Scott Olson/Getty Images News

Investment thesis

Wingstop is growing impressively, though it is facing short-term headwinds due to inflation in chicken prices. Even after a steep fall, the stock looks slightly overvalued as compared to peers. Wingstop’s higher growth compared to other restaurants makes the stock attractive. Strong digital sales partly contribute to this outperformance. Yet, investors should get a better entry point, as near-term headwinds and broader market weakness may pressure the stock further.

An overview

Wingstop (NASDAQ:WING) is a fast casual wings-focused restaurant chain with over 1,700 locations worldwide. Majority of its restaurants are franchise operated. The company generates revenue through royalties, advertising fees, and franchise fees and by operating company-owned restaurants. Around 59% of the domestic restaurants are in four states – Texas (26%), California (21%), Illinois (6%), and Florida (6%).

In the US, the company generally grants the franchisee the right to operate at a particular location for an initial term of 10 years. Under the franchise agreement, each franchisee pays a royalty of 6% of their gross sales net of discounts. Additionally, the franchisee contributes 4% of gross sales net of discount to fund national marketing and advertising. In 2022, this contribution rate will increase to 5% of gross sales net of discounts.

International franchise are master franchisees, which grants them franchise and distribution rights for entire regions or countries. Their royalty fee is set at 6% of the sales.

The principle raw materials for Wingstop are bone-in and boneless chicken wings. Chicken constitutes nearly 69% of all purchases as of fiscal 2021.

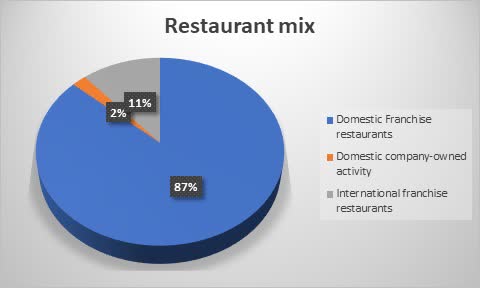

Wingstop

As much as 98% of Wingstop’s restaurants are franchise owned.

5-year financials are impressive

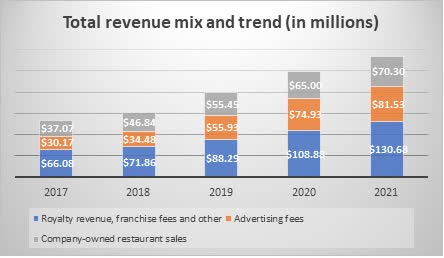

During the period 2017-2021, Wingstop’s total revenue grew at a CAGR rate of 20.7%. Total revenue for 2021 stood at $282.50 million against $133.32 million in 2017. Royalties, franchise fees, and other revenue saw a growth of 18.6% CAGR in the same period. Advertising fees increased 28.2% whereas company-owned restaurant sales increased 17.3%.

Wingstop

Total operating costs and expenses saw an CAGR increase of 20.4% in the period. Operating income for 2021 stood at $73.7 million as against $33.87 million in 2017, showing a growth of 21.5% CAGR.

Net income for the period saw growth of 15.5%. Net income for 2021 stood at $42.66 million as against $23.94 million for 2017. Cash Flow from Operations also saw a similar growth of 15.5% CAGR. Cash Flow from Operations stood at $48.88 million in 2021 as against $27.44 million in 2017.

Quarterly results were hurt by inflation

For the first quarter of 2022, Wingstop’s total revenue grew 7.8%. Total revenue for the first quarter of 2022 stood at $76.20 million vis-à-vis $70.69 million in same quarter last year. Royalty revenue, franchise fees, and other revenue grew 11% due to 208 net franchise restaurant openings coupled with domestic same store sales growth of 1.2%. Advertising fees increased 4.7% due to an increase in system-wide sales of 12.7%. At the same time, company-owned restaurant sales increased 5.9% mainly due to addition of four net new units, coupled with a 2.1% growth in company-owned same store sales.

Cost of sales as a percentage of company-owned restaurant sales was 84.3% in first quarter of 2022 vis-à-vis 75.6% in the comparable period in 2021. Food, beverages, and packaging cost increased due to a 14.2% increase in the cost of bone-in chicken wings over the year. Net interest expense increased 10.8% due to a securitized financing transaction in March 2022.

Due to higher costs, operating income for the quarter stood at $16.6 million as against $19.80 million in the comparable quarter last year, showing a decrease of 16.1%. Net income decreased nearly 34% and stood at $8.67 million for the quarter.

Strong guidance

Wingstop’s vision is to become a top 10 global restaurant brand. Management believes there is scope to reach a restaurant count of more than 4,000 in the United States and more than 3,000 internationally. In first quarter of 2022, company generated 62.3% of sales through digital channels. The management aims to increase digital sales with continued investments in technology. It also expects deflation in the bone-in wings.

The management expects to open 220 net new units in 2022. It expects low-single digit domestic same store sales growth. Diluted EPS is expected to be in the range of $1.55 to $1.57.

The company recently announced new development agreement for Indonesia. This is expected to increase the restaurant count there to 120 from the current count of 50.

Valuation

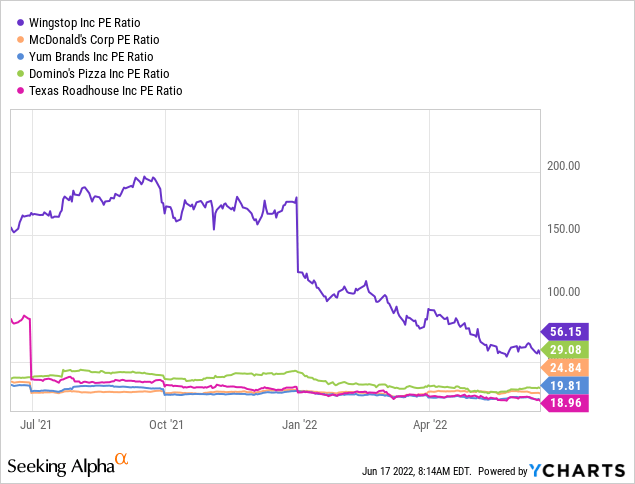

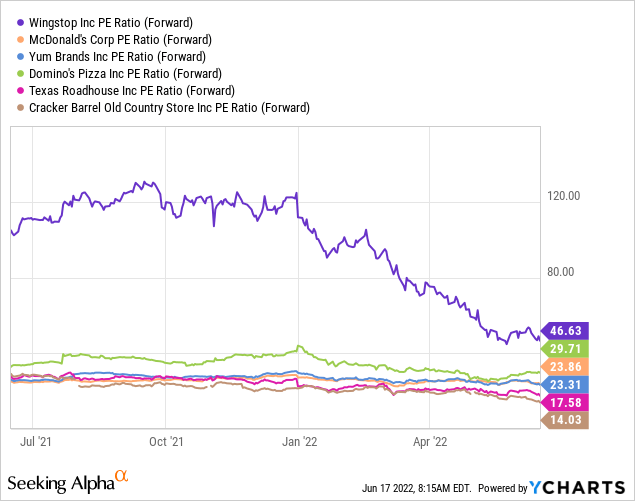

Wingstop stock is currently trading at a discount to its 5-year median Price to Earning and Price to Sales ratio. The current P/E stands at 56 vis-à-vis 5-year median of 111.8. Yet, despite the steep fall this year, Wingstop stock still trades at a premium compared to top stocks in the sector.

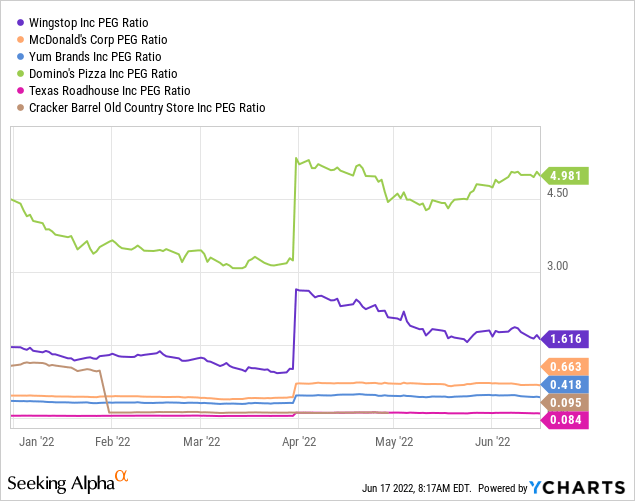

Despite Wingstop’s higher growth, the P/E ratio still looks a bit high, as the PEG ratio shows below.

Seeking Alpha’s proprietary Quant Ratings rate Wingstop as “Sell.” The stock is rated extremely low on valuation, which is clearly higher than the sector. It’s also rated low on momentum, though this can change as the stock starts to recover. The stock is rated high on growth and profitability factors.

Conclusion

Wingstop has shown impressive growth over the past few years. The stock is trading at a discount to its own 5-year median P/E ratio. However, the valuations are still not favorable compared to its peers.

Moreover, the major purchase item (chicken) has seen a spike in prices. Although the management believes that the peak has been seen in the chicken wings prices, one must monitor the commodity’s prices. Any further increases might be detrimental to the stock price in the short run. The company has also shown a decrease in operating and net income in the latest quarter.

Thus, even though the long-term prospects look good, the stock might correct a bit further, before recovering. Investors may want to watch it for some more time before jumping in.

Be the first to comment