imaginima/iStock via Getty Images

The Update:

Apologies for being quiet so far this month. I finally succumbed to COVID and just could not focus on writing anything. That said, I have not taken my eye off of the market. For those who have, it has been an eventful couple of weeks.

The inflation bug that I have been writing about since last summer has finally bitten various corners of the market. The Federal Reserve has officially abandoned any pretenses of viewing inflation as “transitory”, a ridiculous notion that I criticized in October. The impacts of the Fed’s about face are far and wide. Among the most notable has been the steep rise in yields and a major flattening of the US Treasury curve.

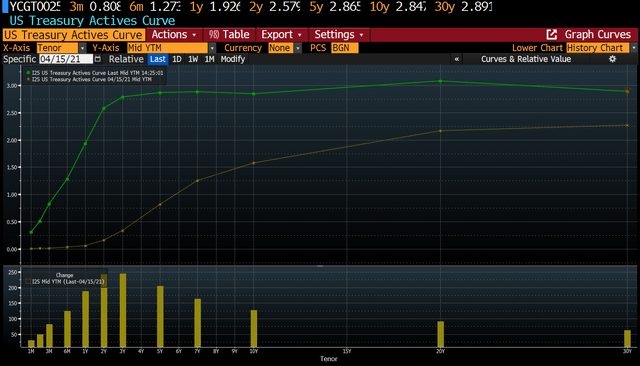

As one can see below, current yields (the green line) have risen considerably from the same point last year (the yellow line). The most violent moves on a yield basis have occurred in the front end. The 2-year US Treasury (marked as 2y on the X-axis) is currently yielding 2.58%, up from 0.17% last year. The dramatic move in yield in the 2-year has pushed the difference between its yield and that of the 30-year US Treasury to just 0.30%, down from 2.1% last year. There is basically no difference between the 5-year and the 30-year US Treasury yields, whereas last year, there was a large relative difference.

US Treasury Curve now vs. April 15 2021 (Bloomberg)

Bond traders call this dynamic a flat yield curve and it usually means that the Federal Reserve will be raising interest rates aggressively in order to slow down the economy and tame inflation. In my opinion, that is the right reaction to both inflation and the Fed’s response to it.

Market Reaction:

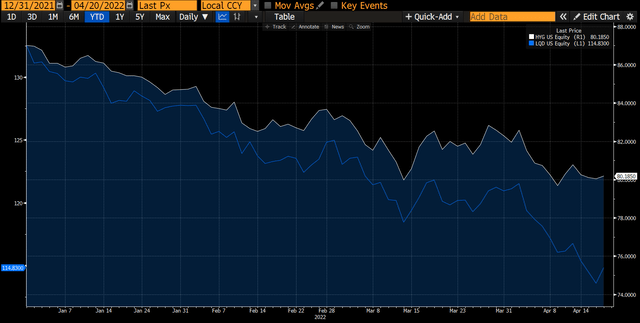

Higher yields and a flatter US Treasury curve have a lot of implications. Owing to bond math (yields up means prices down), the prices of many bonds have taken a beating. The longer duration and lower the coupon, the more the price has dropped. Two popular bond ETFs – HYG for high yield corporates and LQD for investment grade corporates – have been pummeled year to date. The price declines have far outweighed the dividends.

HYG and LQD year to date performance (Bloomberg)

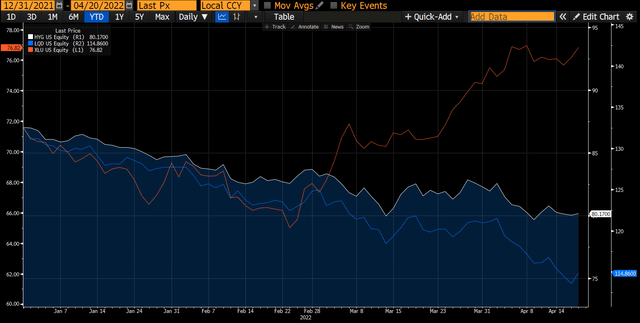

I believe people have shifted out of these ETFs and into ETFs that they believe will still throw income and offer protection from higher interest rates. Utilities Select Sector SPDR ETF (NYSEARCA:XLU), a utility ETF, appears to be a beneficiary of this investor action. As you can see below, XLU (orange line) has risen dramatically while LQD and HYG have sold off.

XLU vs. HYG and LQD Year to Date Performance (Bloomberg)

To a certain extent, I understand this move. Utilities offer income to those who need it, but the ETF owns stocks of companies who can grow earnings, thereby partially mitigating the mathematical effects of inflation. However, utility stocks are still sensitive to the discounting factor impact of higher interest rates. Meaning, you still need to divide a utility’s earnings over time by the appropriate interest rate. The higher the interest (discount) rate, the lower the present value of a company’s future earnings.

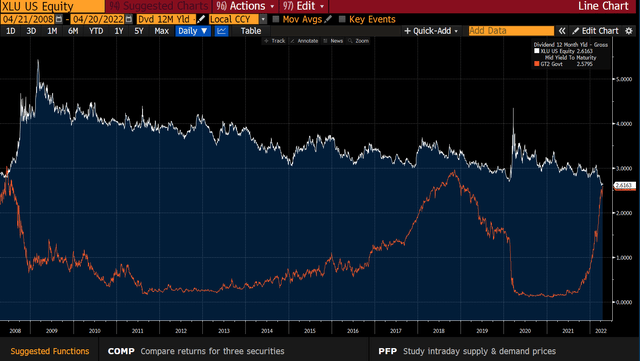

Moreover, I understand the need for yield and worrying about price decline in bonds. However, the 2-year US Treasury should not move much in price regardless of interest rate policy thanks to its short maturity. Therefore, for those who need income but eschew risk, the yield on the XLU should decently exceed the yield on the 2-year US Treasury. For the first time since the 2008 Financial crisis, it does not.

Dividend Yield of XLU vs. Yield of 2-Year Treasury (Bloomberg)

Of course, there are tax considerations between the two different income streams, but my point remains valid. Using the XLU as an income replacement over bonds is not without risks. As I demonstrated in the above chart of the LQD and HYG, price declines of income yielding instruments can quickly overwhelm the dividend benefits.

Conclusion:

I am not making a bearish call on the utility space writ large. I just think that to the extent the price appreciation of the recent weeks is due to investors looking for income replacements bonds because of interest fears, that move is misguided. At the very least, investors should look at US treasuries as a benchmark for their yield demands.

Be the first to comment