lovelyday12/iStock via Getty Images

Fed Chairman Powell’s remarks at the Jackson Hole Economic Symposium on August 26th framed what most of us hope won’t come to pass.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time,” Powell said. “The historical record cautions strongly against prematurely loosening policy.” … “Lowering inflation to the 2% target is the central bank’s “overarching focus right now” even though consumers and businesses will feel economic pain.” … Another “unusually large” increase in the benchmark lending rate could be appropriate when officials gather next month, though he stopped short of committing to one.”

By way of quick digression, I continue to thump my head over what’s going on with our inverted yield curve – something is seriously askew when T-bills trade materially higher rates than the 30-year. I posit that the Treasury and Fed are “signaling” to borrowers to lock-in long-term financing before the Fed raises short-term rates again and, working with the Treasury, increase withdrawals of liquidity from the system, as in “quantitative tightening”. Something more than a mild recession is possible.

Disruptive Change

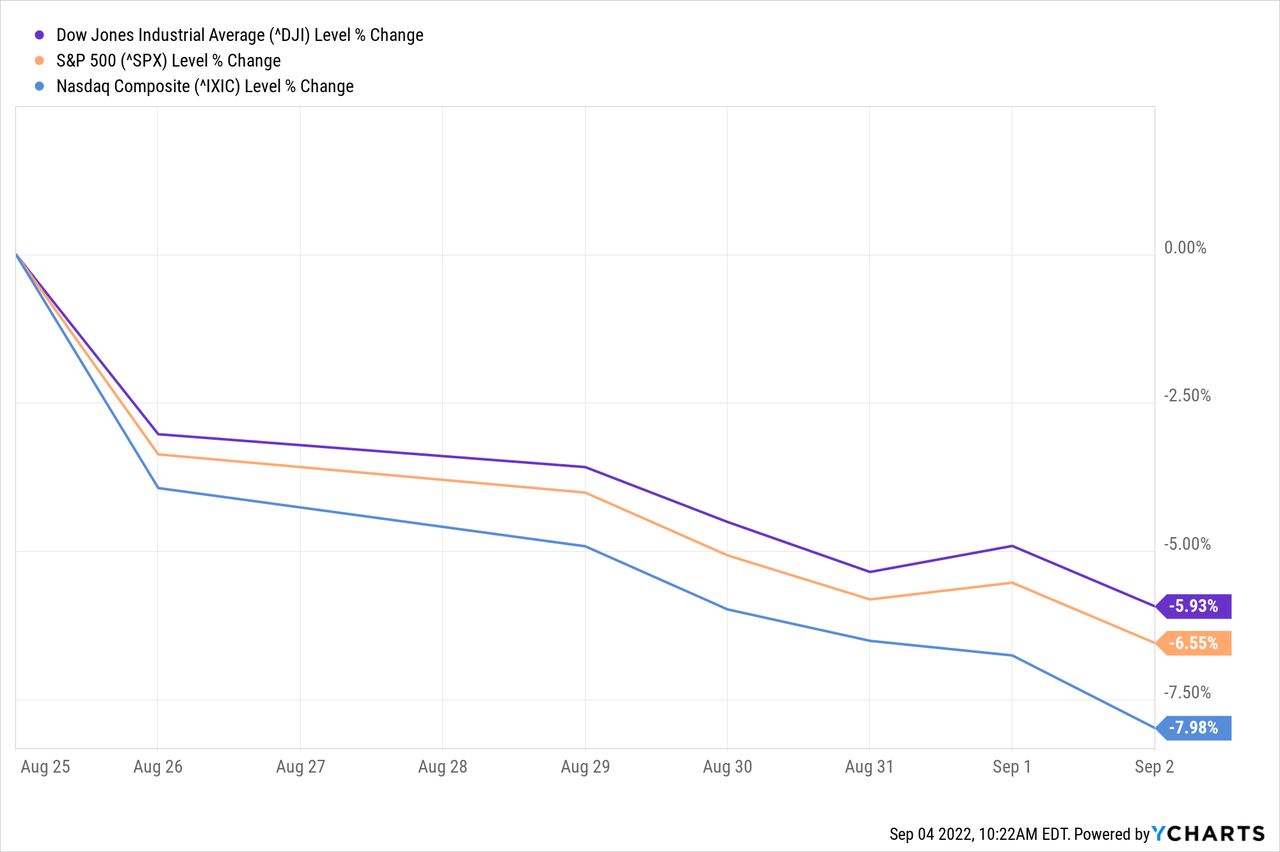

Compared to decades of accommodative monetary policy, the Chairman hints at potentially “disruptive change” requiring, “high-level strategic responses from company leadership to ensure their company can survive long-term.” Sensing this, the markets reacted swiftly with all major U.S. indexes – the Dow, S&P, and NASDAQ – falling by well over 5% over the last 6 trading days, alarming.

Couple this with disruptive geopolitical and climate changes that are upon us: a) Russia invading Ukraine and then further escalating those matters by withholding energy supplies from NATO countries, and b) profound effects of global warming framed by NOAA’s vast longitudinal research and outlined in my last article for SA – melting glaciers, rising seas, disappearing rivers, draining reservoirs, unabating fires, and wildlife under threat.

In passing, I’d point out that these two disruptive changes are, in a way, reciprocals of one another insofar as the “weaponization” of oil and (natural)gas will hasten the conversion to renewable energy.

Electric Utilities

In an earlier SA article, I observed that, as in baseball, “We investors have a lot coming at us amidst the din of crowd noise and glare of sunlight. …and occasionally, it’s worthwhile to pause and ask where companies are on their trajectories.”

Now is just such a time as we have seen with most sectors hit and hit hard – chips, streaming, hospitality, real estate, durable goods, staples, retail, the list goes on. However, a few sectors are weathering the market turbulence comparatively well, among them, utilities. Why? – Because utilities serve to inelastic demand as regulated – meaning also protected – by public utility commissions (PUCs).

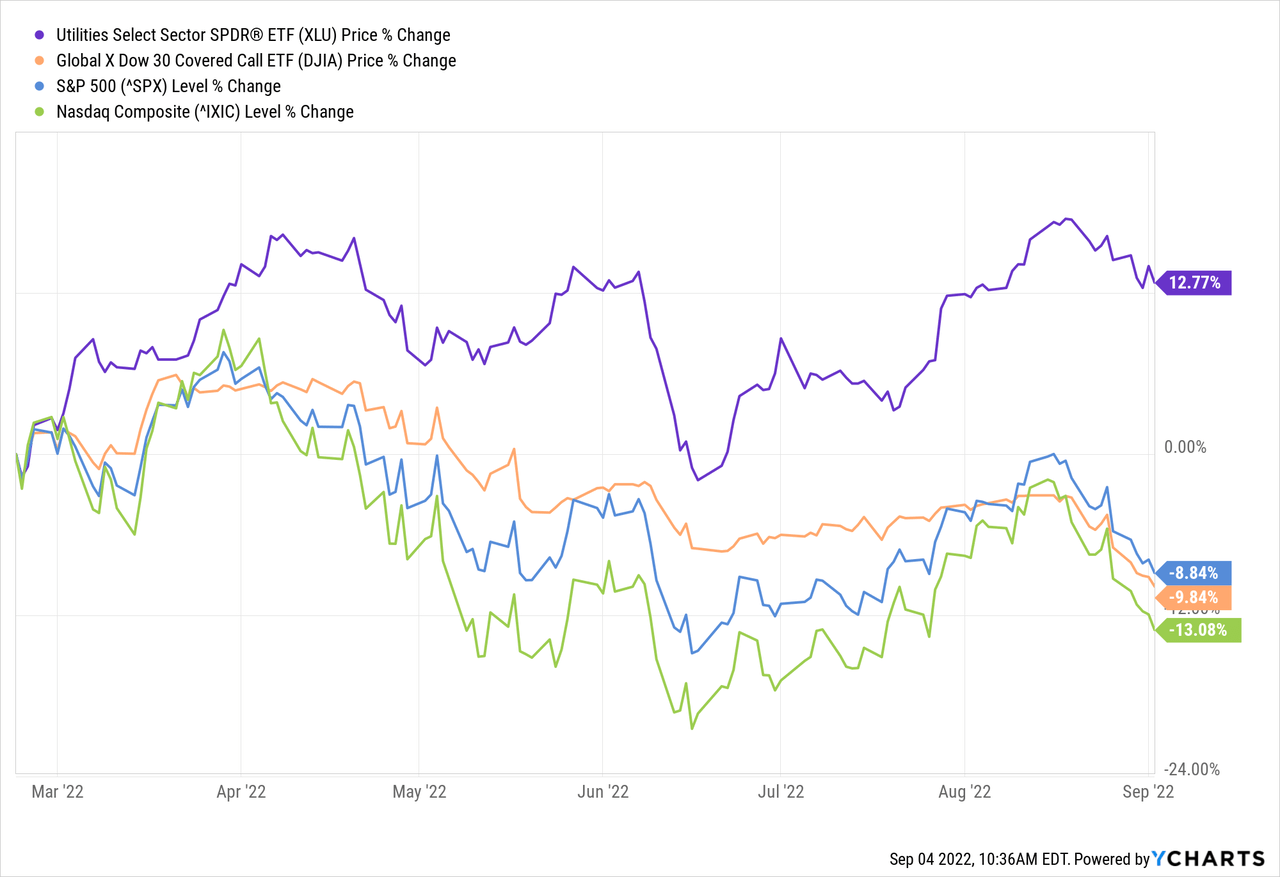

I draw your attention to the largest utility sector ETF in the U.S., State Street’s SPDR Fund (XLU) with $18 billion in assets under management. Here, you can see that this fund has far outperformed the major US indexes, by 21+% in absolute value, since market turbulence really set in at the beginning of this year.

Xcel Energy

For those who are not stock pickers, XLU is an investment option worth considering if you buy into the thesis of this article. However, I am a stock picker and therefore focused on attempting to identify the best of the best which includes Xcel Energy (NASDAQ:XEL) among electric utility companies. I favor Xcel for experiential, strategic, and financial reasons.

Peter Lynch, the genius behind Fidelity’s Magellan Fund advised, “Buy what you know”. We know Xcel as our home utility and are impressed for various reasons, including:

- Their reliability and responsiveness when components of the system go down for whatever the reason, complete with a slice-n-dice outage map and online reporting and status functionality.

- Their monthly statement that tracks kilowatt usage, relative to average outdoor temperatures, and as compared to neighbors recognizing that there are legitimate differences in electricity consumption, for example, among those who maintain second homes and/or drive EVs (we don’t).

- Their alliance with the “Center for Energy and Environment” which, for a nominal fee, will conduct an energy “audit” confirming progress made toward energy efficiency and pointing out areas for improvement, such as the insulation in our attached-garage – walls, ceiling, and door – with abysmally low R-values.

Our experience with Xcel extends to confidence we have in their strategy as demonstrated in two key areas: 1) Their progress toward clean energy, including with a voluntary payment program, to which we contribute, helping the company with its conversion to wind power (and for which we receive periodically a “dividend”), and 2) Their use of advanced tools and techniques including company controlled remote “lock” thermostats to balance the supply and demand of energy during peak-load weather events to protect their grid/and our availability of electricity. Xcel is a forward-thinking operator.

Return of Investment

As reflected in their low betas – XEL’s is .58 – utility companies are not swing-for-the fences growth investments of the kind to which I’m occasionally drawn. Then again, in these times, one must be realistic including with diversification in the tried-and-true. Xcel’s financials are utility-like right through their P&L, over into cash flow, and across their balance sheet. Compliments of SA, here are some core numbers:

|

Xcel Energy |

2021/2020 |

|

Revenue/Growth |

$13.4B/+16.5% |

|

Op. Income/Growth |

$2.1B/+1.8% |

|

Net Income/Growth |

$1.6B/+8.4% |

|

Op. Cash Flow/Growth |

$2.2B/-23.1% |

|

Liquidity/Current Ratio |

0.8x |

|

Capital/Liabs. to Equity |

2.7x |

|

Price-to-Earnings Ratio |

23.5x |

|

Dividend Yield |

2.6% |

|

Payout Ratio |

58.6% |

As for professional analysts, MarketWatch reports that sixteen cover XEL, with 8 having it as a “buy”, 1 an “overweight”, 5 “hold”, and 1 each “underweight” or “sell”. Their average price target is $77 which, against the stock’s close on Friday of $74.41 represents a modest potential gain of 3%.

As to risks, regulation helps mitigate the financial ones. Given their criticality to all else economic and social, PUCs will/should ensure that electricity providers remain healthy, including when it means passing along higher capex/upgrade/conversion, and opex/fuel/labor, costs on to consumers.

No, I believe the major risk to all utilities stems from poor grid design and oversite exposing their systems to hacks, attacks, and accidents. In my prior lives as Chief Information Officer of a nationally-ranked broker-dealer and then a global hedge fund, we experienced related outages when the World Trade Tower collapse severing – in our case, for only ten seconds – our network connectivity to Wall Street. We also suffered local outages when boneheaded contractors would fail to mark cables only to hit them with their backhoes.

Not good, but we had considered such contingencies in our system design, including with separate primary and disaster recovery co-lo providers – with real-time backup, intrusion detection, and running on separate grids with diesel backup. But failures brought on by foreign and domestic terrorists may be another matter as reported in last week’s “Sixty Minutes” segment on the topic.

Add me to the list of SA’s authors and quants that have XEL as a “Buy” with factor grades in the B-C range except for a D valuation score influenced by their highish P/E: Growth C+ (seems low, given the market-share their electricity is ‘capturing’ from ICE vehicles), Profitability B+, Momentum B+ (seems high, given toppy professional analyst target prices), and Revisions B-. During times like this, it’s worth remembering that return-of-investment supersedes return-on-investment. I sleep better with XEL in our book.

Be the first to comment