Lemon_tm/iStock via Getty Images

Thesis

Sorry, but has Mr. Market now lost any rational anchor for good? With Meta Platforms’ (NASDAQ:META) stock now below $170/share, the company is trading at x7 EV/EBTDA and a 2023 forward PEG of below x1. Arguably senseless arguments have scared investors. In this article, I will debunk three of them: The TikTok narrative (1), the no-growth narrative (2), and the anti-metaverse narrative (3).

Personally, I value Meta shares at >$280/share—with very conservative assumptions. If this opportunity is not a Strong Buy, nothing is. Whatever bears and anti-META mercenaries might say, at current prices I keep accumulating as much as I can.

The TikTok narrative

Firstly, let us start with the most obviously flawed argument: the claim that TikTok is going to compete with Meta’s social media empire. In my opinion, TikTok is a short-video entertainment company. Arguably, nobody joins TikTok to share personal news, connect with friends and family, or to communicate one’s identity. People join on TikTok to be entertained. There is Netflix for long (plus one hour) videos, YouTube for medium-length (a few minutes) videos and TikTok for very short (few second) videos. That said, entertainment is a completely different vertical than Meta’s social media offering, and investors should put this into the correct perspective. Why has nobody ever voiced real concern regarding Meta’s competition with YouTube and Netflix? It is true, however, that TikTok competes with various Meta apps for attention. TikTok will also join the competition for ad-budgets, like YouTube and soon also Netflix. For reference, Facebook currently accounts for 31.5% of the total digital ad budget. And other, undefined, digital media including TikTok, Snap, Twitter, etc., account for cumulatively 35%. As the digital ad market is still growing attractively at +5% annually, I don’t see intra-industry competition as a strong argument against Meta. But again, Meta’s value proposition – the social media empire – is very unlikely to be threatened by TikTok.

The no-growth narrative

Secondly, there is also the no/little growth narrative. Where is this coming from? I simply advise readers to focus on the facts. From 2018 to 2021, Meta has more than doubled revenues—growing a CAGR of approximately >30%. For 2022 Meta is expected to grow 7.1%, according to analyst consensus. Most notably, this growth is expected despite the multifaceted macro-economic challenges such as rising real yields, supply chain-challenges and geo-political tensions. In fact, the market is even pricing a recession.

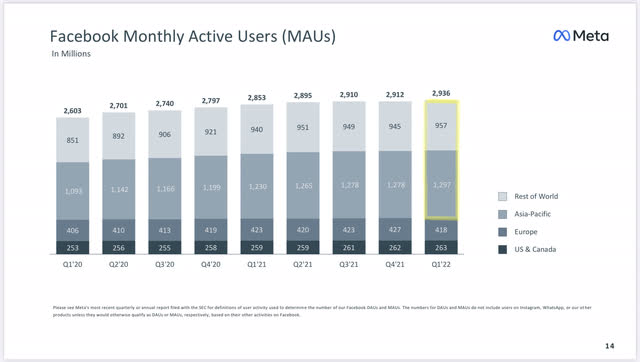

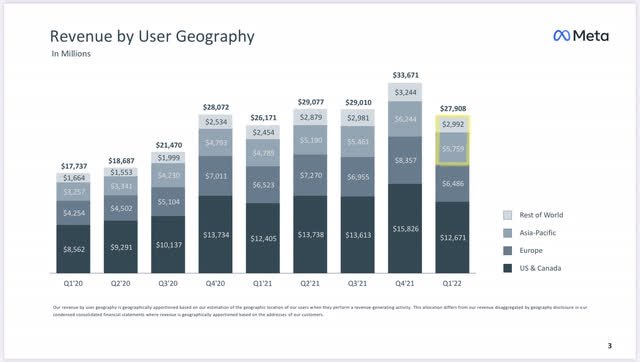

Meta’s growth is also supported by supported by facts. First, I want to highlight that the company’s legacy business “Family of Apps” still has lots of untapped monetization potential. For reference, Asia-Pacific and RoW account for approximately 75% of the conglomerate’s monthly user base.

But now, look for how much revenue the 75% user base accounts: approximately one third. While I do not want to claim that revenue per user of RoW and Asia-Pacific should be equal to the same metric in the US and Europe, I just want to highlight that there is a significant monetization gap. Investing in Meta is also an investment in emerging markets.

Furthermore, investors should not underappreciate Meta’s growth optionality provided by “Reality Labs”. Meta’s Oculus headset incorporates the best technology in the virtual reality growth vertical. While it is still difficult to estimate where this technology is going, it is likely to see high-demand from multiple use-cases, including gaming, social media and home-office work. As an umbrella term, let us define the potential market as the metaverse economy–a 13 trillion market by 2030 according to Citi.

The anti-metaverse narrative

Finally, let us also have a look at the anti-metaverse narrative. Investor sentiment behaves as if Mark Zuckerberg were taking an ultra-speculative bet on something completely new. But this is absolutely not how I see it. In fact, I just see in the metaverse an evolution of communication and the concretization of a trend that is already been developing but has largely remained undefined.

Mark Zuckerberg describes it as follows:

When I got started in 2004, the main medium for people to share online was text. Then we got phones… with cameras and it became primarily photos, now it is video. But it is not the end of the line. There is something after text, photo and video. Communication keeps on getting more immersive.

As the adoption and sophistication of VR technology is progressing, as it undoubtedly will, communication is going to become more immersive. Thus, Zuckerberg is only highlighting and going where the music will play. And his intuition is likely to be correct and financially rewarded.

Fundamentals are best in class

Meta Platforms is without a doubt one of the most profitable companies that an investor can buy, with Gross Profit Margin equal to 80.34%; EBIT Margin of 36.68%; Return on Assets of 16.74% and Net Income Margin at 31.20%. These numbers are even more notable if we consider the companies top-line revenue of 117.93 billion. That said, in 2021 Meta generated operating income equal to $46.75 billion and income attributable to shareholders equal to $39.37 billion, or $13.99/share. Needless to say, these results were achieved despite the company investing and expensing $24.66 billion (20% of revenues) in R&D.

Also, Meta’s balance sheet is stellar. As of Q1 2022, Meta recorded $43.90 billion of cash and short-term investments and $14.66 billion of total debt, implying a net cash position equal to $29.24 billion. In 2021, cash from operation was respectable $57.63 million.

How analysts see it

Analysts are very bullish on Meta Platforms as well. Based on 55 analysts who cover the stock, there are 32 strong buy ratings, 8 buy ratings and only 1 sell rating. The average target is $283.97/share and the highest target stands at $466/share. Most notably, the average target would imply more than 65% upside.

Moreover, according to the Bloomberg Terminal, as of June 2022, analyst see Meta Platform’s strong fundamental performance as sustainable. Revenues for 2022, 2023 and 2024 are estimated at $126.08 billion, $146.47 billion and $161.53 billion. This would equal a 3-year CAGR of approximately 10%, from 2022 to 2025. Respectively, EPS are estimated at $11.70, $13.94, and $15.85. While I personally model higher EPS, in this article I do not want to challenge analyst consensus. Usually, analyst consensus estimates not for target prices, but for revenues and earnings, are quite indicative of a company’s future performance.

Residual Earnings valuation

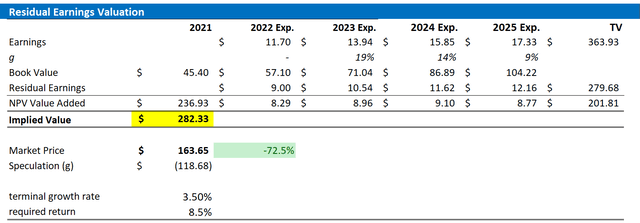

So, if analyst consensus is right about META’s business forecast, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast revenues and EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal. As I mentioned, challenging analyst consensus is out of scope for this article.

- The estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of June 1, 2022. My calculation indicates a fair WACC of 8.5%.

- To derive META’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5%. Although I think that growth equal to the estimated nominal long-term GDP growth is strongly understating META’s potential, especially as the company is spending 20% of revenues in R&D, I want to be conservative in my valuation.

- I do not model any share-buyback—further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for META of $282.33/share, implying material upside of about 72%.

Analyst Consensus EPS; Author’s Calculations

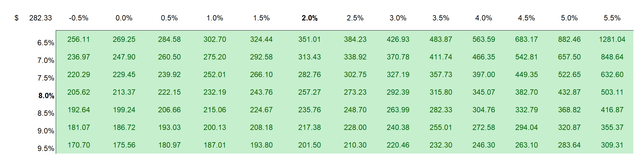

I understand that investors might have different assumptions with regards to META’ required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation. The risk/reward looks highly favorable to me.

Analyst Consensus EPS; Author’s Calculations

Risks

I would like to highlight the following downside risks that could cause META stock to materially differ from my price-target of $282.33/share:

First, a worsening macro-environment including inflation and supply-chain challenges could negatively impact the ad-budget of Meta’s customer base. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly.

Second, investors should monitor competitive forces in the industry. Although I highlighted the difference between TikTok and Meta from a value-proposition perspective, I also highlighted that the company is competing for advertising spending. Thus, if competition increases more than what is modelled by analysts, profitability margins and EPS estimates for Meta web must be adjusted accordingly.

Third, much of Meta’s current share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though Meta’s business outlook remains unchanged. In addition, inflation and rising-real yields could add significant headwinds to Meta’s stock price, as the higher discount rates affect the net-present value of long-dated cash-flows.

Conclusion

Meta is and will remain the dominating social media company. The business is still in high-growth mode. And yes, Zuckerberg’s definition and strategy for the metaverse make absolutely sense, in my opinion.

In this article, I haven’t even touched on many attractive arguments that make Meta such a wonderful investment, such as >10% share buyback (1), the value of betting on Zuckerberg (2), and the company’s clean/high-quality accounting (3). Perhaps I will write a second part to this article soon. For now, readers and investors might want to appreciate the company’s absolutely stellar business fundamentals and consider Meta as a Strong Buy. Below $170/share, I personally accumulate as much as I can. My target price: $282.33/share.

Be the first to comment