Ethan Miller/Getty Images Entertainment

Investment Thesis

Wynn Resorts stock is down 33% in a year’s timeframe. Headwinds in its Macau operations are hurting the company’s performance. COVID-related restrictions may stay in place for a bit longer in Macau. However, those should eventually get lifted, which should boost Wynn’s earnings. When that happens, the stock will surely see a rebound.

About Wynn Resorts

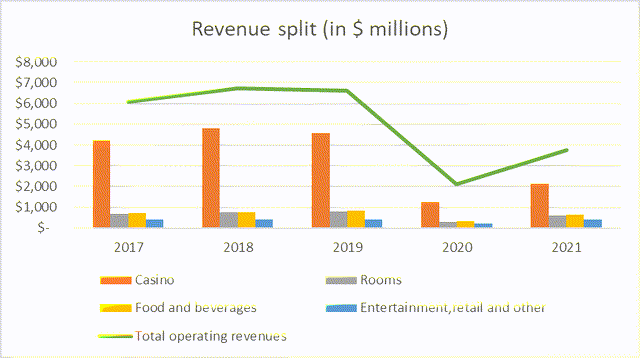

Wynn Resorts (NASDAQ:WYNN) operates luxury casinos and resorts. It has four megaresorts – Wynn Macau and Encore in Macau, and Wynn Las Vegas and Encore in Las Vegas. In Massachusetts, they operate Encore Boston Harbor. The company also operates online sports betting, gaming, and social casino business through Wynn Interactive Ltd. Majority of its revenue comes from casino business. However, this number saw a steep fall in 2020. The issue is that the casino revenue hasn’t recovered even now.

As seen in the chart above, the revenue from casinos reduced drastically in 2020. The casino revenue, which stood at $4,574 million in 2019, was nearly reduced to half at $2,133 million in 2021. Although this has recovered over 2020, it is still far below the pre-pandemic levels.

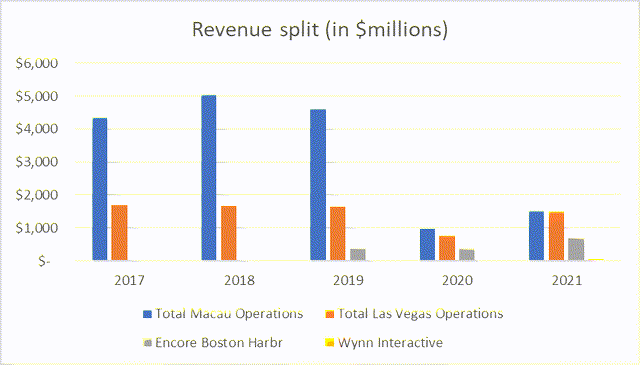

Macau is the biggest contributor to Wynn’s casino revenue. This makes the revenue susceptible to the COVID-related restrictions in Macau. Recently, Macau has been grappling with COVID spread and has implemented lockdowns to curb the spread of the virus. This does not bode well for the company which has historically been dependent on Macau for majority of its revenue.

Lower Macau revenue hits Wynn’s performance

In the second quarter, Wynn Resorts’ total operating revenues stood at $908.8 million as against $990.1 million in second quarter of 2021, falling 8.2%. The biggest contributor of revenue, Casino segment, saw a decrease of 40.3%. Casino revenue for Q2 2022 stood at $359.6 million as against $602.7 million last year.

Rooms revenue grew 46.1%, Food and beverage revenue grew 54.1%, and Entertainment, retail and other revenue grew 17.6%. Total operating expenses decreased 5.8% to $960.9 million in Q2 2022 as against $1,019.6 million in Q2 2021. The operating loss widened to $52 million in Q2 2022 as against a loss of $29.5 million in Q2 2021.

The Macau operations were affected due to COVID-related restrictions during the quarter. Management believes that this market will benefit in the long-term with return of visitation over time. Current situation in Macau warrants worry for investors as the operations in the area will likely be affected due to COVID-related restrictions even in the coming quarters.

If we analyze the geographical revenue split of the company, then Macau operations were the only area where the company saw a revenue decrease. Total Las Vegas operations saw a growth of 58%, Encore Boston Harbor saw a growth of 27.2%, and Wynn Interactive saw a growth of 32.2%. Thus, the only contributor to the fall in total revenue was Macau operations. Going forward too, unless the situation in Macau gets better, one should expect similar revenue trends.

Why Macau matters?

Macau business was the highest revenue contributor over several years for the company. Macau operations contributed nearly 70% of the total revenue in 2019. Thus, any slowdown in the market would restrict the company in reaching the pre-pandemic sales levels. Unlike other casino players who are concentrated in Las Vegas, Wynn resorts is dependent heavily on Macau. Revenue from Macau stood at $4,613 million in 2019. This reduced to $1,509 million in 2021. This trend continued in 2022 too with Macau operations seeing a decrease in revenue. Thus, pre-pandemic level revenue recovery seems far at this moment.

Valuation

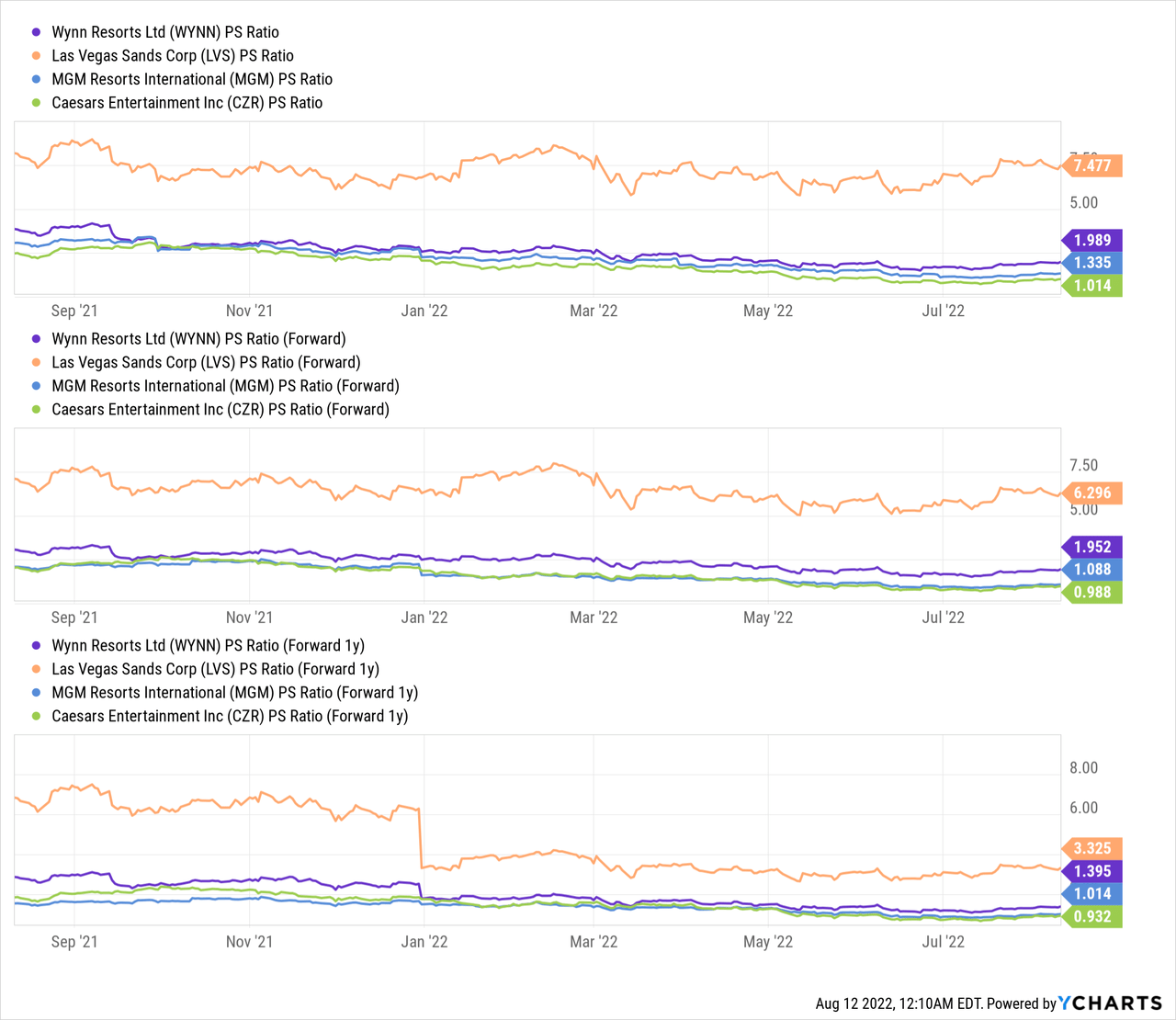

Wynn Resorts’ stock is trading at an attractive PS ratio when compared to Las Vegas Sands (LVS). However, that has historically been the case. Wynn’s forward PS ratio based on sales estimates for the current fiscal year is higher than its current PS ratio, implying that analysts expect its sales to remain depressed in the coming quarters too.

However, its 1-year forward ratio is lower than the current ratio, indicating an eventual recovery in sales.

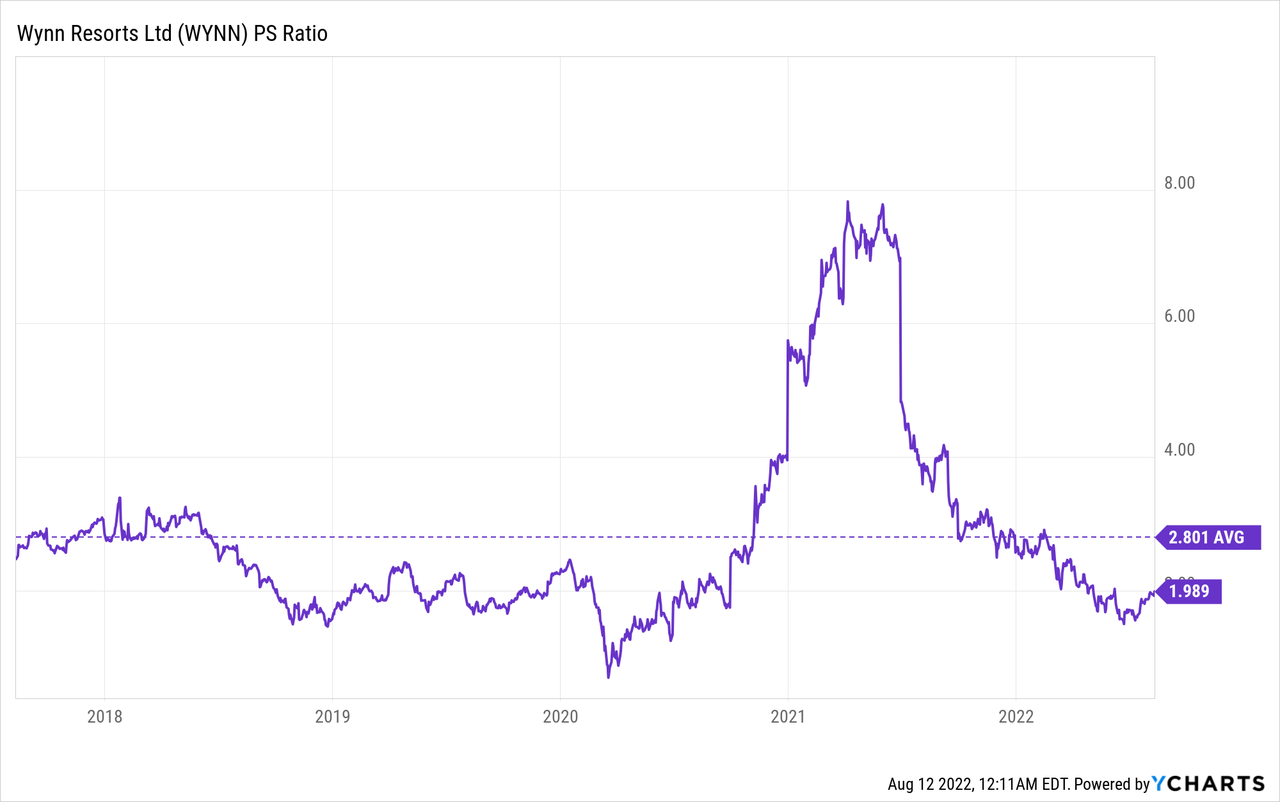

Due to the headwinds that the company is facing in Macau, Wynn’s PS ratio is lower than its own 5-year average ratio.

Overall, the stock seems to be attractive based on valuation.

Seeking Alpha’s proprietary Quant Ratings rate Wynn Resorts as “Hold.” The stock is rated low on Profitability and Revisions factors.

Conclusion

Casino industry as a whole might be seeing a recovering in Las Vegas, as is evident from the Las Vegas operations numbers of Wynn Resort too. However, the company’s main revenue contributor has been Macau Operations. This segment is still hit with COVID-related lockdowns. Thereby, Wynn Resorts would take more time than its Las Vegas-located peers to fully bounce back to pre-pandemic levels.

Thus, one can find faster growth in Las Vegas peers with better near-term prospects of full recovery. Wynn Resorts investors will have to still wait and watch the situation in Macau. Thus, it is a stock for patient investors with a higher appetite for risk.

Be the first to comment