gesrey/iStock via Getty Images

Article Thesis

Inflation has turned into one of the biggest investment themes in the world in the current environment. Companies from the materials sector tend to offer inflation protection, although some of them have to battle rising expenses for manpower, machinery, parts, and so on. We believe that Altius Minerals Corporation (OTCPK:ATUSF) is one of the best inflation protection picks, as its revenues rise thanks to rising commodity prices, while costs are generally low and do mostly not rise in an inflationary environment.

Inflation

Around two years ago we started to warn about inflation, e.g. in May 2020 with an article written by my colleague Darren McCammon: Fear Creates Opportunity: Cash is Trash. Over the months, we added several others centered around a major theme: The Fed was holding rates near zero while printing money at a rapid pace, and different forms of stimulus (e.g. direct cash payments in the US) further fueled the conditions that would make inflationary pressures rise upwards. As it turns out, inflation did indeed become a huge theme, with the US inflation rate, as measured by the CPI, rising to a forty-year high of 8.5% in March. Investors naturally are looking for ways to secure their wealth and buying power, making inflation-resistant stocks an important theme.

Streaming/Royalty Companies

In short, streaming and royalty companies finance mining projects in exchange for a percentage of the commodity that is extracted from the mine. Due to their unique business model, these companies tend to have even more significant advantages than the mining companies themselves in an inflationary environment. As the value of the mined material increases, streamers earn additional revenue, just like the mines and miners, but usually without incurring any additional mining cost — those are paid by the miner, and not by the streaming or royalty company. Labor, power, mining equipment, and many other mining costs tend to increase in an inflationary scenario, but that doesn’t impact the streamer, as the miner is responsible for these expenses.

There’s another factor at play on top of that: Streaming companies also benefit from inflation because they exchanged a certain amount of money or other assets in the past in return for a small percentage (e.g., 3%) of all future production for the lifetime of the mine. Thus, if higher prices encourage mining firms to take on new projects and/or increase production, the streaming company gets its percentage share from a bigger project without having to pay any additional cost as the price has been paid in the past.

The combination of these two factors makes commodity streaming firms an excellent inflation hedge — at least as long as demand and pricing for the underlying commodity are strong.

Altius Minerals

Altius Minerals Corporation is not a well-known streaming/royalty company, primarily due to the fact that it is a rather small company. Its market capitalization is still below $1 billion today, despite gains of more than 60% over the last year. The company’s assets are diversified across different commodities in the metals and mining space. This includes coal (power generation), base metals and battery metals, iron ores (for steelmaking), and even potash that is used as a fertilizer. The company thus benefits from price increases in a wide range of commodities, including iron ore, copper, zinc, potash, precious metals, coal, and so on. In an inflationary environment where prices for many different commodities are pushing multi-year or even all-time highs, that seems highly intriguing to me.

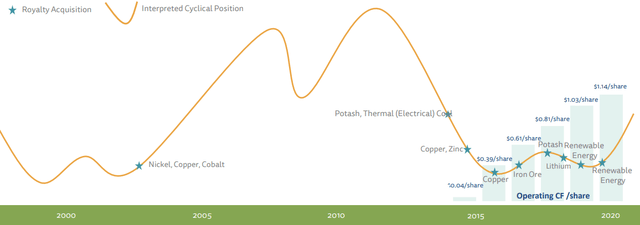

Altius is not just a financials-focused commodity streaming firm, however. They also try to discover new mineral resources. In fact, Altius’ discoveries have evolved into more than 61 new royalties and/or mining equity interests since 2016. Plus, Altius tendency to invest countercyclically, has resulted in steadily increasing operating cash flows per share over the last few years.

This cash flow growth occurred even before commodity prices started to take off in 2020 when inflation started to really kick in.

Q4 Results

Adjusted EBITDA for the most recent quarter was CAD$0.43 per share, relatively flat year over year. Adjusted operating cash flow per share was CAD$0.38, up by 18% year over year.

Debt is relatively low. In fact, Altius has around CAD$100 million in cash and fungible equities, with total debt only slightly higher, at around CAD$120 million. The low net debt level allows Altius to return money to the company’s owners via both dividends and buybacks. In 2021, the company has paid out $22 million, which may not sound like too much, but which seems solid considering the company’s small size and ongoing growth investments. Based on current payouts, Altius Minerals offers a dividend yield of a little more than 1%. Investors should note, however, that the dividend has risen rapidly in recent years. Between 2017 and 2022, Altius Minerals has increased the payout per share by a massive 200% — with growth like that, a lowish yield isn’t too much of a problem.

One thing to remember with streaming firms is that their royalties typically lag commodity price changes due to delays in contracts resetting to new pricing or purely due to logistics. Thus, Q4 revenue, earnings, and cash flows tend to be determined by Q3 commodity pricing, and so on. The big price surge in many commodities that occurred during February and March of this year should thus start to appear in Altius’ Q2 results.

Valuation

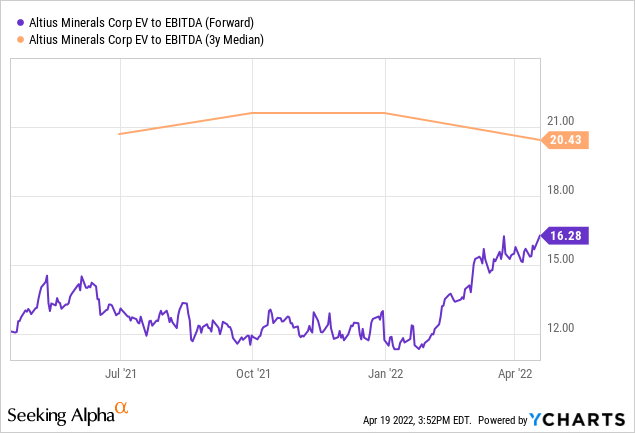

Altius Minerals is trading at 16x EBITDA today. That is not an ultra-low valuation, but investors should consider the company’s high earnings quality with a significant cash flow conversion rate and its strong balance sheet. Looking at the historic norm, Altius Minerals is actually trading at a discount:

Compared to how the company was valued in the past, Altius Minerals is trading at a ~20% discount today — despite the fact that the current environment of rising commodity prices is very constructive for Altius’ profits and cash flow.

Takeaway

Altius looks like a solid long-term investment overall. It offers exposure to a wide range of commodities that are needed to feed the world (fertilizer), for the transition towards EVs (copper), and so on. Altius Minerals has a clean balance sheet, solid, well-aligned management, and it offers steadily growing shareholder payouts. But most importantly, Altius is a great inflation hedge — if commodity prices continue to rally, so will Altius’ revenues. At the same time, its expenses are low and have mostly been fixed in the past, so margins should expand in an inflationary environment. This distinguishes Altius compared to mining companies, oil companies, and so on — their revenues rise, but so do their costs. Altius Minerals thus seems like an especially strong inflation hedge.

Be the first to comment