Bruno Giuliani/iStock Editorial via Getty Images

Ryanair Holdings plc (NASDAQ:RYAAY) just released its three-month numbers. As a reminder, we initiated a buy rating towards the Irish company thanks to our analysis of the Gamechanger strategy. In detail, our conclusion was: “more seats, less fuel consumption, higher capacity loads, lower tariffs, and consequently more customers that equal more profit” in a continuous positive circle. With a compelling valuation, we recognized Ryanair as the clear champion in the European low-cost fares. Today, after our Q1 result analysis, we reaffirm our buy rating with a target price of €19 per share.

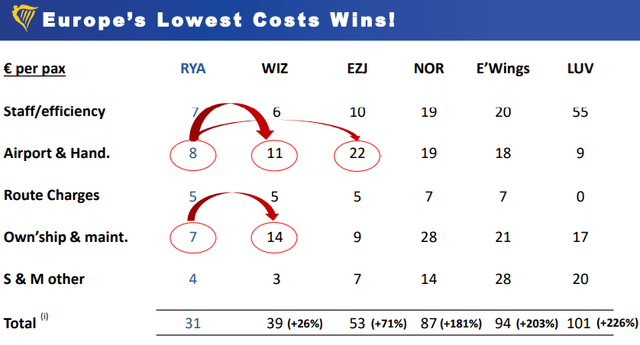

Source: Ryanair Q1 Results presentation

Q1 Results

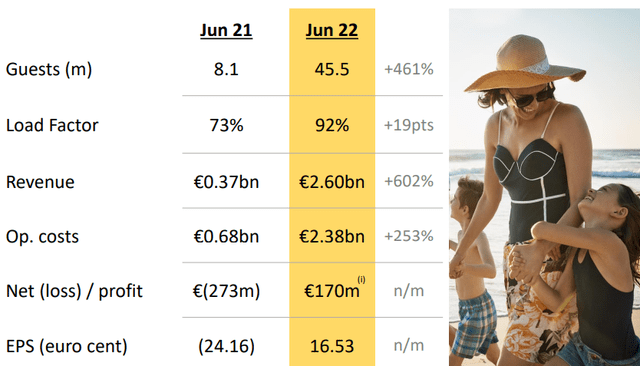

Looking at the bottom line, the largest low-cost airline in Europe recorded a net profit of €170 million in April-June 2022, compared to a loss of €273 million recorded in the same period of 2021. The net income result exceeds the Wall Street consensus, which estimated earnings for the period at €150 million. Traffic recovered sharply, from 8.1 million to 45.5 million passengers (with a load factor of 92%). Russia’s invasion of Ukraine in February damaged Easter bookings and rates. As a result, average rates fell 4% from the same pre-Covid quarter. Topline sales increased by 602% to €2.6 billion and EPS stood at €16.53 compared to a negative result in the same period of 2021.

Source: Ryanair Q1 Results presentation

On the first out of four days of strikes in Spain, the company also announces that it will start negotiations with the unions for an acceleration of staff wages. They are also asking for the application of the 14 salaries and 22 working days of vacation (and not the 20 days offered by Ryanair) and to abolish the subcontracting model through external agencies (part of the same group). Some flights have been canceled and there are traffic repercussions all over Europe. Delays and inconveniences are also announced on Wednesday due to the cancellation of many flights for a one-day strike for Lufthansa ground personnel.

Conclusion and Valuation

Ryanair expects to fly over 165 million passengers this year. Due to the uncertainties over the year’s second half, the company is increasing its capacity beyond pre-Covid levels to pick up the strong summer demand in an attempt to gain new market share. The investments also concern its fleet. Indeed, Ryanair plans to take delivery of additional 50 727 max aircraft from Boeing before summer 2023. The airline also said it has extended 73 leases of the Airbus SE A320 jets. During the Q&A call, we understood that flight bookings are made increasingly close to the departure date, a phenomenon that determines for the company a “zero visibility” in the second half of the financial year. Having said that, we reaffirm our thesis and our valuation at €19 per share, forecasting a net profit of €1 billion.

Be the first to comment