Jae Young Ju/iStock via Getty Images

Currently growing at negative single-digits, Xerox Holdings Corporation (NASDAQ:XRX) is investing in markets that grow at a double-digit. In my view, further investments in digital transformation, cybersecurity, and workflow automation could bring the company’s valuation higher. Xerox reports a significant amount of leverage, which certain investors may not appreciate. However, under my discounted cash flow model and the sum of parts valuation model offered by XRX, the company is significantly undervalued.

Xerox

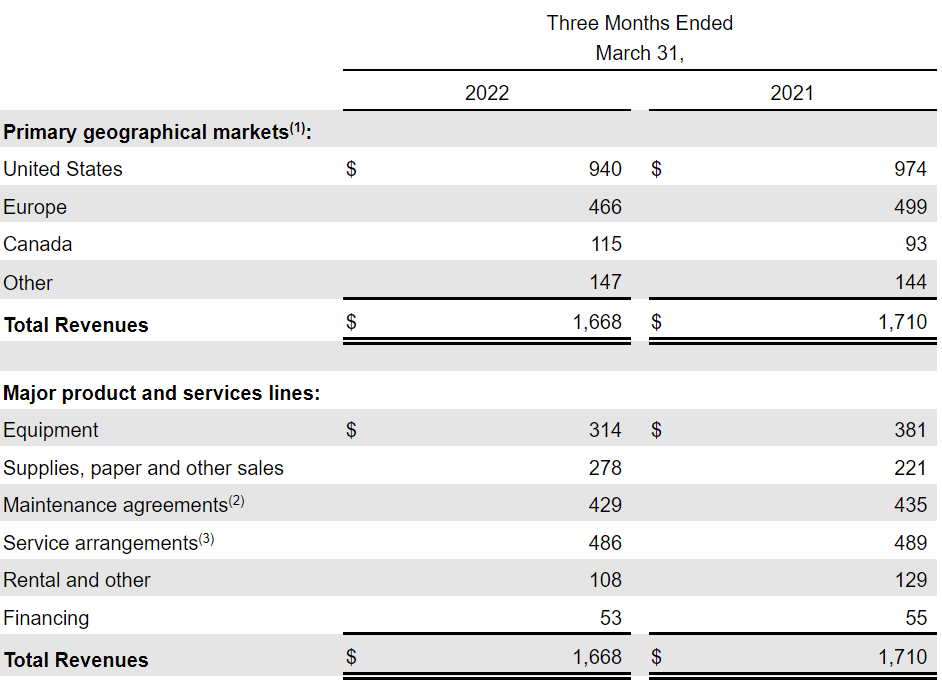

Xerox designs, develops, and sells document management systems, solutions, and other services to clients in the United States, Europe, and other regions.

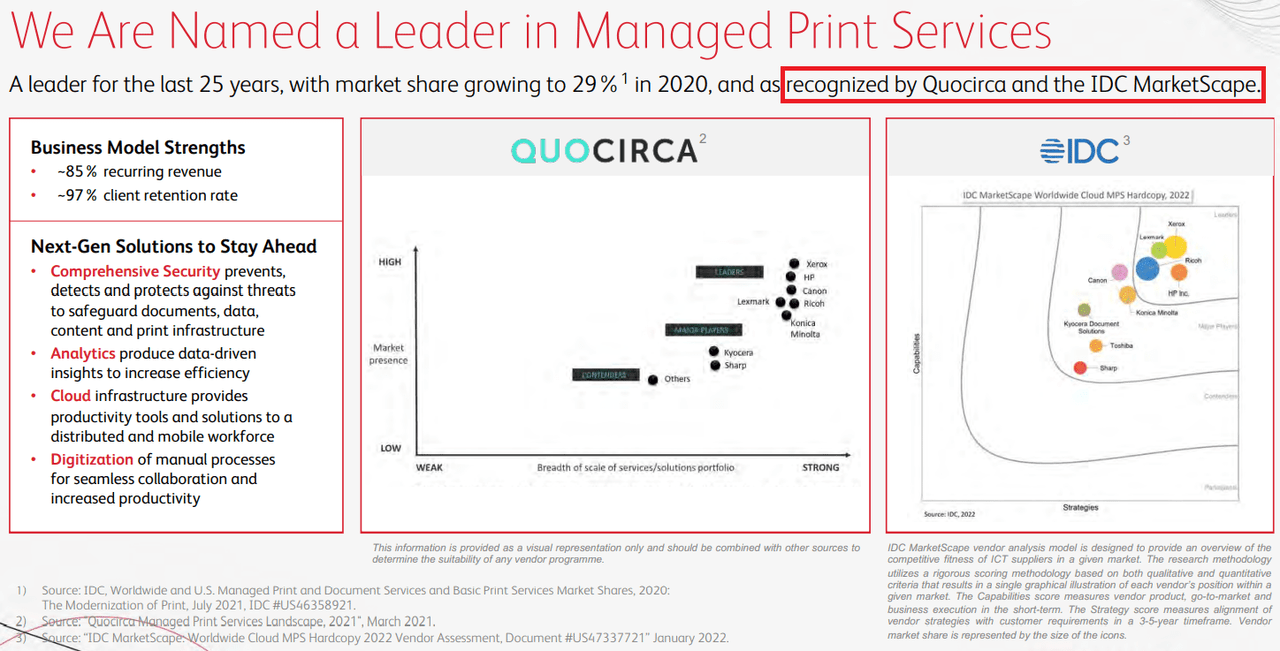

IDC MarketScape indicated Xerox as the leader in managed print services with market share growing to 29% and ~85% recurrent revenue. The company has been a leader for the last 25 years.

Investor Presentation

I believe that the company is well diversified with sellers all over the world, which may diminish future revenue growth volatility. Besides, the fact that the company’s footprint spans approximately 160 countries allows Xerox to deliver products to customers of all sizes regardless of complexity. I also see significant growth opportunities in Asia and Latin America, where the company is not present at all.

10-Q

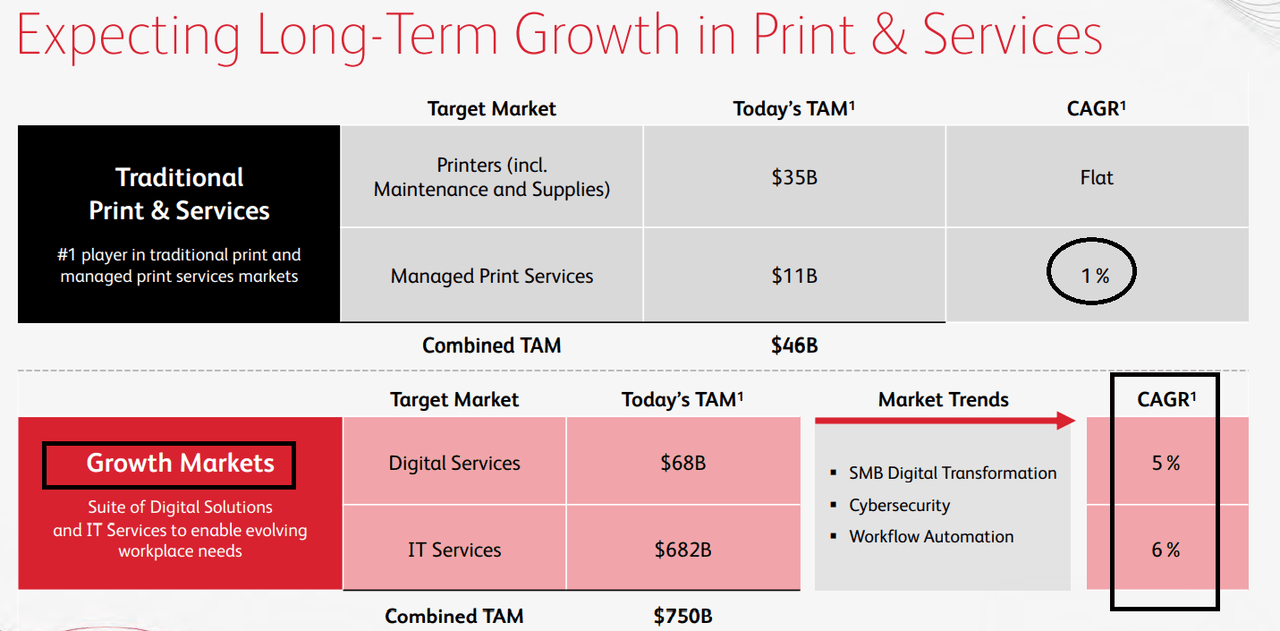

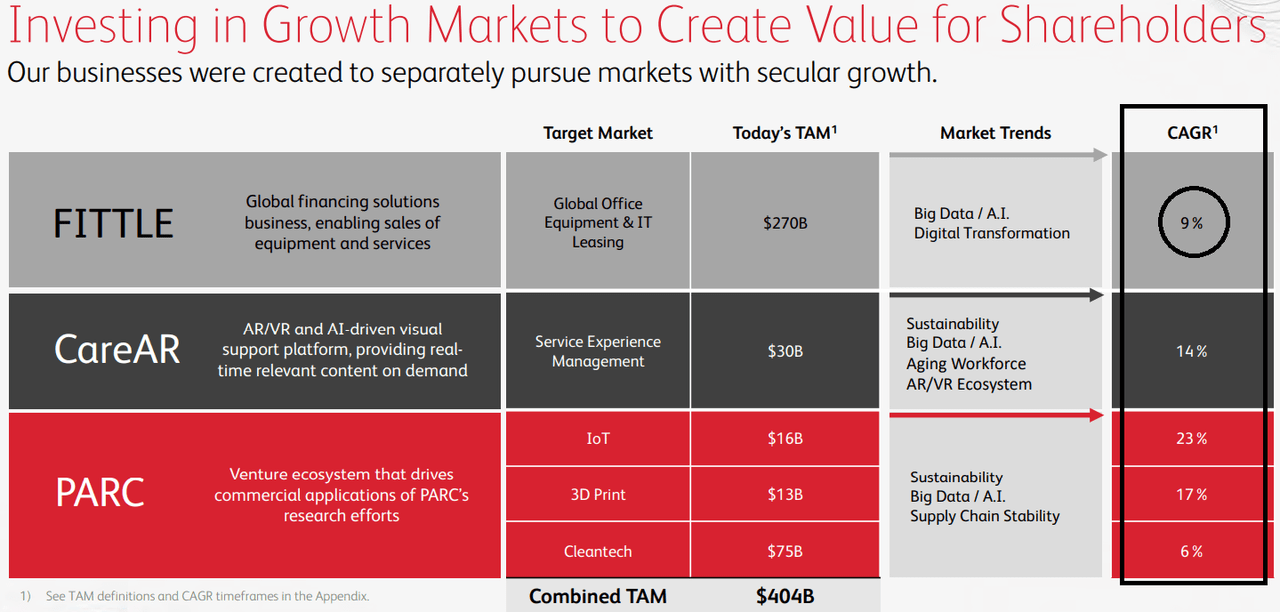

With that about Xerox’s business model, I am writing about the company because it is currently entering growth markets. In the last presentation to investors, Xerox noted that digital transformation, cybersecurity, and workflow automation could help Xerox’s target markets reach a CAGR of 5%-6%.

Investor Presentation

Xerox also expects to invest much more in global financing solutions, which could grow at a CAGR of 9%. Service experience management, internet of things, and 3D Printing are also expected to offer double digit sales growth.

Investor Presentation

Beneficial Outlook And $450-$500 Million In Free Cash Flow

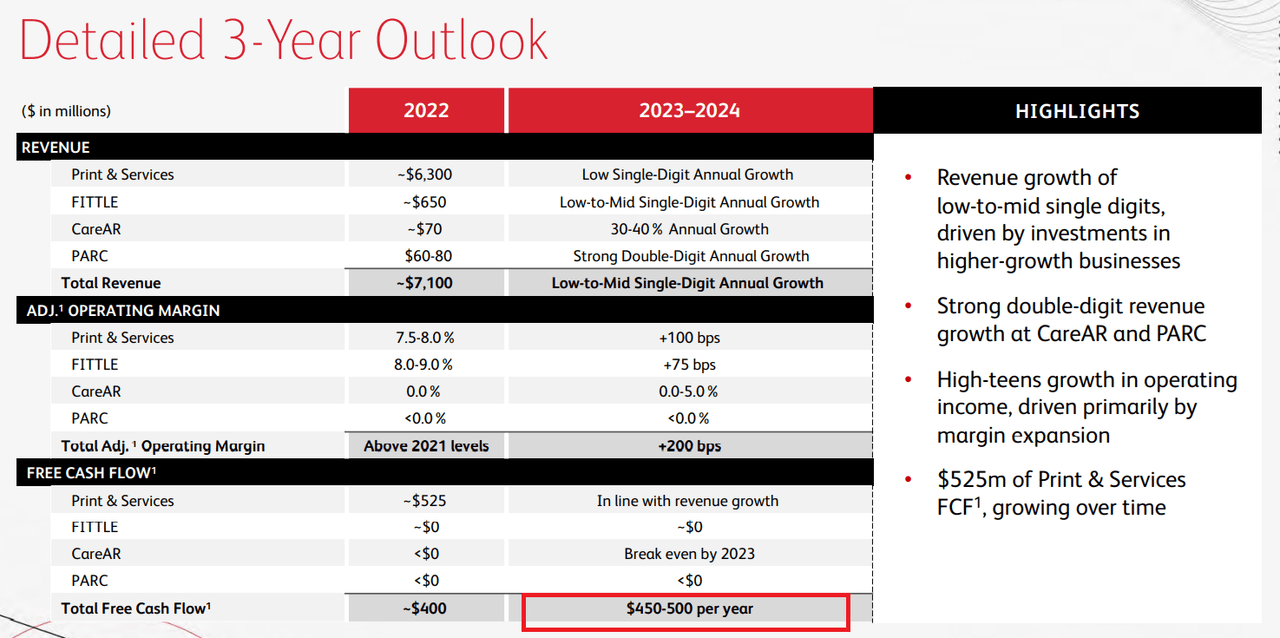

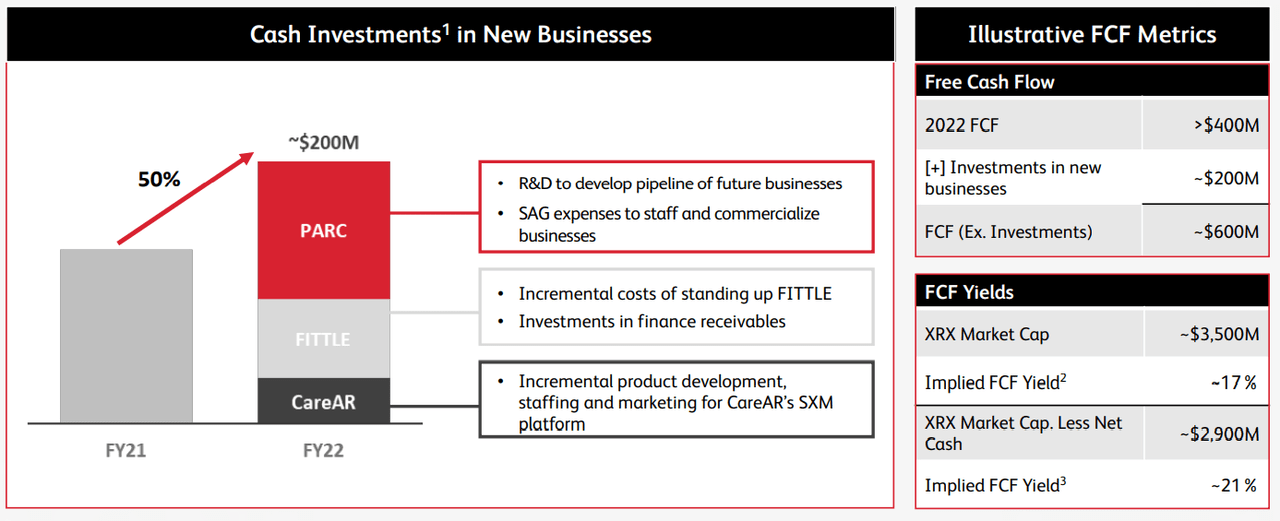

In the last presentation to investors, management offered a detailed projection of future free cash flow. My financial models are partially based on the figures reported by management, so I believe that investors may be interested. Xerox expects an adjusted operating margin close to 7%-9%, low-to-mid single-digit sales growth, and free cash flow close to $450-$500 million per year. I believe that the numbers may get even better from 2024 because the company expects to increase its investments in new businesses.

Investor Presentation Investor Presentation

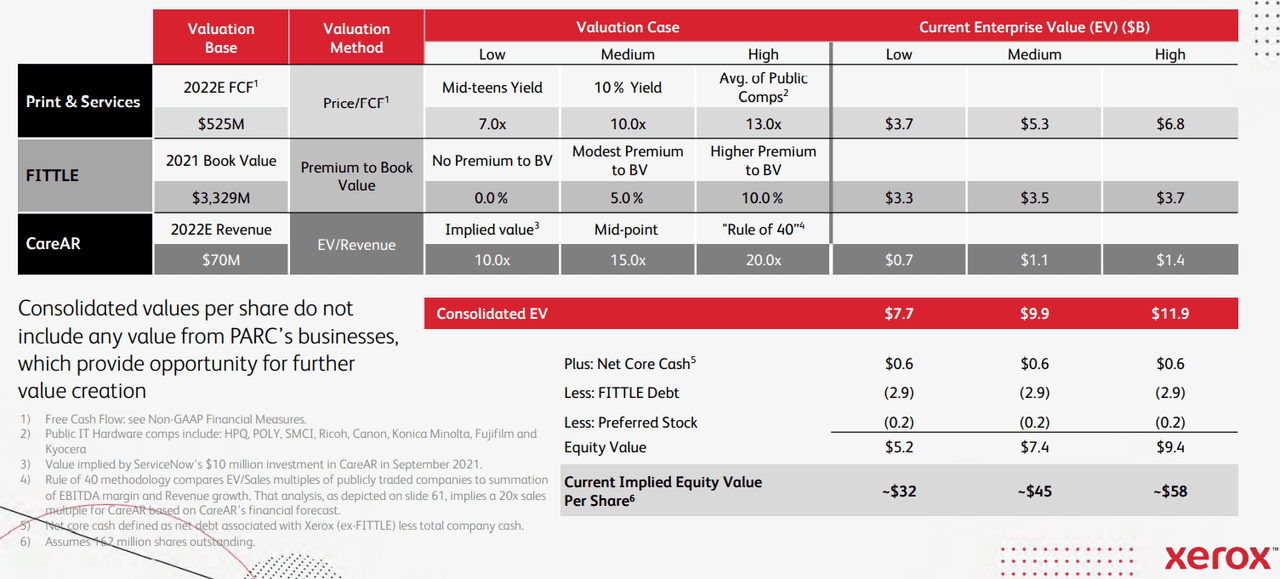

The company also offered an explanation about its own valuation model. It included different valuation methods for each business segment. I used a DCF model with the free cash flow projections given by Xerox, but a sum of parts is also a great valuation technique. The result includes an implied equity value per share of $32-$58.

Investors Presentation

My Base Case Scenario Resulted In A Valuation Of $37.9-$56.3

Under my base case scenario, I assumed that Xerox will likely obtain cost savings in 2022. Notice that management already announced that Project Own It, one of the company’s initiatives, is expected to bring significant simplifications of operations. Cost savings could bring free cash flow, and enhance future market capitalization.

Project Own It is Xerox’s enterprise-wide initiative to simplify operations, drive continuous improvement and free up capital to reinvest in the business. We expect to deliver $300 million of gross cost savings in 2022. Savings generated by Project Own It will enable us to invest in our operations, targeted adjacencies and innovation focus areas and ultimately help improve our long-term revenue trajectory. Source: 10-K

I also expect CareAR’s AR-driven service experience platform to bring further revenue growth. I am quite optimistic because management noted traction in the conversion of trials to subscriptions, which may enhance growth in 2022.

CareAR’s AR-driven service experience platform is in the early stages of customer adoption. To date, client interest and product trials have been positive, and we are seeing traction in the conversion of trials to subscriptions. We are investing in CareAR’s product, people and distribution partners and expect our refined go-to-market approach to drive significant growth in 2022. Source: 10-K

I believe that further expansion of IT Services business in new jurisdictions will likely enhance the company’s target market. As a result, the number of potential customers will likely increase, which may enhance revenue and FCF generation.

We are expanding our IT Services business geographically and with enhanced capabilities to support growth in this market, including an expansion of our offerings to include cyber security, RPA and other digital solutions. Source: 10-K

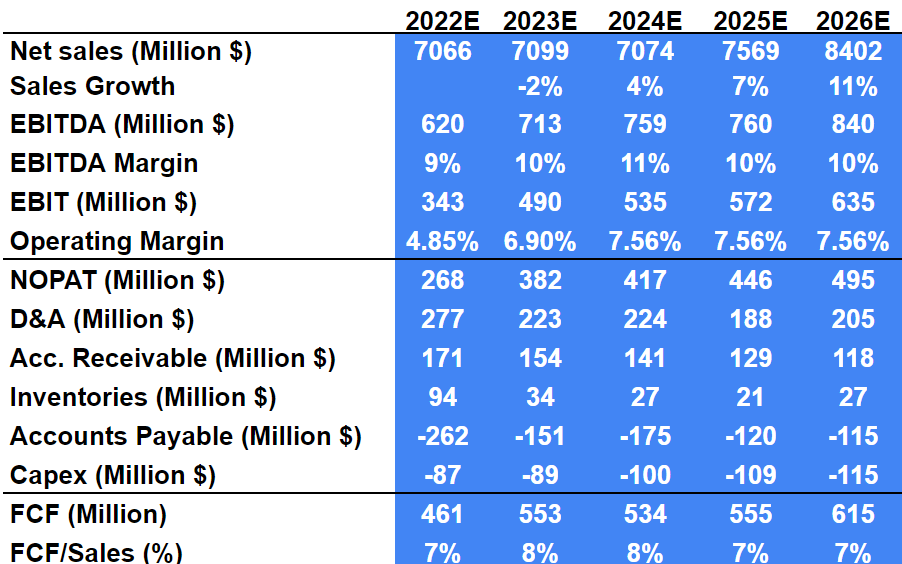

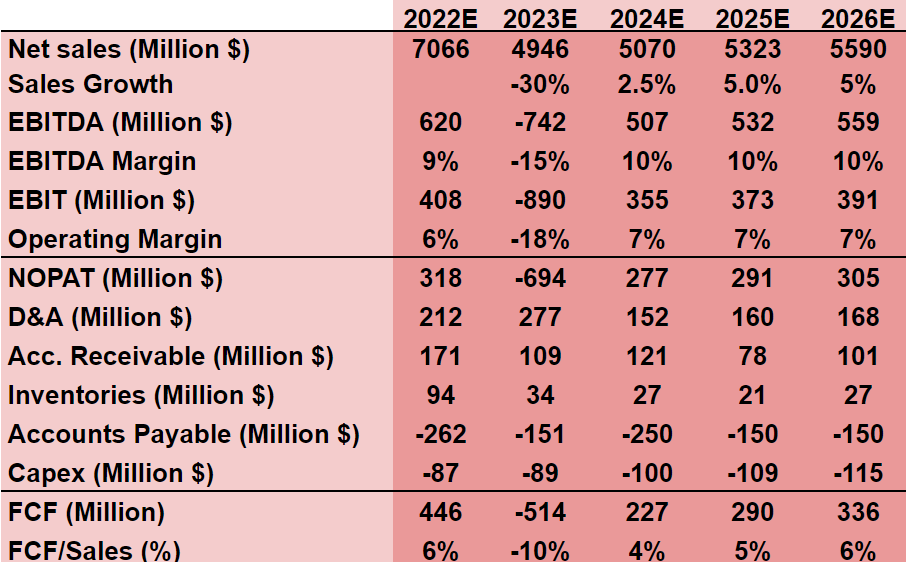

Under my base case scenario, I used some figures from the guidance given by management, but I remained a bit more conservative. I used a discounted free cash flow model to assess all the businesses owned by Xerox. With an operating margin close to 7% and sales growing at single digit, I obtained 2026 NOPAT of $495 million.

I also included depreciation and amortization around $205-$277 million, conservative changes in working capital, and capex of $87-$115 million. My results include 2026 free cash flow of $615 million and an FCF/Sales ratio of 7%.

Arie Investment Management

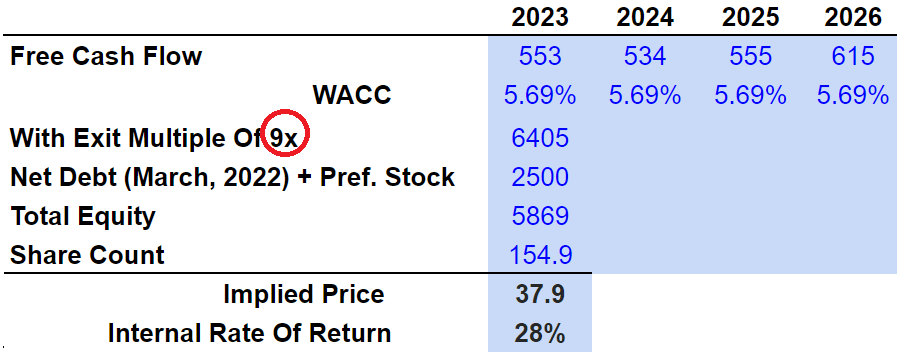

With a discount of 5.6% and an exit multiple of 9x forward EBITDA, the implied equity would be $5.8 billion, and the fair price would be $37.9.

Arie Investment Management

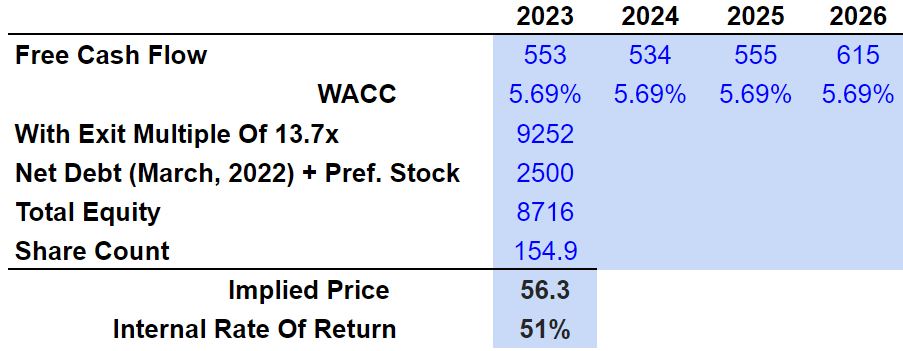

If we become a bit more optimistic, we can use a valuation of 13.7x EBITDA, which is close to the median EV/EBITDA multiple reported by the industry. The results in this case are close to the valuation offered by Xerox. The fair price stands at $56.3.

Arie Investment Management

My Bearish Case Scenario Implied A Valuation Of $10

Xerox does report a significant amount of debt. Some of the company’s debt depends on the future variation of interest rates. In my view, an eventual increase in interest rates may lower future free cash flow, and bring the company’s valuation down. Management warned about this risk in the annual report:

Our ability to provide customer financing is a significant competitive advantage. We have and will continue to have a significant amount of debt and other obligations, including that arising from our expanded FITTLE business scope, the majority of which continues to be in support of our customer financing activities. Our substantial debt and other obligations could have important consequences. Increase our vulnerability to interest rate fluctuations because a portion of our debt has variable interest rates. Source: 10-K

Xerox is making ambiguous investments in new markets, and offering new products such as CareAR and FITTLE. Under this case scenario, I assumed that management would fail to predict future demand for its products. As a result, future revenue will be smaller than expected, and the demand for the stock may vanish:

In connection with our standing up of several businesses, including CareAR and FITTLE, we face additional risks regarding whether these businesses will achieve expectations regarding customer adoption and financial performance, including projected revenue for fiscal year 2022. If we do not succeed in these efforts, or if these efforts are more costly or time-consuming than expected, our business and results of operations may be adversely affected, which could limit our ability to invest in and grow our business. Source: 10-K

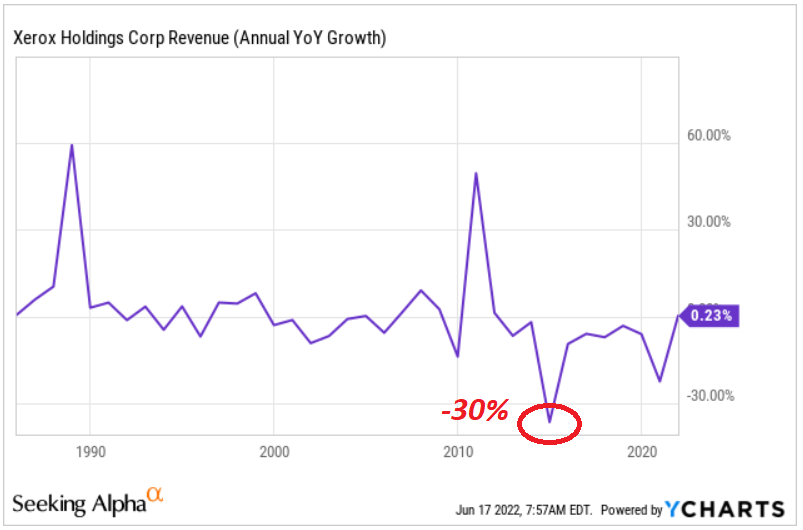

Under my worst case scenario, I included 2023 sales growth of -30%, which we saw once from 2010 to 2020. I believe that it could happen again.

YCharts

I also assumed an EBITDA margin close to 10% and operating margin around 7%. My results include free cash flow of around $227-$336 million from 2024 to 2026. The free cash flow/sales ratio would be close to 4%-6%, which is lower than that in the previous case scenario.

Arie Investment Management

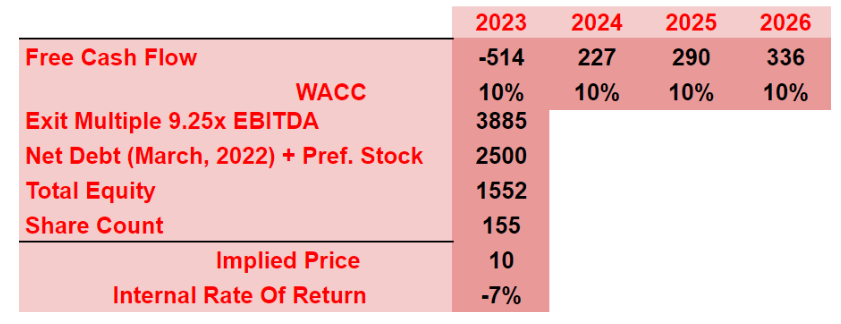

With a discount of 10% and an exit multiple of 9.25x, I obtained an equity valuation of $1.5 billion. The fair price would be $10 per share.

Arie Investment Management

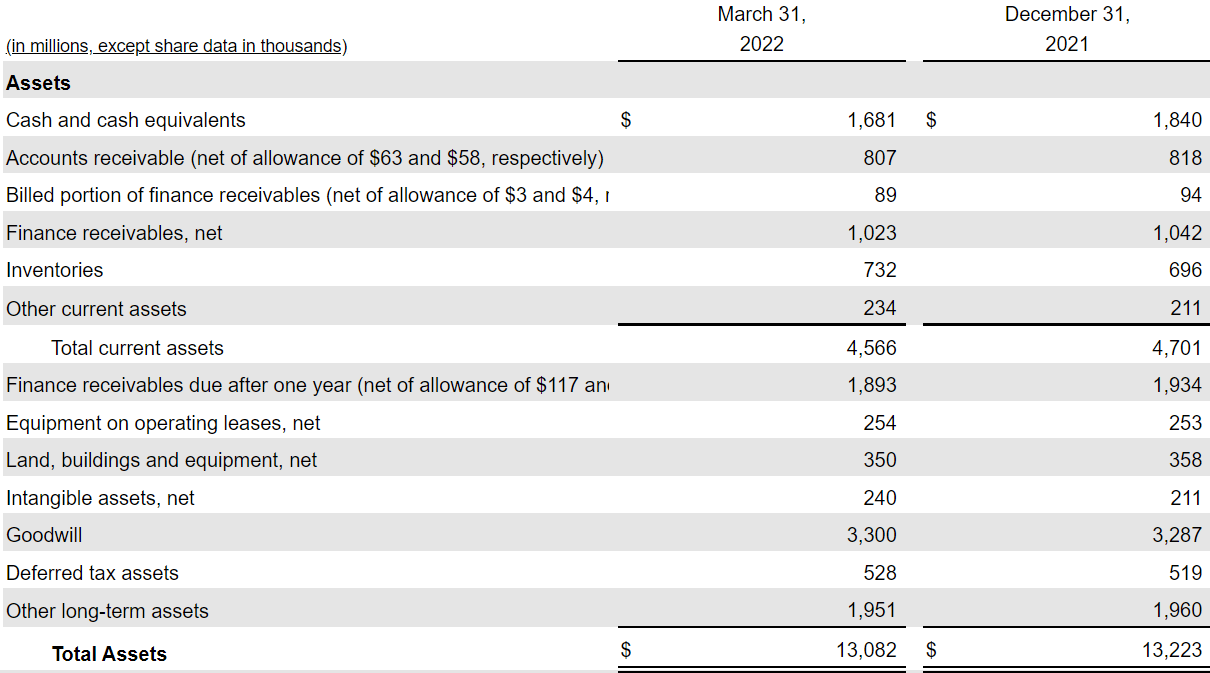

Balance Sheet

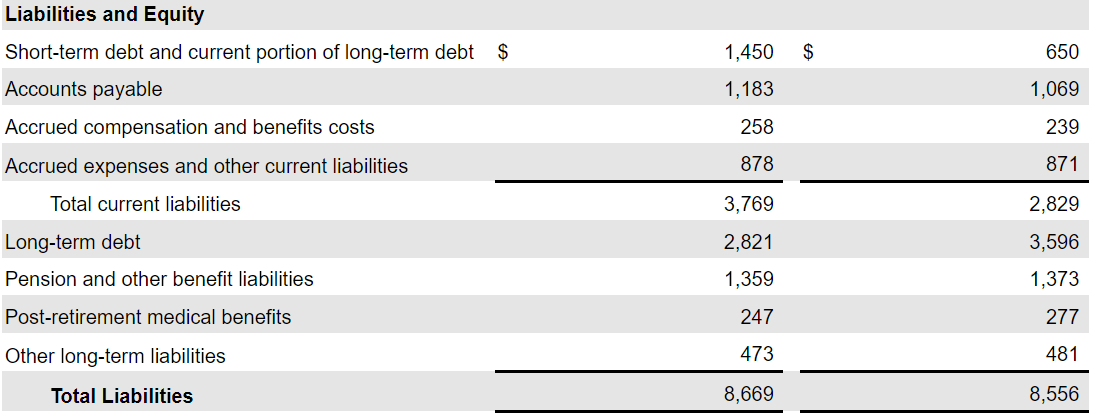

As of March 31, 2022, Xerox reported $1.68 billion in cash, $13 billion in total assets, and an asset/liability ratio of 1x-2x. I believe that management has sufficient cash to finance future investments in growing markets.

10-Q

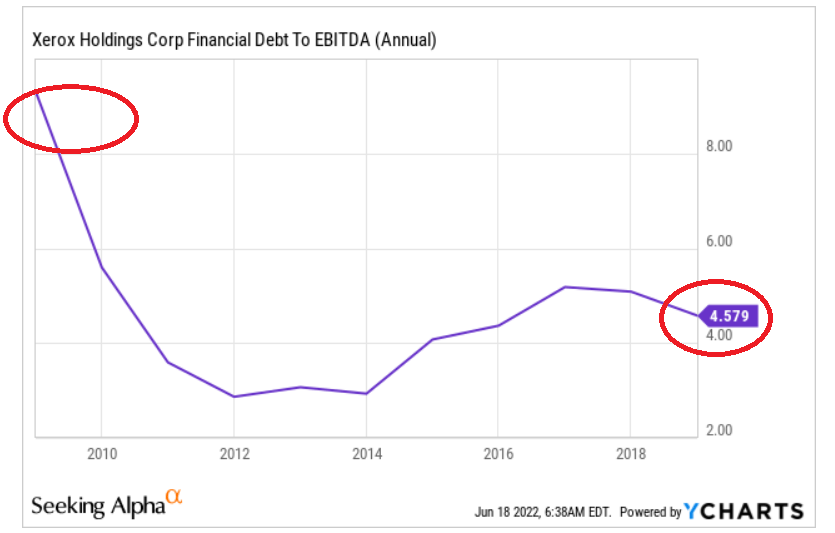

With short-term debt worth $1.4 billion and long-term debt worth $2.8 billion, the leverage stands at close to 4x EBITDA, so if you don’t like leverage, you may pass on this name. However, Xerox has a business model, which includes recurrent revenue, and it is a leader in the market. I believe that the total amount of debt is under control. Let’s note that ten years ago, the company reported financial debt to EBITDA close to 8x.

YCharts 10-Q

Takeaway

Currently growing at a decent pace, Xerox is also investing in growing markets, which will likely bring revenue growth. The guidance given by management is quite optimistic as it includes stable free cash flow for the near future. In my view, investors who are not afraid of leverage will find Xerox quite an interesting play. Even considering the risks, the current price mark fails to represent the company’s future free cash flow. In my opinion, the company is certainly undervalued.

Be the first to comment