Sundry Photography

Investment Thesis

WW International (NASDAQ:WW) is not in a good place. The business is experiencing some severe headwinds in revenue and subscriber growth. The company has repeatedly failed to adapt and generate sustainable top-line growth. The business is starting a promising turnaround, but I want to see solid progress before I would consider investing.

WW International’s Long-Term Decline

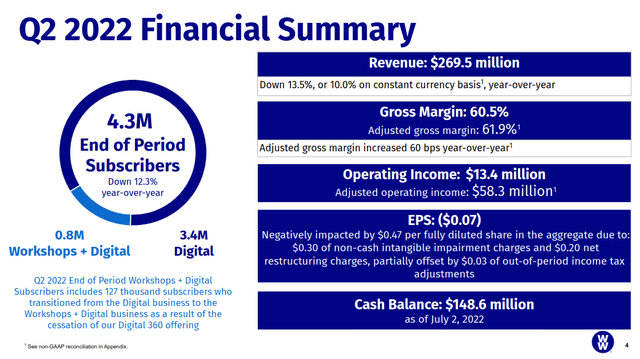

WW International is still suffering from a long-term decline in revenue. Over the past 10 years, the company’s top line has decreased at a negative 4.5% CAGR. The company’s last quarter was especially poor. The business reported a 13.5% drop in revenue and a 12.3% drop in subscribers year over year.

WW International Q2 2022 Earnings Deck

A major driver of this long term trend is the decline in the company’s physical workshop offerings. The weight loss industry has become increasingly digital. This has disrupted WW’s core business, forcing them to move online as well. This digital segment has higher margins but lower revenue.

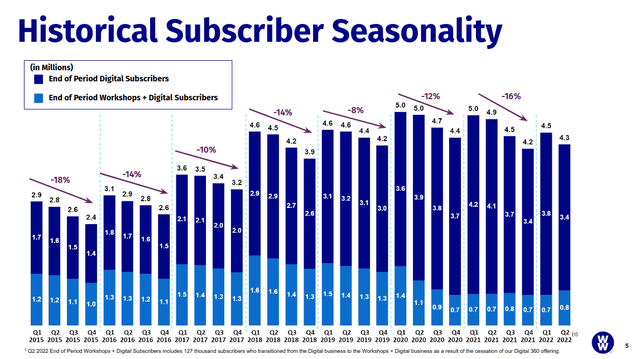

WW’s physical segment reported a large decrease in customers during the pandemic. Workshop subscribers cratered by almost half over the course of 2020. The reopening of the economy hasn’t created much of a boost either. Workshop subscribers have stayed relatively flat over the past two years.

WW International Q2 2022 Earnings Deck

The growth trends have gotten worse lately. Even as the company’s top line was declining, it managed to consistently grow its subscriber counts year over year. But this trend has reversed in the past two years. The company reported a year over year subscriber decline last year. The last quarterly report showed subscribers down by double digits year over year. Management expects to end the year with 3.5 million to 3.7 million subscribers. This would be the worst result since 2017.

WW simply hasn’t been effective at adapting or dealing with headwinds to their business. The company spent years launching a variety of new offerings with mixed results. Late last year, the company announced its PersonalPoints offering. This is an engine that personalizes the Weight Watchers service. But management recently revealed that the offering has underperformed and hurt sign up performance. The company’s past attempts have also performed poorly. The business shut down its Digital 360 offering within two years of its launch.

WW International’s management mentions several tailwinds for the weight loss market. One example is widespread weight gain caused by lockdowns and the pandemic. People are now looking to improve their health since the economy has reopened.

But the competitive landscape has changed. Weight Watchers now competes with a variety of weight loss and calorie tracking apps. I think that competitors such as Noom have done a better job of positioning their offerings in the current market. There’s also the explosion of diet and fitness advice available on the internet and social media. I don’t believe that a favorable macro backdrop is enough to confidently buy shares.

What Is The Company Doing To Turn Around?

WW International is trying to turn itself around. The company replaced its CEO earlier in the year. The business has started a series of cost cutting measures. This will save an estimated $35 million per year.

The company has also started cutting and streamlining unnecessary assets. The company sunset its Digital 360 offering. It shut down Kurbo, a coaching program for kids and families. Management is also trying to streamline their consumer products business. They cut the segment’s SKUs from 358 down to 113. They are phasing out Wellness Wins, WW’s in app rewards program.

These are significant steps to move the business forward. The company has a lot of services and side businesses that are likely a drain on resources. But there still isn’t a clear path to growth. This is even more important now that both subscribers and revenue are deteriorating.

The company’s new strategy focuses on building communities to improve retention. This includes doubling down on the company’s physical presence. That experience can then be expanded to digital channels. On their last earnings call, the new management explained their plan.

The workshop experience is about a peer-to-peer experience. It’s the coaches they are facilitating but people are on a journey together. They’re coming for the weight loss, but they’re staying there because of the belonging, because of the connection because people are supporting each other through their weight-loss journey. That’s the part that I’m saying is missing from Digital.

Digital ends up being a very lonely experience. And remember, we’re coming out of two years of COVID, where people feel lonelier than ever, and weight loss is an emotional problem. In order to solve it, you needed emotional solution that’s only something that other humans can provide… we need to bring more of that magic online. I’m not saying it literally. I mean it figuratively that we can build better community. You come for the weight loss that you stay for the community.

This sounds like a step in the right direction. In the past, the previous management seemed to deny that there were problems in the core business. On their earnings calls, they repeatedly blamed macro pressures. They also haphazardly launched new products without a clear goal. A renewed focus on the core business is important here. But this vision is still a long way away, and the company has a poor track record of delivering on its promises. I want to see evidence of growth before I become invested in this story.

High Leverage Makes The Company More Expensive

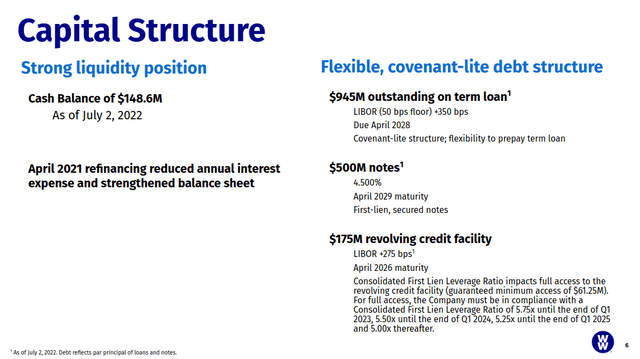

WW International is trading at only a $280 million market cap. This puts the company at a P/S of 0.25 times and a P/E of 4.4 times. But this doesn’t account for about $1.5 billion in long term debt and liabilities.

WW International Q2 2022 Earnings Deck

This debt isn’t an immediate concern since a lot of it isn’t due for many years. But after adjusting for it, the business is trading at an EV/E of 26 times and an EV/FCF of 13 times. This strikes me as an expensive valuation for a business with this type of growth trajectory.

This gives the company a debt to adjusted EBITDA ratio of 4.8 times. This is extremely high. Worse, management has guided for this number to increase over the rest of the year and into 2023. $945 million of this debt is at a variable rate as well. This is very concerning since the debt burden may limit the company’s options.

WW’s liquidity and cash burn positions are more promising. The company is consistently free cash flow positive. The business generated $128 million in the past year. Also, the company has over $150 million in cash on hand plus a $175 million revolver to ensure liquidity.

Still, this company is unlikely to return any meaningful amount of cash to shareholders for many years. This isn’t promising for a company that still hasn’t managed to find its footing in the digital age.

Final Verdict

There may be a good turnaround story here, and I think this stock is worth watching. WW International’s new management has identified some core issues with the business. But the company fundamentally isn’t in a good place. Management’s commentary about “stabilizing” the business reflects this. Because of the company’s poor track record, I want to see evidence of stabilization or growth. For these reasons, I recommend avoiding this stock at the current time.

Be the first to comment