NicoElNino

A Quick Take On WNS (Holdings) Limited

WNS (Holdings) Limited (NYSE:WNS) reported its FQ2 2023 financial results on October 20, 2022, beating expected revenue and EPS estimates.

The company provides business process management and related outsourced services for organizations.

Given the possible full valuation of the stock at its present level combined with a slowing growth environment, my outlook for WNS in the near term is on Hold.

WNS Overview

Mumbai, India-based WNS was founded in 1996 to provide business process management services for a variety of industries worldwide.

The company operates in two segments:

-

Global BPM

-

Auto Claims BPM

It also provides digital transformation services and a range of related financial, customer experience, research, legal and human resources outsourcing services.

The firm is headed by Group CEO Keshav Murugesh, who joined the firm in 2010 and was previously CEO at Syntel and CGO at ITC Infotech.

WNS’ Markets

According to a 2021 market research report by Grand View Research, the global market for business process outsourcing was an estimated $232 billion in 2020 and is expected to reach $446 billion by 2028.

This represents a forecast of 8.5% from 2021 to 2028.

The main drivers for this expected growth are an increasing usage of digital tools and delocalized talent to maximize business efficiencies.

Also, the versatility of outsourcing services is increasing as other types of service process automation and intelligence adds to return on investment for enterprises.

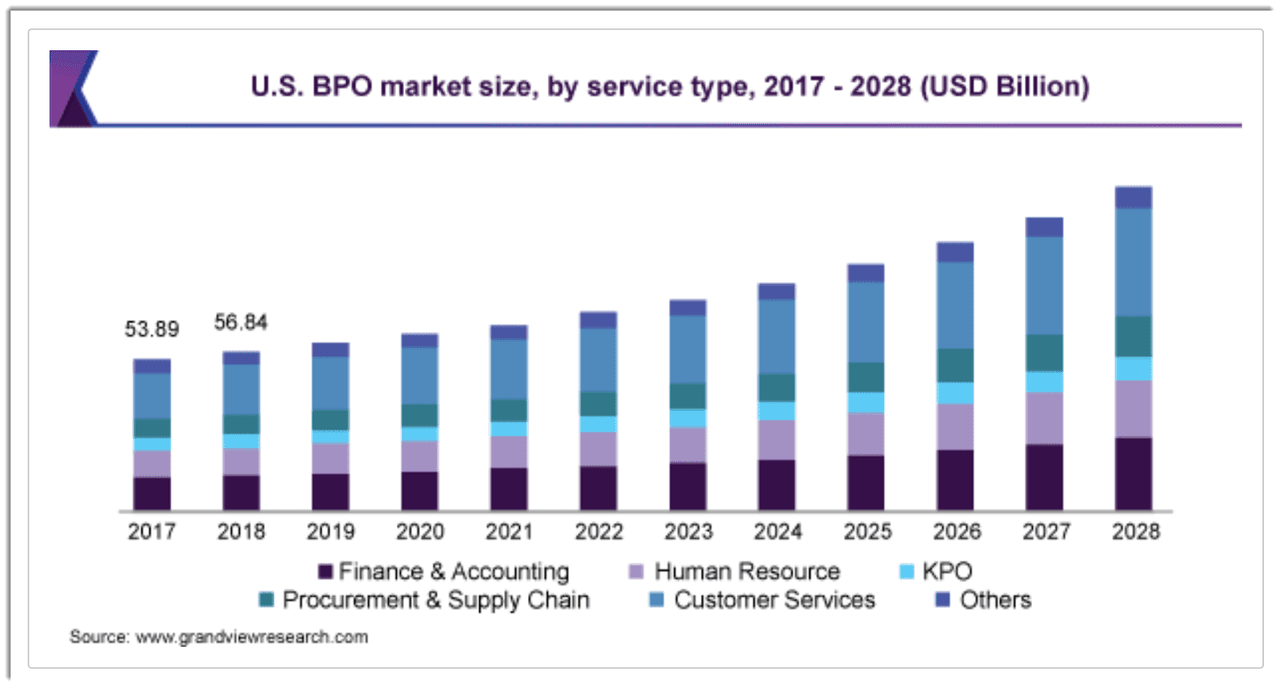

Below is a chart showing the historical and expected future growth trajectory of process outsourcing services in the U.S.:

U.S. BPO Market (Grand View Research)

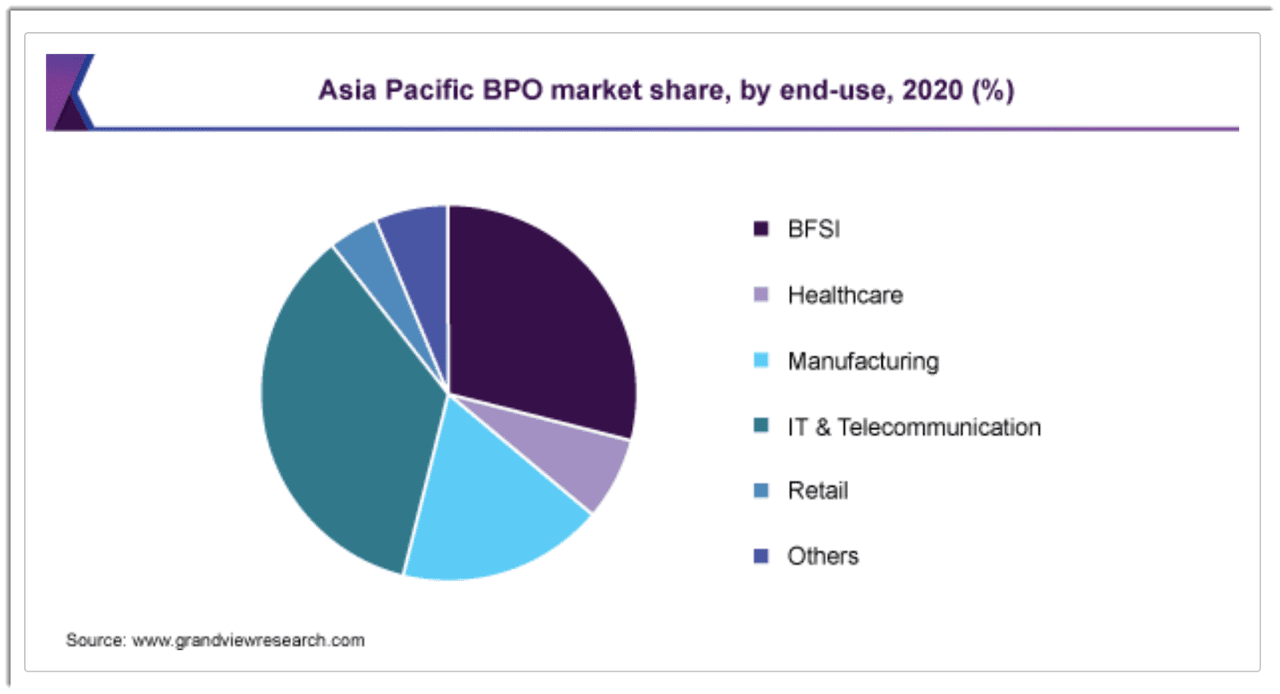

The Asia Pacific market is forecast to see the highest CAGR from 2021 to 2028 and the chart below indicates the breakdown of that market by end-use industry in 2020:

Asia Pacific BPO Market (Grand View Research)

The company also operates in the business process management industry, which was a $10.6 billion industry in 2020 and is forecast to reach $26 billion by 2028, representing an expected CAGR of 12.0% from 2021 to 2028, according to a Fortune Business Insights research report.

Notably, AI-enhanced business process management services are expected to emerge as a major trend in the BPM industry over the coming years, as it has the promise of providing further insights into generating business process efficiencies across organizations and their ecosystems.

WNS’s Recent Financial Performance

-

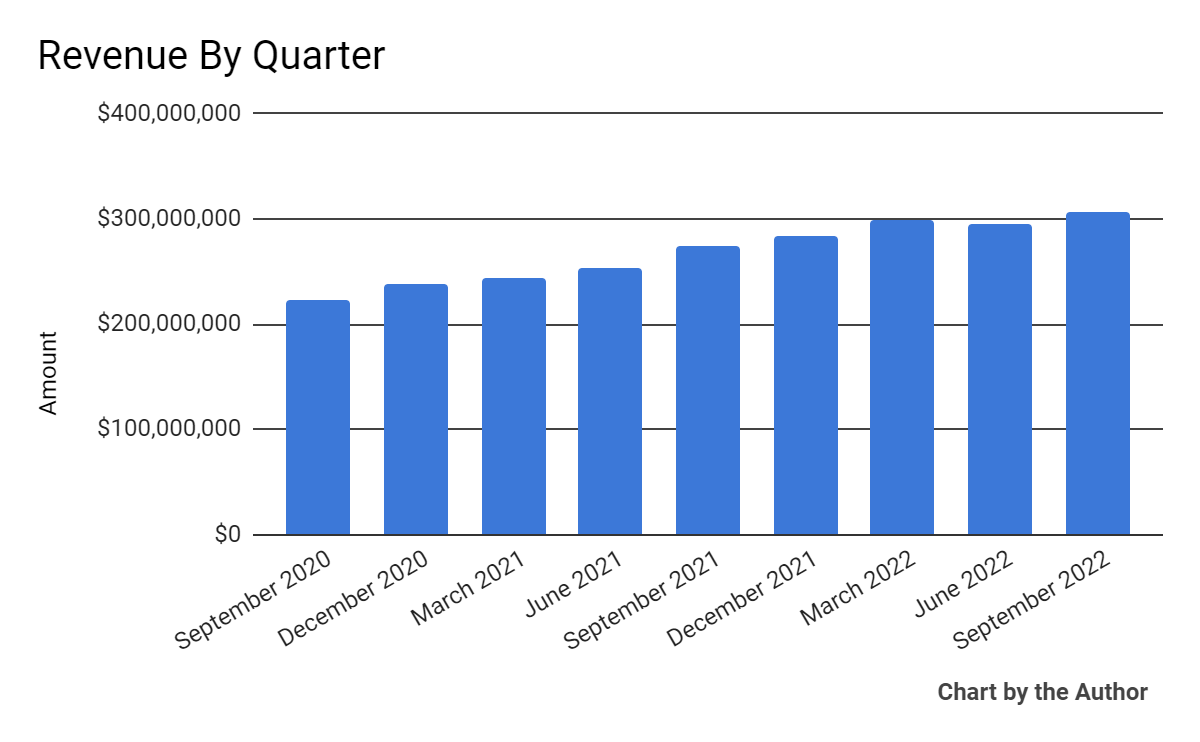

Total revenue by quarter has grown revenue per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

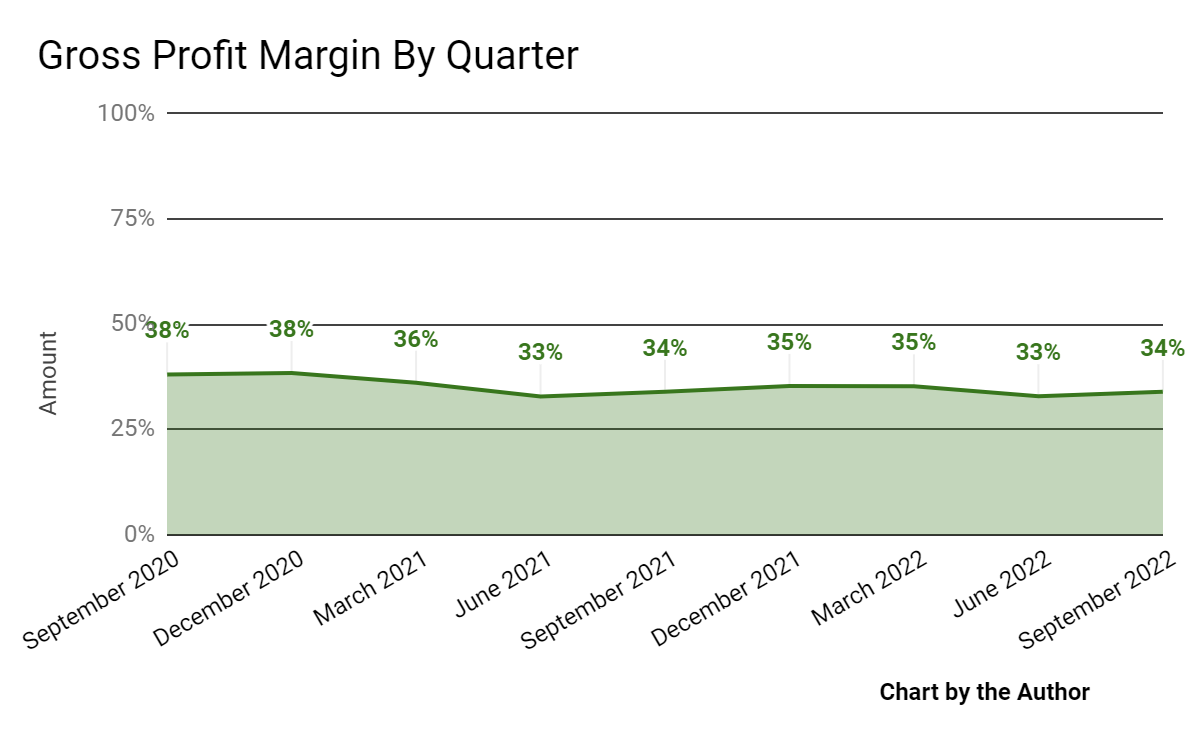

Gross profit margin by quarter has trended slightly lower over time:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

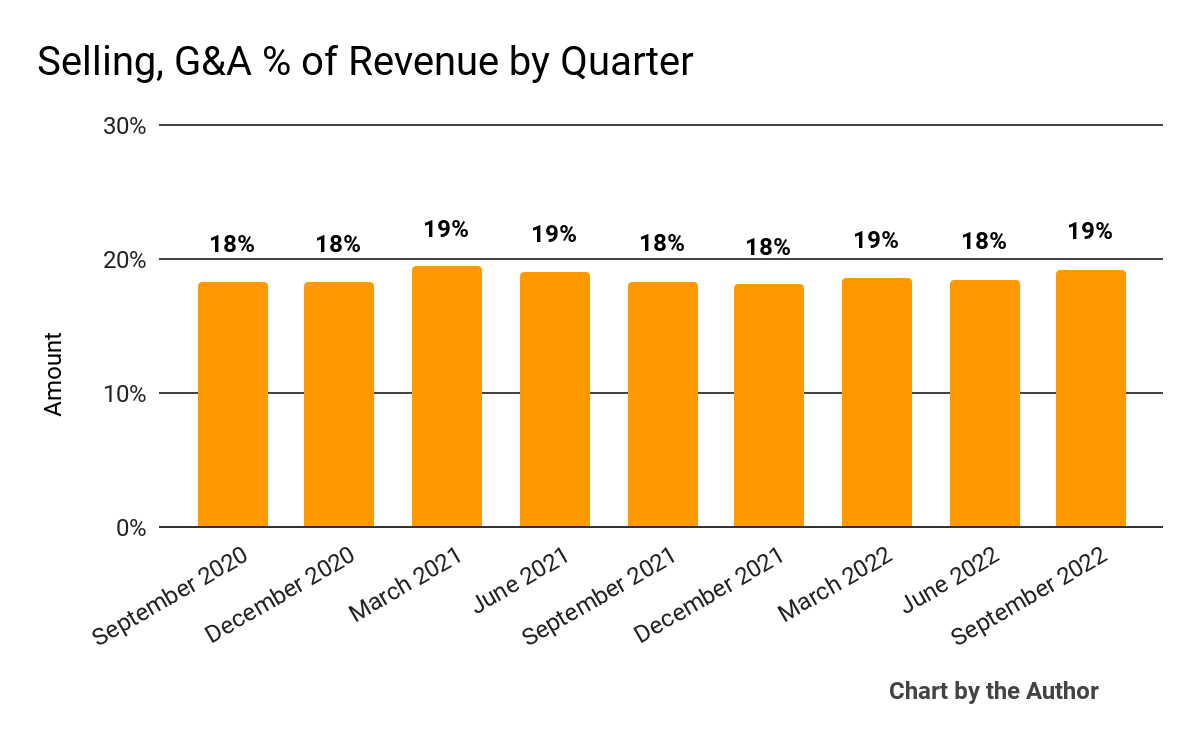

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

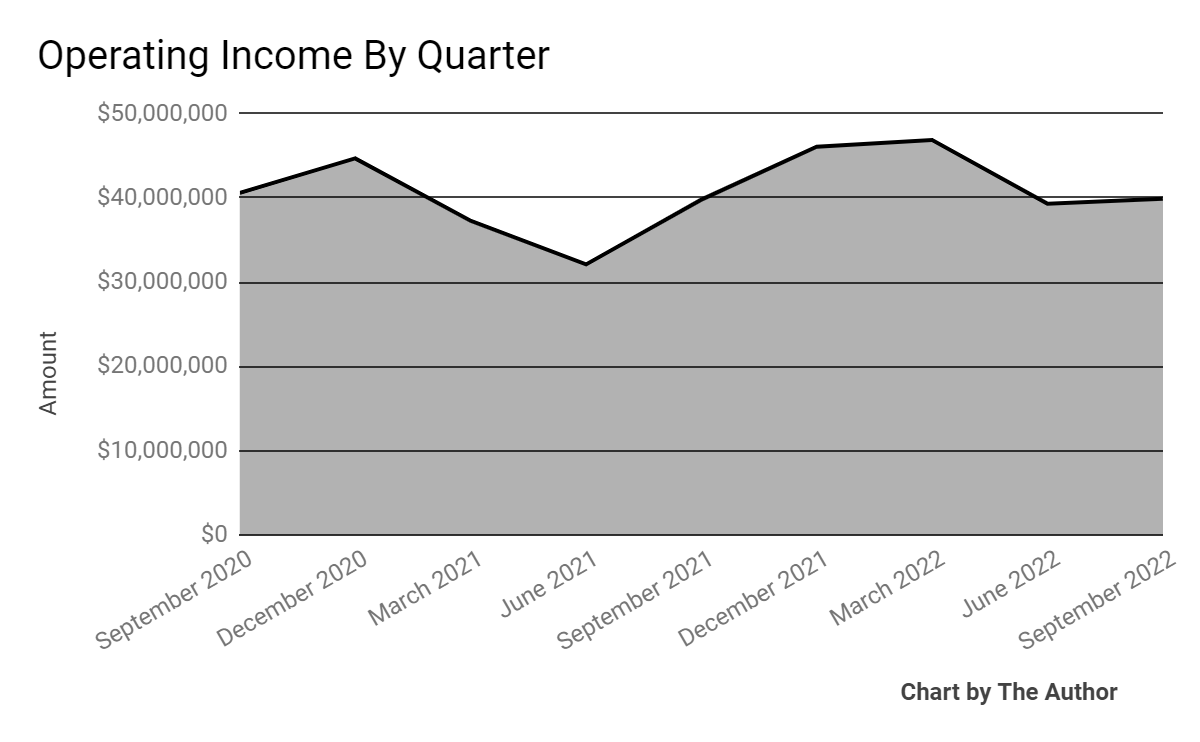

Operating income by quarter has trended a bit higher over time:

9 Quarter Operating Income (Seeking Alpha)

-

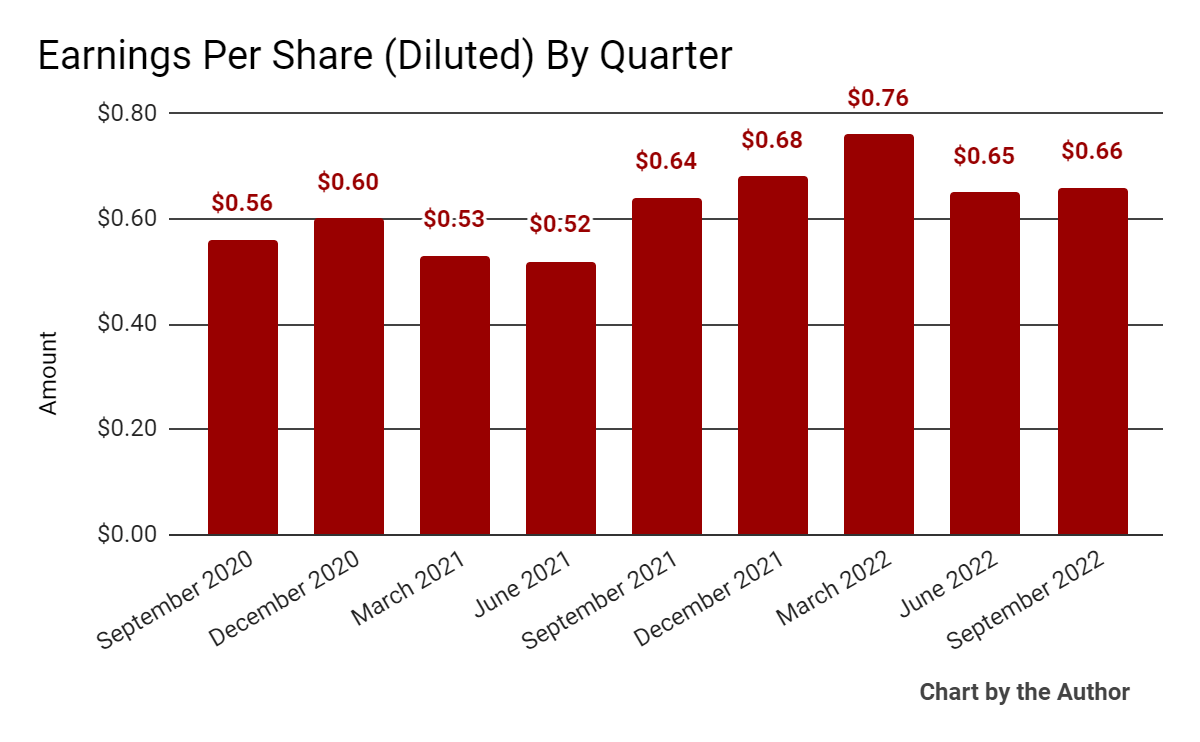

Earnings per share (Diluted) have increased in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

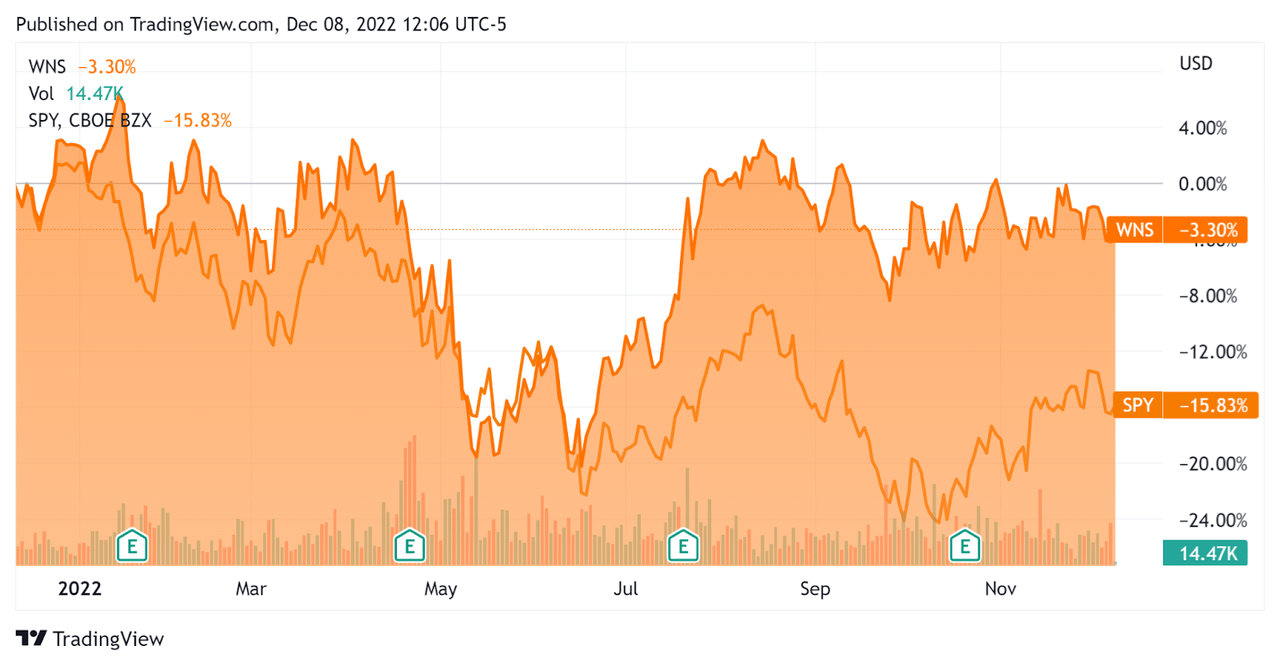

In the past 12 months, WNS’s stock price has fallen 3.7% vs. the U.S. S&P 500 index’ drop of around 15.8%, with WNS decoupling from the S&P around July, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For WNS

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.4 |

|

Enterprise Value / EBITDA |

21.4 |

|

Revenue Growth Rate |

17.5% |

|

Net Income Margin |

11.8% |

|

GAAP EBITDA % |

16.1% |

|

Market Capitalization |

$4,011,691,260 |

|

Enterprise Value |

$4,078,172,160 |

|

Operating Cash Flow |

$175,159,008 |

|

Earnings Per Share (Fully Diluted) |

$2.75 |

(Source – Seeking Alpha)

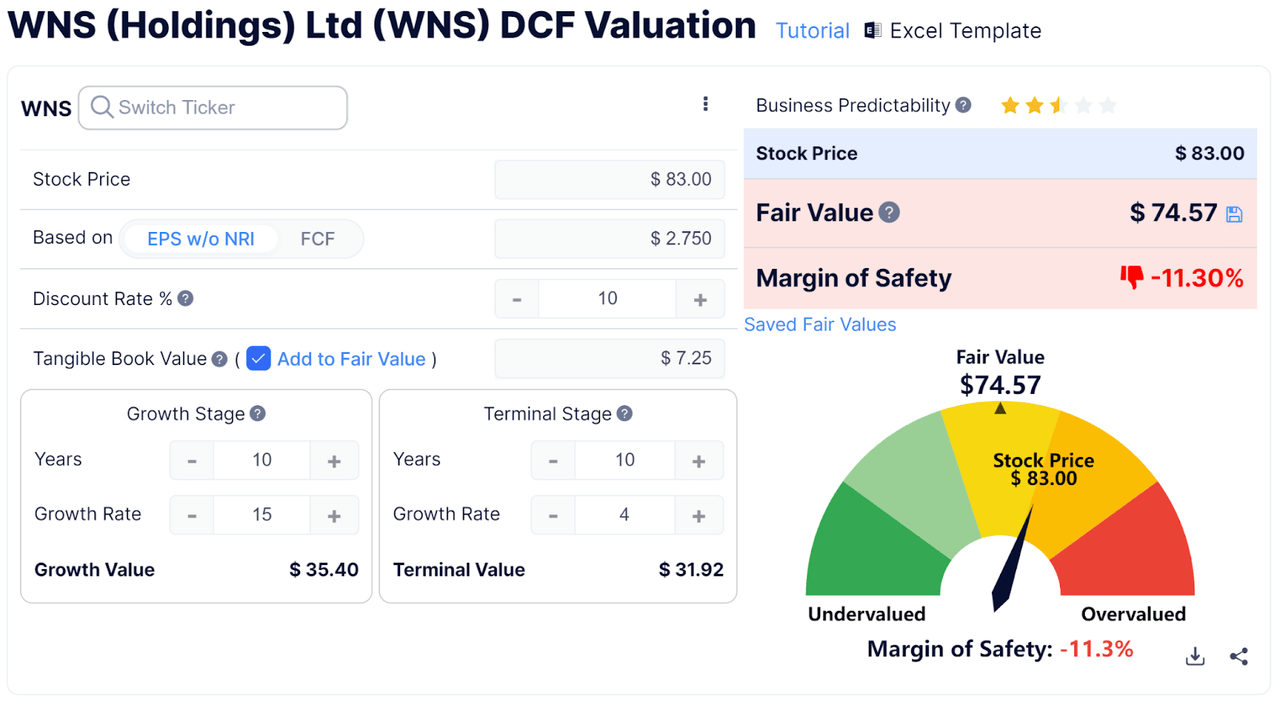

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

WNS Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $74.57 versus the current price of $83.00, indicating they are potentially currently somewhat overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On WNS

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted the 3% revenue contribution of its recent acquisition of intelligent automation company Vuram for $165 million.

The company added 9 new logo customers and expanded relationships with 21 existing customers.

Leadership continues to see strong demand for the company’s BPM services and believes that the trend ‘will remain largely independent of the macro environment.’

As to its financial results, total revenue rose 13.7% on an as-reported basis, with a negative 6.7% foreign exchange impact.

Management did not disclose any customer retention metrics.

Gross profit margin was essentially flat, as was SG&A as a percentage of revenue.

Operating income and earnings per share were also within a narrow range.

For the balance sheet, the firm finished the quarter with $190.6 million in cash, equivalents and short-term investments and $79.5 in total debt.

Over the trailing twelve months, free cash flow was $142.8 million, of which capital expenditures accounted for a use of $32.4 million of cash.

Looking ahead, for the full fiscal year 2023, management expects total revenue of $191 million at the midpoint of the range, assuming an Indian Rupee to USD exchange rate of 82.

Regarding valuation, my discounted cash flow analysis suggests that the stock may be slightly overvalued at its current price, given generous growth assumptions into the future for WNS.

Potential risks to the company’s outlook include a slowing global growth outlook and a stronger US dollar, both of which would generate stronger headwinds for revenue growth denominated in dollars.

Given the possible full valuation of the stock at its present level combined with a slowing growth environment, my outlook for WNS in the near term is on Hold.

Be the first to comment