David Ramos

Chinese smartphone giant Xiaomi (OTCPK:XIACF) has been seeing strong growth over the past few years. Although the momentum reversed and near-term prospects are cloudy due to macro headwinds, long-term prospects could be better but the stock carries considerable competitive and political risks.

Strong topline growth; profits up despite significant jump in R&D spend

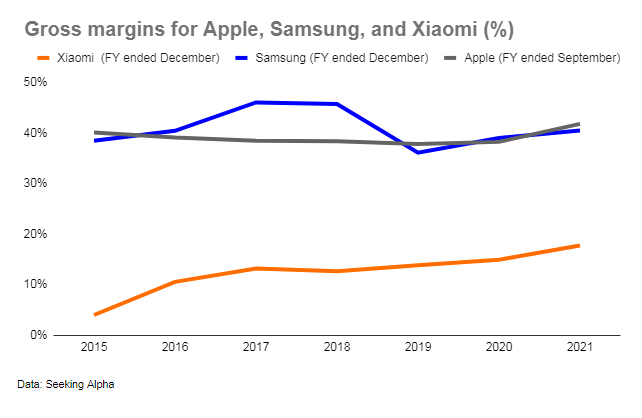

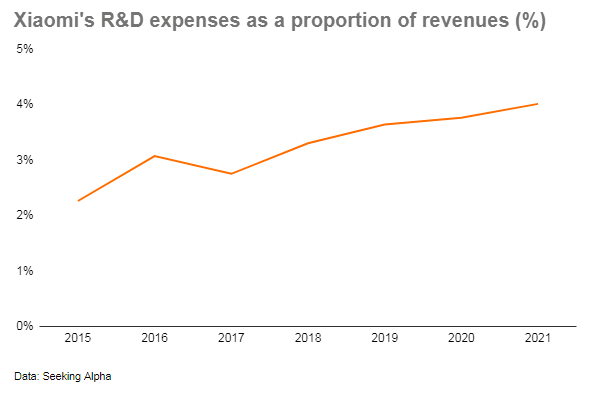

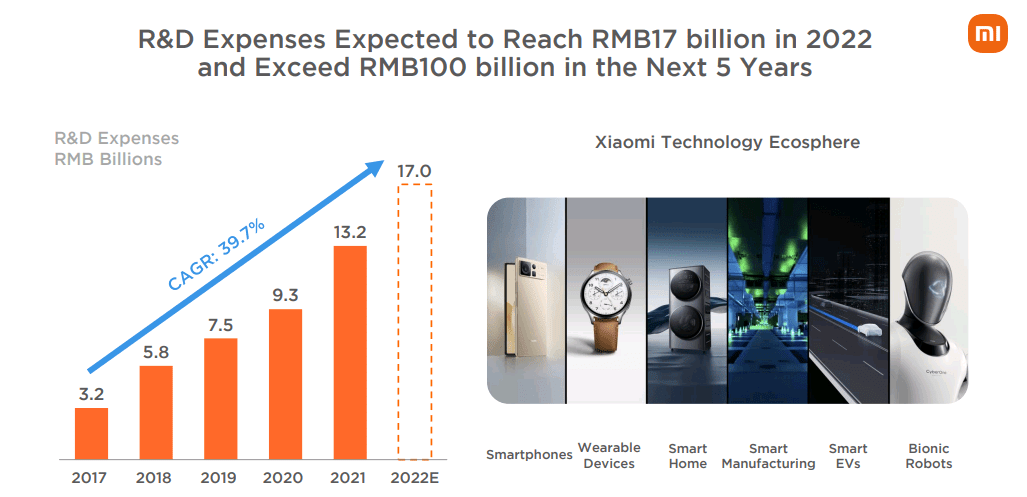

Full-year 2021 revenues jumped 33.5% YoY to CNY 328.3 billion, and operating profits increased 8.2% despite a 42% jump in R&D expenses. Helped by its premiumization strategy and growing high-margin internet services, Xiaomi’s overall gross margins have been consistently increasing over the years.

Author

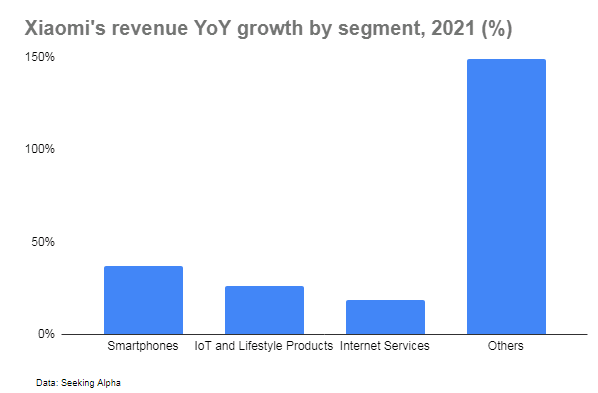

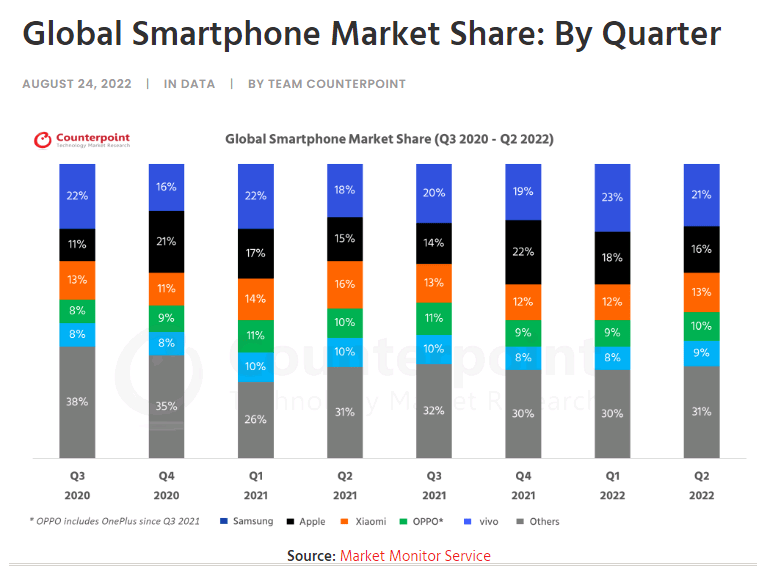

All segments reported stellar revenue growth; smartphone revenues rose 37% YoY to CNY 208.9 billion on the back of strong growth in smartphone shipments which rose 30% YoY to 190.3 million units in 2021. The company finished the year as the world’s third biggest smartphone company by shipments with a record high market share of 14.1%, according to Canalys.

IoT and lifestyle devices revenues rose 26.1% YoY to CNY 85 billion, helped by robust shipments of smart TVs (shipments of which rose to 12.3 million units) and a 60% YoY growth in shipments of large household appliances such as refrigerators, washing machines and air conditioners.

Internet services saw revenues rise 18.8% YoY to CNY 28 billion, helped by a 28.4% YoY increase in MIUI global monthly active users to 508.9 million in 2021.

All segments delivered expanding margins. Smartphone segment gross margins increased considerably in 2021 to 11.9% from 8.7% in 2020. IoT and lifestyle products gross margins rose to 13.1% in 2021 from 12.8% in 2020. Meanwhile, Xiaomi’s internet services segment saw gross margins jump to 74.1% in 2021 from 61.6% in 2020.

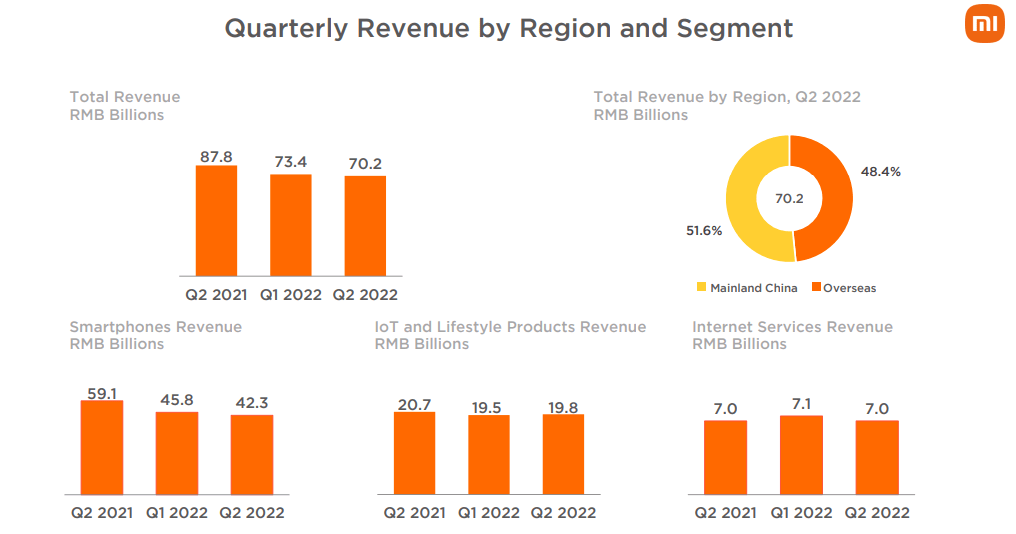

The momentum decelerated in 2022 as macro headwinds affected smartphone and IoT and lifestyle product sales. Q2 2022 revenues dropped 20% YoY to CNY 70.2 billion, led by revenue declines in its top two biggest businesses – smartphone segment revenues dropped 28% YoY to CNY 42.3 billion, and IoT and Lifestyle products revenues dropped 4.3% to CNY 19.8 billion. Internet Services revenues were flat at CNY 7 billion.

Xiaomi Q2 2022 investor presentation

Xiaomi’s long-term prospects however are more optimistic.

Premiumization strategy to drive margins, revenue and profit growth

Xiaomi has long been known as the best price-performance smartphone brand and has been particularly popular in the low-and-mid-range segment. Xiaomi began its push into the high-end segment a few years ago and those efforts are already bearing fruit. Premium smartphone shipments (priced CNY 3,000 and above in Mainland China and EUR 300 and above overseas) more than doubled in 2021 to 24 million units compared with 10 million the previous year. As a proportion of total smartphone shipments, premium phones made up 13% in 2021 compared with 7% the previous year. The improved product mix helped Xiaomi’s Smartphone segment, its biggest segment by revenues and profits, improve its gross margins from 8.7% in 2020 to 11.9% in 2021. The segment was also the second-fastest growing segment in 2021, with revenues rising 37.2% in 2021, second only to Xiaomi’s ‘Others’ segment which reported a revenue growth of 149%.

Author

Going forward, Xiaomi is clearly committed to transforming into a high-end smartphone brand, with the company aiming to surpass Apple (AAPL) to become the top seller of premium smartphones in China (Xiaomi’s biggest market) in three years. Towards that end, the company is investing heavily in R&D, with CNY 100 billion earmarked for investments in innovation over the next five years to support the company’s premiumization strategy.

Author

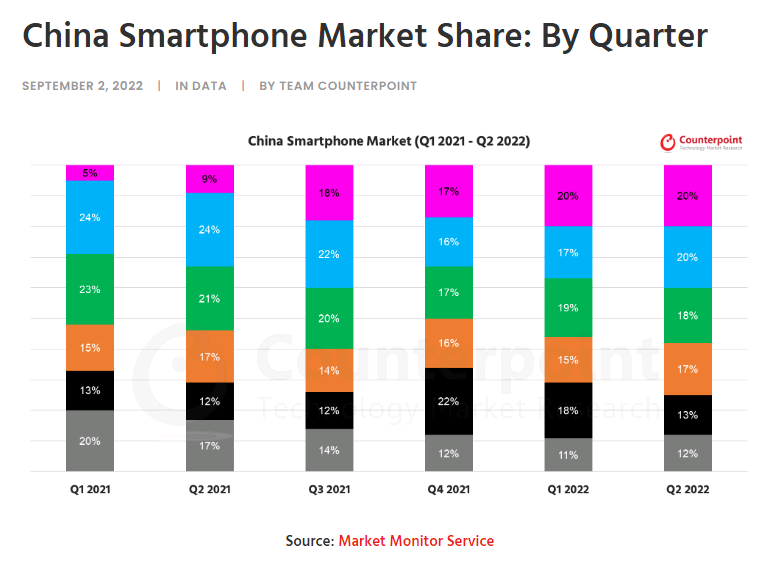

Xiaomi’s move towards the premium segment is positive for revenues, margins, and profits. The average Xiaomi phone is 40% to 75% cheaper than Samsung and Apple phones, respectively, which suggests a tremendous runway to increase Xiaomi’s average selling prices (ASP) which was CNY 1,097.5 in 2021. How successful the company will be in this effort however remains to be seen. Apple is not likely to sit still and Apple consumers are notoriously sticky (Apple’s customer satisfaction and loyalty have been growing over the years and their NPS score is significantly higher than the average NPS score of the consumer electronics industry). Over in China, Samsung (OTCPK:SSNLF) could have been a more likely candidate to encroach on (Samsung would also not be expected to remain stagnant in the face of competitive threats but arguably Samsung customers are not as sticky as Apple, and in China, Samsung may be at a disadvantage as Chinese consumers, notably younger Gen Z consumers, are increasingly favoring local brands, a trend known as “guochao“) but Samsung was decimated by Xiaomi and local rivals OPPO and Vivo a few years ago, and Samsung’s market share in China is 0% currently. The rest of the market is divided between local Chinese smartphone players, who like Xiaomi tend to command the low-to-mid end of the market, and like Xiaomi, have ambitions to capture the premium end of the market (including Honor – the budget smartphone brand spun off by Huawei – who has been enjoying massive traction in China lately with their market share soaring from just 5% in Q1 2021 to 20% in Q2 2022. Honor is now nurturing ambitions to go upmarket).

Counterpoint Research

China’s domestic rivals are seeing considerable traction in their respective premium ambitions; OPPO saw its ASP rise 15% YoY in 2021, while Vivo’s ASP rose 19% YoY, outpacing Xiaomi and Samsung whose ASPs rose 5% during the year. Although it could be argued that Xiaomi’s lackluster ASP growth could partly be due to its pledge to not earn more than 5% profits on hardware sales, it nevertheless indicates Xiaomi will be up against a tough fight in the battle for China’s premium smartphone market. Premium leader Apple meanwhile largely kept pace with its ASP increasing 14%.

Xiaomi does have a slight edge over domestic rivals however in terms of brand strength with a smartphone installed base of more than 500 million (the only Chinese brand in an elite club whose only other members are Samsung and Apple).

Outside China, however, Xiaomi might find better success. More than 1.3 billion smartphones were shipped worldwide in 2021, and Samsung, the dominant player with a market share of about a fifth of the market, has models across all segments.

Counterpoint Research

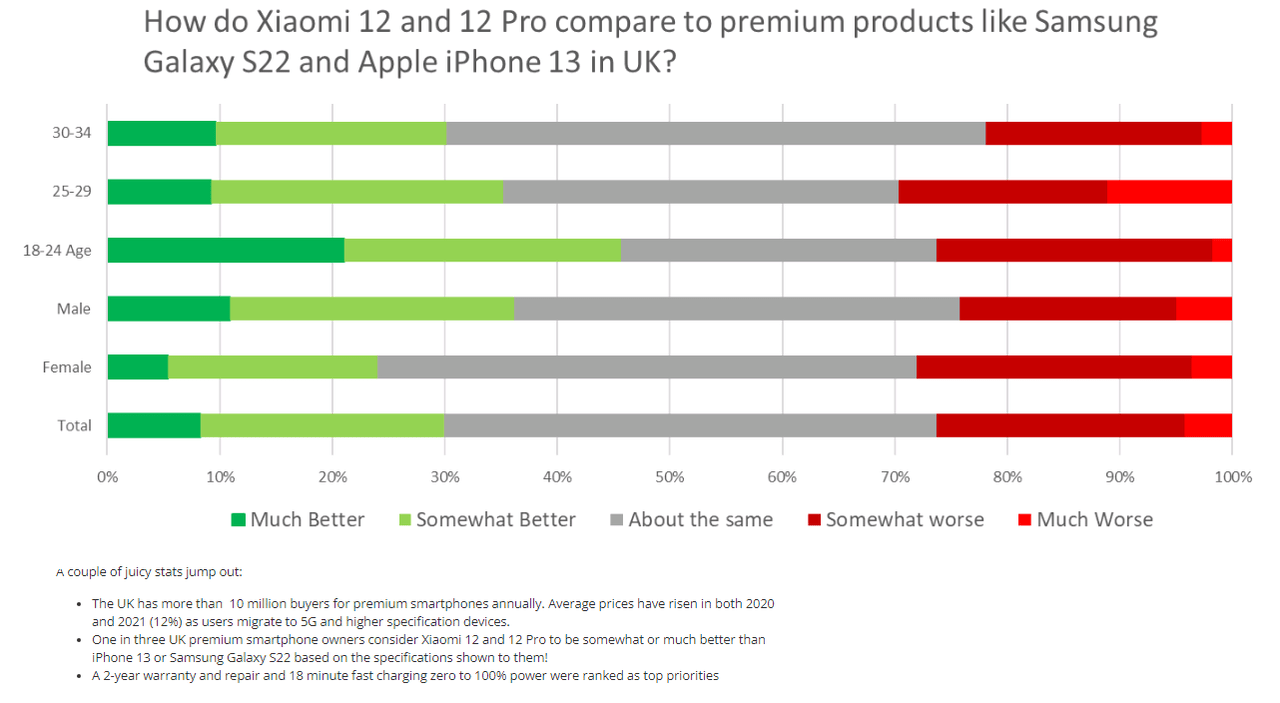

Unlike Apple, Samsung arguably doesn’t command a level of brand power and customer loyalty comparable to Apple, making Samsung a relatively easier target. Xiaomi has signaled its intent to attack the premium market in overseas markets such as India, and the UK, and surveys suggest Xiaomi could have a reasonable chance at successfully carving out a share.

Strategy Analytics

Internet services could drive profitability

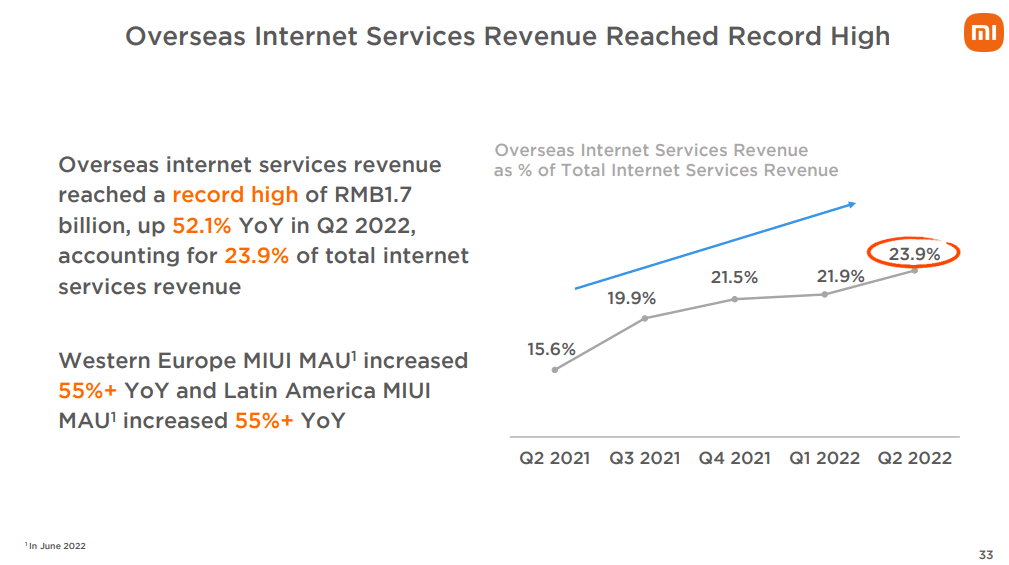

Riding on the back of a 28.4% growth in MIUI users, which reached 508.9 million monthly active users (MAUs) in 2021, and a 33.6% increase in the number of connected IoT devices, which reached 434 million in 2021, Xiaomi’s Internet Services business segment which includes reported a 19% YoY revenue growth for 2021. According to Xiaomi, China accounted for around 80% of its internet services revenue in 2021, leaving room for growth with overseas expansion, which could not only support revenue growth, but margins, and profitability as well. Overseas’ share of internet services revenues has been on the rise.

Xiaomi Q2 2022 investor presentation

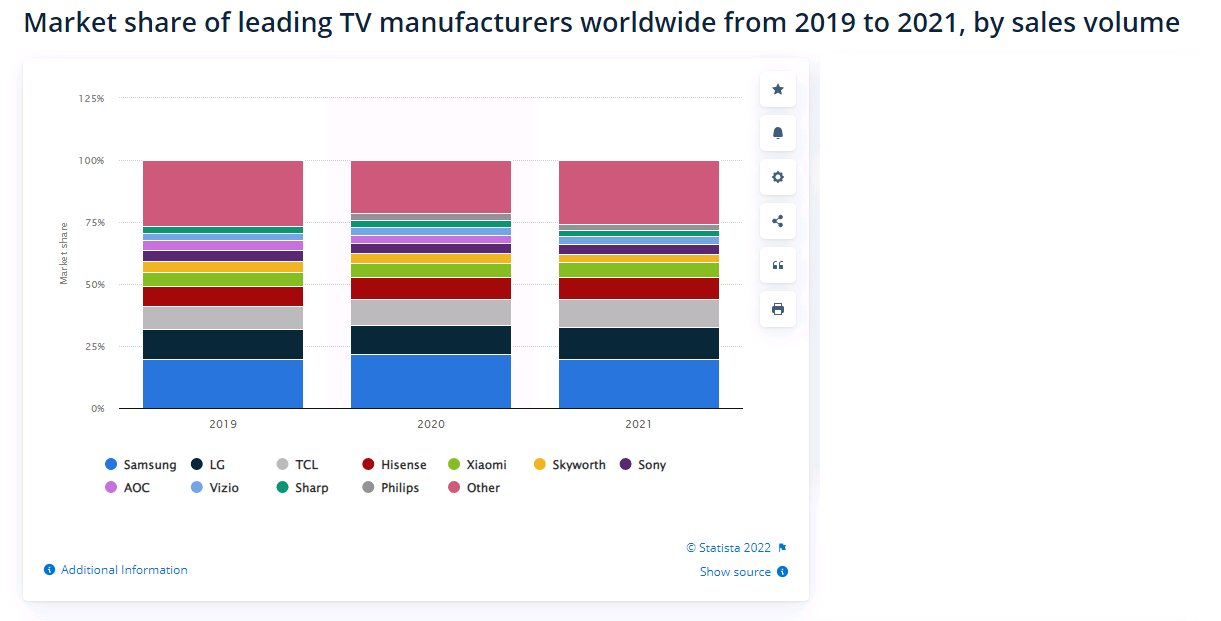

Moreover, smart TVs, the only IoT device Xiaomi is currently monetizing, has enjoyed strong growth and is expected to continue growing in the coming years, opening further opportunities to drive topline and margin growth in this segment. Xiaomi’s smart TV shipments rose to 12.3 million units (despite a downturn in the global TV market) and also saw an increase in ASP, in line with the company’s premiumization strategy. In terms of Smart TV shipment volume, Xiaomi was ranked number one in China for the third consecutive year, and within the top five globally. Globally, Xiaomi, among the top five biggest smart TV players, has been increasing market share over the past few years albeit by a very small margin (from 5.8% in 2019 to 6.1% in 2021), but encouraging compared to its rival market leader Samsung whose market share of 19.8% was unchanged during the period.

Statista

Solid financials

Xiaomi is financially decent in terms of leverage. The company’s total debt to equity of 26 is considerably better than Apple’s 205.

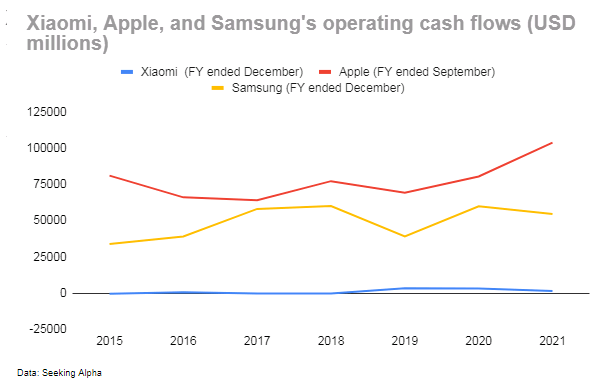

Xiaomi’s operating cash flows however are considerably lower than Apple and Samsung (Apple’s operating cash flows are about 100 times bigger than Xiaomi’s).

Author

Xiaomi’s anticipated heavy investments in the coming years into areas such as EVs and robots suggest operating cash flows are likely to remain pressured.

Xiaomi Q2 2022 investor presentation

Risks

Xiaomi’s near-term prospects are murky due to receding tailwinds from Huawei’s absence (arguably, Xiaomi’s stellar growth in the global smartphone space in 2021 was partly the result of Huawei’s downfall) and covid-induced smartphone demand, alongside rising headwinds from macro challenges. The trend has already impacted the smartphone market (global smartphone shipments have been on a downtrend this year with YoY declines in Q1 and Q2, and in China, the world’s biggest smartphone market, smartphone shipments have slumped 23% for the first eight months of the year), and could continue impacting the market in terms of volume as well as price as consumers downgrade to cheaper models. Smartphone sales accounted for 64% of Xiaomi’s revenues in 2021, and any impact to this business could have a material impact on topline and bottom line growth. A downturn in consumer spending could also affect IoT and lifestyle product sales, Xiaomi’s second biggest segment accounting for 26% of 2021 revenues.

Longer term, geopolitical tensions between China and the United States could cripple Xiaomi, resulting in the company facing a fate similar to Huawei whose smartphone business was decimated by American sanctions imposed in 2020, which prevented the company from sourcing critical smartphone chips (Huawei’s smartphone shipments plunged 82% YoY, and revenues dropped 29% YoY in 2021, the first decline since before 2002). In May 2021, the U.S. removed Xiaomi from a government blacklist, but this could only be a temporary victory.

Political tensions between China and India (Xiaomi’s biggest market outside Mainland China) could potentially deal a further blow to Xiaomi. Indian authorities have already begun cracking down on Chinese brands from Chinese apps such as TikTok, to Chinese smartphone makers, including Xiaomi, OPPO and Vivo. Indian authorities recently froze Xiaomi’s assets in the country.

A further risk to consider is that Xiaomi’s advertising business can be challenged by increasing privacy laws governing user data. This segment is Xiaomi’s most profitable segment (with gross margins of 74% in 2021, compared with 11.9% for smartphones, 13% for IoT and lifestyle devices, and 22.6% for others), and any impact to this business could have a negative impact on profitability.

Summary

Xiaomi has been enjoying strong topline growth and margin expansion lately and although the momentum decelerated this year, driven by macro headwinds and a covid resurgence in China, the company’s long-term prospects are potentially brighter. Xiaomi’s premiumization strategy along with internet services expansion could drive revenues and expand margins although heavy investments into new technologies such as EVs and robots could limit profit growth and cash flows. However, significant risks, including stiff competition and political risks (particularly in major markets such as India), suggest the stock may be better suited for long-term investors with a relatively high risk threshold. With a P/E of 49, Xiaomi is rather pricey, however, and considering potentially weak near-term prospects, investors may opt to wait for a better entry point.

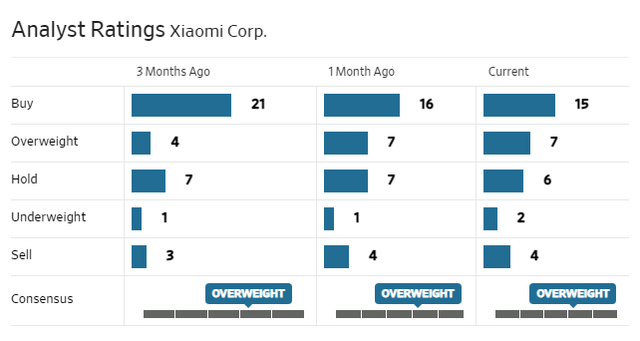

Analysts are mostly bullish on the stock.

Be the first to comment