imaginima

Woodside Energy Group (NYSE:NYSE:WDS), an Australian oil & gas exploration and production company, recently posted Q2 2022 earnings- a headline earnings beat which would have actually been a miss after adjusting for a ~$427m one-off gain (related to the Pluto-2 sale) included in the underlying profit calculation. Looking past the underwhelming H1 2022 result, capital allocation upside doesn’t appear to be on the cards for Woodside either, with management opting for a more conservative approach to balance sheet management.

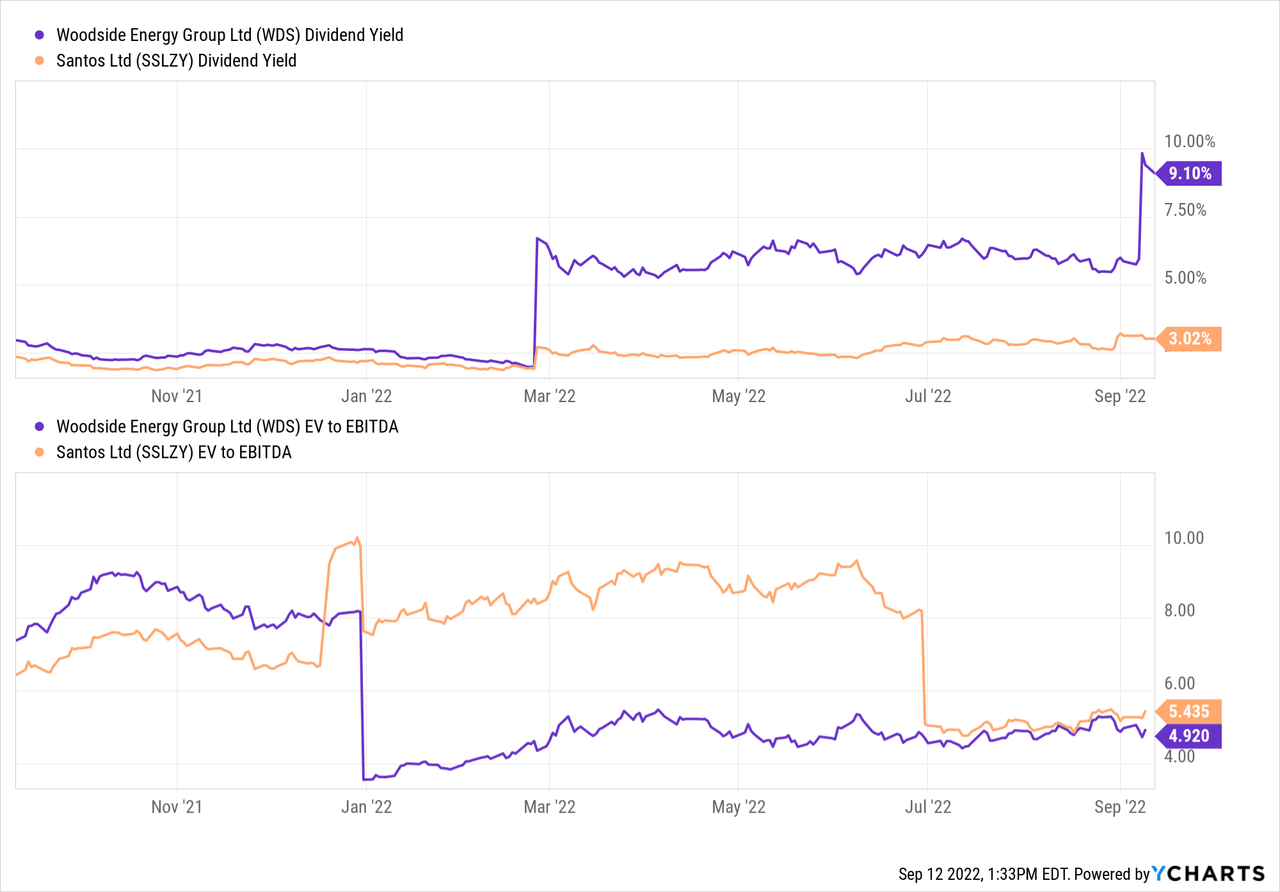

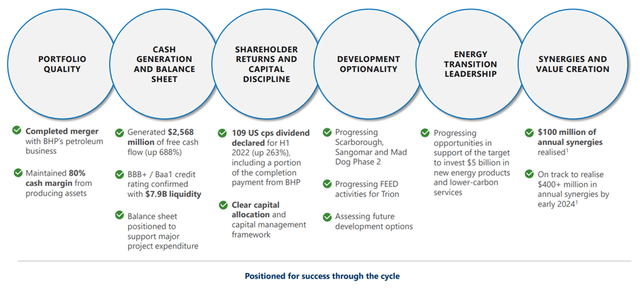

That said, Woodside still offers compelling near-term leverage to spot LNG prices, in addition to its peer-leading dividend yield. Thinking long term, the acquisition of BHP Group’s (BHP) petroleum assets also add substantial scale benefits and diversification across the product and asset base. While management could opt to reset to a more conservative outlook at the upcoming strategy day (scheduled for December), the undemanding 4-5x EV/EBITDA and attractive FCF/dividend yield offer ample safety margin.

Underlying H2 2022 Numbers Fall Short

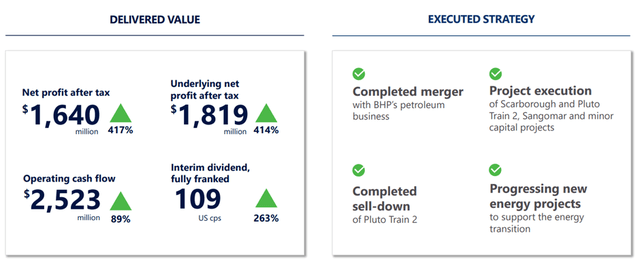

As expected, following its recent merger, Woodside’s H1 2022 result was marred by several one-offs. On an adjusted basis, statutory net profit was up by ~$179m after tax at $1.8bn – this includes $424m of BHP-related merger costs and ~$245m from provision changes. Of note, unit production costs were ~20% higher at $6/boe (excluding FX and interconnector); this was mostly down to maintenance requirements, though, so expect the run rate to normalize lower over time. Woodside also pegged its underlying EBITDA at $3.97bn, although this excludes ~$427m of one-off profits from the sale of Pluto T2. Given gains from the sale were the result of a sale-leaseback transaction and thus, at the discretion of Woodside and the purchaser, GIP, I would contend that this should have been included in the adj EBITDA calculations. After incorporating the one-off gain, EBITDA would have been closer to ~$3.7bn – a miss relative to consensus expectations.

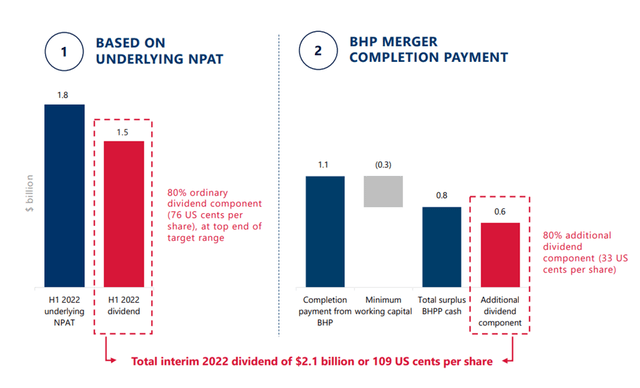

The headline fully franked dividend will be welcomed by investors at $1.09/share, though a closer look reveals an elevated payout on sustainable net income. Of the $1.09/share number, ~$0.76/share (or ~80% of the payout ratio) comes from Woodside’s underlying net profit calculation, which includes non-recurring asset sale gains. Meanwhile, the remaining ~$0.33/share is paid out of a one-off cash true-up payment from BHP (~80% payout ratio). That said, the balance sheet de-levering is a positive sign, even if the lower $2.3bn net debt position was helped by a one-off cash payment from the BHP acquisition. The Board’s decision to lower the gearing range to 10-20% (previously 15-35%), despite the projected step up in growth capex, also bodes well for bringing balance sheet capacity in line with industry peers. While this could pave the way for more buybacks and special dividends, Woodside’s decision to prioritize balance sheet headroom over shareholder returns is a prudent move, in my view – particularly given the cyclicality of commodity prices.

Puts and Takes from the Guidance Update

On a positive note, Woodside reiterated its production guidance of 145-153mboe, capex of $4.3-4.8bn, and a spot gas hub exposure range of 20-25%. The ~$9bn slated for spending on Sangomar and Scarborough/Pluto T2 over the H2 2022 to 2024 period is within expectations as well. Trion capex could swing things, though – while the contract strategy is still in review amid the ongoing supply chain disruptions, a sooner-than-expected final investment decision could push gearing well above the target range. More broadly, it seems unclear if the scale of Trion capex is preferable to dividends at this juncture – for context, Woodside’s share is at ~$5bn based on prior BHP disclosures, while projected returns at ~15% IRR are close to greenfield hurdle rates. On the other hand, the ~$5bn investment target (both organic investment and M&A) for ‘new energy’ initiatives and to lower carbon spending by 2030 has also been maintained.

The BHP Petroleum merger progress looks good – although management noted ~$424m in one-off costs incurred in the latest half-year, Woodside has unlocked ~$100m of annualized synergies to date and remains on track to achieve the ~ $400m/year target by early-2024. On capital allocation, Woodside is maintaining the 50-80% payout (as a % underlying net profit) dividend policy. The variable approach screens favorably, in my view, as it allows for flexibility through the cycle. Plus, the company’s decision to remove the dividend reinvestment plan (DRP) discount is another step in the right direction, allowing it to remove shareholder dilution by acquiring DRP shares on-market (vs. issuing new shares).

Looking Ahead to the December Strategic Review

The upcoming strategy day, scheduled for December, will likely see an unconstrained first look into Woodside’s mid to long-term strategic path. Given this comes following months of access to BHP’s petroleum assets and post-completion of the merger, the incremental visibility presents a prime opportunity to lift any lingering M&A overhang. That said, I see more downsides than upsides here – in particular, management could opt to reset any optimism from prior merger-related disclosures to a more conservative bar. Thus far, the signs have been far from convincing as well – Woodside most recently missed the gross BHP/Woodside production target (initially outlined in April) but offered little color on the underlying reasons. Depending on whether this trend is structural (as opposed to a one-off), we could see a sizeable downward revision to the five-year outlook.

Elsewhere, the company could also announce more disposals, particularly with regard to the smaller and later-life assets in its portfolio. Even assuming it finds buyers, though, navigating the process will be challenging in light of regulatory hurdles around decommissioning in Australia as well as ESG headwinds globally. Sales of its remaining portfolio assets are unlikely to move the P&L needle, although the cash influx could help the balance sheet.

Messy H1 2022 Result Outweighed by Compelling Near-Term Outlook

Woodside’s messy interim numbers fell short of expectations, but this was expected coming on the heels of the recent BHP transaction. On the plus side, the balance sheet is as strong as ever, helped by the sell-down of a non-operating stake in Scarborough LNG and the BHP-driven cash injection. This adds defensiveness to Woodside’s pipeline of growth assets (including new energy deployments), and with core operational assets also outperforming, I see limited risk to the current high-single-digit % dividend yield (vs. Santos (OTCPK:STOSF) at in the mid-single-digits %). While management could use the upcoming strategy day as an opportunity to reset expectations lower (to regain credibility via easier beats-and-raises), the undemanding valuation (based on the discounted EV/EBITDA and elevated FCF yield) likely prices in a fair bit of skepticism already.

Be the first to comment