izusek

Materialise (NASDAQ:MTLS) was a real narrative stock through the pandemic, with its valuation becoming completely detached from the fundamentals of the business. Despite facing headwinds from a weakening macro environment and high energy prices, Materialise will continue to benefit from secular growth in additive manufacturing and a rebound in automotive and aerospace manufacturing. Given the current valuation, Materialise’s stock should perform well over the long-term, although progress on the profitability front may be required before the stock moves higher.

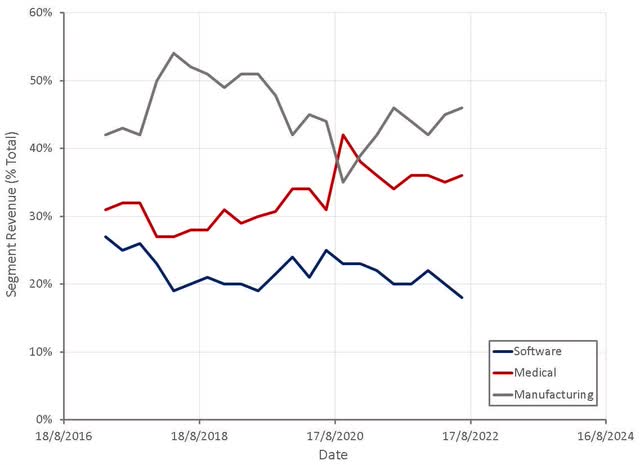

Materialise offers a range of additive manufacturing software as well as on demand parts printing. It segments its business into software, medical and manufacturing. They continue to build out the capabilities of their software platforms and are in the process of shifting towards higher value add manufacturing.

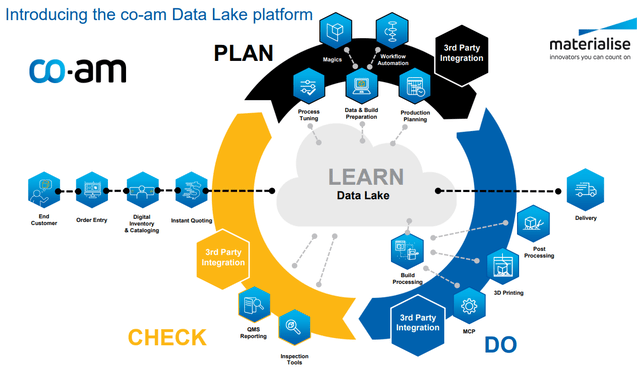

CO-AM Platform

Materialise will soon be introducing their CO-AM platform, which gives manufacturers cloud-based access to a range of software tools that enable them to plan, manage and optimize every stage of their operations. The CO-AM platform utilizes a datalake to connect all production tools and track operations, which aims to make optimizing operations simpler. Materialise will offer more than 25 software applications on its CO-AM platform, including integration with Magics; AM Watch for shopfloor data collection, and its Build Processors for connectivity with more than 150 different 3D printing systems.

Figure 1: CO-AM Platform (source: Materialise)

Materialise expects that the CO-AM platform will appeal to customers who operate a larger number of machines, with interest expected to come from something like 20% of the user base. Materialise’s Magics software is already widely used by larger additive manufacturing service organizations for data preparation, potentially giving the company a launchpad from which to introduce a more integrated solution.

The CO-AM platform will help to advance the use of additive manufacturing in serial production by helping manufacturers achieve the consistent quality standards that are necessary in mass production. Serial production refers to the manufacturing of large quantities of goods in batches, often producing a range of goods using one machine. For example, serial production would generally be used for mass personalization manufacturing.

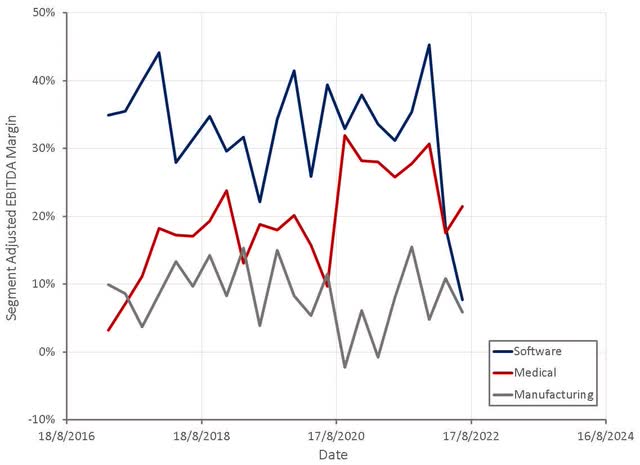

From a financial perspective, Materialise’s software segment is the most attractive part of the business, but growth has stagnated over the past few years. The CO-AM platform could reaccelerate Materialise’s software revenue growth, but should also be supportive of its other segments.

New Software Products

Materialise continue to build on the functionality of their software with the introduction of Magics 26. Magics is software for data and build preparation, and Magics 26 combines support for native CAD workflows with its existing mesh capabilities.

Magics 26 will incorporate the Siemens Parasolid kernel, opening up a range of new opportunities for users. Users can make adjustments to the original design files using CAD operations to increase printability. The adjusted file remains compatible with the PLM system and are easiest to use for post-processing steps such as CNC milling operations.

Link3D Acquisition

Materialise acquired Link3D in 2021 for 33.5 million USD. The acquisition will not have a material impact on revenues in the short-term and will be a drag on margins. In 2021, Link3D had revenues of 2.3 million USD and EBITDA losses of 4.6 million USD.

Link3D provides software for digital manufacturing which will help Materialise develop their cloud-based platform, by integrating Link3D’s additive MES (Manufacturing Execution System) solution with Materialise’s Magics software suite. MESs track the transformation of inputs into finished products and provide information that allows manufacturing operations to be optimized.

Software

Materialise sells software that is compatible with nearly all printer types to customers that own 3D printers in order to enhance their efficiency and throughput. Materialise offers two horizontal software platforms, Magics and Mimics. Materialise’s software offerings include:

- Software that converts a CAD file into a 3D printable format

- Software to optimize a specific 3D customer application

- Software to organize and integrate a “factory” of multiple printer types and brands

Software revenue comes from software licenses, maintenance contracts and custom software development services with the majority of sales through Materialise’s own sales force and a minority through system manufacturers.

Medical

Materialise produces both custom medical devices and software for making custom devices and helping doctors plan surgeries. 3D printing for medical applications is the fastest growing business at Materialise, driven largely by growing demand for 3D surgical implants. 3D printed medical devices at the moment are primarily surgical guides. In particular, CMF is the growth engine of the medical devices business. The medical business is also fairly exposed to elective surgeries, which was a large headwind early in the pandemic, but had more or less normalized by Q3 2020.

Materialise’s Mimics Suite realized revenues of almost 23 million Euros in 2021. Materialise is developing AI to support the planning of surgeries and the design of devices, in addition to introducing AR and VR functionality.

Manufacturing

Materialise utilizes its own printers to manufacture end-use parts and prototypes for customers, primarily in the medical devices and automotive fields. The key differentiating factors of Materialise’s 3D printing service are:

- The size of printers and the prototypes and parts that it can produce via Mammoth stereolithography printers

- The speed and variety in which parts can be produced, with Materialise operating one of the largest 3D printing sites in the world with a range of printing technologies.

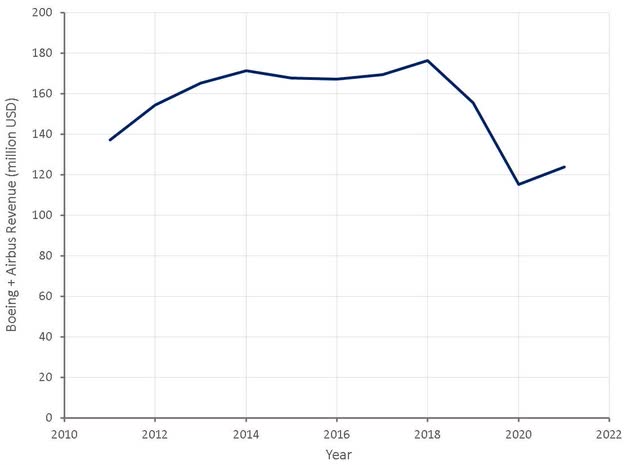

Materialise’s Manufacturing segment was the most negatively impacted by the pandemic, due in large part to its reliance on the automotive and aerospace sectors. Manufacturing revenue has now fully recovered, with Q2 2022 revenue exceeding Q2 2019 by more than 10%. There has been a substantial shift in the Manufacturing business which has driven this rebound though.

The manufacturing business is benefitting from a post-COVID rebound in product development that leverages additive manufacturing for prototyping. Materialise is also doing well in small, certified manufacturing series production.

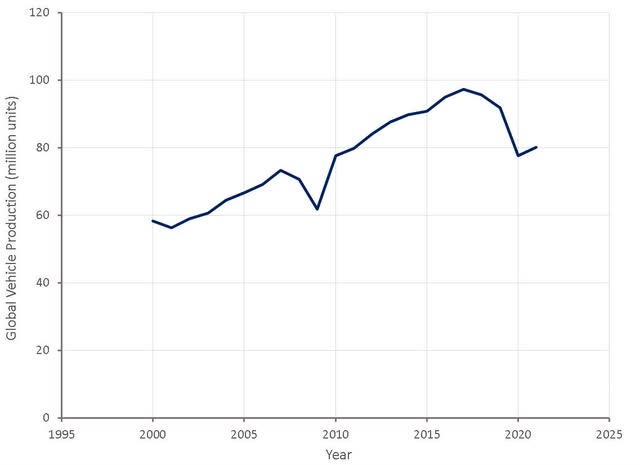

Figure 2: Global Vehicle Production (source: Created by author using data from OICA)

Figure 3: Boeing Plus Airbus Revenue (source: Created by author using data from company reports)

The importance of the automotive sector to Materialise’s plastics manufacturing activities has declined over time. Industrial goods and medical device contract manufacturing projects grew 25% YoY in Q2 2022, while automotive projects remained stable at 2021’s depressed levels. Within automotive subcontracting, Materialise has instead chosen to focus on areas with better margins, like large stereo-lithography parts printed on their Mammoth printers.

ACTech had a large legacy business involved in the development of new internal combustion engines for cars. The combination of diesel gate and the pandemic reduced ACTech’s turnover by approximately 50% in early 2020. ACTech has now pivoted from small cylinder blocks and turbochargers to complex casted components for electric car drive-trains and chassis. This shift has returned ACTech to pre-COVID revenues with a more favorable margin profile.

The ACTech facility can now support the manufacture of a wider variety of components and larger components using sand 3D printing. Sand 3D printing uses a sand-like working medium with a polymer to bind the particles together. This can be used to produce finished products or molds for an alternative material to be poured into. This has opened new opportunities for Materialise in agricultural, mining, construction and marine vehicles, producing a small series of large engine parts.

The complexity of these types of parts is increasing to improve the thermodynamic efficiency of engines, which necessitates the use of precision sand printing and casting small series parts. Sand printing, molds assembly, metal casting, and post processing steps, like CNC milling, are necessary competencies to support these types of operations, and Materialise believes that offering integrated solutions provides significantly more value to customers.

To support this opportunity, Materialise is investing in an additional 9,000 square meter facility that will be dedicated to CNC milling and quality control operations. This facility will also create space for Materialise to increase sand printing, molds assembly and casting operations in the old plant. Materialise expects to invest 23 million Euro’s in the coming years, which will double ACTech’s capacity.

Materialise’s Manufacturing segment also includes nascent footwear and eyewear businesses. These businesses aim to leverage the capabilities of 3D printing to cost-effectively create personalized designs and reduce inventories and inventory risk. Materialise made a strategic investment in Ditto in 2020 to support their eyewear business. Ditto is a developer of virtual eyewear try-on platforms. Materialise will be investing heavily in their Motion business in anticipation of the release of new products that should support long-term growth. The eyewear and footwear lines are currently experiencing volatile growth and it will take time before they become significant contributors to the Manufacturing segment’s revenue.

Financial Analysis

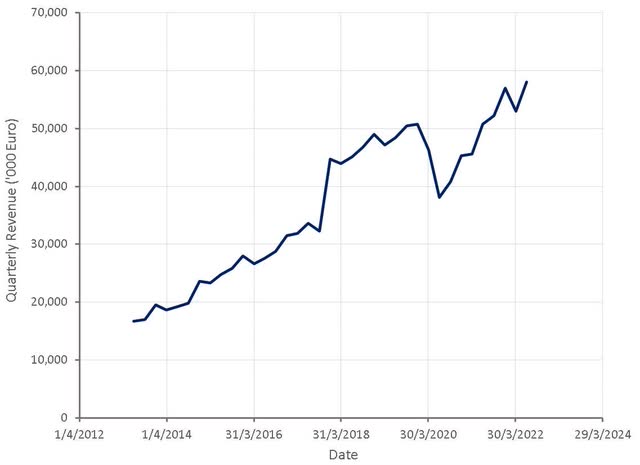

Materialise’s business is still recovering from the pandemic, and the manufacturing segment is currently driving growth as a result of this. Software revenue growth has been weak in recent years, although this is a period of significant investment and product development. Revenue from Link3D and the Magics cloud platform are not expected to be material until 2023. It should also be noted that Materialise’s transition to cloud hosted software will be a temporary drag on revenue growth due to the timing of revenue recognition. Despite deteriorating macro conditions, management continues to expect that revenue will grow in excess of 10% for the full-year, although this implies that growth may only be approximately 5% in the second half.

Figure 4: Materialise Revenue (source: Created by author using data from Materialise)

Figure 5: Materialise Segment Revenue (source: Created by author using data from Materialise)

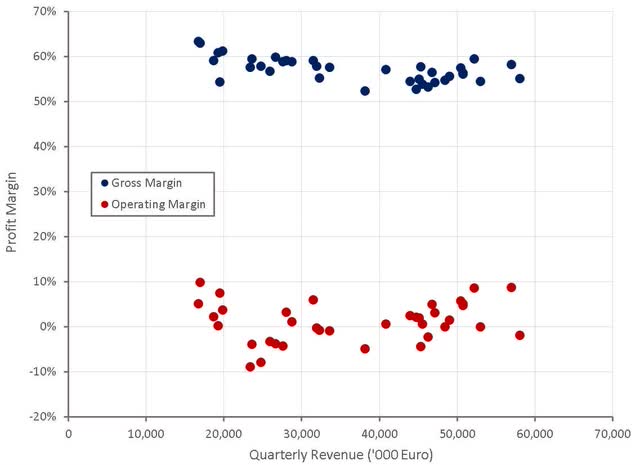

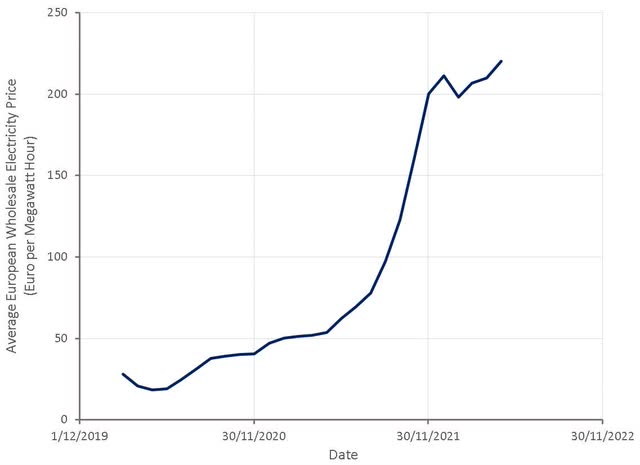

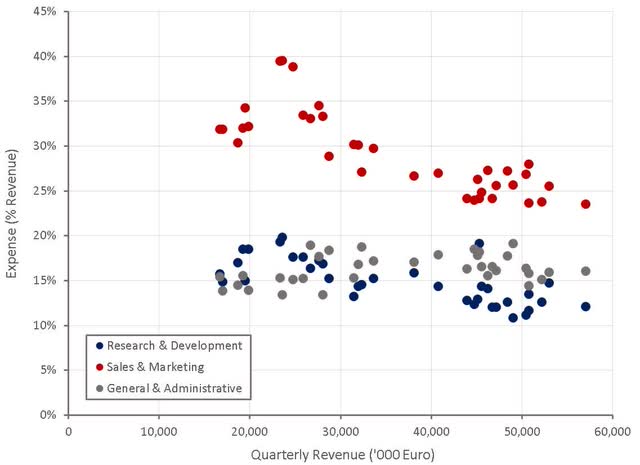

Materialise is facing pressure on margins from higher energy prices and wage inflation, but has so far managed to offset this through higher utilization, insourcing and productivity improvements. Materialise’s focus on higher value-added activities should also be supportive of margins going forward, although investments will be a headwind in the short-term.

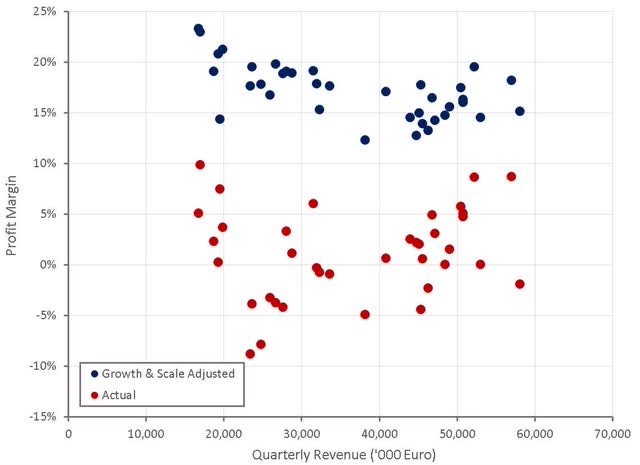

Figure 6: Materialise Profit Margins (source: Created by author using data from Materialise)

Figure 7: European Electricity Prices (source: Created by author using data from Statista)

Materialise’s business mix also has a large impact on margins, as each of their business segments has a very different margin profile. In particular, the manufacturing business has historically had very low margins, although this should improve going forward.

Figure 8: Materialise Segment Margins (source: Created by author using data from Materialise)

This is a period of significant investment for Materialise, including the launch of new products, expansion of facilities and an internal digital transformation project which is expected to commence in the fourth quarter of 2022. While these initiatives should be beneficial in the long-run, they are currently eroding margins. As Materialise scales and their growth normalizes, their operating profit margins should increase to the mid-teens, although this will be heavily dependent on the success of their growth initiatives.

Figure 9: Materialise Operating Profit Margins (source: Created by author using data from Materialise)

Figure 10: Materialise Operating Expenses (source: Created by author using data from Materialise)

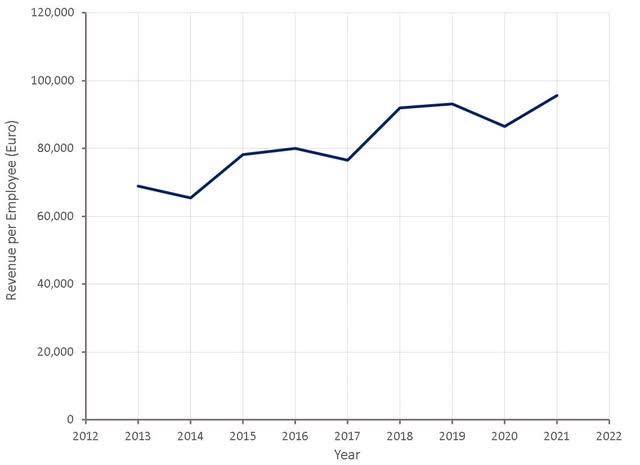

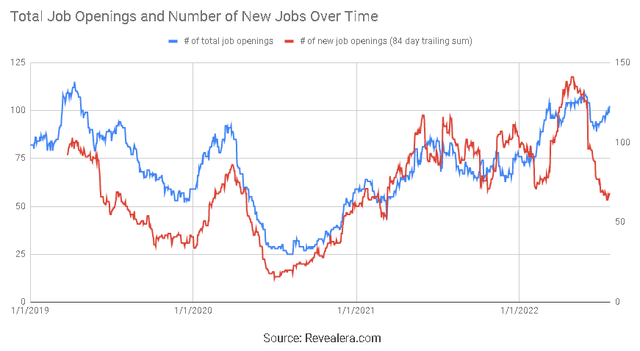

Increasing revenue per employee will be a large driver of margin improvements for Materialise as employees are one of the company’s largest cost drivers. The company continues to make progress on this front and it appears that hiring is fairly modest despite the company’s growth plans.

Figure 11: Materialise Revenue per Employee (source: Created by author using data from Materialise)

Figure 12: Materialise Hiring Trends (source: Revealera.com)

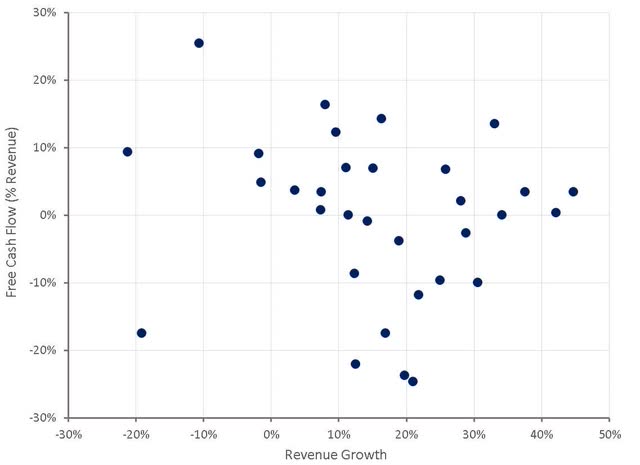

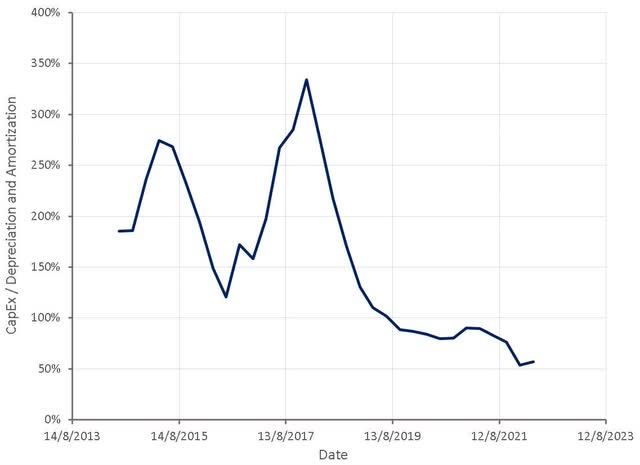

Materialise has generally been free cash flow positive in recent years, although this can largely be attributed to a period of weak investments. Investments are expected to increase significantly going forward, which will temporarily depress cash flows.

The 23 million Euros flagged for the ACTech expansion will go towards acquiring and renovating the building this year (6-7 million Euros), followed by 10 million Euros in 2023 and the remaining 7 million Euros in 2024.

Figure 13: Materialise Free Cash Flows (source: Created by author using data from Materialise)

Figure 14: Materialise CapEx Relative to Depreciation and Amortization (source: Created by author using data from Materialise)

Valuation

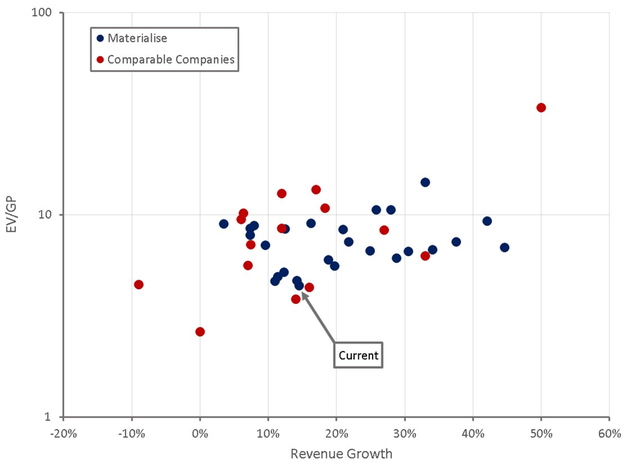

Materialise trades broadly in line with its own historical multiples, although it appears cheap relative to peers based on its growth and margin profile. Based on a discounted cash flow analysis I estimate that Materialise is worth approximately 17 USD per share.

Figure 15: Materialise Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Materialise has a solid business and is investing in capabilities that could significantly increase the company’s value. While the stock currently appears reasonably priced, Europe’s energy crisis creates a large amount of uncertainty for the manufacturing sector. Investments will weigh on margins in the short-term and a recession could undermine growth.

Be the first to comment