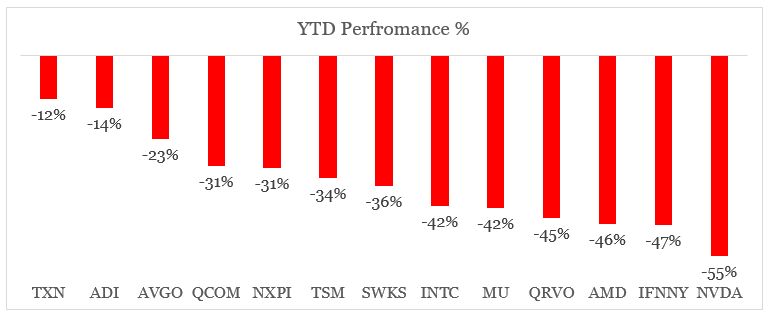

I covered all that in detail in a thought piece called ‘Texas Instruments: Long-Term Strategy As A Competitive Advantage‘ from November of last year. Without going into too much detail, Texas Instruments is so far the best performing semiconductor stock from the expanded peer group below and its negative 12% return year to date is in line with the overall market decline.

prepared by the author, using data form Seeking Alpha

There are many similar examples of outstanding long-term strategies that are often misunderstood by the market, which expects management to deliver on the quarterly revenue growth and EPS estimates. For the purpose of keeping this article short and concise, I will not go into detail, but for anyone interested to delve more into this topic, I would recommend an article I recently wrote on Nestle (OTCPK:NSRGY) and a controversial thought piece on Exxon Mobil (XOM) from 2020 called ‘Exxon Mobil: When Short-Term Markets Meet Long-Term Industry Cycles‘.

How the process works

The purpose of The Roundabout Investor is for me to create a collection of all such roundabout ideas that I came upon through the years in combination with new opportunities that I discover in the future.

With that in mind, I have also structured the service to provide additional insight into potential roundabout investments as well as broader market implications for the strategy.

To achieve this, there are four main pillars of The Roundabout Investor:

- Roundabout Investment Ideas: These are my highest conviction roundabout ideas and represent the foundation of the service.

- The Roundabout Portfolio: This is a concentrated illustrative all-equity portfolio that combines those Roundabout Investment Ideas that I believe have hold the highest potential in the current environment.

- Watchlist Ideas: Occasional updates on companies that could soon become Roundabout Investment Ideas, but have certain red flags that will have to be resolved first.

- Market Overviews: These will provide holistic overview of the market from time to time, in order to facilitate the roundabout strategy and give context to the current state of the market.

In addition to all that, you will have the opportunity for live chat sessions for any additional questions that you might have.

Getting started

For a short period of time, I will offer a lifelong discount to the price of The Roundabout Investor for annual subscribers. The discounted price currently stands at $479 (a 43% discount from the monthly rate of $70) for an annual subscription and will increase to $579 per year.

If you are not yet certain whether the service is appropriate for your circumstances, you can also try the 2-week trial period. You won’t be charged during this 2-week period and will have more time to decide whether this is the right service for you.

Also, do not hesitate to ask, if you have any other questions about the service. You can send me a direct message on Seeking Alpha by following this link.

If you’re reading this via Seeking Alpha’s mobile app, to try this service right now go to seekingalpha.com and enter The Roundabout Investor in the site search to visit my Marketplace Service checkout page.

Be the first to comment