Sean Gallup/Getty Images News

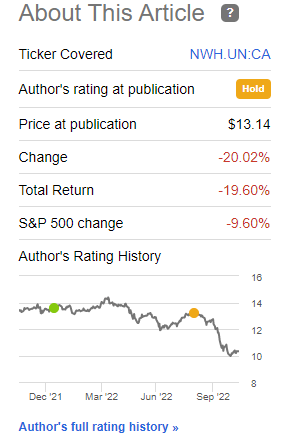

When we last covered NorthWest Healthcare Properties REIT (OTC:NWHUF) (TSX:NWH.UN:CA), we told investors that they need to keep their eyes on the ball and not lose sight of the immense leverage that the REIT had. The numbers had been bumped up thanks to yet another acquisition in a long list of acquisitions that did nothing to boost the adjusted funds from operations (AFFO).

But the risks are increasing, and this empire building has squashed returns versus where they could have been. Asset buying has costs and AFFO does not even capture that. Multiple equity issuances below NAV, also have costs. That is why we are sitting at $0.80 in AFFO versus a possible $1.20. We are not even fond of the AFFO quality today, as we view management fee AFFO as of lower value than property NOI derived AFFO. Overall, we have little faith in this strategy, but it is one that might not blow things up for a while. We also think they could sell this for a small premium even today. All of this gets us to a “hold”.

Source: Keep Your Eye On That Leverage

The stock as traded on TSX has dropped sharply.

Seeking Alpha

The US OTC securities have fallen even faster with the Loonie in the bin. As our readers know, we are most attached to value and often change the opinion on a security when the price changes. Is there a case to be made today?

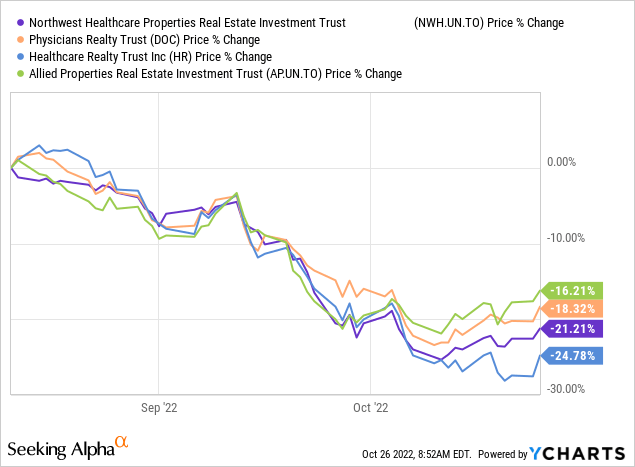

Performance

While NWHUF declined sharply, this was part of a generalized downturn seen in the market. On the US side, Physicians Realty (DOC) and Healthcare Realty (HR) tanked hard. Allied Properties Real Estate Investment Trust (AP.UN:CA), which is a general office REIT, also dropped as much.

Sentiment aside, NWHUF has some particular challenges that are unique to it.

Debt

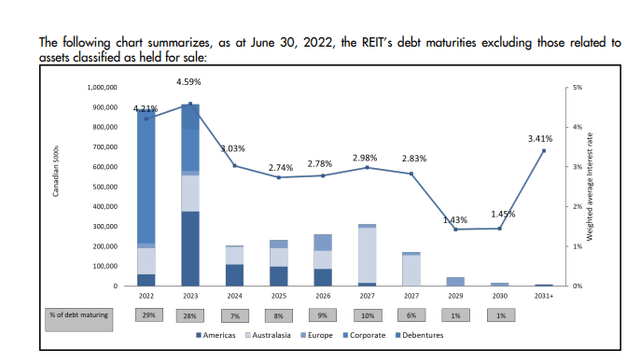

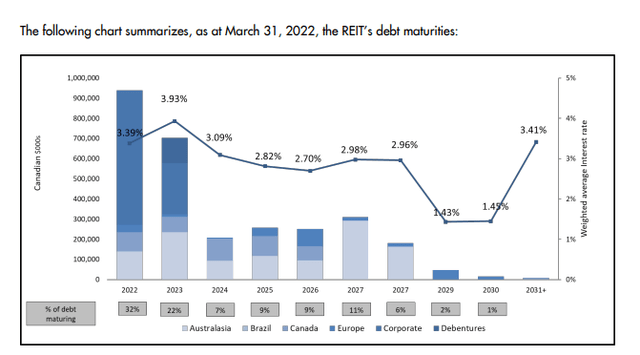

NWHUF has a lot of refinancings ahead of it. Total debt was about $3.75 billion and more than half was coming up for refinancing based on the Q2-2022 numbers by end of 2023.

A lot of this debt is currently floating. One easy way to visualize just how much fun these rate hikes are having with NWHUF is to look at the delta in interest rates from Q1-2022 (below) to Q2-2022 (above).

By the time we get to Q4-2022 results these numbers will be running through NWHUF’s interest coverage and AFFO with a vengeance. Q2-2022 refinancings were done when market conditions were mild as opposed to the current wild conditions. Even those tiny ones got a 1.4% bump.

During the three months ended June 30, 2022, the REIT refinanced and amended Canadian mortgages totaling of $51.1 million maturing in the upcoming year, bearing weighted average interest rate of 3.82% with new mortgages of $50.8 million, bearing weighted average interest rate of 5.20% with weighted average term to maturity extended by 4 years.

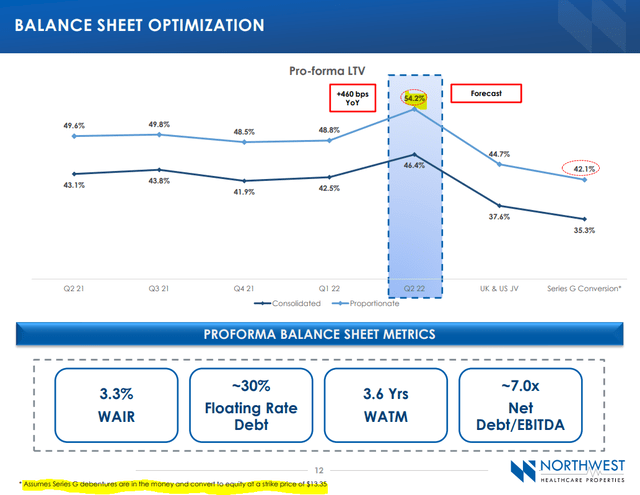

NWHUF was trying to accomplish massive joint ventures on the large (is there another kind this REIT does?) acquisitions on last check. These included trying to move $1B of U.K. hospital assets into a new structure. Considering the climate in the UK financial markets, we are going to go out on a limb and say that this will likely take some time. The second was forming a joint venture around the U.S. portfolio. This could happen, but we doubt they would get close to what they paid for those assets on a proportionate basis. They bought at the market top in 2022 and now will have to settle for less. They also planned to raise capital for a new $5 Billion global healthcare fund. The last one is dead on arrival. The first two were expected to lower leverage by 900 basis points.

Convertible Debt Issue

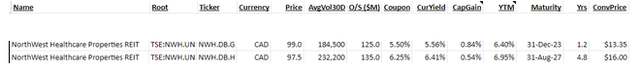

NWHUF did manage to get convertible debentures issued in Q3-2022.

TORONTO, Aug. 25, 2022 /CNW/ – NorthWest Healthcare Properties Real Estate Investment Trust (“NorthWest” or the “REIT”) is pleased to announce the closing of its previously announced public offering (the “Offering”) whereby NorthWest sold $135 million aggregate principal amount of 6.25% convertible unsecured subordinated debentures (“Debentures”), on a bought deal basis, to a syndicate of underwriters (the “Underwriters”) co-led by RBC Capital Markets and Scotiabank.

The REIT has granted the Underwriters the option to purchase up to $20.25 million aggregate principal amount of additional Debentures at a price of $1,000 per Debenture to cover over-allotments, exercisable in whole or in part anytime up to 30 days following closing of the Offering.

The REIT intends to use the net proceeds of the Offering to repay short-term floating rate debt with a weighted average interest rate of approximately 7.5% and for general trust purposes.

Source: Yahoo

The convertible debentures were a stroke of genius. Giving people the lollipop of a potential capital gain via conversion (at $16.00), while knowing that there was no planet on which the company would not dilute like crazy if the shares would ever get in that price postal code. But the amount is really small. They have a lot of refinancings ahead and that leverage reduction is not likely coming through.

Verdict

NWHUF is definitely in a pickle here. Leverage was really high after the large acquisition. Deleveraging assumed two joint ventures and conversion of convertible debentures into common shares.

At the current price and market conditions, none of those three are happening. As we walk through refinancing rates and the pound of flesh likely to be extracted on the credit facilities, we are growing increasingly concerned that the dividend might get cut.

Trapping Value

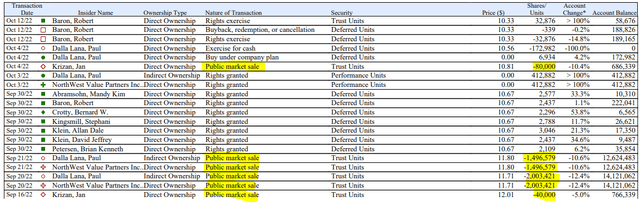

This rating signifies a 33-50% probability of a dividend cut in the next 12 months. Insider selling has been particular heavy as well.

Note that Northwest Value Partners Inc. transactions are the same ones which show up under the CEO, so investors should not double count them. Nonetheless, the selling has been high, considering that it has occurred after the share prices have dived.

Even though the shares are cheaper, we are finding better values where companies have mainly long-term debt in place and have zero shorter term refinancings to get through. We continue to rate the common shares as a hold/neutral.

Investors wanting exposure here, can consider the shorter-term convertible debentures with a yield to maturity of 6.4%.

Canadian Convertible Debentures

We had earlier owned the NWH.DB.H but got out at par when we saw the writing on the wall. We expect a large issue from the REIT and this one will likely come at far higher cost. That could smash NWH.DB.H far lower.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment