Jonathan Kitchen

I’m a fan of taking a walk down memory lane, and I’m definitely a fan of bragging, which is why I’m very happy to be writing about Illumina Inc. (NASDAQ:ILMN) this morning. Way back in January of 2018 I put out an article suggesting that the shares were a bad investment, and since then they’re down about 7.8% against a gain of 49% for the S&P 500. Much has happened since, obviously, so I thought I’d check back in on the company to see if it’s worth buying at current prices. I’ll make the determination by looking at the most recent financial performance and by looking at the stock as a thing distinct from the underlying business. I want to work through whether or not recent analyst pessimism presents a buying opportunity or not.

Welcome to the “thesis statement” portion of the program. This is a paragraph that I present at the beginning of each of my articles which summarizes my perspective on a given company. It is full of spoilers, so if you don’t want to learn how this drama unfolds until the end of the article, stop reading this paragraph now and jump to the “financial snapshot” section below. I offer this thesis statement for those people who want to be exposed to as little “Doyle mojo” as possible, because my writing can be “taxing” for some. You’re welcome. Now, in case you missed the title of this article, and sailed past the bullet points above, I’ll let you know that I think it best to continue to avoid this name. Although during their most recent conference call the company seemed to express hope that restrictions in China would ease, it seems that that’s not happening. Further, the company seems hard pressed to turn growing sales into growing profits, and it’s profits that investors are compensated with. Worst of all in my view is the fact that the shares are morbidly expensive at the moment. Slowing profitability and expensive stock price is not a great combination in my view, and so I’ll continue to avoid.

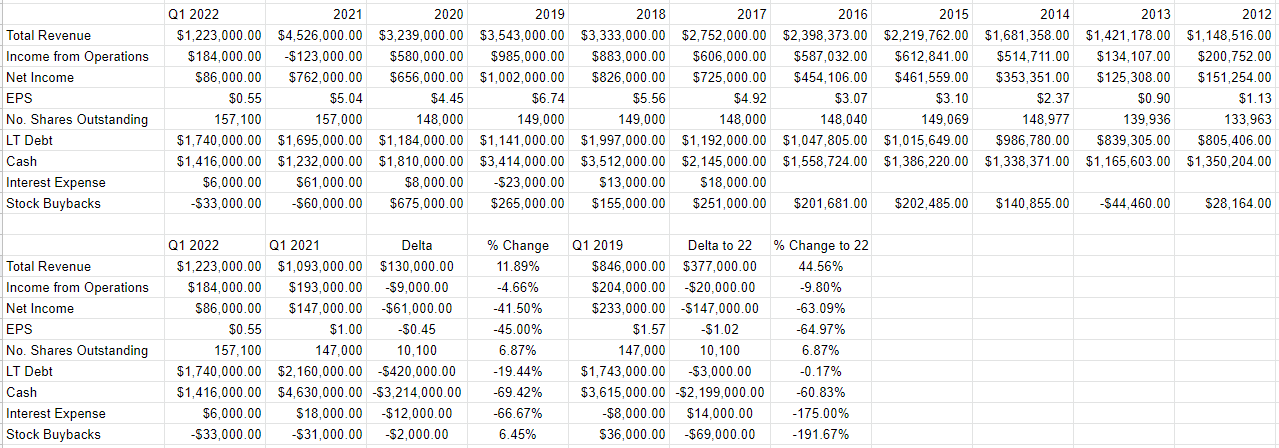

Illumina Financial Snapshot

Although the top line is about 36% higher in 2021 than it was in 2018, net income in 2021 was actually about 8% lower than it was when I last checked in on this company. I feel a need to remind investors at this point that we’re compensated by what’s left over after employees, suppliers, governments, landlords, and others are paid. So, growing sales is great, but we care more about the bottom line.

When we focus on the most recent quarter, the same theme of ‘growing sales, falling profits’ re-emerges. Specifically, in spite of the fact that revenue is about 12% greater now than it was in 2021, operating income and net income were down by 4.7% and 42% respectively. These decreases are generally caused in turn by cost of product revenue, cost of service revenue, and R&D expenses increasing by 12.8%, 19%, and 64% respectively. In case you’re worried that my comparison to 2021 isn’t representative, fret no longer. When we compare the most recent quarter to the same period just before the pandemic, the same theme emerges. Revenue was 45% higher than 2019 in 2022, and operating income, and net income were 9.8% and 63% lower.

It’s not all wailing and gnashing of teeth over at Illumina, though. The capital structure remains quite strong as evidenced by the fact that cash represents about 81% of long term debt. This suggests to me that there’s little risk of a liquidity or insolvency crisis anytime soon. For that reason, I’d be comfortable buying the stock if I could pick it up at an attractive price.

Illumina Financial History (Illumina investor relations)

The Stock

It seems that I’ve just experienced another bump in followers, which induces in me a mix of gratitude and bafflement. Anyway, welcome. You new people haven’t been exposed to my tendency to drone on about the same theme for years at a time, but every 5,000 mile journey starts with the first step, so here we go. I am of the view that the business and the stock are very different things, and as such, we need to consider each of them separately when making a buy or sell decision. I’m of the view that a reasonably strong company can be a terrible investment at the wrong price, while a struggling company can be a decent investment if you pick it up at a sufficient discount to intrinsic value.

Another way to conceive of this idea is that business is an organization that buys a number of inputs, performs value-adding activities to those, and sells its “thing”, whether that “thing” be transportation services, wine and spirits, software, or whatever else at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. If you’ve invested in stocks previously, you may have noticed that the crowd can be capricious and has a tendency to drive prices up and down relatively frequently. Added to that is the volatility induced by the crowd’s views about a given sector, Oracle (ORCL) may go up or down if Microsoft (MSFT) has a good or bad quarter, in spite of the fact that these may be poor analogs of each other. Add to that the fact that a company’s stock can be buffeted by our collective view about “stocks” as an asset class, and we see that the stock is often a poor proxy for what’s going on at the firm. This is frustrating in some ways, but it also represents opportunity for us. If we can spot discrepancies between the price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. In my world, “down in the dumps” means “cheap.”

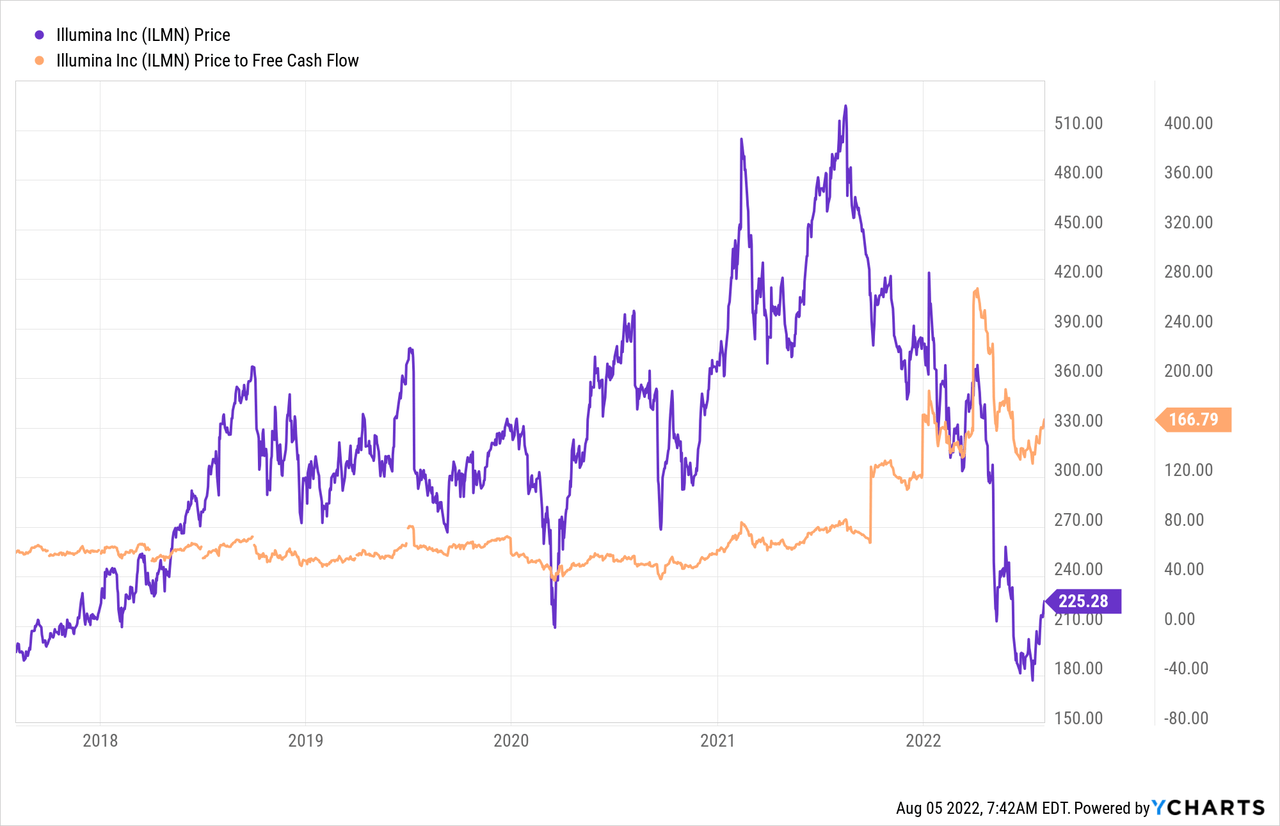

Those who read my stuff regularly know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complicated. On the simple side, I track multiples of price to some measure of economic value, like earnings, free cash flow, book value, and the like. Ideally, I want to see a company trading at a discount to both the overall market and its own history. When I last reviewed Illumina, I complained about the fact that the stock was trading at a price to free cash flow of about 83.5. I thought then and now that that was an objectively expensive price for a company that I admitted was great. Fast forward 4 ½ years and valuations are even worse in my view, per the following:

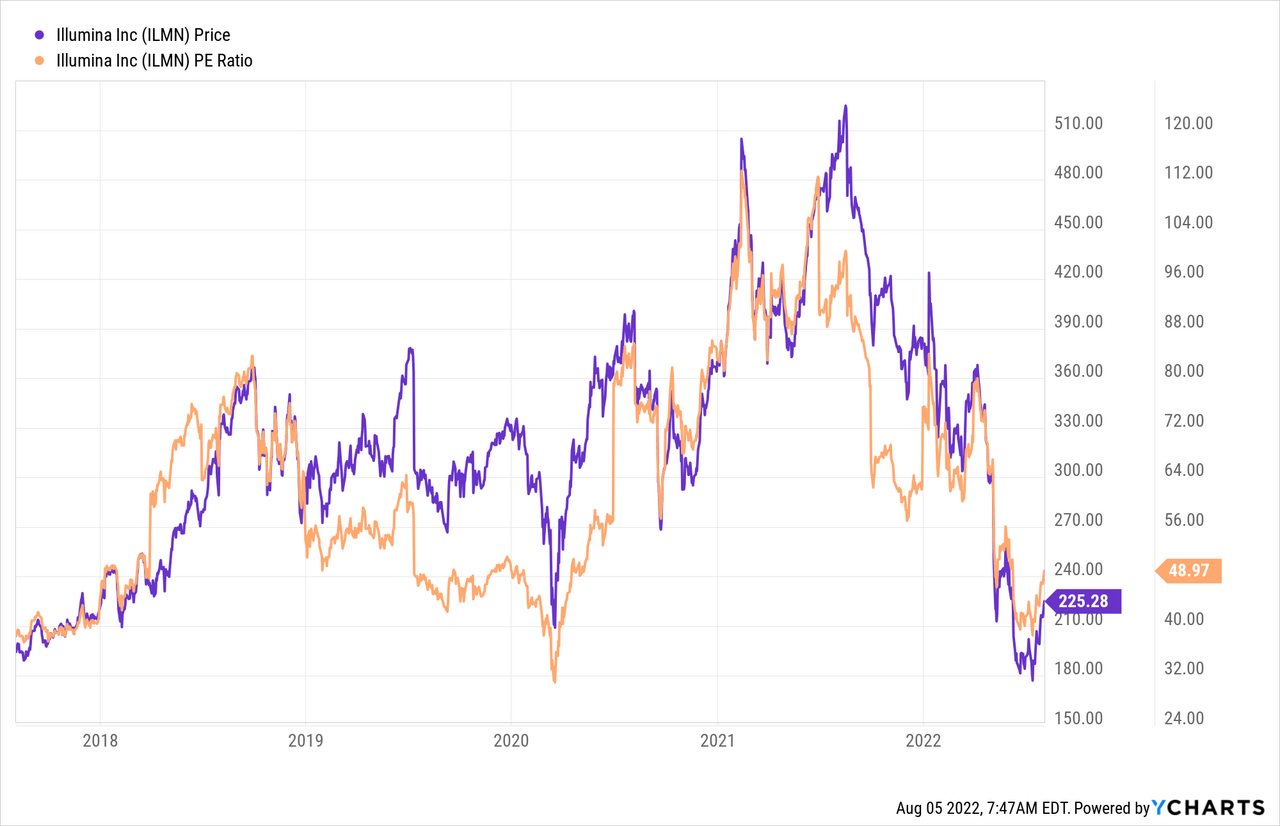

Although the shares are even more egregiously expensive on a price to free cash flow basis now than they were previously, the shares are now relatively cheap on a P/E basis. The problem, from my perspective, is that “relatively” cheap is not the same thing as “cheap.”

It may not be fully logical to anchor on my first review, I feel a need to point out that the shares are more expensive now than they were previously, in spite of the fact that profitability is lower now than it was four years ago. This is a bad combination in my view.

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Illumina at the moment suggests the market is assuming that this company will grow at about 11.25% over the long term. This is an extraordinarily optimistic view in my opinion. Given the sclerotic profit growth, and the valuation, I will continue to avoid the name.

Conclusion

Illumina is about to report earnings again, and those may very well blow investors away, and the stock may jump in price. This is obviously quite possible. The problem for me is that the shares are richly priced in spite of the weight of evidence that the business is slowing. We’re not seeking returns, we’re seeking risk adjusted returns. In my view, the business is facing too many headwinds at the moment to justify an investment here. The fact that the shares are relatively excessively priced is merely icing on the cake.

Be the first to comment