Kevin Winter/Getty Images Entertainment

The pain for WM Technology (NASDAQ:MAPS) got even worse following the Q2’22 results back in August. The market absolutely hates the cannabis space plus just about any SPAC deal providing a double whammy for the owner of Weedmaps. My investment thesis remains Bullish on the stock despite an ongoing period of weakness in the cannabis space.

Source: FINVIZ

Market Struggles

Despite all of the promise of a consumer and technology platform servicing the growing U.S. cannabis space, WM Tech. continues struggling to meet somewhat aggressive financial targets. The sector hasn’t grown at the clip as expected with a tough retail market due to high inflation. All of the public multi-state operators (MSOs) haven’t reported overly impressive numbers during this period either.

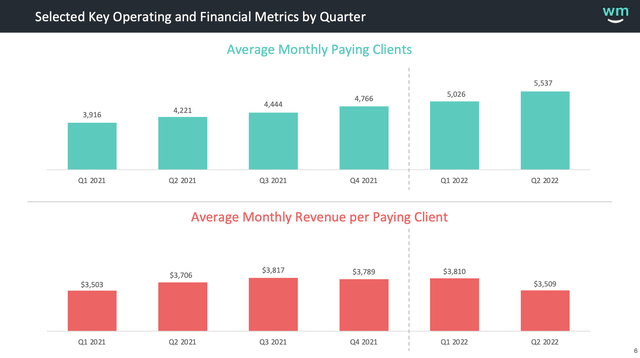

For the June quarter, WM Tech. reported strong growth in paying clients, but the average monthly revenue per paying client dipped massively. The company continued to innovate and build the marketplace, but the advertising and delivery business struggled and client liquidity in certain instances curtailed spending despite healthy returns on platform spending.

Source: WM Tech. Q2’22 presentation

WM Tech. missed estimates by a wide margin with revenues hitting $58 million, $3 million below guidance. Even worse, the company guided to 2H revenues flat to down for the year.

Originally, the Weedmaps business was forecast to reach up to $70 million in quarterly sales by the end of 2022. Regardless, the most important aspect of the quarterly results was the 10% sequential increase in paying clients to 5,537 while the company had nearly 500 clients either removed from the platform or put on payment plans.

The company grew paying clients by 30% YoY in an environment where cannabis businesses weren’t exactly expanding. Very few states increased license holders during the last quarter, though states like New York have plans to start recreational cannabis with additional license holders.

The main issue was clients only spending $3,509 per month, down from $3,810 last year. As mentioned above, at least 500 clients were forced to scale back operations and submit payment plans.

In a very positive sign of the viability of clients utilizing Weedmaps and WM Tech. software solutions, the spend from California customers grew 10% YoY while the licenses cannabis market in the state fell by 10%. The company can expand market share, but WM Tech. needs a healthy retail cannabis market in order to meet growth targets.

Deep Value

The business has definitely struggled to meet any financial targets since going public. WM Tech. is far more reliant on end cannabis markets than probably appreciated when the company went public via the SPAC deal.

With 145 million shares outstanding, WM Tech. only has a market cap of $300 million here after the Biden boost. Struggling or not, the company is still on pace to generate $219 million in annual revenues in this tough retail environment.

States from Illinois to New Mexico to New Jersey to New York plan to issue thousands of licenses that will expand the market for WM Tech. The New Jersey and New York recreational cannabis markets alone are set to boost U.S. cannabis sales by up to $8 billion.

The company guided to revenues flat to down despite July sales growing at a mid-single clip. WM Tech. reported Q3 sales last year of $50.9 million, so the guidance doesn’t exactly add up considering what would amount to a massive $7.4 million dip in sequential revenues to hit a flat number in Q3’22.

The company forecasts a similar dip to paying clients ARPU while possibly still growing the client base in a tough environment. Investors have to be careful extrapolating too much from the current environment.

The stock has fallen too much due to the tough retail environment beyond their control. The combination of some claims of illegal cannabis on the platform from an MJBiz article contributed to a massive dip in WM Tech. since mid-Summer.

If WM Tech. gets the business worked out, the stock will trade at a far higher multiple of sales. The company has growth opportunities in Canada, Europe and Mexico and will ultimately participate in the U.S. cannabis sector growth from current annual sales of $25 billion to over $100 billion long term.

The company has a $48 million cash balance and has plans to reach adjusted EBITDA profits in the 2H after cutting spending and slashing the workforce by 10%. The business just isn’t priced for the opportunity evidenced by the 64% gain on October 6 following President Biden finally making moves on marijuana reform.

Takeaway

The key investor takeaway is that WM Tech. isn’t correctly priced for the opportunity ahead in the cannabis sector. The stock has already given back a lot of the Biden pop. Investors should use any further weakness to load up on the Weedmaps owner below $2.

Be the first to comment