tupungato

Investment Thesis

Williams-Sonoma (NYSE:WSM) has continued its strong performance even as the housing market cools. The company has seen broad strength across its portfolio. Management is committed to generating strong shareholder returns. The business pays out a consistent dividend and has consistent share repurchases.

The company’s shares have declined almost 40% due to a poor macroeconomic backdrop. But I think the business is well positioned to navigate these headwinds. I believe that shares are undervalued, especially for dividend growth investors.

Strong Brands Generate Solid Growth

Williams-Sonoma’s performance has been stellar for the past few years. Since 2019, the company has boosted its revenue by 40% and its EPS has almost quadrupled. Free cash flow almost tripled to over $1.1 billion.

The company has seen consistent growth across its brand portfolio. Pottery Barn’s revenue was up by almost 70% since before the pandemic. West Elm reported more than 70% topline growth compared to 2019. Even the company’s weaker brands have increased their revenues over 2019 levels.

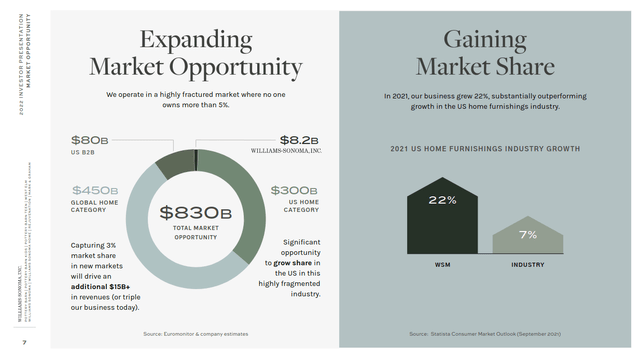

Williams-Sonoma 2022 Investor Presentation

The company has substantially outperformed the broader furnishings industry. I think there are clear opportunities for the business to grow its market share even further.

Most importantly, the company has continued to succeed in a tough environment. Its competitors are experiencing inventory issues and severe margin pressure. But Williams-Sonoma has an interesting strategy to boost margins and increase incremental revenue.

Pricing Integrity Boosts Margins

In 2020, the company made the bold decision to stop running sitewide promotions. This would increase the company’s profit at the cost of losing some potential sales.

This strategy has been paying off quite well. Since making the change, the company’s margins have expanded nicely. Now, the company’s gross margins are consistently around 45%. The increased profitability has helped the company offset inflation and supply chain costs.

It also doesn’t appear to be affecting the company’s topline too much. The business has maintained healthy inventory levels. Its balance sheet has similar inventory on hand compared to pre-pandemic levels. I think these are impressive results. Other retailers are still struggling with excess inventory and cost inflation.

A Focus On Brand Loyalty

I especially like how the company is driving brand loyalty across its properties. Loyalty programs can generate incremental revenue and increase marketing efficiency. Management explained the clear financial benefits on their fourth quarter earnings call.

Customers who shop across our brands generate 3x to 4x more revenue than the single brand customer. And we’ve seen incredible results this past year due to our continued marketing efforts. In fiscal ’21, approximately 60% of our sales came from cross-brand customers, a record high in terms of percent to total. And our cross-brand customer counts grew faster than those of the single-brand customer. While new customer acquisition is always a priority and continues to grow, we believe we have even more upside by increasing our share of wallet with our existing customer base.

The company started The Key Rewards, a cross-brand loyalty program. The program offers rewards points and special offers across all Williams-Sonoma brands. The company also offers a credit card with extra benefits. I think this may help the business generate more sustainable revenue even during a potential downturn.

The Broader Market Is Weakening

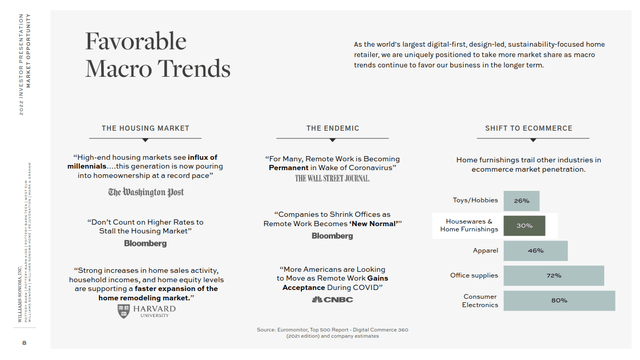

On the other hand, the market Williams-Sonoma operates in is weakening. In April of this year, the company released its earnings presentation. It detailed what management saw as key macro trends that would boost their business.

Williams-Sonoma 2022 Investor Presentation

The company expected higher homebuying activity, remote work, and ecommerce to drive growth for the core business. All of these trends have since reversed. The housing market has stalled. Workers are increasingly going back to the office. Ecommerce has become weaker as well. Adobe’s latest digital price index is showing broad declines in online pricing.

During the 2008 housing crash, Williams-Sonoma’s fundamentals declined rapidly. The company’s net earnings cratered, and the company became unprofitable. Shares sank by over 90%. The business managed to recover quickly in the years that followed. This is still evidence that the company’s earnings could fall quickly if we enter a recession. For now, I think that companies targeting higher-income customers will be less affected by a recession. Most of Williams-Sonoma’s brands fall into this category.

Strong Returns At A Cheap Price

Williams-Sonoma’s shares are quite cheap. The company is trading at a forward P/E of 8.5 times and an EV/EBITDA of just over six times. This is within the range I’d be willing to pay for a company with high-single-digit topline growth. I’ve discussed the cooling housing market and potential declines in consumer spending. I think the cheap valuation is already pricing in a lot of the risk.

The company has generated strong returns for its shareholders. Shares have a 13.6% free cash flow yield, and the company returned over $1.5 billion to shareholders last year. Management is clearly committed to returning excess cash to its investors.

The company also has a lot to offer income investors. The company has paid out a regular dividend for 15 years. The company continued to raise the dividend each year by an average of 20%. These hikes continued even through the 2008 crash. I think the most important detail is the company’s low payout ratio. The business only used 20% of last year’s free cash flow to pay its dividend. Not only does the dividend have a lot of room to grow, it is very likely to be safe and sustainable.

Final Verdict

Williams-Sonoma has performed quite well, shrugging off unfavorable macro headwinds. The company continues to generate strong free cash flow and returns a lot of cash to investors. Although the business is cyclical, I think the company is well positioned for the current environment. Shares have likely been dragged down by the recent underperformance of some other retailers. I think this stock may be a good pick for income investors looking for dividend growth potential.

Be the first to comment