JHVEPhoto

Willis Towers Watson (NASDAQ:WTW) is mostly a consulting company and therefore depends on the productivity of its workers. Due to departures noted in the last quarter earnings productivity had fallen in some of their key segments as rolodexes left the company. Hiring has now accelerated to staunch that effect which is still being digested in this quarter. While we think the headwinds from departures are in the rear-view, we have non-specific concerns about the economy and the danger of unemployment spiraling which we think is still being underappreciated by many market actors. The effects on clients of companies like WTW is likely to impact engagements. While we think WTW is an interesting company that should be followed, the direction is uncertain at this moment, and we’d wait for the market to digest macro risk further before doing anything.

Quick Macro Note

While many capital markets have closed as a consequence of the rising rates, and while markets are expecting yet another 0.75% bump to the Fed Funds rate, the unemployment spiral is an effect that markets might not be anticipating properly due to flywheel effects. While layoffs now could legitimately be trimming of fat, income is still leaving the economy, which could require carving off more lean segments as well, in which case an eventually emaciated corporate environment constitutes a quite serious recession. We worry about this unemployment spiral and refrain from taking bets against what can be considered network effects.

Back to WTW

With unemployment spiraling and potentially hitting headcounts, businesses that concern themselves heavily with the workforce of clients could be at risk, namely companies like WTW. While their businesses don’t necessarily model revenues on a per-seat basis, the demand for engagements around issues like hiring, compensation and benefits is subject to some amount of reduced demand as the calculation simplifies for employers in a less tight labor market where employees have less bargaining power. In corporate risk and broking the effects of lower headcounts are more direct as the size of tickets fall.

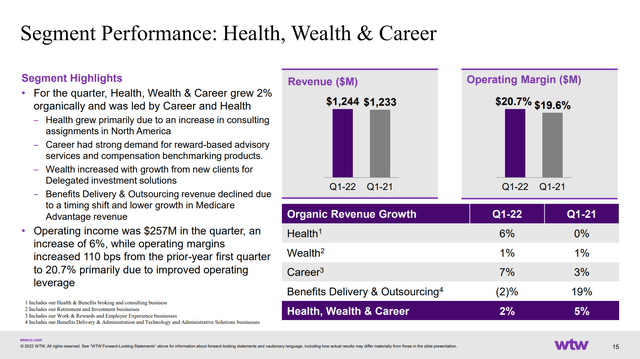

The last quarter saw limited growth despite favourable environments due to departures of quite valuable employees. Hiring has accelerated 23% this quarter to fill the ranks again. There’s nothing wrong with doing this but we worry that some of them won’t be productive right away as they are shown the ropes, and once they do the market might be less favourable and marginal productivity will be limited. This attrition affected both the HCB and the CRB lines, and these are the businesses that are subject to risk if client headcounts fall. Indeed, as of yet these headcounts and employee management businesses are the ones doing quite nicely now, and this is where we believe growth is most subject to change. Within the newly defined Health, Wealth & Career segment it is health and career that are rising the most which includes all employee oriented and broking businesses.

HWC Segment (Q1 2022 Pres)

Overall revenue is still coming out of a plateau with just 2% increases as the company deals with the attrition effects from recent quarters. Cost management has allowed for very solid EPS growth at 22%. While cost can still be managed, we think the macro environment could become troublesome for companies with all these corporate engagements.

Final Remarks

WTW is working through a cost improvement programme that is so far yielding results. About 10% of projected cost savings have already been achieved since programme inception, and the current quarter allowed for half of the current savings to come through. Run rate savings could contribute a total of 25% growth in operating profit, as of now it’s 2.5% with the rest coming from general discipline in expenses. We are skeptical of management delivering fully here, but scope for savings should be appreciated by investors who are taking a longer term bet here.

Ultimately, WTW is a strong player in its markets and consulting based businesses do have opportunities to flex their relationships with clients to counter recessions. But with recessions often making decisions easier on the firing side, we wonder if the environment can benefit WTW at all, with some businesses being quite likely to see modest declines as headcounts fall. By no means is WTW extremely risky, but when we consider the universe of possible investments trading at a 14x PE, we think that better deals can be acquired where economics are more attractive and where multiples are also lower. WTW is no Korn Ferry (KFY) which is entirely levered to labour market dynamics and plays a different role for clients as a recruiter, but concerning itself with the workforce of clients could be an issue for engagement if unemployment spiraling kills employment bargaining power and simplifies the issue of employment.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment