Here’s what we do: We issue new shares at $24.2125 while comparable shares trade for about $21.39. Yeah, I actually convinced an underwriter to take this deal for $150 million. He’s so fired. VioletaStoimenova

Get ready for charts, images, and tables because they are better than words. The ratings and outlooks we highlight here come after Scott Kennedy’s weekly updates in the REIT Forum. Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

Last time you heard from me, I was highlighting an opportunity to swap between the AGNC preferred shares. However, I also mentioned that we had already posted an article on AGNC’s shocking new share: AGNCL on September 8th. I’m not a tease. I said I’d turn it public this week and I’m delivering. Here’s the article we sent subscribers, in full, along with some updates after the end.

Start of Subscriber Article

Title: AGNCL: A Shocking Preferred Share

- AGNC’s new preferred share is remarkable. The future dividend payments on it are only slightly higher than the projected payments for AGNCM.

- When AGNCM closed at $21.39 and AGNC can get $24.2125 per share of AGNCL, that’s a hilarious spread. Underwriters are hoping investors are bigger fools.

- AGNC might use the proceeds to call part of AGNCN. The spread is wide enough. They might be better off buying MBS and hedging though.

- Based on future cash flows, AGNCL should cost about $.54 more than AGNCM. After AGNCM goes ex-dividend (late September), the spread should be around $.80 to $.90.

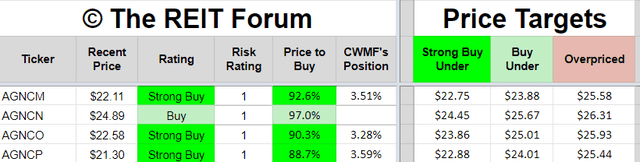

- The best deal among the AGNC preferred shares today is AGNCP at $21.30.

AGNCL (AGNCL) is the upcoming preferred share from AGNC (AGNC). It is the most remarkable new offering in years for the sheer absurdity of the pricing. AGNC is taking advantage of the underwriters. By my estimate, underwriters are set to overpay by more than $13 million. Someone at AGNC deserves a bonus and someone at the underwriters deserves to get fired. We’ll briefly cover the implications, then move into the pricing. In my opinion, the pricing is the most interesting part.

Note: AGNCL might trade under a temporary ticker at first. That’s common for a new issuance, but you won’t want to buy AGNCL (unless the price craters) so it doesn’t really matter.

Implications

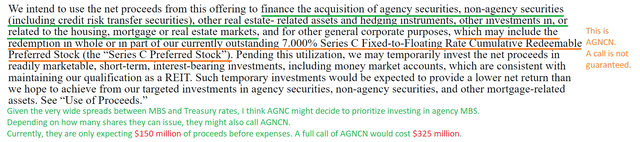

The market believes AGNCN will be called. It might be. It’s one of the potential uses of proceeds:

I don’t want to dismiss the potential for calling AGNCN (AGNCN) outright, but if I were managing AGNC, I would be prioritizing investments in agency MBS. If I could issue over $500 million of AGNCL at $24.2125 per share, then I’d be thinking about calling AGNCN as well.

Calling AGNCN and replacing it with AGNCL is a good deal for AGNC. However, it may not be the best deal available when the MBS to Treasury spreads are wide.

Generally, I say that if a REIT can save about 75 basis points on the dividend it makes sense to call an old share and issue a new one. The spread on AGNCL meets that criterion. However, the spreads on agency MBS are pretty wide. Buying more MBS and entering new hedges may be a more beneficial strategy for the common shareholders.

AGNCL vs. AGNCM

AGNCL is a preferred share that shouldn’t be happening. It’s one the underwriters never should’ve agreed to. Yesterday, we suggested investors in AGNCN should swap for (AGNCP), (AGNCO), or (AGNCM). We used a comparison of AGNCN vs. AGNCO because it was the simplest comparison.

For AGNCL, I believe AGNCM is the simplest comparison.

AGNCM closed at $21.39 (up quite a bit today).

There are two ways this can play out:

- AGNCM gets called.

- AGNCM does not get called.

If AGNCM gets called, investors get a huge capital gain that outweighs everything else in this analysis. End of analysis. AGNCM wins by a mile in that scenario.

Therefore, we’re going to focus on the scenario where AGNCM does not get called.

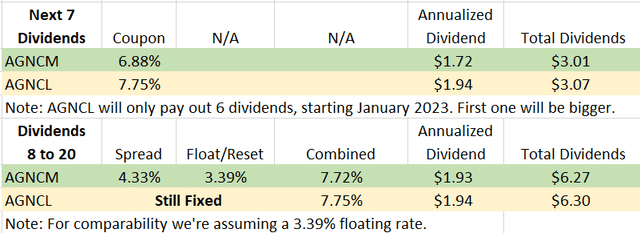

Three Periods for Dividends

There are three periods to consider:

- The next 7 dividends. Before either can be called.

- Dividends 8 to 20. AGNCM floats and can be called (starts 4/15/2024).

- Dividends 20+. Either share can be called. AGNCL resets.

First Two Periods

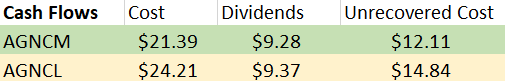

Which share would investors rather have over the first two periods? See the table:

Note: AGNCM will actually use short-term rates, but the yield curve today would imply that the short-term rates should average roughly around 3.39% between dividends 8 and 20. This matches the 5-year Treasury, so we settled on the 3.39% rate from the 5-year Treasury.

Looking only at the income (ignoring share prices), it appears AGNCL has a modest advantage. It wins by $.06 in the first period and by $.03 in the second period. However, that’s only winning by $.09.

What happens if we factor in the share price as we evaluate cash flows?

The REIT Forum

The investor in AGNCM would have recovered all but $12.11 of their investment while the investor in AGNCL would still have $14.84 left to recover. That’s a difference of $2.73, even if we don’t discount the cash flows. If we were discounting the cash flows, AGNCM would win by a larger margin due to the lower starting price.

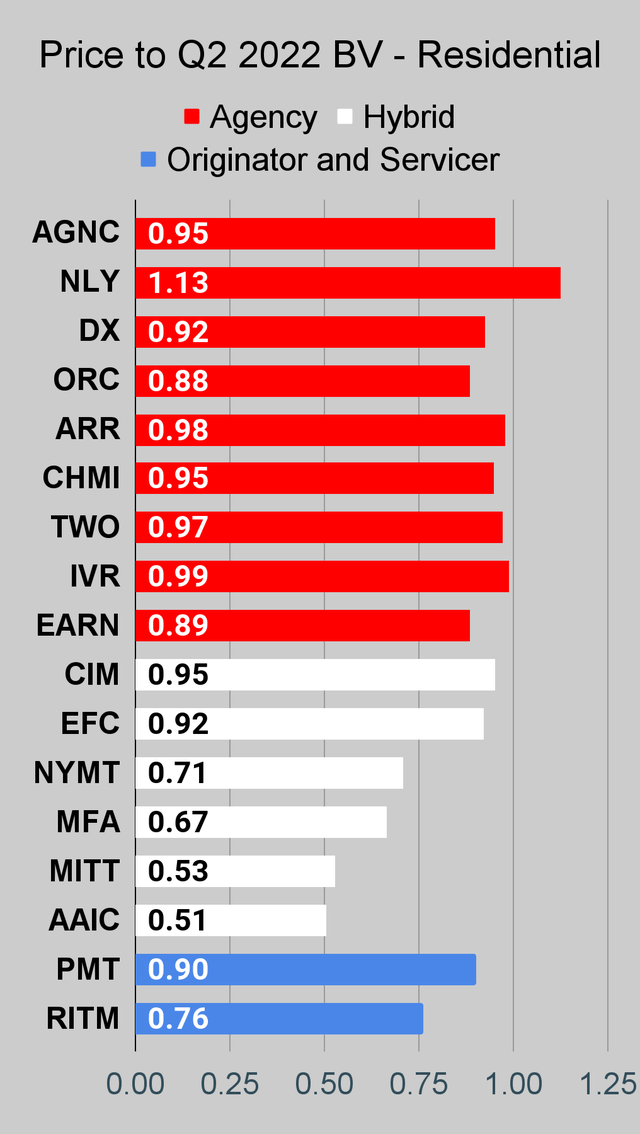

Third Period

Will AGNCL be worth far more than AGNCM 5 years from now?

The REIT Forum

For a projected difference of $.02 in the annual dividend rate, how much more would you pay for AGNCL? A reasonable estimate is probably $.20 to $.30 per share (midpoint $.25 per share). It’s certainly possible that the 5-year Treasury rate will be higher than short-term rates. But it isn’t guaranteed. How much value should we assign for using the 5-year Treasury rate instead? Since AGNCL only resets every 5 years rather than each quarter, if rates fall right after a reset date AGNC would simply call the shares. However, if rates rallied after the reset date, investors would be stuck with the lower yield for 5 years.

Therefore, the feature probably is not worth a significant premium. When the yield curve is steep it helps investors, but it also creates an unfavorable dynamic with call risk. Let’s assume a net value of $.20.

Combining that with the slightly higher spread means AGNCL’s projected future value should be about $.45 higher than AGNCM.

Adding the extra $.09 in projected dividends over the next 5 years gives us a total $.54 difference in present value.

Note: This factors in the fact that AGNCM will go ex-dividend in a few weeks. After that, the justified price spread will increase by a bit less than the ex-dividend amount. It’s a bit less than the full dividend amount because AGNCL will be accruing dividends also.

Efficient Pricing

- After AGNCM is ex-dividend, AGNCL should cost about $.80 to $.90 more than AGNCM for markets to be efficient.

- Targets for AGNCL will most likely be around $.80 to $.90 higher than AGNCM after the September 2022 ex-dividend date.

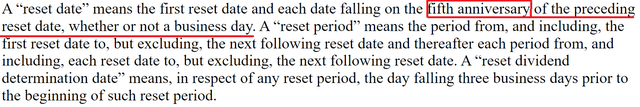

5 Years Per Reset

Here’s the section indicating the reset only occurs every five years:

Underwriters Wrecked

The underwriters are set to buy 6 million shares of AGNCL. After the expenses and commissions, AGNC expects to bring in $24.2125 per share of AGNCL. Therefore, underwriters are looking to unload these shares above $24.2125 just to avoid losing money. They are looking for the “bigger fool” to buy the shares off them.

Unless AGNCM reaches $23.67, buying AGNCL at $24.2125 would have been better off buying AGNCM instead. If AGNCM reaches $23.67, it would be up $2.28 from yesterday’s closing price of $21.39.

For the underwriters to unload these shares without eating a loss, they either need the other AGNC preferred shares to rally hard or they need to find some big suckers.

Using AGNCM’s closing price from yesterday at $21.39, underwriters should’ve been willing to offer no more than $21.93 per share of AGNCL. That is the price where they would have gotten a similar deal to the market price for AGNCM. That does not include a profit margin. It’s just getting shares at a comparable deal to the market price.

If the market efficiently priced AGNCL relative to AGNCM, using yesterday’s close, the underwriter would be eating a loss of $13.69 million on the investment even if they had zero other expenses. The underwriters need suckers to bail them out. They will probably find a few, but I’ll be surprised if they find enough.

Other Scenarios

When AGNCM begins floating (4/15/2024):

- If short-term rates are indeed around 3.39%, then AGNCM would need to trade at a price pretty similar to AGNCL for the yields to be equal.

- If short-term rates rise above 3.39%, then AGNCM wins by a larger margin.

- If short-term rates are below 3.39%, then AGNCM wins by a smaller margin.

- If short-term rates hit 0%, then AGNCM wins by a much smaller margin.

If investors expect short-term rates at 0% they should be picking fixed-rate shares instead or holding Treasuries (predicting a recession severe enough to make the Federal Reserve react).

Risk Rating

Even if AGNC does not use the proceeds to call AGNCN, the risk rating on the shares would stay at 1. Adding $150 million to the liquidation preference for AGNC preferred shares would only be a 9.76% increase. That’s not quite enough additional preferred equity in the capital stack to justify increasing the risk rating.

However, if they continued issuing AGNCL without retiring any of the other preferred shares, the risk rating could be increased to 1.5. I’m not convinced they can get underwriters to agree to underwrite more AGNCL after this.

Best Deal Today

The best choice today is AGNCP (AGNCP). While I expect to make slight adjustments to targets for the recent change in interest rates, those changes will be quite small. For fixed-to-floating shares that float in a few years, the adjustments will be tiny.

AGNCP currently wins on having the largest discount to target prices, beating out AGNCO by about 150 basis points (90.2% vs 88.7%):

This article could’ve been prepared using a comparison of AGNCP and AGNCL, but AGNCM provided a more direct comparison due to the comparable spreads and higher initial dividend rates.

End of Subscriber Article from September 8th

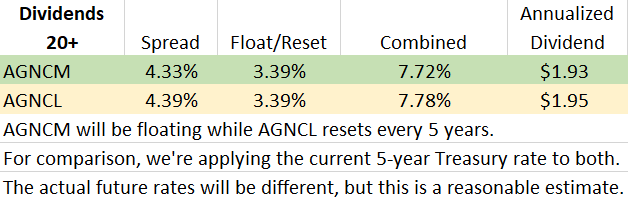

So how did we do? Most of you probably know we killed it. Some investors may argue that math doesn’t matter. Maybe we used too many words. Too many sentences. Who knew we would actually use writing or math after high school?

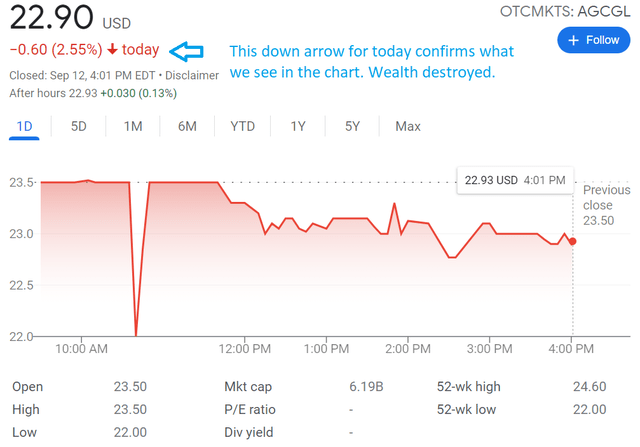

Well, here’s one you can show to anyone. It’s the price of AGNCL across the first 48 hours. During this time, AGNCL was trading as AGCGV (because shares are issued with temporary tickers):

Over the first 2 days, volume was only 220,634 shares. Well, that’s the volume on the markets StreetSmart Edge was tracking. There may have been some other sales. How many shares did AGNC offer? 6,000,000. That’s before underwriters would have the opportunity to buy an extra 900,000. I think they might pass on that deal.

But why does the chart end on September 9th? Maybe I’m just hiding the latest data? Try again. The ticker changed to AGCGL. It promptly continued the trend of getting destroyed:

For comparison, AGNCM is now $22.24. The gap is $0.66. That’s pretty close to my estimate for where the spread should land.

Condolences to those who destroyed more than 6.1% of their investment in 3 days by not understanding how to use relative values. All our subscribers knew not to jump into those shares. What’s more expensive? Is research really more expensive than bad choices? I don’t think so.

One last note. AGNCM dominated on September 9th and we swapped from AGNCM (taking a healthy gain) into additional shares of AGNCP. I’ll cover that in more detail in another article.

Since we first wrote about the arbitrage opportunity on Wednesday, here are the price changes:

If you still think the market is efficient, you might as well believe in Santa. (The REIT Forum)

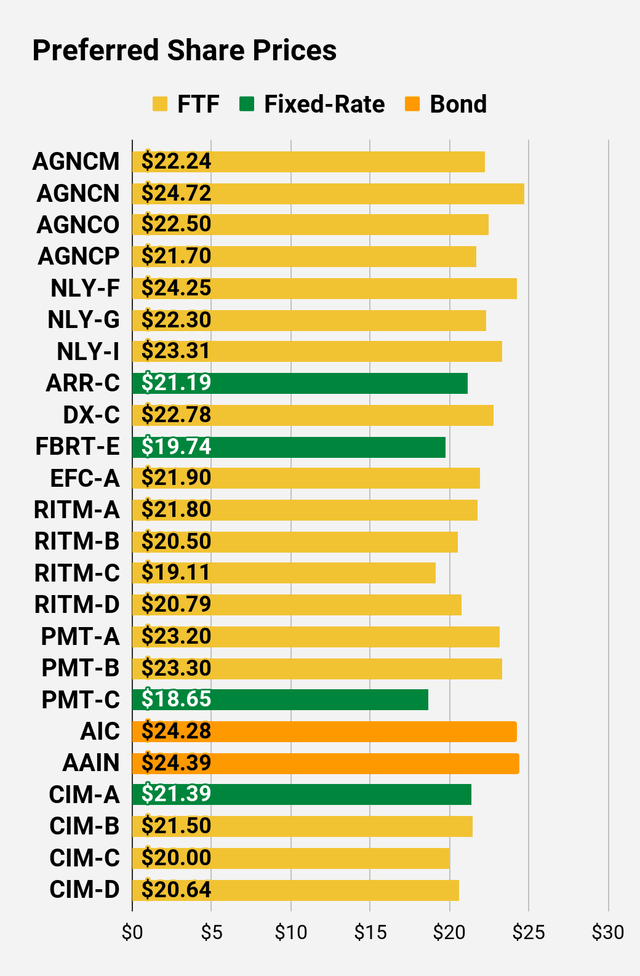

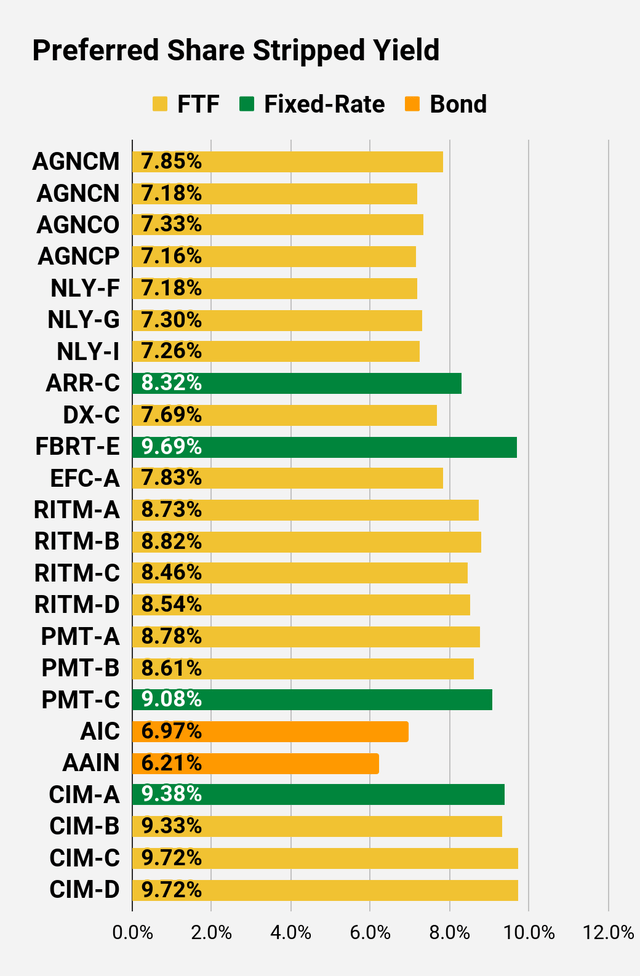

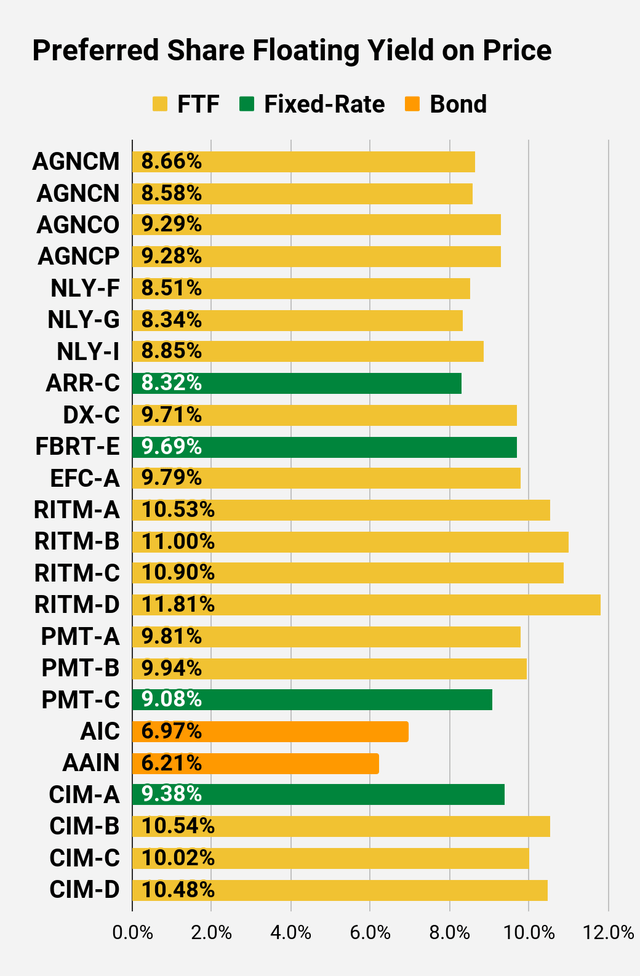

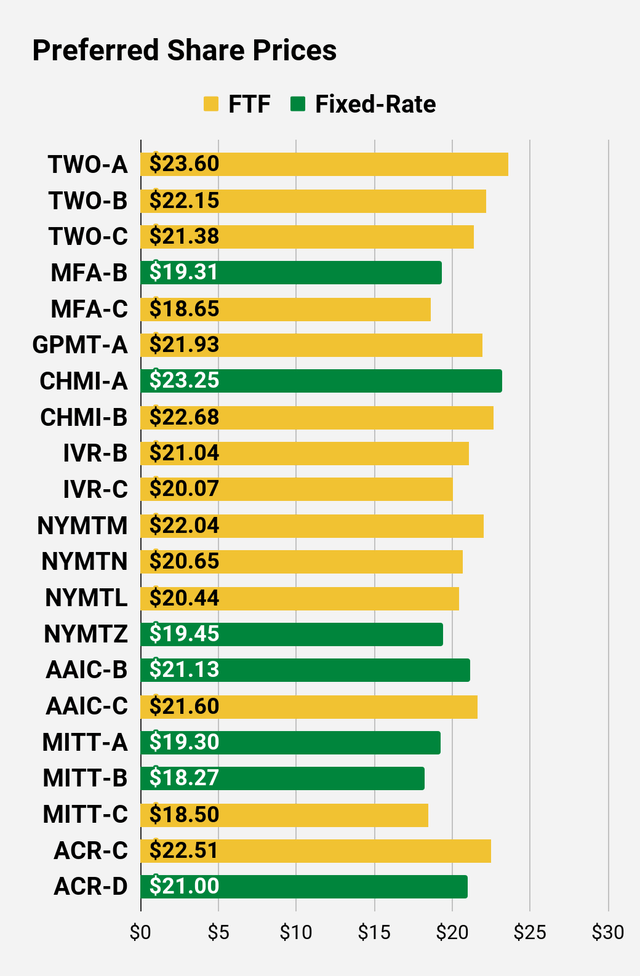

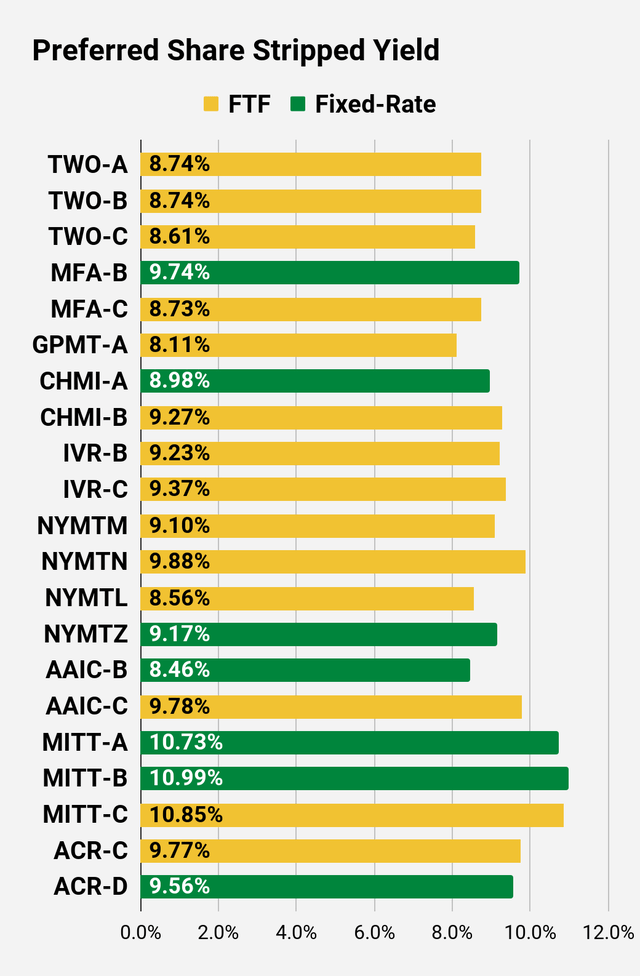

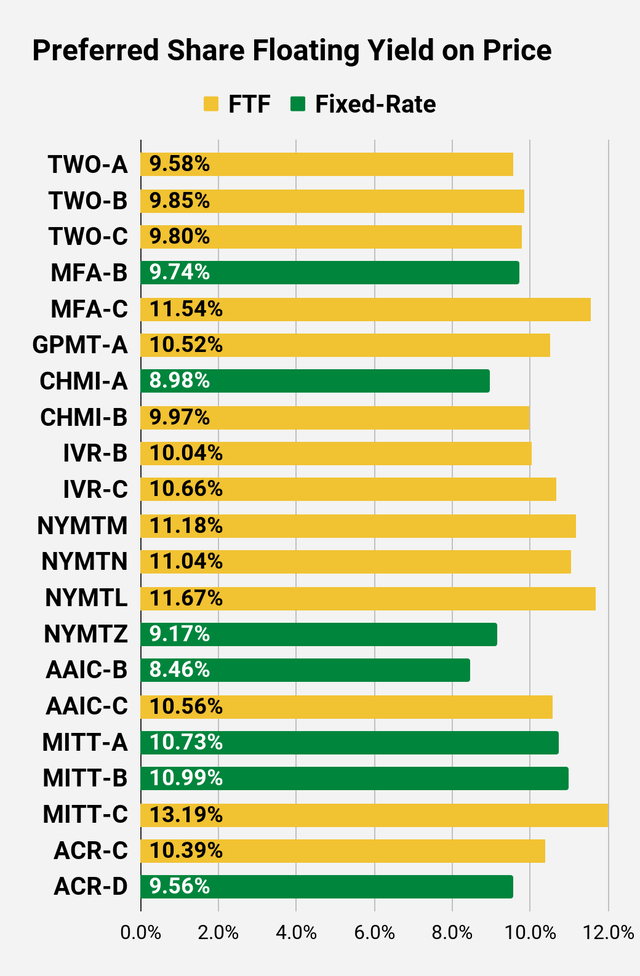

The rest of the charts in this article may be self-explanatory to some investors. However, if you’d like to know more about them, you’re encouraged to see our notes for the series.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We’re including a quick table for the common shares that will be shown in our tables:

Let the images begin!

Note: We’ll be updating tickers soon to replace AINV with MFIC. We wait until all of our data sources have the updated ticker.

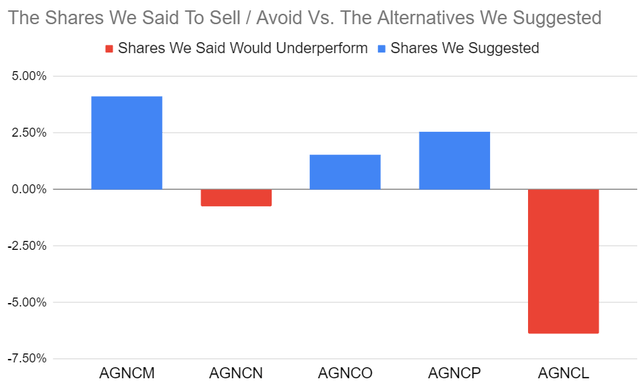

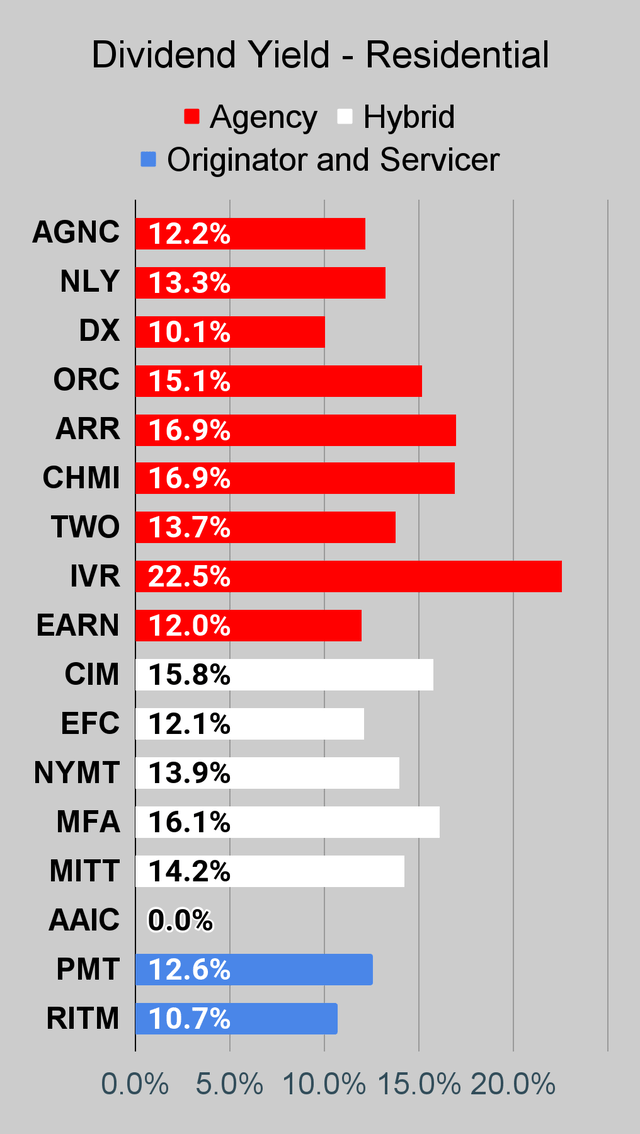

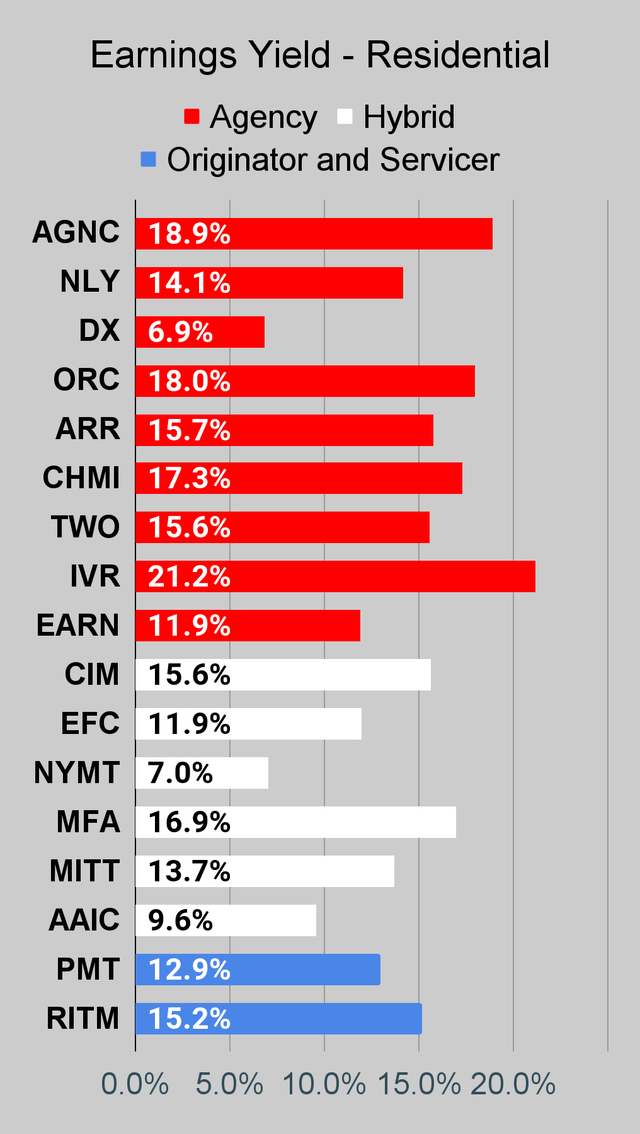

Residential Mortgage REIT Charts

Note: The chart for our public articles uses the book value per share from the latest earnings release. Current estimated book value per share is used in reaching our targets and trading decisions. It is available in our service, but those estimates are not included in the charts below.

The REIT Forum |

The REIT Forum |

The REIT Forum |

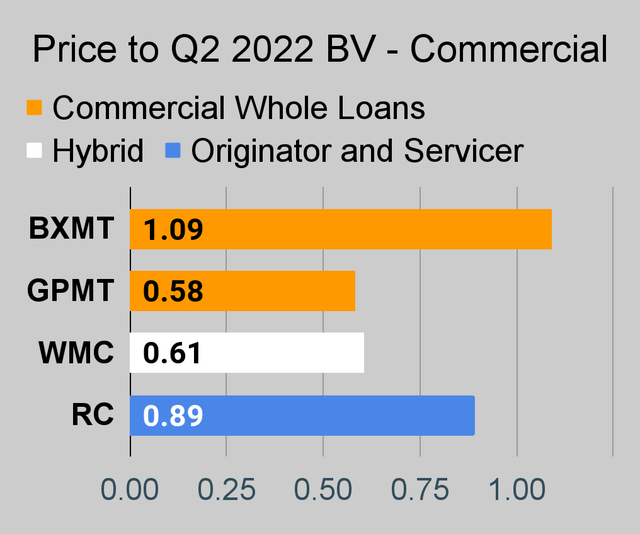

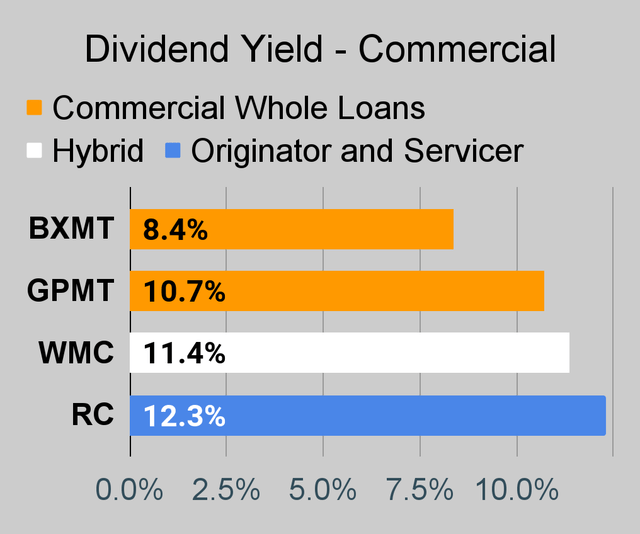

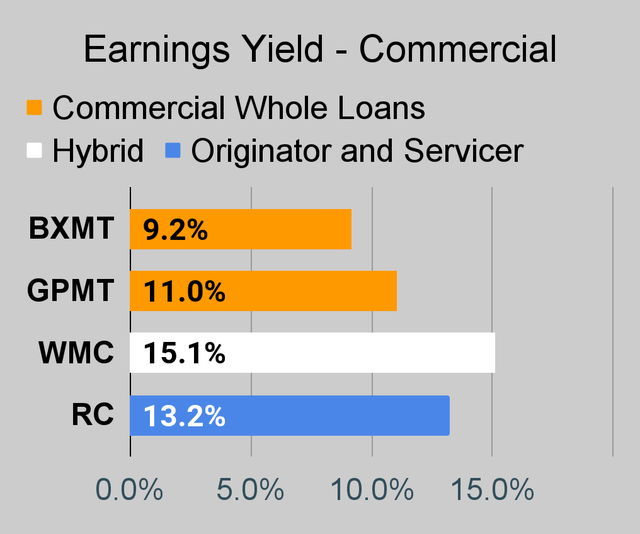

Commercial Mortgage REIT Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

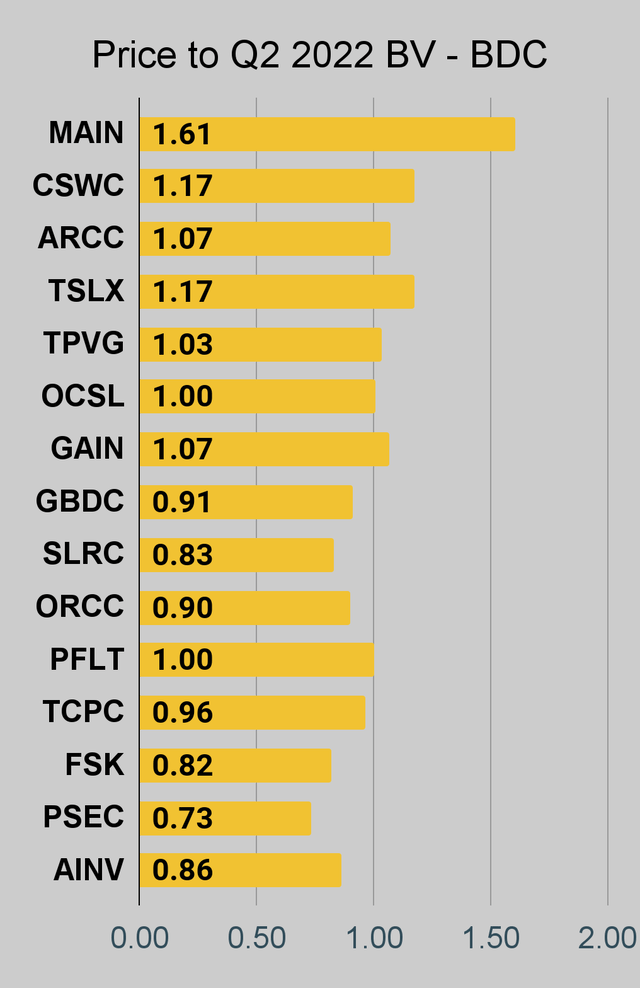

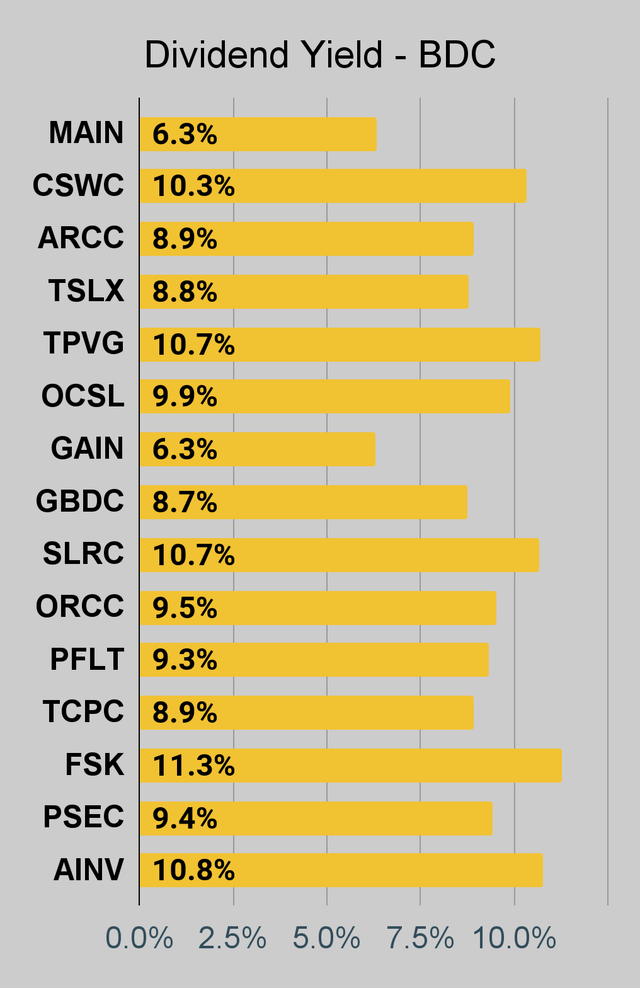

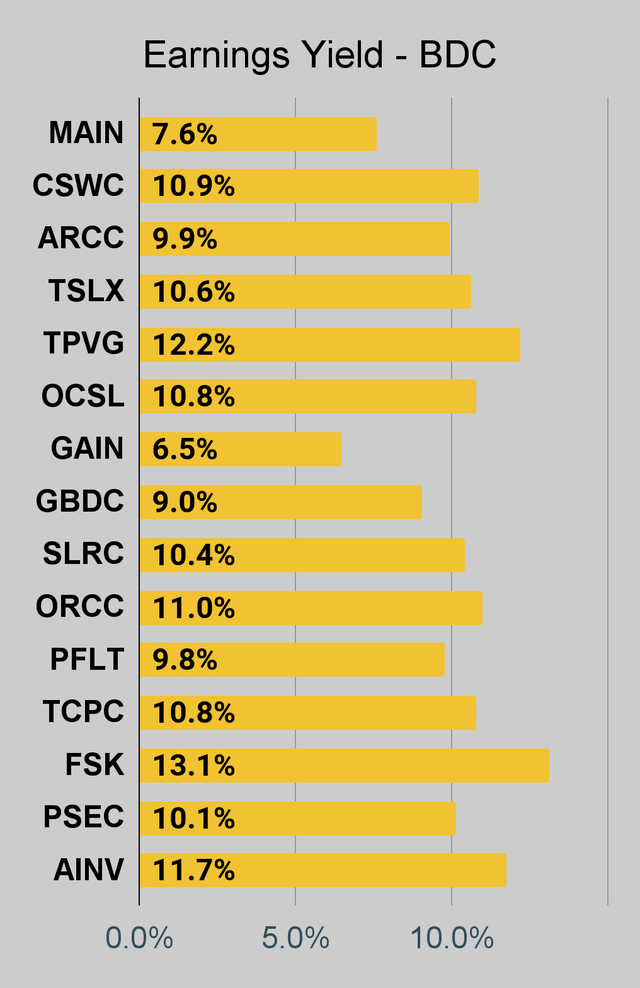

BDC Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

Preferred Share Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

Preferred Share Data

Beyond the charts, we’re also providing our readers with access to several other metrics for the preferred shares.

After testing out a series on preferred shares, we decided to try merging it into the series on common shares. After all, we are still talking about positions in mortgage REITs. We don’t have any desire to cover preferred shares without cumulative dividends, so any preferred shares you see in our column will have cumulative dividends. You can verify that by using Quantum Online. We’ve included the links in the table below.

To better organize the table, we needed to abbreviate column names as follows:

- Price = Recent Share Price – Shown in Charts

- BoF = Bond or FTF (Fixed-to-Floating)

- S-Yield = Stripped Yield – Shown in Charts

- Coupon = Initial Fixed-Rate Coupon

- FYoP = Floating Yield on Price – Shown in Charts

- NCD = Next Call Date (the soonest shares could be called)

- Note: For all FTF issues, the floating rate would start on NCD.

- WCC = Worst Cash to Call (lowest net cash return possible from a call)

- QO Link = Link to Quantum Online Page

Second Batch:

Strategy

Our goal is to maximize total returns. We achieve those most effectively by including “trading” strategies. We regularly trade positions in the mortgage REIT common shares and BDCs because:

- Prices are inefficient.

- Long-term, share prices generally revolve around book value.

- Short-term, price-to-book ratios can deviate materially.

- Book value isn’t the only step in analysis, but it is the cornerstone.

We also allocate to preferred shares and equity REITs. We encourage buy-and-hold investors to consider using more preferred shares and equity REITs.

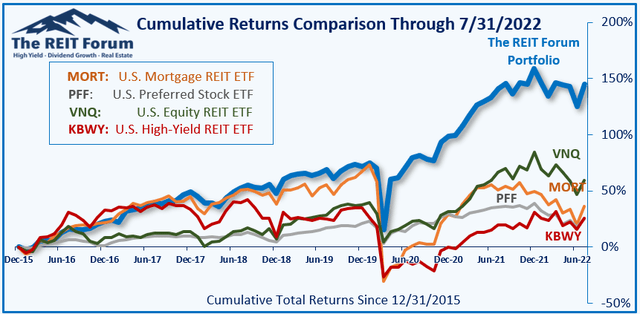

Performance

We compare our performance against 4 ETFs that investors might use for exposure to our sectors:

The 4 ETFs we use for comparison are:

|

Ticker |

Exposure |

|

One of the largest mortgage REIT ETFs |

|

|

One of the largest preferred share ETFs |

|

|

Largest equity REIT ETF |

|

|

The high-yield equity REIT ETF. Yes, it has been dreadful. |

When investors think it isn’t possible to earn solid returns in preferred shares or mortgage REITs, we politely disagree. The sector has plenty of opportunities, but investors still need to be wary of the risks. We can’t simply reach for yield and hope for the best. When it comes to common shares, we need to be even more vigilant to protect our principal by regularly watching prices and updating estimates for book value and price targets.

Ratings: This article was excellent. A+.

Be the first to comment