Richard Drury/DigitalVision via Getty Images

Introduction

Despite operating in a tough environment where several of the largest companies including Tencent (OTCPK:TCEHY), Alibaba (BABA) and Ping An Insurance (OTCPK:PNGAY) are posting big declines in EPS figures, NetEase’s (NASDAQ:NTES) fundamentals have remained stable. Since the stock is being pulled down due to political concerns and not due to weak earnings or future prospects, I believe there is value to be found in NetEase.

NetEase is a Chinese company that provides online services centered on content, communication and commerce. The company is a developer and operator of several online PC and mobile games, email and advertising services. NetEase has licensing agreements with major companies, including Mojang and Blizzard, to bring some of their respective titles to the Chinese market.

Fundamentals

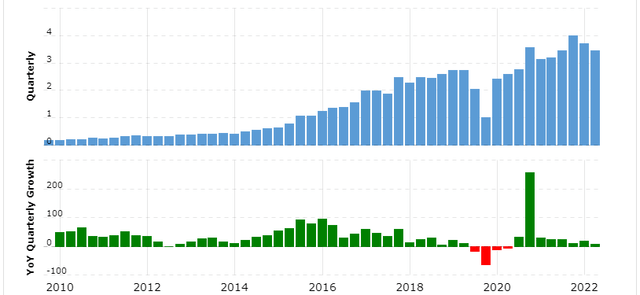

NetEase has grown its revenue at a rapid pace, with only a few quarters of decline. Growth has averaged 30% per year going back to 2010.

As the company grew larger, growth eventually dropped to low double digits, which is still a respectable growth rate considering the size of the company.

The growth has largely been a result of new games being released while existing games continued to grow. As the games eventually matured and with more revenue needed to move the needle, a slowdown in revenue growth was to be expected.

Analysts expect revenue growth to continue next year.

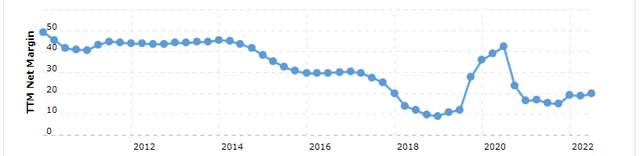

The profit margin shows a great history of profitability, with not a single year of negative earnings. However, the margin has been declining after the explosive increase in revenue during 2015, which was due to new games and a licensing agreement being made.

It has since stabilized at ~17%.

The rapid growth in revenue combined with an albeit declining but profitable net profit margin, has led to many consecutive years of strong net income growth.

Net income growth has averaged an annual growth rate of ~21% from 2010 – 2022. The growth is very impressive, especially when you consider, that it was achieved without diluting shareholders. The outstanding number of shares has barely increased, and thus EPS has also increased by ~20% per year.

Capital Allocation

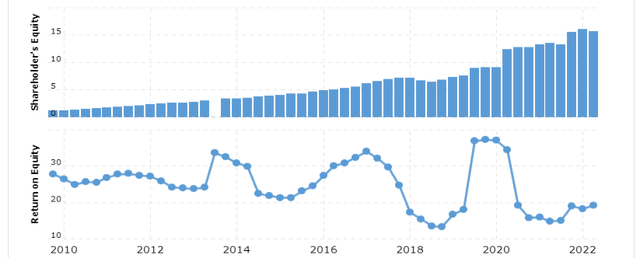

As seen in the image below, NetEase achieved approx. ~25% return on equity a year from 2010-2017. The return is very impressive, considering that almost all earnings were reinvested. Only a small portion of earnings were paid out in dividends beginning in 2013, along with occasional minor share buybacks to offset dilution.

Return on equity now appears to have stabilized at ~17%. Given that the company spends ~25% of earnings on dividends, and that they manage to keep reinvesting 17% on equity going forward, equity and thus earnings should grow by ~12.75% a year in the future.

The key takeaway being that the majority of earnings are reinvested, which I believe is prudent given the high double-digit reinvestment rates that management is able to achieve.

I do find it comforting that it seems to have stabilized and even increased in recent months. The high reinvestment ability underlines the strength of the company and its moat.

Valuation

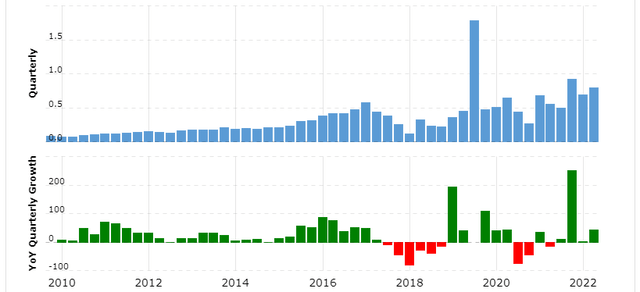

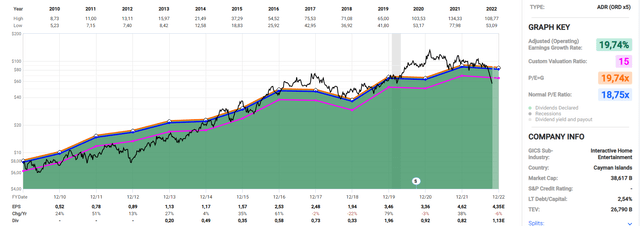

As seen in the image below, the average annual growth rate from 2010-2022 has been 19.74%. We can also see, that growth has slowed in recent years. This was to be expected given the decline in return on equity.

The annual growth in EPS from 2010 – 2017 was 25.05%. In line with their ROE during that period. Given that ROE has been ~17% from 2017 – 2022, and that the dividend payout ratio is ~25% with no meaningful share buybacks, a reasonable estimate of future annual EPS growth would be ~12.75%.

The estimated growth is in line with analysts’ expectations for the next 2 years, who also estimate low double digits.

The company has grown at above-average rates over the past decade, and was therefore rewarded with a higher-than-normal earnings multiple. Growth has averaged 19.74% per year, and the average multiple has been 18.75. A return to its average multiple would indicate returns of ~48%. I believe the company should be trading at a higher multiple of its current multiple of 12.9, but as growth of over 15% per year does not look likely, I do not believe that its average multiple provides a margin of safety anymore.

A return to a standard 15 earnings multiple, which would still indicate ~20% upside potential, seems more reasonable.

Stock Chart

Quick disclaimer: A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

Shares of NetEase are currently below its 50-moving average, which has been a strong support area several times in the past. This is commonly seen with consistently growing companies, which NetEase would classify as. A return to its 50- moving average would indicate a return of 40%. This would also bring the stock close to its average multiple and slightly above the standard multiple of 15.

However, should the stock continue to decline, which the current market weakness and political developments in China may be a catalyst for, then I would expect strong support at its 200- moving average. I consider it highly unlikely that such low valuations would occur, but in this market I guess anything is possible.

Final Thoughts

There is no doubt that NetEase is a strong business. The company has shown great growth in fundamentals for many years in a row, and is not expected to stop anytime soon. Although reinvestment rates have fallen in recent years, it still shows promising prospects for future growth. With a 17% return on equity and a dividend payout ratio of ~25%, estimates for annual growth of ~12.7% are very reasonable.

With annual growth of 12.7% in mind, the current valuation seems quite attractive. The company trades well below its average earnings multiple. While I think it is somewhat justified by slower earnings growth, at least a standard multiple of 15 should be given going forward.

It’s clear to see, that even though part of its low valuation is due to the political fear surrounding Chinese equities, it is far from random, that NetEase has experienced less volatility than other Chinese stocks. The company is only expected to post a slight decline in EPS this year, after coming of a year with growth of +30%.

Barring political turmoil, the company is expected to grow at double digits while being valued at below-average earnings multiples. The stock chart is in line with the earnings in suggesting, that it might make sense to consider NetEase.

I therefore give the company a “buy” rating.

Be the first to comment