BlackJack3D

W&T Offshore (NYSE:WTI) is not well known like the larger Oil companies, and that’s where part of the value lies. Based in Houston, TX W&T Offshore has interests in 43 active Oil fields, and has 606,000 gross acres under lease for the purposes of Oil & Gas exploration and extraction. Their focus is in their backyard, i.e. the Gulf of Mexico on the shelf and Deepwater. Before getting into more details, let’s take a look at the basics, to use this as a baseline for a value comparison.

Fundamentals

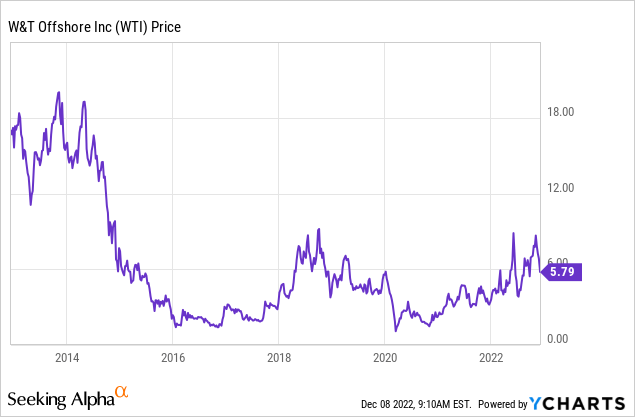

As you can see, at $5.79 a share it’s a bargain, even not considering the current global macro environment. The market cap is just over $900 Million, and the P/E ratio is below 4. That’s an amazing statistic, considering the P/E of tech companies like Amazon (AMZN) can be as high as 40, 50, or even 80 depending on how you calculate the P/E (trailing or forward). In any event, I think W&T Offshore has more room to move up vs. the Mega Caps. For example in the case of Exxon (XOM) how much higher can it go? Scaling issues become problematic when you are that big. W&T Offshore does not have that problem. It’s a relatively new player in the space, opening its doors in 1983 in Houston, TX – home of NASA.

They do not pay a dividend.

Competitors include Laredo Petroleum, Inc.(LPI), SandRidge Energy, Inc.(SD), SilverBow Resources, Inc. (SBOW), Berry Corporation (BRY), VAALCO Energy, Inc. (EGY), Callon Petroleum Company (CPE), Kosmos Energy Ltd. (KOS), GeoPark Limited (GPRK), Kimbell Royalty Partners, LP (KRP), and Vista Energy, S.A.B. de C.V. (VIST). Laredo Petroleum, Inc. has a P/E ratio of 2, which is better than W&T Offshore from a value perspective. SandRidge Energy, Inc. has a P/E ratio of just less than 4. SilverBow Resources, Inc. has a P/E ratio of less than 2. The whole sector seems to be a great value play, and unlike other sectors, consumers need energy. Or in other words, you can probably live without Amazon, but you can’t live without Gasoline. Let’s be realistic.

As referenced by an SA author that has been covering the stock since 2016:

..with the recent rally in oil and natural gas prices, the company managed to generate a significant amount of cash and cut its net debt to an attractive level. This overheated price environment has decreased significantly in the last few months and could drop lower depending on the world economy, which is struggling with a possible global recession in 2023. It puts solid financial support that helps the long-term narrative.

Part of the reason the P/E is so low is because they don’t pay a dividend, and also because they are a smaller local business, without a multi-national model like the ones the big firms operate. Oil markets can be volatile so the thinking likely is ‘safety in numbers.’

From W&T Offshore’s latest financial report, which is Q3 2022, they are having a fantastic year:

- 41.5 Boe/d – Maintained strong production of 41.5 thousand barrels of oil equivalent per day (“MBoe/d”) (50% liquids), or 3.8 million barrels of oil equivalent (“MMBoe”)

- $113.9M – Reported Adjusted EBITDA of $113.9 million for the third quarter of 2022

- $48.7M – Adjusted Net Income totaled $48.7 million, or $0.33 per diluted share in the third quarter of 2022

USD Inflation is complex, exposure to energy can’t hurt

The Macro market we are in Globally is super complex, due to the fact that inflation is likely caused more by sanctions, not Fed policy – explained here well.

Energy, and specifically Oil and Gas, is a great hedge because it drives the entire world. Although there have been huge efforts to increase the use of alternatives such as Solar and Wind, they currently represent a tiny minority of energy consumption. In the US, a tomato travels an average of 1500 miles from farm to store; NAFTA created a situation where large retailers were importing tomatoes from Mexico, to be sold in Wisconsin (that’s a long drive, using lots of Diesel!). Point being that any portfolio can use exposure to energy, but purchasing Oil (USO) is a linear solution. Companies like W&T Offshore are out there in the field, they are part of the service industry that surrounds energy. Without companies like W&T Offshore, consumers would not have access to Oil and Gas (they are providing a valuable service, a need if you will). Buying WTI stock, you’re not only buying the rights to the Oil and Gas in the ground they are extracting, you are betting on their team to bring it to the consumer, to refine it, crack it, and make it consumable. This is not an easy business! W&T Offshore has a track record of success and professional corporate execution.

Recent deals

W&T Offshore is always on the hunt for fresh deals. In September they refinanced their debt, closed some hedge positions and used that free cash to pursue more deals in the Gulf of Mexico:

refinance notes due in late 2023 using some of the proceeds from closing profitable hedges, Chief Executive Tracy Krohn said on Wednesday. The company also plans to pursue new properties in the U.S. Gulf of Mexico where it has operated for 40 years as its trims debt and builds cash reserves, Krohn said at the Barclays CEO Energy-Power Conference. W&T Offshore historically has acquired assets in the Gulf of Mexico, expanded their production and used the cash flow to pay down debt and finance further acquisitions.

W&T is not a well known name in the industry, and we feel that’s exactly why it’s a good buy. This is reflected in the P/E ratio and other variables. They have strong cash flows from Oil and Gas operations and are using the bull energy market in the right way.

Unlike many companies, W&T does have a hedging department. About 50% of publicly traded companies hedge, W&T is one of them. That puts them in the class of companies that is staying on top of markets, so they can avoid the absurd excuses when markets move against them. They even publish a summary of their hedging operations on their website for investors.

They hedge their Oil and Gas supply mostly by buying puts, or selling Oil today for delivery some day in the future. They also utilize complex hedging strategies involving swaps and collars, a sign of a sophisticated hedging operation. Due to the hedging, it would limit the companies ability to capture the bull market in Oil, but only by a margin. The hedging will reduce the risks on the downside, should Oil fall, and the energy markets can be extremely volatile. So we see the hedging as a plus, not as a minus.

In conclusion, we are bullish the sector, and bullish on energy. We recently wrote a bull article for Devon Energy (DVN). We think that some companies, such as W&T Offshore, stand out from its peers.

W&T has great management, is in the right market (Oil & Gas) and is undervalued, what else do you want in a stock?

Risks

Obviously, this is a bet on a bull energy market. In the future, should alternatives grow rapidly, there would be less demand for Oil. Climate Collapse could cause infrastructure to be damaged. For example, Oil is produced in regions that are prone to severe Hurricanes, such as in the Gulf of Mexico. This happened in March in Kazakhstan, not in the US, but it can happen here too. The planet has seen an uptick in major planetary events such as earthquakes, volcanoes, and violent storms around the world. While unlikely, a major climate event could damage infrastructure and limit the companies ability to produce or sell. To be clear, it wouldn’t necessarily have to be W&T Offshore that gets damaged, it could be any of the infrastructure down the pipe they rely on to sell product.

We feel though, that the benefits outweigh the risks – however any investor should be aware of the risks and manage their portfolio appropriately.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment