Kwarkot/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

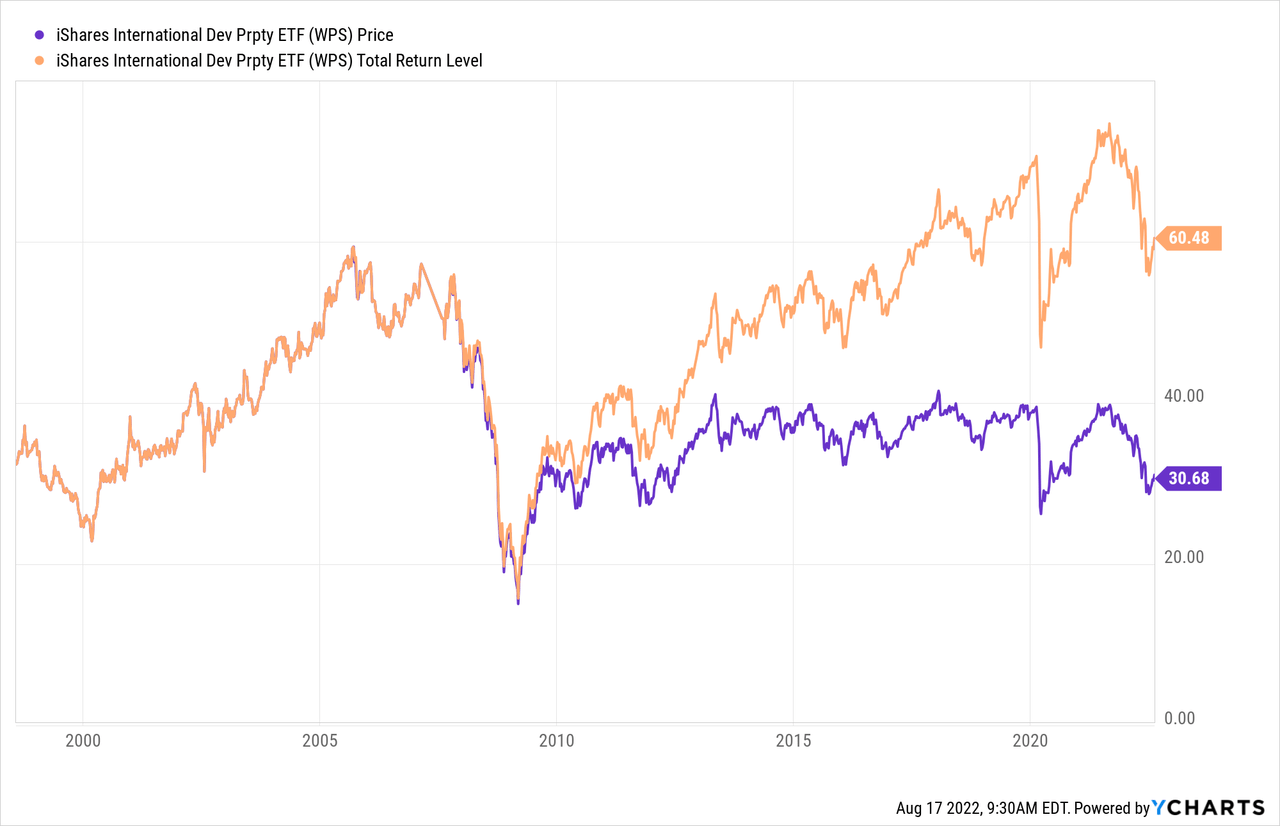

In this article I will review two International Real Estate ETFs even though this is an asset class that has done poorly compared to the Vanguard Real Estate ETF (VNQ) which invests in the US REITs market. The picture is more mixed for the iShares International Developed Property ETF (NYSEARCA:WPS), but the clear laggard is the Vanguard Global ex-U.S. Real Estate ETF (NASDAQ:VNQI). More on that in the Portfolio strategy section of this article.

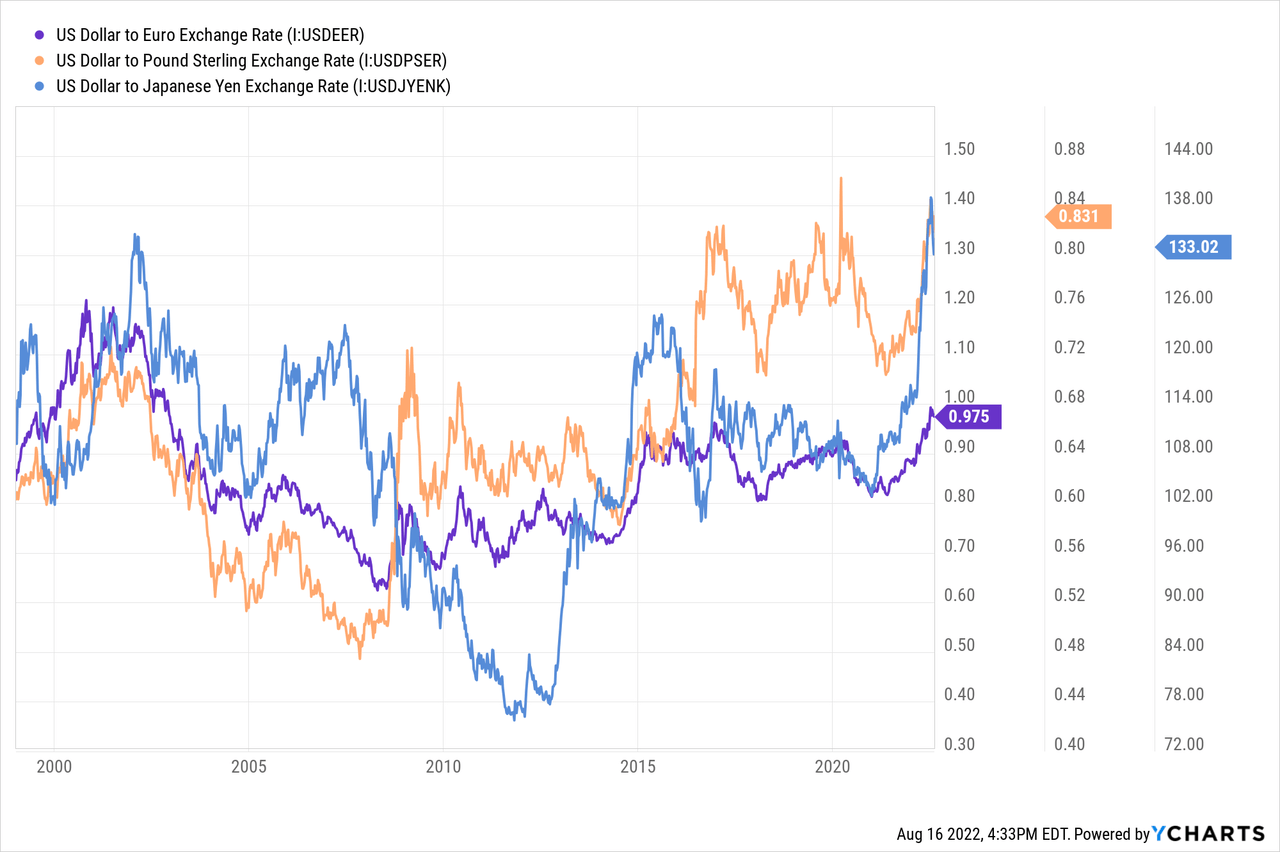

One factor that effects USD investors when putting funds into assets priced in other currencies is the movement of the USD against those currencies unless the investor, or in this scenario, the ETFs hedge against that effect; neither of these ETFs hedge.

Currently the USD is on a tear, almost reaching the peak hit at the height of the COVID panic. While that strength is not good for foreign assets, when the USD reverses course and weakens versus these currencies, it should add to the performance of both ETFs covered here. For more on the subject, here are links to recent Seeking Alpha articles about the strength of the USD:

I give WPS a BUY rating in lieu of buying a Total International equity ETF, but a HOLD when the other investment would be a Developed International equity ETF. I would pass on VNQI for international exposure.

iShares International Developed Property ETF review

Seeking Alpha describes this ETF as:

iShares International Developed Property ETF is an exchange traded fund launched by BlackRock, Inc. It is managed by BlackRock Fund Advisors. It invests in public equity markets of global ex-US region. The fund invests in stocks of companies operating across real estate sectors. It invests in growth and value stocks of companies across diversified market capitalization. WPS may invest up to 20% of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the index, but which BFA believes will help the fund track the index. The fund seeks to track the performance of the S&P Developed ex-U.S. Property Index. WPS started in 2007.

Source: seekingalpha.com WPS

WPS has $62.5m in AUM and has a TTM yield of 4.67%. The managers charge 48bps in fees.

Index review

With WPS investing based on an Index, some understanding of that index is important. S&P describes the Index used as:

The S&P Developed Ex-U.S. Property Index defines and measures the investable universe of publicly traded property companies domiciled in developed countries outside of the U.S. The companies included are engaged in real estate related activities, such as property ownership, management, development, rental and investment.

Source: spglobal.com Index

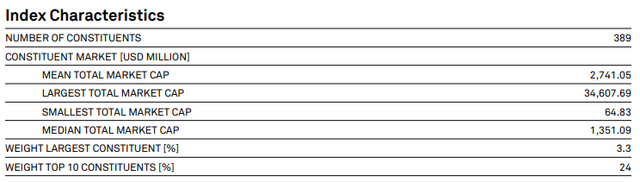

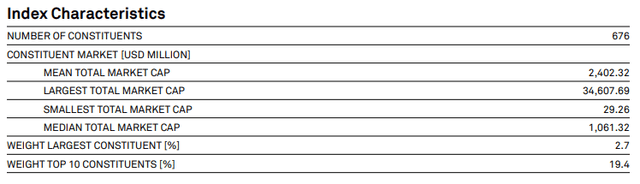

S&P provides some basic statistics on the Index.

The Index is rebalanced annually in September with share changes and IPO updates in March, June, and December. The Property Index specifically excludes companies whose main source of revenue is derived from fees or interest earned when providing real estate services or financing. The REIT indices specifically exclude timber REITs, mortgage REITs, tower REITs, and mortgage-backed REITs. Over the past decade, the Index shows a 1.08% CAGR.

WPS holdings review

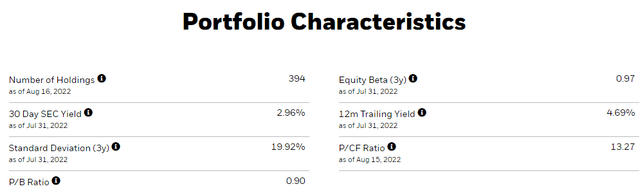

iShares provides a standard set of data points for their ETFs:

Like stocks, REITs also have sectors though different managers/index providers use different sets or even different assignments.

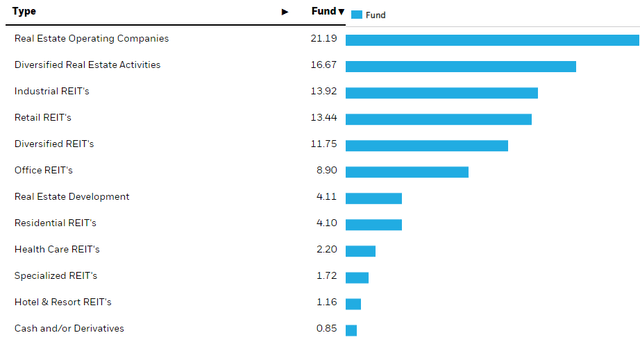

Because both of these ETFs use SPGlobal indices, the classifications match and I will compare them later in this article. The next table shows the allocations to the Top 10 countries.

With the exception of no China allocation (by rule), the rest closely match VNQI. Noticed “developed” is not based on size but country and market rules/stability, thus Singapore and Israel are okay. Hong Kong is also based on historical designation.

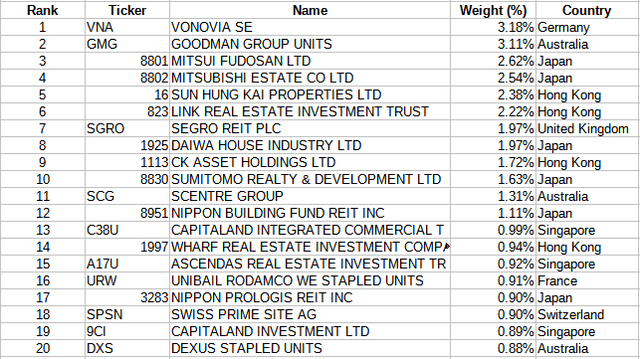

Top 20 holdings

ishares.com; compiled by Author

The Top 20 represent 33% out of a portfolio of nearly 400 holdings. About 1% of the assets are in currency holdings spread across 12+ countries.

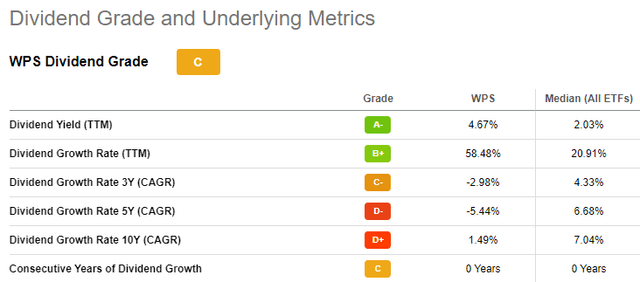

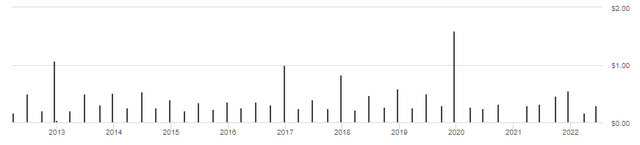

WPS distributions review

WPS follows a distribution pattern I recognize from other REIT ETFs recently reviewed; unsteady with little growth over time. Seeking Alpha gives WPS a “C” grade for their distribution history.

seekingalpha.com WPS scorecard

Vanguard Global ex-U.S. Real Estate ETF review

Seeking Alpha describes this ETF as:

Vanguard Global ex-U.S. Real Estate ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. The fund invests in public equity markets of global ex-US region. The fund invests in stocks of companies operating across real estate sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. It seeks to track the performance of the S&P Global ex-U.S. Property Index. VNQI started in 2010.

Source: seekingalpha.com VNQI

VNQI has $4.2b in AUM with a 12bps fee structure. As you will see later, the distributions are too erratic to list a yield for VNQI.

Index review

S&P describes the Index use by VNQI as:

The S&P Global Ex-U.S. Property Index defines and measures the investable universe of publicly traded property companies domiciled in developed and emerging markets excluding the U.S. The companies included are engaged in real estate related activities such as property ownership, management, development, rental and investment.

Source: spglobal.com Index

This index has almost 300 more holdings than the non-EM version but average market-caps are about the same. Except for including Emerging Market country REITs, the rules are the same. I count roughly 16 EM countries with China (7.6%), India (1.7%) and the Philippines (1.4%) the largest three.

VNQI holdings review

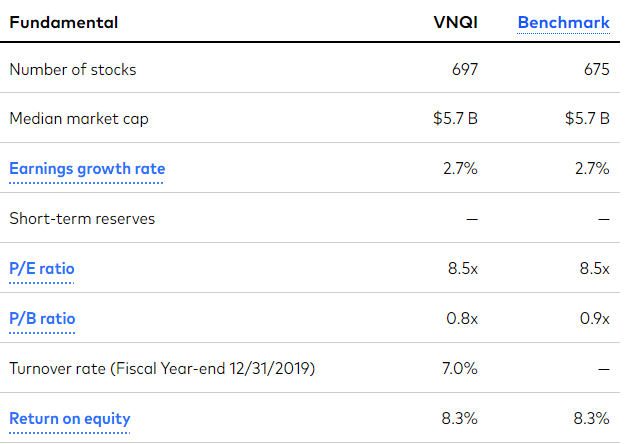

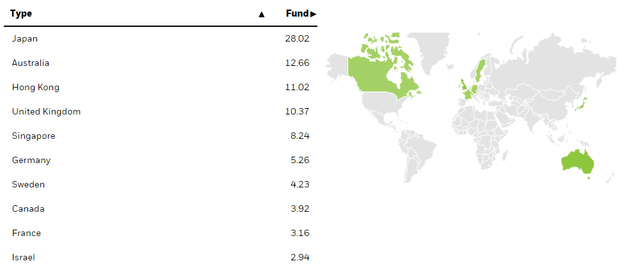

Vanguard provides these basic statistics for VNQI as of the end of July, the latest available.

investor.vanguard.com VNQI

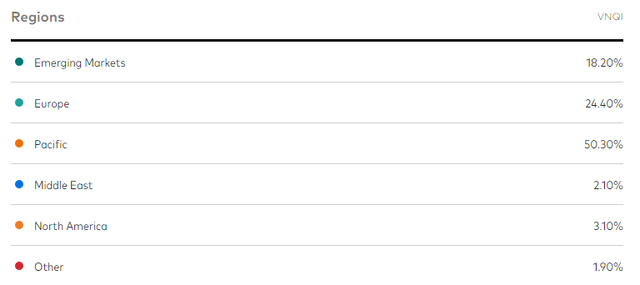

The allocations across regions are:

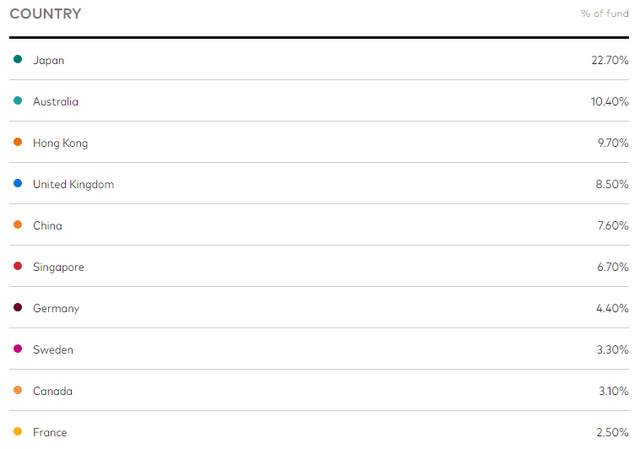

The Middle East includes a Developed country, Israel, and several Arab countries. The Top 10 country exposures are:

investor.vanguard.com countries

Note that Hong Kong comes in 3rd. Despite that designation, which is based on trading or incorporation of the asset, there could be mainland Chinese firms in this percentage. WPS holds Hong Kong REITs as an indication of its Developed World designation. Despite its placing 5th by weight, China has the most holdings at 103, followed by Japan at 87.

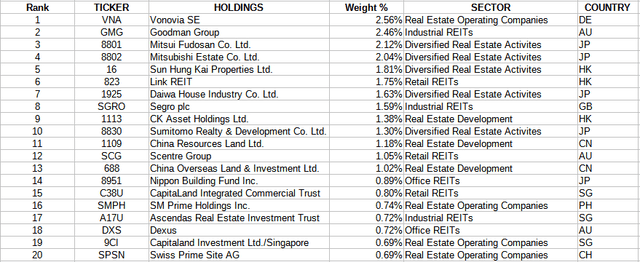

Top 20 holdings

The largest holding is the 3% in the liquidity reserve, a common feature with Vanguard ETFs.

advisors.vanguard.com; compiled by Author

The Top 20 shown account for 27% of the market value of VNQI. The Top 10 in both ETFs are the same REITs in the same order.

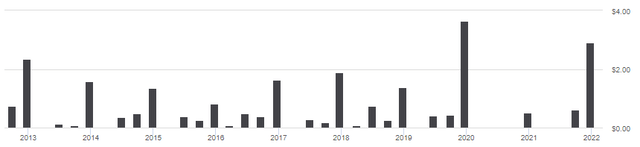

VNQI distributions review

The above illustrates why I was reluctant to state a yield for VNQI. For investors looking for steady income, neither of these ETFs fit that need. Seeking Alpha doesn’t give VNQI a score for this factor.

Comparing ETFs

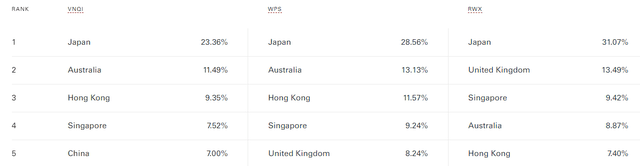

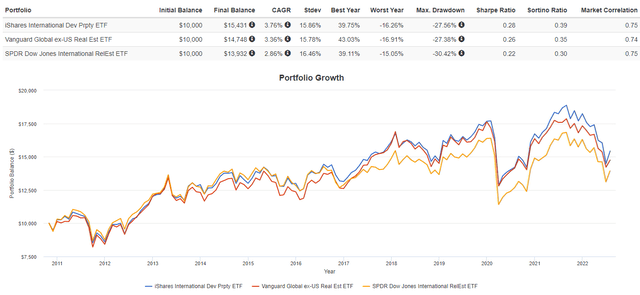

For some parts of this comparison, I included another popular International Developed REITs ETF, the SPDR Dow Jones International Real Estate ETF (RWX). We start with return and risk data, which shows why RWX wasn’t reviewed.

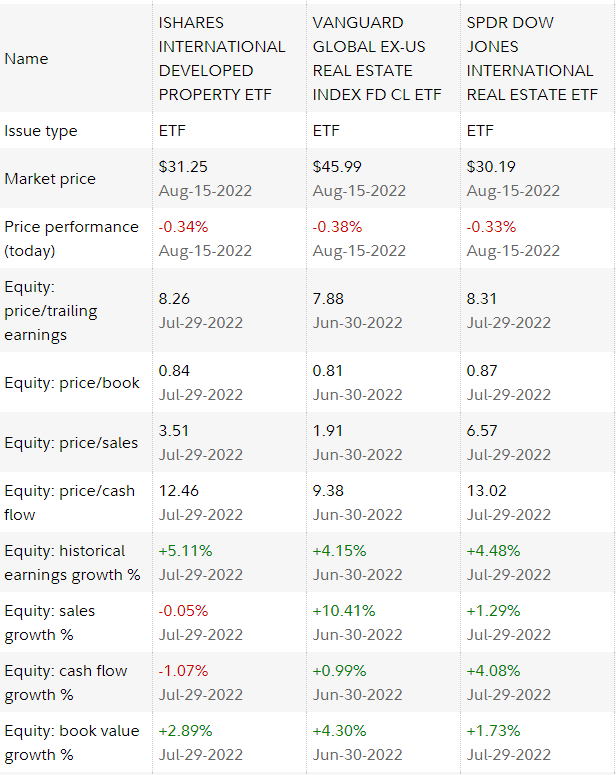

Since 2010, WPS has generated 40bps in extra return over VNQI with about the same level of risk. Both the Sharpe and Sortino ratios favor WPS. Both ETFs outperformed RWX. While the following are a snapshot-in-time, it does show how the ETFs differ in some important factors.

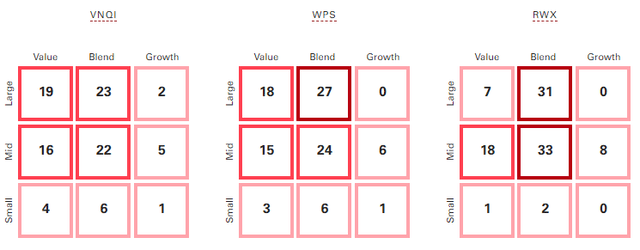

While VNQI and WPS Styles match up well, RWX has more of a Blend weighting and less in Small-Cap REITs than the other two ETFs. The top five countries in each ETF are very similar, except for VNQI’s exposure to China.

advisors.vanguard.com compare Fidelity.com compare

Between WPS (1st set) and VNQI ( 2nd set), most ratios point to VNQI having more of a Value slant on the Price ratios and better ratios that are Growth-oriented. This could explain why VNQI was the best performer of the three over the past year.

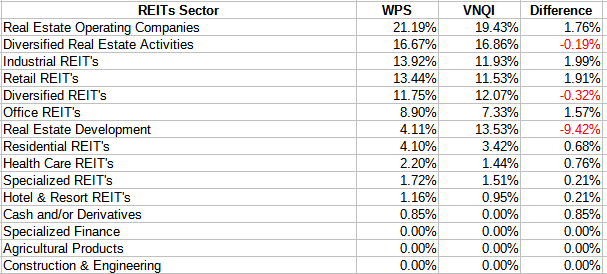

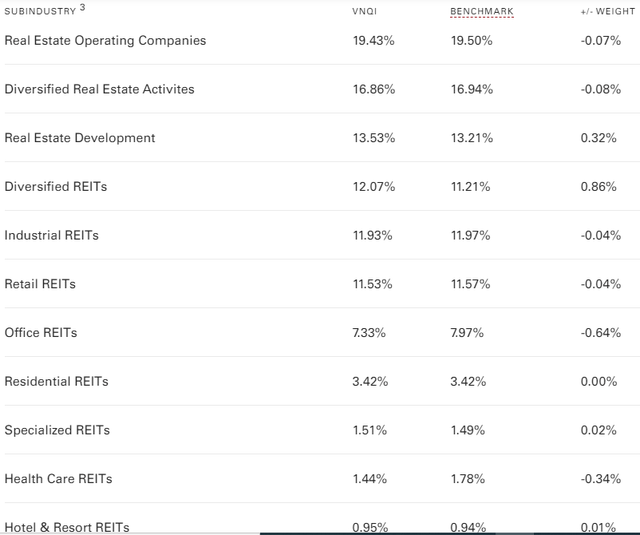

Looking at just WPS and VNQI, the REITs sector allocations match up like this:

Multiple sources; compiled by Author

For this, I chose to ignore the 3% Liquidity Reserve held by VNQI. Most of the other sectors in WPS make up for the large underweight in Real Estate Development. The difference is almost totally due to the inclusion of EM REITs in VNQI, with China being most of that allocation bump.

Portfolio strategy

There are several questions for an investor to reflect upon related to these two ETFs, beyond their relative risk and return results; some being:

- Am I looking to add to or replace an existing international ETF?

- Despite the lower CAGR from VNQI, am I underweight EM exposure?

- Am I underweight international assets and believe the USD has peaked?

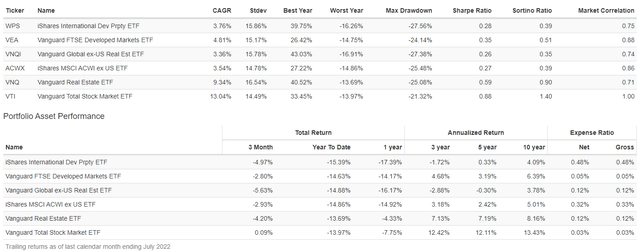

Along with the two ETFs reviewed by this article, I added the following to provide data to start the research needed to answer the above questions and maybe others too.

- Vanguard FTSE Developed Markets ETF (VEA)

- iShares MSCI ACWI ex-U.S. ETF (ACWX)

- Vanguard Real Estate ETF (VNQ)

- Vanguard Total Stock Market ETF (VTI)

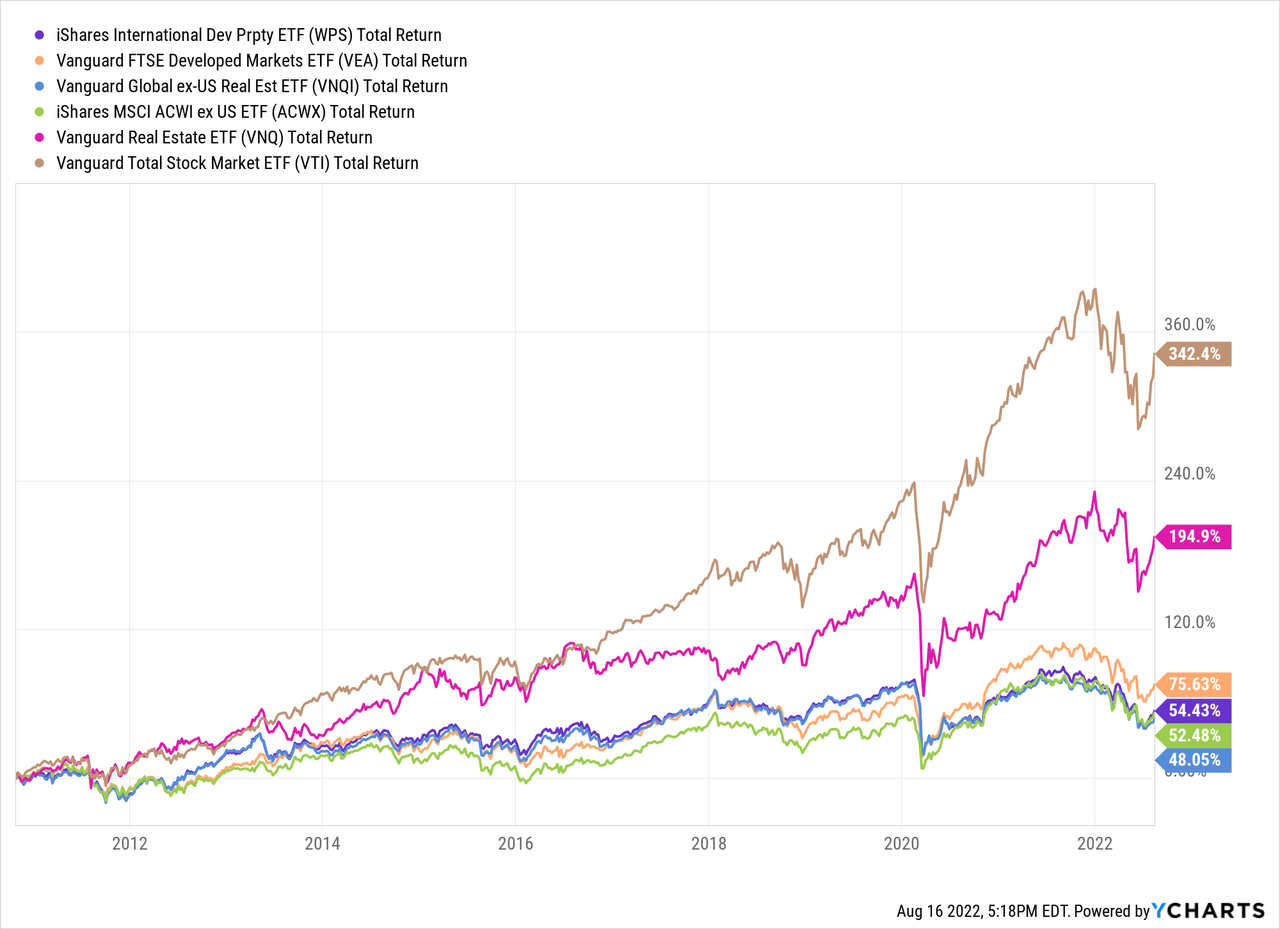

The PortfolioVisualizer data that follows goes back to late 2010 when VNQI started and ends with July’22.

The data above aligns with the REIT ETF preceding its Equity ETF counterpart. From this, we get the following information:

- Both US-only ETFs, by far, provided the best returns.

- Both foreign REIT ETFs trailed their Equity ETF counterpart, with the Developed Market gap bigger than the full International set.

- The Developed Market REIT outperformed the full International REIT ETF.

- The same overall results occurred for the Sharpe and Sortino ratios.

So replacing US REITs with international REITs, performance wise, would be a bad move, even for diversity reasons. Between the other ETFs, the iShares International Developed Property ETF has a better CAGR, StdDev, and lower correlation to its international equities counterpart than the Vanguard Global ex-U.S. Real Estate ETF does.

I would give WPS a BUY rating in place of a Total International equity ETF but not the Vanguard FTSE Developed Markets ETF. As VNQI came in last, I would consider replacing it with WPS.

Be the first to comment