LordRunar

For many investors, the past year has been particularly difficult and volatile. Concerns over inflation, rising interest rates, and a potential recession have all sent the broader market declining. But one company that has performed remarkably well considering the circumstances is Silgan Holdings (NYSE:SLGN). This firm, which focuses on the production and sale of metal containers, dispensing systems, and the running of metal and plastic closure operations, has held up well during the pandemic and, since then, has demonstrated continued attractive growth on both its top and bottom lines. Although the company is still very cheap and likely offers some nice upside potential, it has also seen its shares become more expensive relative to what some other players are trading at. For this reason and this reason alone, I’ve decided to lower my rating on the company from a ‘strong buy’ to a ‘buy’.

Fantastic performance

A little over a year ago, on August 18th of 2021, I published an article detailing the investment worthiness of Silgan Holdings. In that article, I acknowledged that the company had done well to grow both its revenue and cash flows in the prior few years. At that time, shares of the company were cheap on both an absolute basis and relative to similar players. Due to this combination of growth and affordability, I ended up rating the company a ‘strong buy’, reflecting my belief that it would be very likely to significantly outperform the broader market for the foreseeable future. Since then, my call has proven to be correct. While the S&P 500 is down by 11.6%, shares of Silgan Holdings have generated a return for investors of 9.9%.

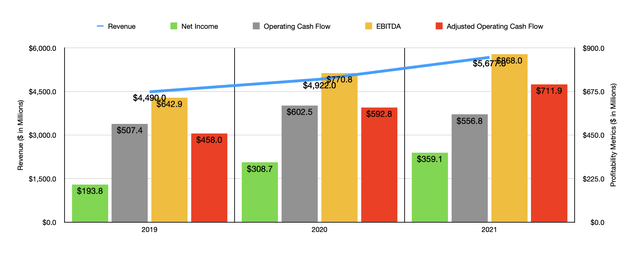

This significant return disparity has not been without cause. To see what I mean, we need only look at financial performance since the publication of that article. Back in 2020, the company generated revenue of $4.92 billion. For the 2021 fiscal year as a whole, sales came in at $5.68 billion. During that one-year window, the company saw significant growth in revenue across all three major operating segments that it runs. Net sales for the dispensing and specialty closures operations of the company grew by 26.2%, driven in large part by a 9% increase in unit volume and, secondarily, due to increased pricing as management pushed on costs associated with inflation to its customer base. Sales for the metal containers business grew a more modest 9.8%, largely as a result of higher raw material and other manufacturing costs being pushed onto customers, as well as a 4% increase in unit volume. And for the custom containers portion of the enterprise, sales rose by 8.8% because of the push-through of higher raw material costs, and because of a favorable mix of products relative to what the company reported for 2020.

With revenue rising, profitability followed suit. Net income rose from $308.7 million to $359.1 million. Of course, we should pay attention to other profitability metrics. Operating cash flow for the company fell from $602.5 million to $556.8 million. But if we were to adjust for changes in working capital, it would have risen from $592.8 million to $711.9 million. Meanwhile, EBITDA for the company also expanded, climbing from $770.8 million in 2020 to $868 million last year. Although some companies have struggled to increase profitability as they push through some costs to their customers, it’s clear that this was less of a concern for Silgan Holdings. Of course, this is not perfectly the case. The actual gross profit margin for the firm decreased by 1.4% in 2021 compared to the 2020 fiscal year because of the inability to push through all of its costs. Investors should be happy though since most of this was made up from a reduction, relative to sales, in the selling, general, and administrative expenses of the enterprise.

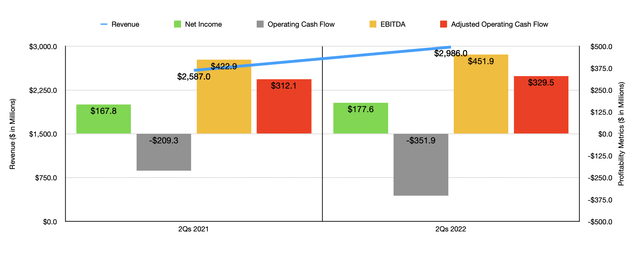

Fundamental performance for the company remained robust for the first half of the firm’s 2022 fiscal year. Revenue during that time frame came in at $2.99 billion. This represents an increase of 15.4% compared to the $2.59 billion generated one year earlier. Once again, the company benefited from growth across all three of its operating segments. But the greatest expansion here involved the metal containers portion of the enterprise. Revenue under this segment jumped by 19.2%, climbing from $1.18 billion in the first half of 2021 to $1.41 billion the same time this year. According to management, this increase was driven largely by higher average selling prices as management continued to push through higher raw material and manufacturing costs to its customers.

But this is not to say that the company is able to do this without any drawbacks in perpetuity. During that six-month window, unit volumes actually came in about 12% lower than what they were one year earlier. This does suggest some weakness in demand because of the higher pricing of the company’s products. Management attributes this to a loading up of inventory by customers in the prior year period. In short, the argument is that, in anticipation of rising costs, customers basically bought sooner than they otherwise would have, frontloading their inventories.

This rise in revenue still brought with it an increase in profitability. Net income for the first half of the year totaled $177.6 million. That compares favorably to the $167.8 million seen one year earlier. Operating cash flow did decline year over year, falling from negative $209.3 million to negative $351.9 million. But if we were to adjust for changes in working capital, it would have risen modestly from $312.1 to $329.5 million. Over that same window of time, EBITDA for the company also expanded, rising from $422.9 million to $451.9 million. Management has taken this opportunity to reward shareholders in the form of share buybacks. In March of this year, for instance, the company announced a $300 million share buyback program. During the first six months of the year, the firm bought back nearly 650,000 shares of stock for a combined $26.4 million, leaving $273.6 million in available capacity. Given the timing of cash flows for the business, it wouldn’t be surprising to see these share repurchases pick up over the next few months if profits remain high. And in February, the company bought back all $300 million worth of the 4.75% senior notes that it had coming due in 2025. Though that interest rate is fairly low, it will save shareholders roughly $14.3 million, on a pre-tax basis, annually.

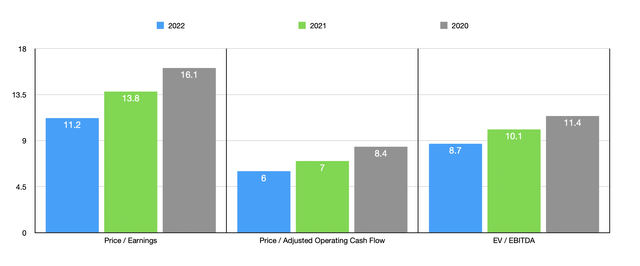

When it comes to the 2022 fiscal year as a whole, management anticipates earnings per share, on an adjusted basis, of between $3.90 and $4.05. At the midpoint, that should translate to net income of $442.1 million. No guidance was given when it came to other profitability metrics. But if we assume that they would increase at the same rate the net income should, then we should anticipate adjusted operating cash flow of $832.7 million and EBITDA of $1.02 billion. Using these figures, we can easily value the company.

As you can see in the chart above, the firm is trading at a forward price-to-earnings multiple of 11.2. This is down from the 13.8 multiple seen using results from 2021 and is down even further from the 16.1 reading that we get using results from 2020. The price to adjusted operating cash flow multiple is even lower at 6, while the EV to EBITDA multiple comes in at 8.7. These numbers are also lower than what the company would be trading at if we used estimates from prior years. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 4.4 to a high of 27.1 and when it comes to the EV to EBITDA approach, the range was from 5.2 to 12.2. In both cases, three of the five companies were cheaper than Silgan Holdings. Meanwhile, using the praise to operating cash flow approach, the range is from 4.8 to 13. Two of the five companies were cheaper than our prospect in this scenario.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Silgan Holdings | 11.2 | 6.0 | 8.7 |

| Ardagh Metal Packaging S.A. (AMBP) | 15.7 | 8.5 | 9.5 |

| AptarGroup (ATR) | 27.1 | 13.0 | 12.2 |

| Berry Global Group (BERY) | 9.4 | 4.8 | 7.6 |

| Greif (GEF) | 10.4 | 6.7 | 5.9 |

| O-I Glass (OI) | 4.4 | 5.3 | 5.2 |

Takeaway

Based on all the data provided, it looks to me as though Silgan Holdings it’s still doing a really great job considering the current economic environment. I am slightly worried about the decrease in unit volume that the company has reported. But given how cheap shares are, even if the business were to revert back to levels of profitability experienced in 2020 or 2021, I do believe that the future for the company should be bright. But because the company has narrowed in terms of valuation compared to what other companies like it are priced at, I have decided to lower my rating on the business to just a solid ‘buy’ for now.

Be the first to comment