Lukas Wunderlich/iStock Editorial via Getty Images

Airlines have been having quite a difficult time lately as recession fears have mounted and inflation has put consumers in a cautious mode. The result is that while airlines are bullish, shares prices actually tumbled. This fits in my view that even if things look good, there is always something that prevents airline stocks from taking off. However, the market sentiment has been negative lately, and that environment simply hasn’t been forgiving to names related to travel.

In the upcoming trading session, I believe that airline stocks could actually get a boost from IATA’s most recent profit forecast for 2022.

Forecast Turns Positive In Challenging Environment

Overall, IATA expects revenues to be climbing by nearly 55% to $782 billion and reach 93.3% of 2019 levels. It shows that in terms of revenues, the market is recovering well. The number of flights will increase to 33.8 million in 2022 and be at 86.9% of pre-pandemic levels. So, what we are seeing is that the revenue improvement is outstripping the number of flights. That likely is driven by solid yield evolution, as demand for air travel is recovering as pent-up demand is materializing.

With the number of flights at 86.9% of pre-pandemic levels, it also suggests that there is more room for revenues to grow as flight activity improves further. However, it should be noted that weakening in air fares could offset some of the gains realized by increased flight volumes. So, demand should remain strong.

With inflationary pressure and supply chain and labor challenges, it might be difficult to increase the number of flights, and there also is a cost overhang as well as a potential demand side pressure. So, those are things to keep in mind. For 2022, fuel costs are expected to make up for 24% of overall costs and be valued at $192 billion.

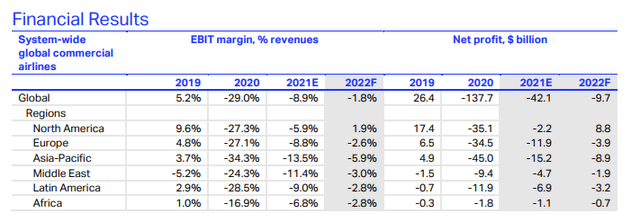

The result is that IATA now expects losses to narrow to $9.7 billion. While still a loss, this is a significant improvement that is expected despite a very challenging cost environment. In 2020, losses were $137.7 billion, with a significant reduction in losses in 2021 bringing the net losses to $42.1 billion in 2021. The newest projection is that the losses will be $9.7 billion in 2022, providing a significant improvement in the profit/losses. It should also be noted that compared to the October 2021 forecast, IATA now expects the losses to be nearly $2 billion lower. So, while fuel prices have surged and labor costs are increasing, the strong air fare pricing environment is providing a boost that outpaces the cost growth.

U.S. Global Jets ETF (NYSEARCA:JETS): Best in Class

Recently, United Airlines CEO Scott Kirby went to great length during his company’s earnings call to promote investment in airline stocks, and if we have to believe IATA, he definitely wasn’t wrong about investment in US airlines. While many regions around the world will still produce losses, North American airlines will be the positive outlier with an $8.8 billion profit expected this year already, and that likely paves the way for global profits in 2023.

As restrictions have eased for U.S. airlines, capacity is expected to be down just 0.5% compared to pre-pandemic levels while globally the capacity is expected to be down 12%. So, that profits some insights on how North American carriers are a step ahead in the recovery.

Conclusion

While I found Scott Kirby’s talk about airline investment a bit too much for an earnings call, IATA’s estimates leave little to imagine about financial performance among North American carriers. Airlines in North America are a step ahead in the recovery phase, as easing pandemic measures are enabling pent-up demand to be released in the marketplace and even amidst challenges on fuel costs, inflation and labor shortages that will result in North America to be the only region for which profits are expected this year.

On Monday, airline stocks in Europe already gained on the improved outlook from IATA. I expect that with North American airlines to be the best in class according to IATA, airline stocks can expect a bump in share prices on Tuesday’s trading session.

Be the first to comment