Jemal Countess/Getty Images Entertainment

Co-produced with “Hidden Opportunities”

Is your portfolio chasing growth a bit too obsessively? Did you know that investing in slower-growing, stable companies can be predictably rewarding? Dividend stocks are a smart way to diversify your portfolio and add predictability to the equation. After all, these securities make it possible to generate income in good times and bad times, notably during today’s times of high inflation and recession fears.

Everyone knows Microsoft’s (MSFT) co-founder Bill Gates. But did you know that a tech mogul like Bill Gates invests in many dividend stocks? His portfolio tracked from Cascade Investments generates over $135 million yearly from dividend payments. Whether this is significant enough for Mr. Gates is unknown to us. Still, it is undoubtedly a sizable chunk of cash that gets generated without any reduction in ownership of those stocks.

Income during good and bad times is my motto, and while I like the security selection criteria adopted by Cascade for their dividend picks, my goals are different from those of Mr. Gates. As such, I pursue similar sectors through a different choice of securities for my portfolio. This article discusses two big dividend stocks I hold in my portfolio for income. With yields of up to 10.8%, these let me sleep well at night despite the sentiment in the financial spheres. Without further ado, let us review the income picks.

Pick #1: SLRC, Yield 10.9%

Believe it or not, Bill Gates has invested in several early-stage and established pharmaceutical, biotechnology, and life-sciences companies over the years. Additionally, Caterpillar (CAT) and Deere (DE) are significant positions in Mr. Gates’ portfolio. These companies are the leaders in industrial, construction, and agricultural equipment. But did you know that equipment financing significantly contributes to the top line of these companies?

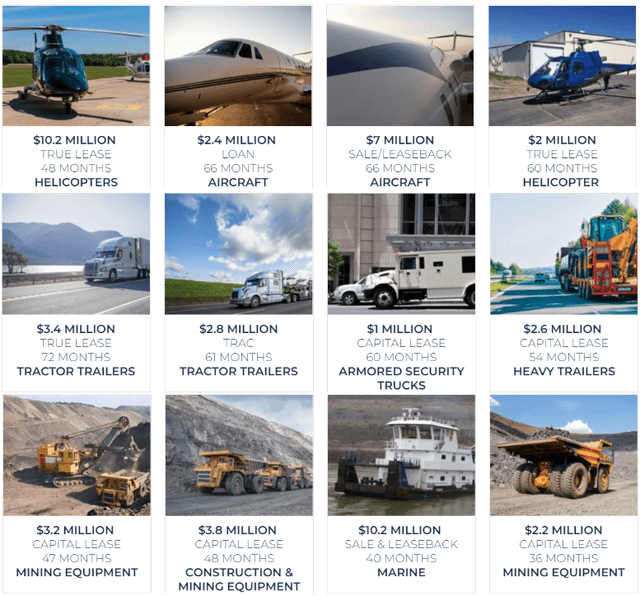

We discuss SLR Investment Corporation (SLRC), a Business Development Company (‘BDC’) that invests in Life Sciences companies through debt financing arrangements. Additionally, SLRC also pursues sponsor financing for non-cyclical industries, equipment financing, corporate leasing, and other wide range of debt investments. Let’s make one thing clear – a BDC like SLRC will never be part of the portfolio of a billionaire like Mr. Gates due to its small market cap and the fact that he already has a well-paid team to manage his portfolio. It wouldn’t make sense for him to pay his team to buy SLRC. (Source: SLR Investment Corporation)

SLR Investment Corporation

Nevertheless, we think SLRC mimics the characteristics of Cascade’s dividend portfolio picks and presents a double-digit yielding opportunity from a quality BDC. As of Q2 2022, SLRC reported a net debt-to-equity of 0.96x, an increase from the previous quarter, and this tells us that the BDC is taking advantage of the rising rate environment by increasing leverage. SLRC continues to stay on the low end of its target leverage range of 0.9x to 1.25x, meaning we can expect them to continue pursuing more opportunities as rates increase.

Almost 50% of SLRC’s $1 billion debt is through senior unsecured fixed-rate notes at a weighted average annual interest rate of 3.9%. And 65% of their assets are floating-rate investments, making SLR a beneficiary of rising rates. The best part is that 97% of their asset portfolio is first-lien senior secured loans, which indicates better downside protection during problematic situations such as recessions.

Earlier this year, SLRC completed the acquisition of a smaller BDC – SUNS. This transaction improves SLRC’s portfolio diversification across cash flow loans, non-cyclic industries, and asset-based loans. This positions the BDC to continue ramping up leverage, taking advantage of rising rates, and covering its distribution. SLRC has maintained a steady distribution since 2013 and recently switched to becoming a monthly payer. The BDC currently pays $0.137/share every month, which calculates to a healthy 10.9% annualized yield.

SLRC trades at a healthy ~18% discount to its NAV. This steep discount has prompted management to announce a new program to repurchase up to $50 million of the BDC’s outstanding shares. This is a win overall, as more of the Net Investment Income becomes available to a smaller pool of shares, improving the prospects for healthy distribution coverage. SLRC is a BDC focused on recession-resistant sectors and is structurally well-positioned for a rising-rate environment. Today, you have the opportunity to lock in 10.9% yields from this undervalued BDC.

Pick #2: ATH-C, Yield 6.1%

Insurance is an excellent future-proof business; Bill Gates and his pal Warren Buffett know this too well. Berkshire Hathaway (BRK.A) (BRK.B) is a significant component of Mr. Gates’ portfolio, and the company notably draws 27% of its top line and ~20% of its Earnings Before Taxes (‘EBT’) from its insurance businesses. No wonder BRK.B occupies a significant position in Mr. Gates’ portfolio.

Let me restate the obvious – Warren Buffett doesn’t like to pay dividends, and he doesn’t need to pay dividends to make BRK.A & BRK.B appealing to shareholders. So I will look elsewhere for my income needs while respecting Buffett and Gates’ eye for the lucrativeness of the insurance business.

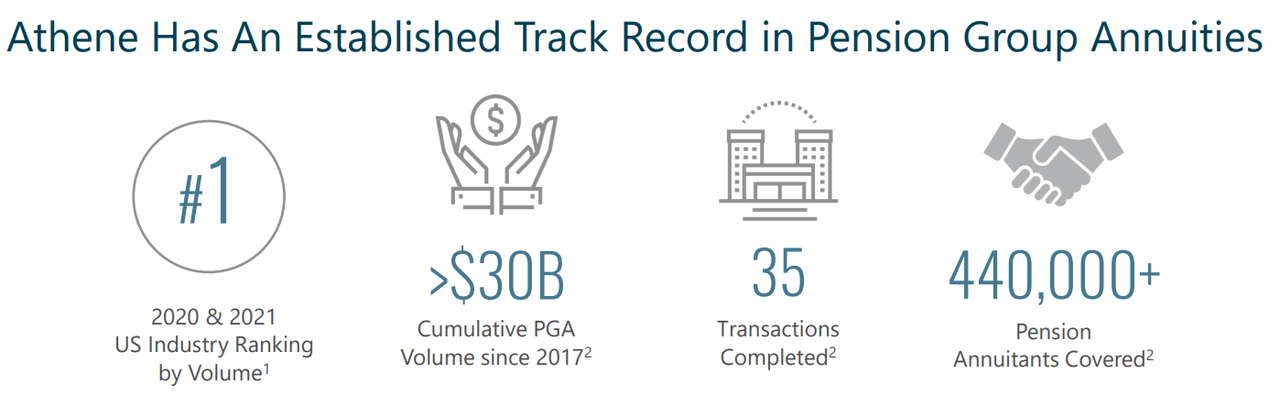

Athene Holdings is an insurance company that specializes in retirement products. It offers annuities, re-insures annuities, and offers other retirement services products. It is a fully owned subsidiary of Apollo Global Management (APO), one of the largest asset-management firms in the world. APO and its subsidiary Athene maintain healthy “A” rated balance sheets. (Source: July 2022 Investor Presentation)

July 2022 Investor Presentation

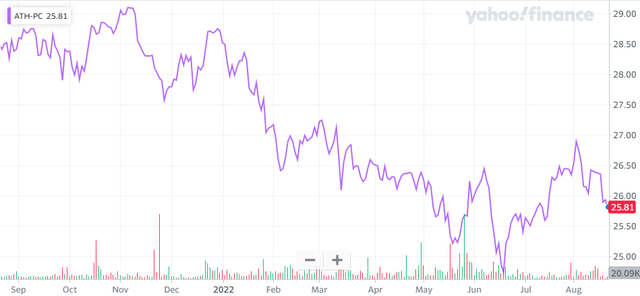

Today, we will discuss one of Athene’s preferred securities, Athene Holding Ltd. 6.375% Series C, Non-Cumulative Rate Reset Perpetual Preferred Shares (ATH.PC). ATH-C is a reset-rate preferred stock. This means that if the stock is not redeemed on its call date (9/30/2025), the original fixed rate will change to 5.97% plus the yield on the 5-year Treasury note at the time. As Peter Lynch says, no one can predict where interest rates (5-year Treasury yields) will be in 2025. However, looking at today’s situation, the yield on the preferred will go from its current coupon of 6.375% to 8.93%. And if the 5-year note continues to rise, the rate can move even higher because it resets every 5 years (unless Athene exercises its option to call ATH-C on any subsequent 5-year Reset Date). Thus, this security is the epitome of preferred stock with solid inflation protection characteristics.

ATH-C is rated BBB by S&P. It is important to note that only a small percentage of corporate preferred stocks carry investment-grade ratings, indicating that ATH-C is a safe income investment. The good news doesn’t stop there. ATH-C’s dividend is qualified, making it eligible for reduced Federal income taxes depending on your situation. This high-quality preferred traded at a deserving premium, as high as $29.20 in November 2021.

Yahoo! Finance

Whether inflation is roaring like a lion or purring like a cat, it destroys your hard-earned savings over the longer term. A reset-rate preferred like ATH-C provides reliable income and the much-needed inflation protection for your portfolio.

Dreamstime

Conclusion

If your portfolio is flying too close to the sun chasing growth, adding stability to the equation is essential. Dividend stocks provide this much-needed stability by ensuring income during bull and bear markets. Billionaires like Bill Gates may not be income investors. Still, looking into their portfolio, we see sizable dividends from cash-flow-rich companies and industry sectors that maintain significant competitive advantage and prioritize returns to shareholders.

Unlike Mr. Gates, we are focused on current income to fuel a healthy retirement. However, I like Cascade’s portfolio design and security composition that ensures resilience through economic conditions. I follow a similar strategy, but because my objectives differ, I pursue it with a slightly different choice of securities in my portfolio. At HDO, we maintain a diversified portfolio of securities targeting an overall +8% yield to ensure peace of mind for retirees. Two picks with up to 10.9% yields to enable a happy and healthy retirement.

Be the first to comment